PayPie: the Future of Credit Risk Assessment

Currently, the risk score market used by businesses across the globe is rife with fraud, errors, and discrepancies. Correcting and preventing these issues is vital, as analyzing risk scores is an integral part of many industries. These include credit insurance, auditing, financing, and more.

This is where PayPie comes in. PayPie is a new accounting platform designed to ensure that data is unbiased and unmanipulated. With this new platform, businesses can rest assured that their data is 100% accurate. Below are some of the reasons PayPie is the future of risk-score analysis.

It Relies on Blockchain Technology

Part of what makes PayPie fraud-proof is its use of single-ledger blockchain technology. PayPie uses Ethereum blockchain to create a single ledger that is viewable by the public. This ledger is decentralized, preventing any one business or entity from manipulating it. The decentralized nature of the blockchain setup also makes it more secure against attempted hacks.

PayPie's blockchain technology is an excellent choice for transparency, but it also has the benefit of efficiency. With this approach, businesses can see real-time financial data that assists them in making informed and accurate credit risk assessments. Previously, it was impossible to see financial data in real time, making risk assessment less accurate and less reliable.

PayPie is highly innovative in this regard. It is the world's first credit risk assessment platform that is based on blockchain. By combining technologies already used in applications relying on bitcoin and other crypto-currencies, PayPie is opening up a new world of buyer and investor transparency, and it also is making commerce remarkably more efficient for all parties involved.

It is Highly Secure

Although PayPie relies on technology that supports transparency, this technology also is highly secure. Its single ledger encrypts all financial entries, making it safe and secure for all parties using the application.

It Uses a Sophisticated Algorithm

Central to PayPie's operation is its sophisticated algorithm. This risk-assessment algorithm is used to evaluate and secure opportunities that will be included in the PayPie marketplace. While the algorithm itself is highly reliable, the single-ledger technology guarantees that the financial data put into the algorithm is reliable as well. In this way, businesses and other entities using the PayPie marketplace are guaranteed an accurate credit risk assessment of prospective opportunities.

It Features a Marketplace

The PayPie marketplace is designed to streamline communications between lenders, investors, buyers, and SMEs. Every financial opportunity in the marketplace has been vetted by the PayPie algorithm, so buyers receive a reliable and unbiased picture of risk before they commit.

What Are Some of the First Opportunities PayPie Offers?

PayPie's creators have noted that their platform has plenty of opportunities for practical applications. In the PayPie whitepaper, it creators mention some of the first opportunities found with the platform. One of these is an opportunity for insurers to sell insurance to businesses, as the platform's risk analytics will help brokers set appropriate rates.

Another opportunity is one for peer-to-peer lending, which will help to grow fledgling businesses. PayPie also allows for third-party financial audits and for credit opportunities for financial institutions, banks, and investors.

When Will PayPie Become Available?

PayPie's creators offer a token crowdsale that opens on October 15, 2017 and closes a month later. Those who purchase tokens will be granted exclusive access to the PayPie platform.

As a technology designed to go against established credit risk assessment procedures, PayPie is poised to revolutionize this industry. By creating transparency and security while standardizing risk assessment, PayPie will allow buyers and investors to choose with confidence.

