Digitex – Commission Free, Trustless Futures Exchange

Note to Readers: Read till the end to know about the “Early Access” to DGTX Tokens and a “Steem Bounty”.

-----------------------------------------------******-------------------------------------------------

Introduction

“Futures” as a concept came into being in the financial world to arrest volatility, especially, in commodities or products usually having a prominent surge or dip in prices. As an example, wouldn't it be obvious that the volatile nature of oil prices surging from a low of USD 40 per barrel last year to USD 70 per barrel in just a few months, would have driven users to de-risk themselves? The answer is yes, and that is what companies do. Aviation industry relies on oil prices to price tickets and eventually make profits and hence these are the ones who would want the prices to be stable or at least enter a futures agreement to get oil at a certain price. Now imagine, an airline company which would have got into a futures agreement three months back to source oil from an oil major at USD 40 per barrel, wouldn’t they be happy that they did so? Of course, the oil major may appear to have lost out but the fact is that a few months back even the oil major would have been worried about oil prices falling further, so in other words, both the airliner and the oil major attempted to de-risk themselves then. So practically it worked for both, the oil major has the oil selling at USD 40 (although the price increased against the concerns of price reduction) and the airliner got the oil at USD 40 when the price nearly doubled. A potential win-win for both parties.

This instrument of the financial world is so effective that such “futures” agreement is entered into to cover almost all known exchangeable assets. It covers products, commodities, stocks, currencies and even cryptocurrencies. In fact, the futures contract, from our example of the airliner, can be traded too. The contract’s worth increased due to the hike in oil prices. So, there is a whole lot that can happen in the futures market. Great, everyone benefits from futures then, right? Not really.

Why is that? Because there are losses too. But that’s not what pinches or hurts an investor. Losses are to be expected but to end up in loss even when they potentially have made a profit is what hurts them the most. How can that be? Well, much like commissions in most agreements involving a third party like an exchange or an agent, futures too has commissions to be paid. This makes profit booking a bit difficult for those trading in futures. That is, if the profit margin is thin, then the entire profit can be wiped out just for paying the exchange commission. So, getting into an actual contract for an underlying product is one thing but to trade such a contract on the exchange is a totally different thing. To add to this, futures trading in the crypto-world involves de-risking of not only the high volatility (more than most products in the real world) of the underlying cryptocurrency but also the high commission to be paid. Considering this, futures trading in the crypto-world would be a big no-no for most investors. But what if this scenario can be changed?

How? This is how. What if there is no commission charged at all at the exchange? Wouldn’t that mean that the investors then have to contend only with the fluctuations in the price of the cryptocurrencies alone? Yes, and that would also open the futures market for possible profits. This definitely would interest existing futures crypto-players and lure more investors to look at this market. Sounds great, but do we have such an exchange?

Turns out we do!

-----------------------------------------------******-------------------------------------------------

We are talking about Digitex!

Digitex is one of the first Futures Exchange which will have zero trading fees making it lucrative for traders. Further, it provides security by ensuring that the user balance and other details are held in a decentralized manner through a smart contract on the Ethereum blockchain. If this is not enough, even the governance will be decentralized allowing the users to decide on the DGTX tokens to be generated in the future.

In Digitex's whitepaper their proposition is described as follows:

Digitex presents a commission-free futures exchange that covers operational costs by minting its own native currency, the DGTX token, instead of charging transaction fees on trades.

Increasing demand for DGTX tokens from traders who are attracted to commission-free futures markets will outweigh the inflationary cost of minting a small number of new tokens each year.

I am sure the “commission-free” part would have enthused readers, especially, the regular traders and for all the good reasons. However, there is more to Digitex and the same is explained in this section.

1. Commission Free Futures Trading

The obvious and most important benefit is the formation of a commission-free exchange. The DGTX token is an ERC223 compatible token on Ethereum Blockchain which will be the exchange’s native currency. All traders, therefore, would be buying the token for trading. All their profits, losses, margin requirements and account balance will be denominated in DGTX tokens. In other words, the operational cost of the exchange can be covered by creating new token instead of charging transaction fees. In doing so, the commissions on trade can be eliminated.

The entire model enters a virtuous cycle, as the demand for DGTX tokens increases with more and more traders wanting to join the commission-free futures trade revolution, which further allows creating new tokens to fund costs and meet future demand.

