House Hacking

We all know hosing costs are a significant expense. The statistics show that housing expenses take up to around 37% of most American’s take home pay! Compared to other categories (food, gas, auto, etc) those numbers don’t even come close. If you want to gain financial independence getting housing costs under control is a great it’s step.

So spending less on housing will have an major impact on the amount of money you’re able to save and invest. Therefore, house hacking is one of the best ways to achieve this goal. What is house hacking you ask? House hacking is a tactic that everyone should consider and it’s simple hacks like getting a roommate to split cost with, refinancing, Airbnb, etc.

So if you want to start house hacking remember to stick to the 1% Rule.

Pretty much the rule states that the rental property should have a gross rent equal to 1% of the property's value each month. For example, if a property is worth $100,000, then it should have a fair-market rent of at least $1,000 per month. A property worth $300,000 should have a fair-market rent of at least $3,000 per month.

If you are planning to live in this property and have roommates and rent out a additional space the property doesn’t have to achieve the 1% rule with you living in it. Instead, you should evaluate the property bases on occupancy. For example, if a property is worth $100,000, then it should have a fair-market rent of at least $1,000 per month. If you have three roommates you should get at least $750/month.

Depending where you live, the 1% rule may sound hard to even impossible to achieve. That’s when it makes sense to start looking at multifamily rental properties. Multifamily or apartment complexes which often allow you to achieve higher rental income relative to the value of the property.

Airbnb is another place to rent your room, guest houses or whole house. Make a conservative estimate on your occupancy and rental rate. You don’t want to assume you’ll have visitors 100% of the time. Please don’t assume they will all paying full price either. instead try to supplement a portion of your housing expenses.

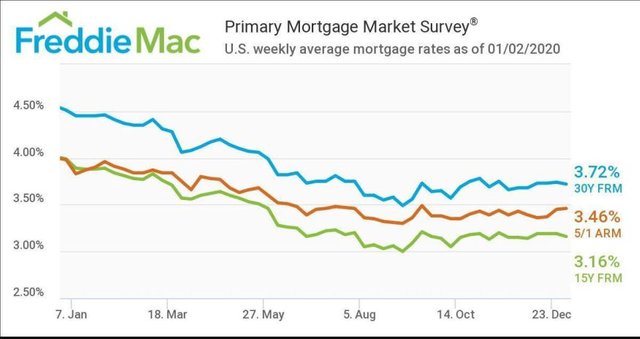

A third hack is refinancing. With rates at historic lows It might be worth checking out if you can lower your rates. However, small interest rate deductions will not be worth it after expenses. It will have to be full point reductions.

These are just some ways to reduced housing costs. I’d be interesting in hearing your ideas?