Harvey aftermath hits a third of US oil refineries by the Financial Times

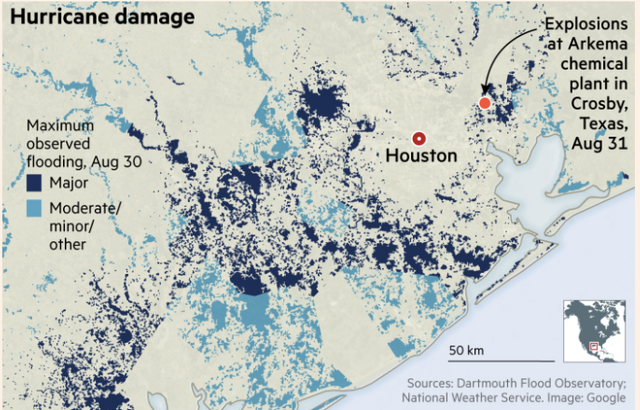

The havoc wrought by tropical storm Harvey began to spread well beyond the Houston area on Thursday as the damage to the US’s energy infrastructure sent the price of gasoline sharply higher and forced Washington to step in to prevent fuel shortages.

Almost a week after the storm first made landfall in Texas, almost a third of US oil refineries — many of which are clustered on the US Gulf Coast — have been affected by the storm, and refineries still in operation in the region are struggling to import crude because of outages at port facilities.

Gasoline futures were particularly rattled by Wednesday night’s announcement by Colonial Pipeline that it was shutting down the key artery carrying fuel from the Gulf coast refining hub to the East Coast, in a move that could drastically restrict petrol and diesel flows to some of the biggest cities in the US.

North Carolina governor Roy Cooper on Thursday declared a state of emergency which will allow gasoline to move through the state more quickly in response to delivery problems.

Colonial said it hoped to make “intermittent” deliveries from points on the line east of Lake Charles, Louisiana, but was unlikely to have the line fully operational from Texas before Sunday.

On Thursday, US wholesale gasoline spiked 13.5 per cent to close at $2.14 a gallon, a two-year high and up by more than a third from levels before the storm struck, meaning motorists will probably face acute price increases at the pumps in the coming weeks.

“A lot of fear is driving the trade right now,” said David Leben, director of oil products trading at BNP Paribas in New York. “It’s the biggest intraday move [in gasoline] many people have seen in this market.”

Ole Hansen, an analyst with Saxo Bank, said more than 3m barrels a day of crude oil are being left in tanks because of the disruptions at Gulf coast refineries, with at least 13 forced to close or reduce run rates, including the nation’s largest.

The Saudi-owned Motiva refinery in Port Arthur, Texas — which can process 603,000 barrels a day of crude, more than any other plant in the country — could be shut for up to two weeks due to flooding, Reuters reported on Thursday.

Pipelines delivering crude from the Permian basin, the largest US shale field, to refineries in Texas have also been closed since the weekend.

In a sign of the mounting supply troubles, the US Department of Energy on Thursday authorised the release of 1m barrels of crude oil from its Strategic Petroleum Reserve (SPR) to Phillips 66’s refinery in Lake Charles, Louisiana, following a request from the company.

The SPR is the largest government-owned emergency crude stockpile in the world, and was established in the aftermath of the Arab oil embargoes of the 1970s. The biggest short-term issue, however, is likely to be a lack of refined fuels rather than crude.

The International Energy Agency, which co-ordinates releases of government-held fuel stocks in the event of major disruptions, said it believed the US had plentiful gasoline and diesel inventories to ride out current supply issues.

An emergency fuel release by member countries was not yet necessary, the IEA said, with the market so far functioning to start moving gasoline and diesel to where it is needed, including a flotilla of tankers heading to the US from Europe.

“Because of the stock levels there is no shortage of crude or product as such, but there is a difficulty in moving it around,” said Neil Atkinson, head of the oil division at the Paris-based IEA.

“If the weather turns again and the flooding lasts a lot longer the situation could change . . . but [an emergency stock release] is not on the table yet.”

The disruption to flows on the Colonial Pipeline, which ships roughly one in every eight barrels of fuel consumed in the US on lines originating in Texas and stretching all the way to cities in the east, has been caused by the lack of available fuel from refineries.

East coast cities including New York, Washington DC and Atlanta have become more reliant on flows from Colonial after a number of older, less profitable refineries were shut down along the eastern seaboard over the past decade.

“With Colonial shut and a quarter of Gulf coast refining capacity out, the south-east will need to get fuel from storage, other forms of transport from the Gulf like trucks and ships, and imports,” said Jason Bordoff, who was an adviser to former US president Barack Obama and is the director of Columbia University’s Center on Global Energy Policy.

European traders have scrambled to send more gasoline to the Americas, with almost 45 tankers booked or under negotiations so far this week, according to Gibsons Shipbrokers in London, with five more added on Thursday.

Latin American countries are, however, also competing with the US for imported fuel, as they normally take at least 1m b/d of petrol and diesel exports from the US, primarily from refiners on the Gulf coast.

“Harvey is the worst event that the refining industry has seen since Katrina and the impact has gone well beyond the US, stretching from Mexico to Europe and Asia,” said Andy Lipow of Lipow Oil Associates, a Houston-based consultancy.

Traders appear to be betting for the moment, however, that either refiners and pipelines will be able to get back online relatively quickly in the coming days and weeks, or enough imports will arrive to thwart any shortages.

The benchmark wholesale US gasoline contract for delivery in October rose 8.7 per cent to close at $1.78 — 36 cents below the September contract.

Crude prices have also been pressured by the disruptions, with oil backing up in storage tanks in the Midwest due to a lack of demand from Gulf coast refiners amid the shut-ins.

West Texas Intermediate, the US crude oil benchmark, has slipped 1.3 per cent to $47.23 a barrel since the storm hit on Friday.

Follow @jessethan for more articles like this!

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://british-utilities.co.uk/2017/harvey-aftermath-hits-a-third-of-us-oil-refineries-financial-times/