2. Hybrid Futures Exchange

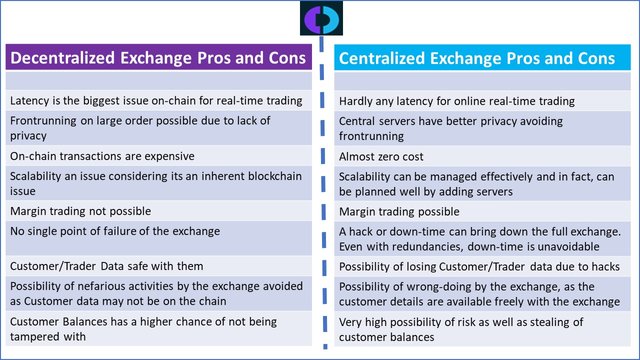

The dependence on a decentralized only exchange or centralized only exchange has its own challenges. What are they? They are explained below:

These are points which have been looked at by the Digitex Team to arrive at a hybrid model where the benefits of both models are built-on and at the same time the negatives are eliminated.

Digitex is the intelligent combination of the speed and reliability of centralized servers with the trustless security of decentralized smart contracts.

The way it is designed is that the Central Matching Engine and Order Book is on central servers and the exchange interacts with smart contracts to update user details. So, the user details like balance, margin liability, profits, and loss are decentralized and under the individual’s control. The exchange does not have physical control of the funds and hence, no wrong-doing is possible by the exchange, assuring privacy and security.

The advantages are:

- Digitex does not have control of individual funds and hence cannot involve in nefarious activities, either through external pressure or internal leaks

- Digitex does not hold private keys and hence not a hacking target. Neither does it run the risk of giving out individual information, in an unlikely circumstance of being hacked

- The matching and book orders on the central servers allow real-time trading

- Scaling up of the central servers with more traders coming in can also be accommodated

- Only when a user wants to withdraw his or her balance will the smart contract check with central servers and updated balance and other details. This way, the gas costs, because of the on-chain transaction can also be reduced

- The above-said point is the only potential for a hack which is undone by the smart contract computing a person’s trade from scratch for the matched trades and then updating the balance. A hacker would be unable to send incorrect details which he could do only by matching all trades done earlier. An unlikely and impossible task

3. Decentralized Governance

Much like the account updates on the blockchain, Digitex brings the governance also to the blockchain. New token issuance is managed democratically through rules and voting systems that are built into the smart contracts and enabled by the DGTX token owners.

What is the impact of giving users the power and control over how the Digitex Futures Exchange is funded?

The biggest assumption in allowing users and owners of DGTX to control the new token release is that users will act on self-interest, leading to the success of the exchange. It also brings in the added aspect of adaptability as the owners will decide the increase or decrease in token issuance based on market conditions.

The expectation is that users will provide a well-thought-out proposal on issuance of token taking care of inflation costs, development and operational costs of the exchange, and additional demand for tokens by new users, balanced by the fact that the additional tokens do not lead to decrease in the value of the token at the hands of the current owners. This balanced approach would take care of the smooth working of the exchange.

The owners can also decide to delegate their voting power if they are unable to actively participate and vote for the issuance. The delegation can be done to a trusted party who the user believes will act responsibly in taking the correct call on the issuance of tokens.

This, in a nutshell, talks about Digitex as a commission-free Futures Exchange.

Take a look at the following video about Digitex by CEO Adam Todd:

----------------------------------------------******-------------------------------------------------

The concept is great but do users really gain from the no-fee structure?

This can be only understood if we can compare the trades with the existing fees from other exchanges. Also, Digitex at the moment allows BTC/USD, ETH/USD and LTC/USD futures contract.

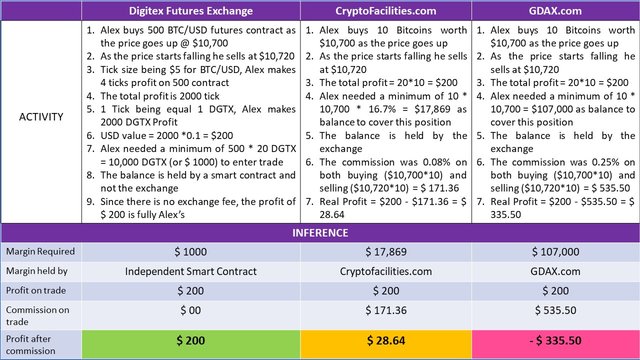

Assume that we have a trader Alex who trades on Digitex Futures Exchange, Cryptofacilites.com and GDAX.com. Similar transactions are done on all three exchanges to arrive at the computation. The explanation are provided.

