Cryptocurrency Craze Sends GPU Prices Skyrocketing — Again

Back in 2013, during the height of the GPU bitcoin mining craze and before ASICs had taken over the market, prices for video cards reached absurd levels. This primarily impacted AMD, since GCN-based cards were vastly better at Bitcoin and Litecoin mining than their Nvidia counterparts, but the end result was awful for enthusiast gamers. GPUs that normally would’ve sold for $200 to $300 were, in some cases, commanding $600 to $800 price tags. Eventually the market cooled down as more customers shifted to ASICs, which both outperformed GPUs and offered a performance-per-watt metric no graphics card could match.

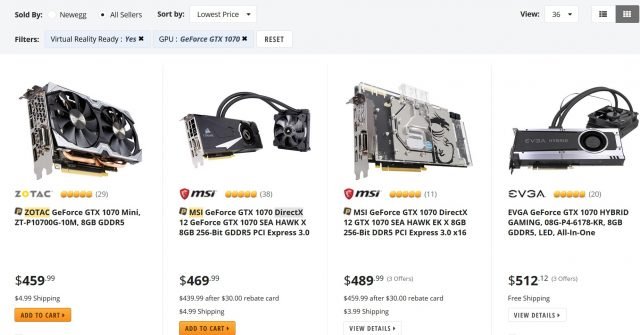

Now we’re seeing the same thing happen again — only this time, it’s hitting both AMD and Nvidia cards. The GTX 1070 should be selling for around $330, and I can confirm I’ve seen it around this price in the not-so-distant past. Today, Newegg shows the cheapest GTX 1070 at $459, as shown below

But this isn’t just an Nvidia problem; AMD is taking a beating as well. UpgradeYourTech keeps track of product SKUs over time, and maps how they change over weeks and months. Check out what’s happened to the RX 580 since that card launched just a few months ago.

On June 6 of this year, the Asus ROG Strix RX 580 topped out at a whopping $849.99. Today, it’s a steal at just $658.90. At first glance, this might seem like a great thing for both AMD and Nvidia, since after all, higher GPU prices means more money, right?

Wrong.

Back in 2013 when Hawaii launched, cryptocurrency miners sent the price of AMD’s entire GCN family into the stratosphere. AMD, however, hadn’t changed its prices, which means AMD wasn’t making a cent of the additional revenue that OEMs like Asus, MSI, Gigabyte, and Zotac were raking in. Now, if you were a serious cryptocurrency miner at the time, buying an expensive AMD GPU instead of an NV card might have made sense, given the enormous performance disparity between the two. One difference between then and now is that people are mining Etherium, not Bitcoin. My admittedly rough understanding is that NV cards are far more competitive now than they were at BTC mining back in 2013.

It may have made sense for miners to pay huge cost. But it made no sense at all for gamers. At the time, I theorized this could cause AMD trouble down the road. While it took several years to get concrete data on what happened to AMD’s GPU sales, I was absolutely right.

If you go back and compare the peaks in AMD’s sales with the company’s product launches, you’ll find there’s a relationship between the two. (Higher sales figures sometimes lag product launch dates, depending on when a GPU debuted within the quarter.) But look at what happened in Q3 2013. The launch of Hawaii and the excellent R9 290 and R9 290X barely budged AMD’s sales. In fact, sales went into a steep decline thereafter.

True, Nvidia responded with the GTX 780 Ti to counter the R9 290X, and yes, the reference R9 200 cards had loud default blowers. But third-party fan designs later solved that problem. It didn’t matter. The cryptocurrency market had blown out AMD’s addressable market, and by the time BTC mining had moved to ASICs, Nvidia had launched its GTX 900 series (Maxwell).

If you want to strike it rich mining Etherium, new GPUs may be a great investment — but neither Nvidia nor AMD is likely to be happy about the long-term impact on their own businesses.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.extremetech.com/computing/251379-cryptocurrency-craze-sends-gpu-prices-skyrocketing