PSE:MPI FY2020 Performance Evaluation

Metro Pacific Investments Corp. (PSE:MPI) Political Woes. After President Rodrigo Roa Duterte promised to tear down the oligarchy in the country, investors have steadily dumped shares in Manila Water Company (PSE:MWC) and Metro Pacific Investments (PSE:MPI), the parent of Maynilad Water Services. The savaged two listed companies suffered deep price losses. The sell-off intensified after the state water regulator said contracts with Manila Water Company and Maynilad Water Services would end in 2022, instead of 2037. Shares of PSE:MWC sink from the 52-week high of P41.40 to its 52-week low of P5.01 while PSE:MPI experienced the same consequence, from its highest price of P7.58 to P2.69.

Philippines Water Franchise Development. Recently, Justice Secretary Menardo Guevarra said a new water concession agreement has been signed between the government and the two water concessionaires that would improve service and result in the implementation of reasonable charges to its consumers. He added that before the new agreement with the concessionaires takes effect, certain conditions should be met and further emphasized that in no case shall the effectivity date be beyond six months from signing. Secretary Guevarra added that the new agreement is a lot more equitable than the original one. He can’t say with any certainty if the government will still pursue any legal action arising from the old agreement as there are many factors to consider.

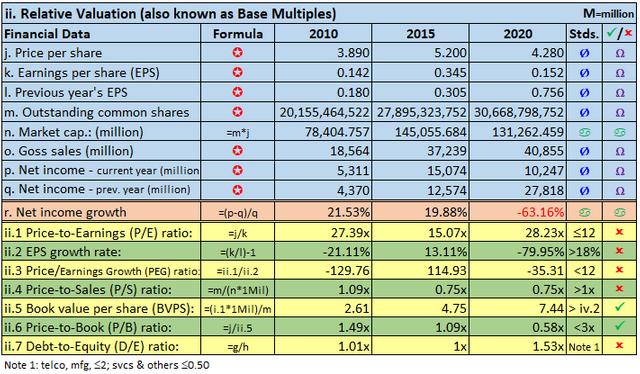

FY2020 Financial Results. The diversified conglomerate net income drastically decreased -63.16% to ₱10.28 billion compared to ₱27.82 billion in 2019 with the plunged growth in revenues at -17.09% to ₱40.85 billion from ₱49.28 billion a year earlier while earnings-per-share was fallen deep at -79.89% to 0.152 compared to 0.756 in 2019.

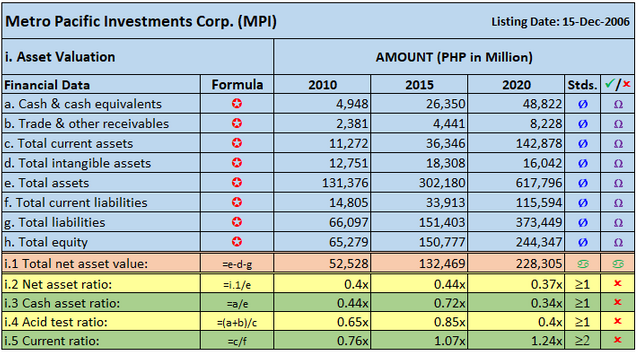

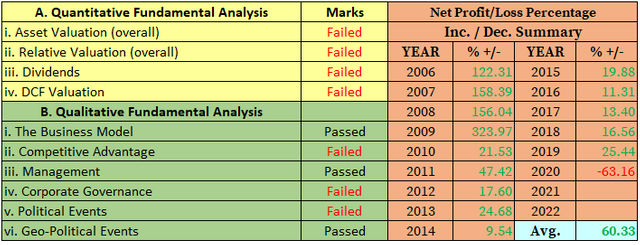

Five-Year Comparative Horizontal Analysis. My main emphasis on this analysis is to determine the profitability and financial position of this company by comparing financial statements for a five-year timeframe interval. This guides me in making sound investment decisions.

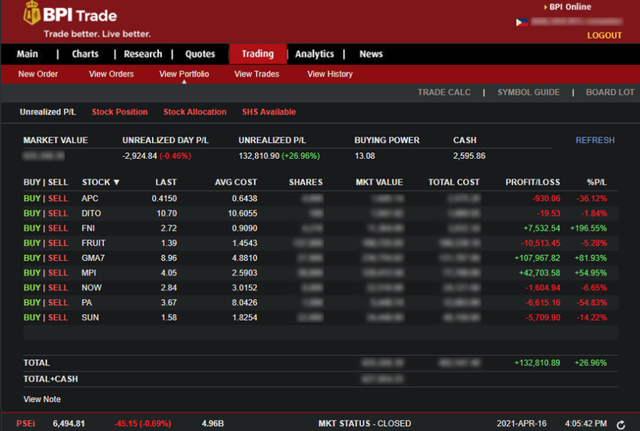

Is PSE:MPI Profitable To Invest At This Time? The answer will depend mainly on your investment strategy and time horizon. The matrices stated in the above table are not convincing at all. My shareholding of this stock was heavily accumulated during their political turmoil and I do not see my PSE:MPI share will expand in the near term. In fact, ready to liquidate any time necessary once the financial result in the coming quarters will not be improved.

The conclusion. In my opinion, the main reason PSE:MPI income plummeted to almost bottomless is due to its political woes with President Duterte’s Administration. Unless they will move towards a) cooperate and abide by the government’s terms; b) make sure their political allies win in the 2022 election; and lastly, join Duterte’s bandwagon, they will endure the same fate again in the future. Although this administration only has a little more than a year from now. If and only if, they will be lost grip in the forthcoming election. On the other hand, PSE:MPI based on the published annual report, claimed that the net income declined owing largely to the economic contraction brought by the WUHAN (COVID-19) pandemic resulting in the reduced toll road traffic, suspended and then reduced light rail services and decreased commercial and industrial demand for water and power. This is what every dud company has to say the least but not an excuse.

DISCLAIMER: I'm not a Certified Financial Planner. Published herein is my personal opinion and should not be construed as a recommendation, an offer, or solicitation for the subscription, purchase or sale of any securities.

Related Topics:

- Metro Pacific Investments Corp. (MPI) FY2019 Financial Results

- Will Metro Pacific Investments Corp. (MPI) Benefit The Government Stimulus Package?

- Metro Pacific Investments Corp. (MPI) share price bottom?

- Metro Pacific Investments Corporation (MPI)

For more topics, please click here ----> https://steemit.com/@php-ph

PHP: Friday, 16th day of April 2021, Philippines.