Here is the outcome:

As we can see, the same example of buying BTC has resulted in differing profits (in fact, a loss too) at different exchanges. The aspect of zero – fee is beneficial to the users on the Digitex platform. Not only this but users need to also notice that the minimum balance required to trade is the least with Digitex while the balance is held by the smart contract and not by the exchange.

-----------------------------------------------******-------------------------------------------------

Let’s summarize the overall Features of Digitex

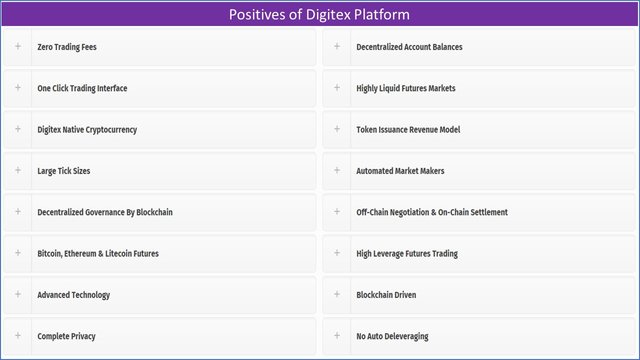

Zero Trading Fees

We’ve already seen the reason for zero trading fees and how it allows traders to profit on the platform. This forms the single biggest advantage of Digitex Platform.

Decentralized Account Balance

Since the users hold the fund as much as their balance through a smart contract, there is absolute privacy and security in transactions. Besides, all the risks associated with the balance being held by exchanges are mitigated.

One Click Trading Platform

The Digitex Futures Markets are displayed on an intuitive ladder interface allowing traders to buy and sell with a single click. The idea is to reduce the need for a mouse or keyboard inputs as much as possible and Digitex team have been largely successful in that.

Highly Liquid Futures Market

As the commissions are removed, traders find Digitex as an ideal place to trade for both short-term and long-term. This ensures liquidity in the exchange. Also, the Automated Market Makers add the additional liquidity desired.

Digitex Native Cryptocurrency

We have seen how the use of DGTX currency allows the exchange to do away with commissions. This is the model which will continue to be used and will ensure the growth of the exchange further.

Token Issuance Revenue Model

Because the users are involved in the voting of new token issuance, the model automatically forms a great balance of managing inflationary cost, development and operational cost of managing the platform, meeting demand from new traders with the right quantity of token to be issued, ensuring that there is no deterioration in the value of the DGTX tokens.

Large Tick Sizes

The large tick size is a distinctive feature of the Digitex Platform. The tick size defines the minimum price differential that a futures contract can move to. The large size like that of $ 5 for BTC/USD, ensures that the noise and volatility are handled and the prices are displayed in a user-friendly manner rather than disappearing from the top or bottom.

Automated Market Makers

This is one of the features which enhances the Digitex Exchange’s ability to stay liquid. The market makers are trading algorithms that are programmed to break-even. With 20% of supply available with them along with a really active trading strategy, the market makers ensure liquidity and allow traders to enter and exit easily.

Decentralized Governance by Blockchain

This facility, as we had initially discussed, allows the continuity of the Digitex exchange by its users. The continuity stems from the fact that the users will be concerned with their self-interest and hence ensure the success of the Exchange.

Off-Chain Negotiation and On-Chain Settlement

Being a Hybrid Exchange, Digitex builds on centralized trade servers interacting with decentralized trader accounts through the Exchange. This ensures that the real-time speed of trading, as well as security of the blockchain, is available to the users.

Bitcoin, Ethereum and Litecoin Futures

Digitex has 3 futures market of BTC/USD, ETH/USD and LTC/USD with large tick sizes.

High Leverage Futures Trading

Digitex offers high leverage to traders, nearly 100 times, from relatively small price movements. Also, unlike other exchanges which may cancel a winning trade to protect itself if the counter-party was too highly leveraged, Digitex does not interfere with trade.

Advanced Technology

Digitex is built on the Erlang/OTP Stack, the same programming language like Whatsapp, so that it can be fast for real-time updates and handle spikes, with less or no latency. The Digitex order matching engine matches trade in less than 1 millisecond and has the ability to scale up to handle millions of concurrent users.