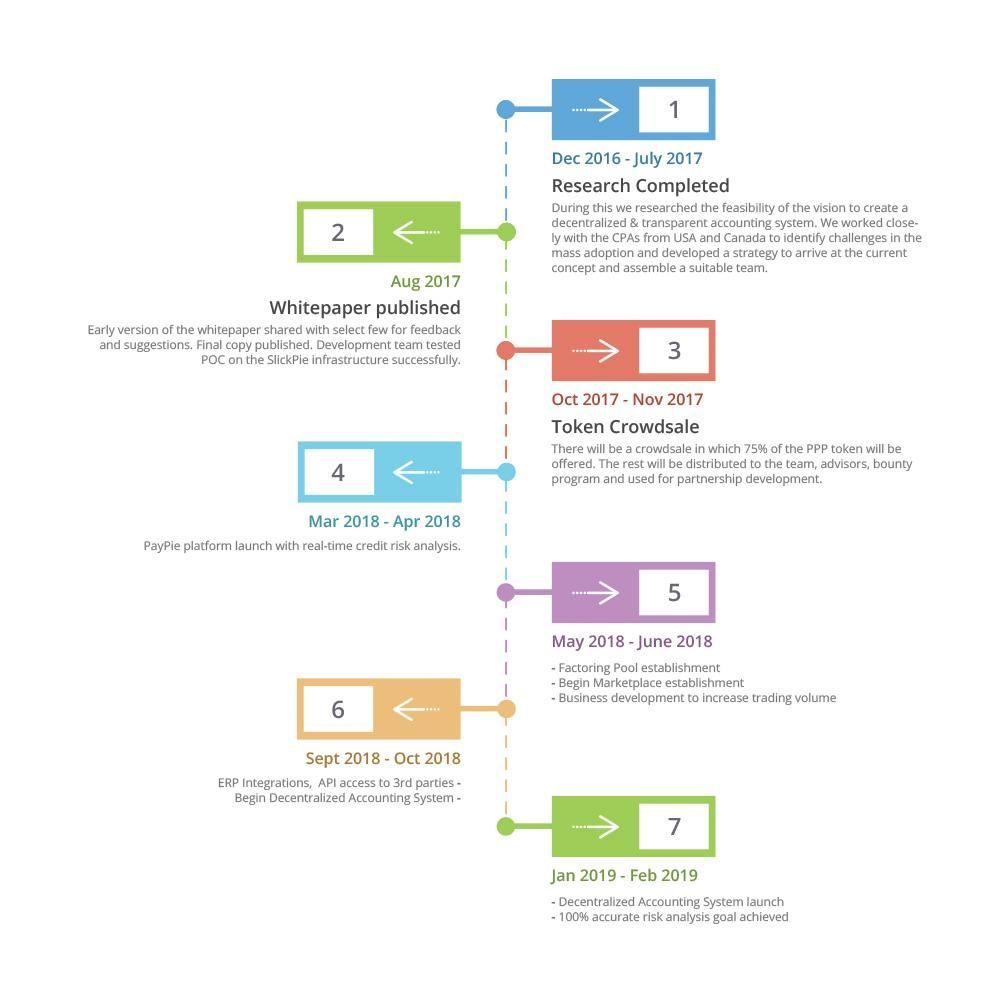

Timeline

Official Website : https://www.paypie.com/

Official Twitter: https://twitter.com/PayPiePlatform

Official Facebook: https://www.facebook.com/PayPiePlatform

ANN : https://bitcointalk.org/index.php?topic=2061671

Whitepaper : https://www.paypie.com/Content/files/PayPie-Whitepaper.pdf

Bitcointalk Profile : https://bitcointalk.org/index.php?action=profile;u=119768

Realtime Credit Risk Assessment would be amazing. The possibilities of blockchain seem endless. Will check out the project.

as analyzing risk scores is an integral

thanks for sharing

the big problem is in scams sites because not payed

Yes it's the future

I see

Who sees that too?

Blockchain is the future of exchange and central financial institute. Even if we bombard with FUD this morning, from China. My opinion this token promisses a good future.

Possible follow-up؟؟؟؟؟؟؟؟

thanks for sharing this post👍👍👍👍

People are now waking up to the fraudulent system which we currently live in and anything which shows transparency is a welcome entity. However, I have decided to take control of my life and finances by being my own banker, thus, ensuring my financial security and not depending on any other person(s) or organisation for my financial well-being. I believe if we all take control by using the new opportunities such as investing in the Cryptocurrencies of choice and holding our private keys etc, there will be no need for these corrupted organisations and they will become a thing of the past.

Steemit Bank invested in your post.

Follow Steimit Bank