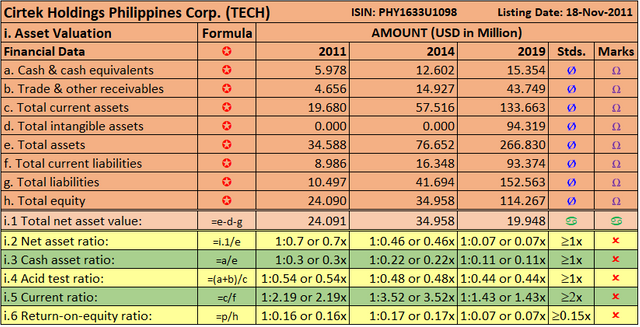

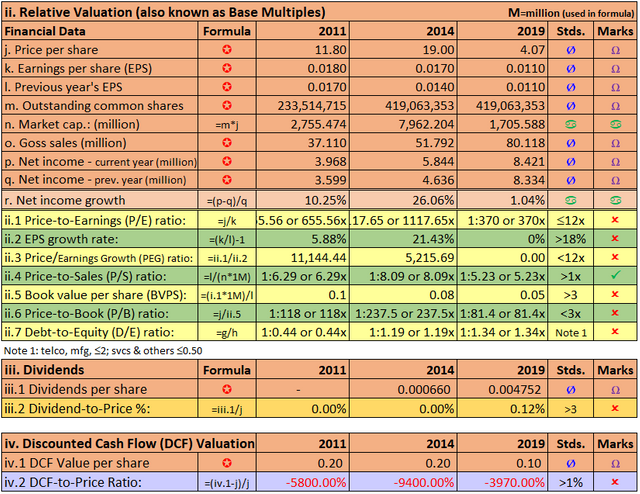

Cirtek Holdings Philippines Corp. (TECH) FY2019 Financial Results

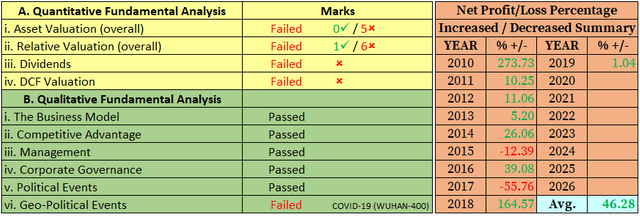

Earnings of TECH is flat in the fiscal year 2019 compared to the prior year. The net income increased by 1.04% to $8.42 million compared to $8.33 million in 2018 with the decreased growth in revenues at 24.75% to $80.12 million from $106.47 million a year earlier.

Business Model. TECH is a fully integrated global technology company focused on wireless communication. It is the holding company of Cirtek Electronics Corporation ("CEC'') and Cirtek Electronics International Corporation (''CEIC''), (collectively the "Cirtek Group''). The Company's principal office is located at 116 East Main Avenue, Phase V-SEZ, Laguna Technopark, Binan, Laguna.

The Cirtek Group harnesses more than 67 years of combined operating track record. The Company's products cover a wide range of applications and industries, including communications, consumer electronics, power devices, computing, automotive, and industrial. For the group complete product information, please refer to their annual report published on the PSE website.

The Risks. The Cirtek Group is exposed to several risks due to its recent acquisition of Quintel Cayman, Ltd. and its subsidiaries, Quintel Technology, Ltd., and Quintel USA. The Company may have potential difficulties in integrating the new business to their existing business model, as their new product offerings may require different marketing and operational strategies. There is also the risk pertaining to the existing customer base of Quintel, as Cirtek may lack knowledge of Quintel's customers' behavior. There is a commercial risk if the Cirtek Group is unable to turnaround the business of Quintel and make it profitable. Cirtek maybe not be able to maintain Quintel's existing product licenses, while Quintel's R&D may be unable to produce new projects in its pipeline or create new tech or innovations to satisfy their customers. As a result, the Company would not be able to meet its projected level of sales or return of investment for their new business.

The Philippine Pension Funds. As of December 31, 2019, Social Security System (SSS) owned 13,626,860 shares and Government Service Insurance System (GSIS) owned 6,350,750 shares comprises of 3.25% and 1.52% of TECH’s total outstanding shares respectively. I knew that before these pension funds infused with their member's money to any company, due diligence is religiously adopted and it always has strict provisions that the said company is bound to declare yearly dividends consistently. I believed it added confidence and investment value to its investors in the long run. It is as well observed that as of March 31, 2020, in its top 100 and beneficial report excludes GSIS.

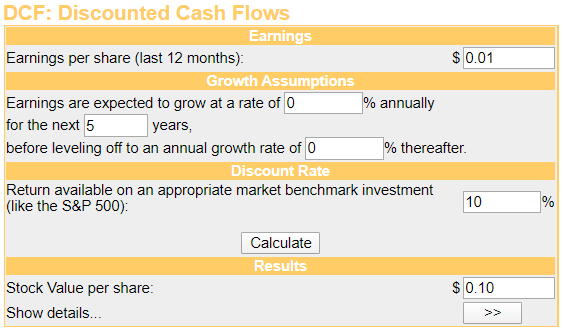

OBSERVATION: The global effect of COVID-19, which I always referred to as the WUHAN-400 plague, has a huge impact on TECH. We are now in the recession cycle and most economists around the globe anticipated a greater than the 1929 great depression. If this prediction materialized, consumer spending may be on sluggish if not on hold that influences their ability to maintain its projected profit. Now, is it time to invest in TECH? In my opinion, it is wise not to participate at this time due to the reasons above cited. Secondly, TECH failed in my overall quantitative fundamental valuations. TECH’s all-time high price at 65.00 on 04-Jan-2018 to its all-time low price on 13-Mar-2020 at 3.60 plunged 94.46% which in my opinion takes time to recover at this resistance level again. Although, it needs confirmatory if GSIS already liquidated their shares and if so, means that this ticker is no longer worth for long-term investing. On the other hand, if you are a short investor or day-trader (tsupetero), this ticker has the potential for a huge gain. At today’s (23-Apr-2020) close price at 8.71, it already gained 142% from its lowest support.

DISCLAIMER: I'm not a Certified Financial Planner. Published herein is my personal opinion and should not be construed as a recommendation, an offer, or solicitation for the subscription, purchase or sale of any securities.

Published - Thursday, 23rd April 2020, at 23:45.

Related Topics:

World Stock Market Bloodbath On Oil Crash

What’s The Impact Of A Negative Oil Price?

EEI FY2019 Financial Results

MRSGI FY2019 Financial Results

MPI FY2019 Financial Results

DMC FY2019 Financial Results

Will MPI Benefit The Government Stimulus Package?

Metro Pacific Investments Corp. (MPI) share price bottom?

What’s next for MPI?

Metro Pacific Investments Corp. (MPI)

DMCI Holdings, Inc. (DMC) FY2019 Financial Results

Please upvote and follow me on ----> https://steemit.com/@php-ph.

Please follow me on Facebook ------> Valencia, Bohol

Please follow me on Twitter ---------> Valencia, Bohol