Blockchain Driven

Digitex leverages blockchain for the known advantages of decentralization, storing of balance information through smart contract, and the most important function of governance through the voting of its members.

Complete Privacy

Being a blockchain, it goes without saying that privacy is a given. However, the important part is that the balances and other details are in the smart contract and nothing of the user is stored on the chain. Which means, even in an unlikely scenario of being hacked, the Exchange does not risk giving out user details.

No Auto Deleveraging

Digitex will never cancel out a winning position to protect itself, as most Bitcoin exchanges do. It is not the winning parties fault if the counter-party is highly leveraged. This should make it a trustable trustless Exchange.

-----------------------------------------------******------------------------------------------------

With such a strong foundation and fast growth, how does Digitex appear moving from 2019 through 2021?

Unlike the futures market of the real world, the crypto-world is quite nascent in comparison. We are comparing nearly six to eight decades of real-world futures market with not even half a decade of the crypto-world futures market. This only means that there is a huge potential here and many traders and investors are yet to discover the crypto-world futures exchanges. Well, the good part is that traders at least understand the futures market because of real-world trading.

Now the known issues with the current crypto-exchanges are undone by the Digitex Exchange. The best of all being zero trading fees. This makes the proposition extremely lucrative as even the real world hasn’t figured a way to do away with commissions. So, it is obvious that the user adoption is going to be exponential. In addition, Digitex is already listed on four exchanges, the adoption of Plasma technology to improve Ethereum’s scaling issues and an innovative governance structure, all point towards its success.

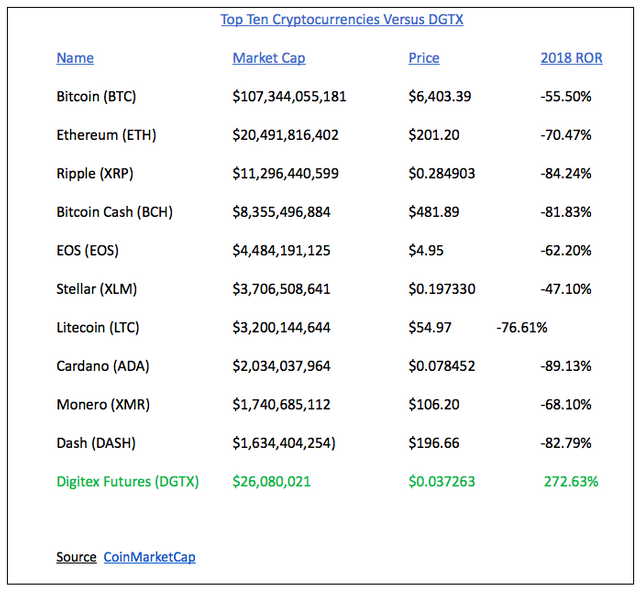

Some early pointers are its ICO getting sold in 17 minutes and the fact that the price had risen by 272% (as per CoinMarketCap. Price comparison shown in adjacent figure) talks a lot about investors' mood

If all these developments are something to go by then we can expect a rock-solid growth from 2019 through 2021. Come 2021, we will witness the first instance of token creation post the ICO in 2018, which in my opinion would be the single most awaited development from the Digitex World!

----------------------------------------------******--------------------------------------------------

A bit about the Tokens

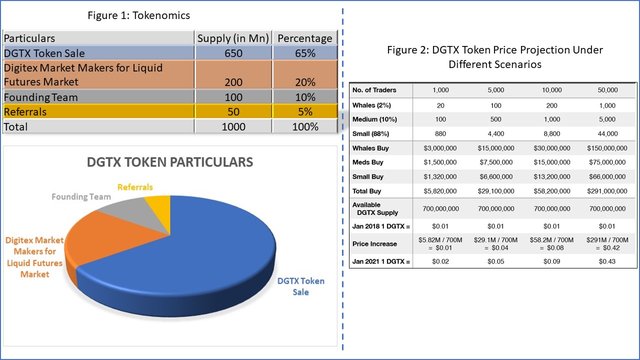

We have discussed the DGTX Tokens so far explaining how it will assist in the functioning of the Digitex Exchange. Now, let’s understand the tokenomics and price discovery till 2021.

Figure 2, as per Digitex’s whitepaper, attempts to elaborate on how the price would increase by 2021 based on the distribution of 650 million DGTX tokens through the sale route and 50 million through referrals. Obviously, the takeaway is that if there are more participants in the token usage the price discovery would be higher as we reach 2021. Of course, this is a conservative take by the Digitex Team.

