Kamix : cheap remittance for africans

Hello everyone,if you interested in the FinTech space, you probably know that the payments industry is worth over half a trillion dollars in transaction volume per year, and the volume of usually consists commission fees. My name is Justin. I'm the founder and CEO of Kamix, and I will tell you how we address the African remittance market with 0% commission fees, while generating sustainable profits from the earliest stage we are.

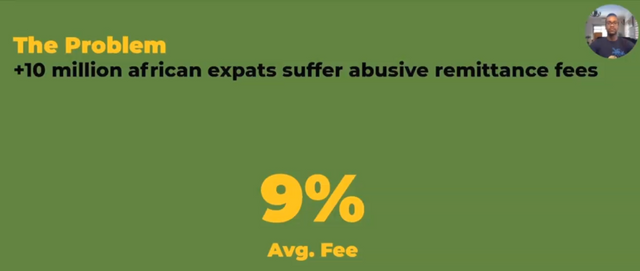

The huge programme in the African market is commission fees, African migrants pay 9% in average, where the rest of the world's migrant would pay 7%

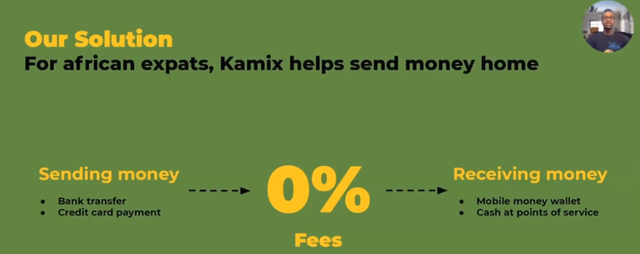

our solution is radical, sending and receiving money possible at 0% Since in Africa. So we built an app that leverages cryptocurrencies and we are eyeing a markets which represents about $6 billion in revenue per year which is currently controlled 90% by two or three big corporations.

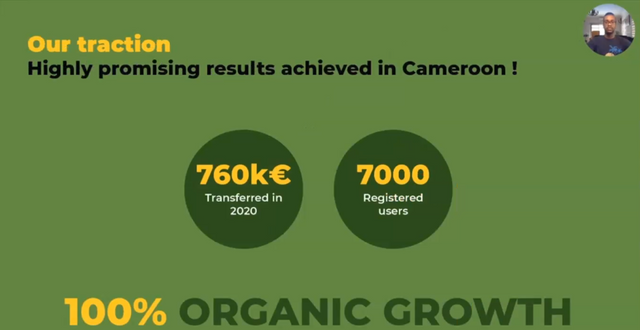

In 2020 We've tested one motor transaction 760,000 euros with 7000 users, and acquired through 100% organic growth, here is what growth look like charts.

Given 20 turns profitable in November 2020 With only 500 monthly active users, out of many 100 1000s available out there, we want to differentiate through user experience which is 100% Digital as we leverage mobile money to deliver money in Africa rather than cash point of sales. We are the only player to propose the 0% fee model

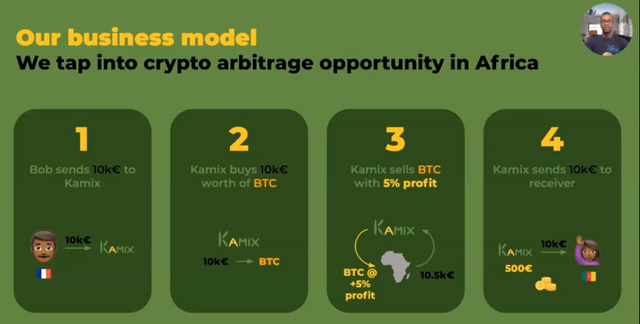

how do we make money

Crypto at a premium in africa

Why do you make the assumption of being able to sell cryptocurrencies with a premium in Africa. This is due to many factors.

