PHILIPPINE BOND INVESTING - The Basics

Due to insistent and popular demand, Most of us Filipino investors are financial savvy but conservative in nature.

That's why i will talk about some of the conservative investments that we have. For this topic we will be tackling about Bonds.

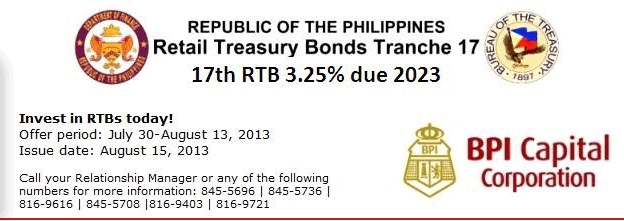

*Sample Retail Treasury Bond Offering by the Philippine Government accessible via BPI Capital Corp

In very simple terms, a bond is an obligation by the borrower (bond issuer) to pay the lender (bondholder) a specific amount of money in the future.

Like stocks, bonds are issued as a way of raising funds. If a company, for example, needs money to expand the business or to pay out loans, they can choose to issue either stocks or bonds in order to raise capital.

But here's the main difference: Unlike stocks, bonds generally offer a specified interest rate. This means the gains are guaranteed (although not as high as stocks in the long run)

The amount of money earned from a bond is determined by the Coupon Rate or Interest Rate of that bond. This is always announced prior to the issue. Most bonds pay coupon interest semiannually, that is, every 6 months, although there are some that pay quarterly or annually.

So where can we invest in Bonds?

As far as i know, There are multiple channels to choose from:

Corporate Bonds (if the company decides to offer one) - this can be a tricky one since the company can only decide whether they will offer or not

Via government bonds (Retail Treasury Bonds) - generally this is a much safer option since these are offered by the government. Personally i haven't tried to invest in these since initial capital requirements are quite high (around 50K to 100K in some cases)

Via managed funds (UITF) in banks - So far this is the most convenient. Currently i am invested in BPI UITF's Premium Bond Fund* an investment that fund seeks to achieve capital appreciation and income derived from a diversified portfolio of primarily medium term fixed income instruments. Unlike the other two above this one is easily accessible since these are offered by banks. Initial capital is also small at around 10K.

.jpg)

So in general, i personally use option 3 since this is the most convenient for me. Please do take note that there are other investments instruments out there and to each is his own style. What might work for me might not not for somebody else. But it hope you get the general idea on how bonds work.

For the next topic/s i will be discussing other investment types that i know.

HOPING FOR YOUR FINANCIAL SUCESS

WIL

NOTES:

*BPI UITF is managed by a fund manager and is a combination of other investments, for the purposes of discussion i only tackled the Bond part of their investment portfolio

DISCLAIMER: Insights posted here are for educational and informational purposes only and does not consitute to investment advice.*

Sources:

https://www.pinoymoneytalk.com/philippine-bonds-101/

https://www.pinoymoneytalk.com/make-money-invest-in-bonds/

https://www.pinoymoneytalk.com/investing-in-philippine-retail-treasury-bonds-rtb/

https://www.bpiassetmanagement.com/pages/bpi-premium-bond-fund

https://ofwmoney.org/how-to/retail-treasury-bonds/

http://kingfinancialcorp.com/corporate-bonds/

@bayanihan - as promised :)

thanks for re steeming @jlthegreat

thanks for the upvotes! i really appreciate it