Interestingly, DGTX token price has already touched $ 0.03 as seen in the previous section. We are still in 2018. This is one more reason for the optimism towards Digitex becoming popular choice among Futures Traders!

----------------------------------------------******--------------------------------------------------

Use Cases

Case 1: Fast Paced Futures Trading

Carl is an active trader in both the real and crypto-world. He does like the crypto-futures market but is unable to do quick trades as the commissions are high and may wipe out his profits. Besides, at times he needs to manage high balance just to get going with the trades. The security and hacking of many crypto-exchanges in the past also makes him worried about his funds.

Carl is introduced to Digitex by one of his friends. Digitex ticks all the boxes when it comes to his expectations out of a futures exchange. There is no commission which means he can trade as often as required and can take position even for small increments. The tick size itself being $5 for Bitcoin makes it easier to get sizeable moves instead of noise level moves. Further, he is quite impressed with the security provided by the blockchain. Carl takes the plunge and has his maverick way on the Digitex Exchange. What’s more, Carl invites more users to try out Digitex!

-----------------------------------------------******--------------------------------------------------

Case 2: Pegging DGTX Tokens

Carla is a trader by profession and is happy and excited to know about Digitex. She immediately takes the plunge as she does not need any more convincing to try out the platform. There is only one thing that keeps bothering her. She understands the volatility of the cryptocurrencies being traded but what about the price fluctuations of the DGTX tokens, itself? Wouldn’t that reduce her profit, if all the values are denominated in DGTX only?

Digitex Support Team gets on a call with Carla and talks to her about the DGTX peg system. This allows Carla to de-risk herself of the DGTX token price movement. Carla is elated and sees how well-rounded the Digitex offering is. She becomes an evangelist of the Digitex platform and invites her friends from the trading community to try out Digitex Futures Exchange.

-----------------------------------------------******--------------------------------------------------

Summary

At a time when futures trading in the crypto-world was avoided due to the trading fees and other related challenges, Digitex brings in an innovative model to handle the said challenges. What’s more the model itself promotes liquidity by using a native token allowing users to trade even at small price movements without paying commissions. The aspect of handing over the governance to owners of DGTX token in addition to liquidity generating technology like the automated market makers makes the solution a compelling one for traders.

The initial apprehension with futures trading in cryptos is effectively undone by Digitex. It truly opens up a commission-free, trustless and highly liquid futures market for trading!

-----------------------------------------------******--------------------------------------------------

Early Access and Steem Bounty

Early Digitex Token Access

Having understood the working of Digitex and how it is at the edge of revolutionizing the Futures Exchange, it only makes sense to get early access to Digitex Tokens. Here’s is how you can get access.

Click here to get going.

Steem Bounty

The Steem Bounty is for a value of 0.5 Steem for Steemit Users. The simple process of registering is explained at @bountyworks.

The steps can be accessed here.

-----------------------------------------------******--------------------------------------------------

Annexure – 7 Facts Readers May Not Know About Digitex

Please note, this is a reproduction of the actual blog by Christina Comben which can be found here.

-----------------------------------------------******--------------------------------------------------

Here’s my Twitter Link:

https://twitter.com/DawsonSavio/status/1041867423236808707

-----------------------------------------------******--------------------------------------------------

It is also recommended that readers understand more about Digitex through any of the following informative resources.

- Digitex Website

- Digitex WhitePaper

- Digitex Blog

- Digitex Telegram

- Digitex Reddit

- Digitex Facebook

- Digitex Twitter

- Digitex YouTube

-----------------------------------------------******--------------------------------------------------

This article is written in response to originalworks’ call on authors’ thoughts on Digitex. It can be read here.

Image Courtesy: Digitex Resources

digitextwitter

digitex2018

i'M VOTED UP, fOLLOW BACK!

ax3 I will send you 1 steem. Why do not upvote on my post.

Posted using Partiko Android

@indianculture1, I suppose your message was meant for ax3. You will have to check on @ax3's page.

Also, join @indiaunited group on steemit. There is a small India world within the bigger Steemit world. :)

Price is what you pay. Value is what you get.

Humoring me, heh @schoolhumor? :)

This post has been submitted for the @OriginalWorks Sponsored Writing Contest!

You can also follow @contestbot to be notified of future contests!

Congratulations @oivas

Thank you @techbuzz07! :)