Firstly is improving dramatically cryptocurrencies in Africa, cannot be satisfied with the existing supply, because the coins and crypto currencies in Africa are mostly important commodities since there is no mining activity, and major liquidity providers based outside of Africa has no incentive to come and address the African market because of the policy from central banks, they restrict outflows capital moves.

which means when external industry providers with cryptocurrencies against African currency,they won't be able to take back the profits, since the central bank, due to his economic policy engine structure of economies, we restrict the outflow of money, hence it result in the shortage in supply which brings a premium of 5% to 20%.

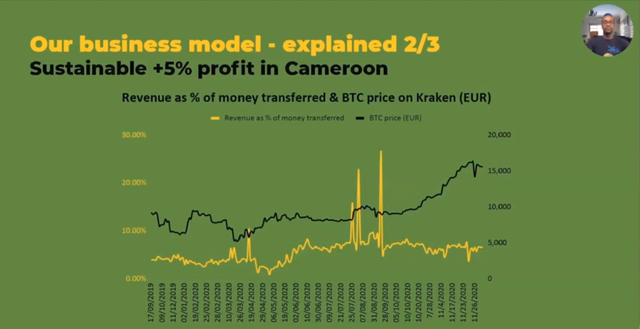

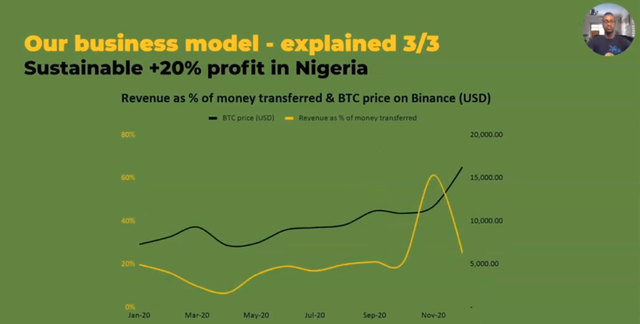

In Cameroon, we are assessed this premium by experience at around 5% Last year, this is what it looks like to charge in Nigeria, the largest African remittance market, where we are starting from this year as far as 20%

We started to leverage cryptocurrencies because of the favorable regulations which are new and more things for for starters, like us, and because the liquidities and arbitrary opportunities as huge as compared to our currency, we believe blockchain is the next big thing in the African tech revolution after mobile money.

Our acquisition strategy is broken into six copiers including delivery of digital distribution networks and refuelling cash back programmes, go fast.

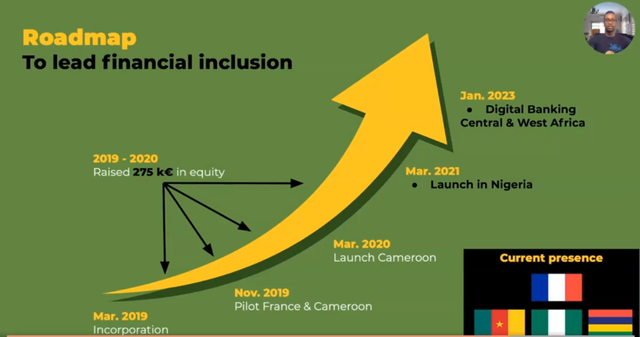

We've raised 275,000 euros so far with presence in three African countries including Nigeria, the largest remittance market $20 billion per year I want to go very fast and which has in the next three years.

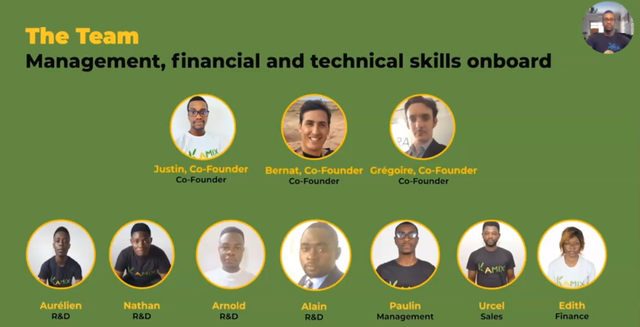

To do so, we need to raise 1 million euros, which is currently made out of 10 people working full time, since two years. And we are happy to discuss any investment opportunities. Thank you for your interest.