WINNING THE PLASTIC WAR WITH PLASTIC FINANCE

Do you know that the world’s oceans are awash in plastic? Every year, eight million metric tonnes of plastic debris lands up in the oceans. Apart from this, marine environments are already polluted, with 150 million metric tons of plastic. This debris is highly harmful as it infiltrates the entire marine food chain and in turn, humans too when we consume seafood. The lack of a devoted waste management system is the main reason for the accumulation of plastic waste. As per a recent study, 90 per cent of ocean debris comes from a total of ten rivers, of which eight are in Asia, and two are in Africa. The perfect solution to this problem is blockchain technology.

Reasons To Use Plastic Finance For Recycling

- Plastic Finance offers reliability, safety, and control over our assets.

- Plastic Finance will help associate crypto tokens to waste which can then be credited to recycler wallets following successful recycling. Blockchain helps register each recycling activity, thus making the process secure and transparent.

- A Plastic Finance system allows workers to accumulate these tokens digitally and also enables them to exchange these tokens for local currencies or cryptocurrencies.

- Plastic Finance eliminates intermediaries, and hence, the workers can get the complete value for every waste they recycle.

One such promising initiative which is promoting the recycling of plastic in developing nations is ‘Plastic Finance.’

What is plastic finance?

Plastic Finance provides an environment, social environment and governance, also known as ESG-themed investing using cryptocurrency and blockchain technology. 1 PLAS token at the public sale price of 10 kg of carbon dioxide per year and approximately 6.4 tons of recycled plastic per year. By recycling recycling, Plastic Finance contributes to CO2 emissions as some of the profits are used for Greenify initiatives such as planting teak in the decarbonisation zone.

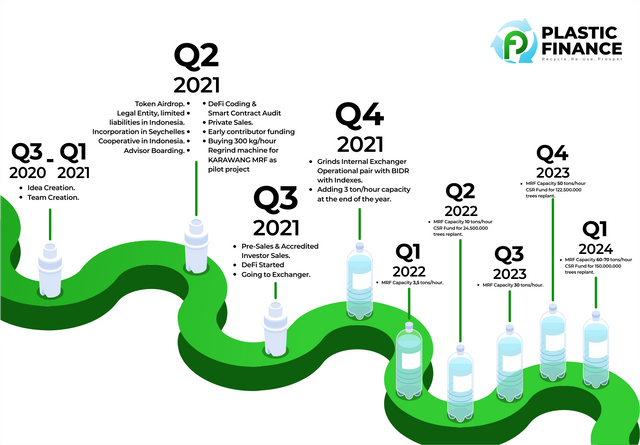

Plastic Finance empowers plastic waste collectors through cooperatives and DeFi, giving them financial inclusion and access to education. For every 50 tonnes of recyclable materials per hour, 50 people are required in the supply chain. Plastic Finance plans to recycle 80,000 to 2.16,000 tonnes of plastic waste per year by the end of 2023.

Blockchain technology and stablecoins can play a huge role in encouraging every household and MRF to optimize funding for the plastics processing industry. With the help of a smart contract, we can tokenize any type of shredded plastic and pellets, create an internal exchange so that people and industry have easy access to the monetization of plastic waste, and the blockchain provides more transparency for any plastic industry supply chain. In addition, we can create DeFi-Dapps (Decentralized Funding, Decentralized App) so that waste can be secured as an asset.

What is PLAS token?

PLAS is the proprietary token of the Plastic Finance ecosystem. PLAS is created to fund recycling projects and serves as a governance and ownership token to generate protege dividends or share profits from recycling and DeFi transactions, internal exchange spreads.

Plastic Finance will charge a 5% commission on the spread price of the internal plastic reclaimed funds exchanger and a 0.175% commission on a withdrawal or loan disbursement transaction on the DeFi platform. All these fees will be pooled into a wallet and can be distributed regularly using a smart contract.

Plastic Finance collects 60% of the net profit annually from the cooperative recycling company. In turn, Plastic Finance will distribute the commission and profit share as dividends to PLAS holders.

With blockchain and DApps, Plastic Finance can streamline the recycling business flow and empower scavengers to better handle their hard work. Plastic Finance will create an app that scavengers can use to sell their MRF waste, exchange it for cash, or store it as an asset in the form of Grinds Stable Coin, which can be secured on our DeFi platform.

Plastic Finance is a plastic waste startup

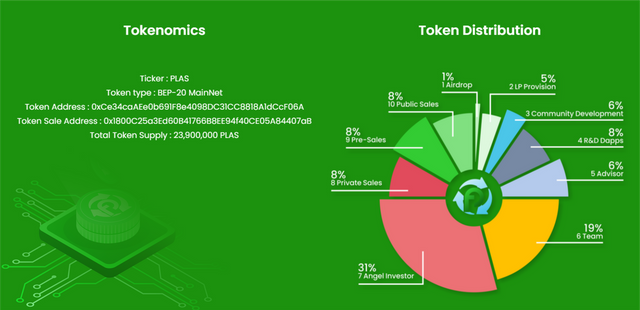

Tokenomics

Ticker: PLAS

Token type: BEP-20 MainNet Token

address: 0xCe34caAEe0b691F8e4098DC31CC8818A1dCcF06A Token

sale address: 0x1800C25a3Ed60B41766B8EE94f40CE05A84407aB

Total number of tokens: 23,900,000 PLAS

Token sale

TOTAL SUPPLY: 23.900.000 PLAS TOTAL

SALE: 2.000.000 PLAS for 1 USD.

EARLY FEES: 7,300,000 PLAS locked until 27 months

ACCREDITED INVESTOR SALE: 2,000,000 PLAS at $ 0.375 minimum 20,000

USD

Presale: 2,000,000 PLAS at the price of USD 0.6.

AIRDROP or Community Grant: 1000,000 PLAS Hardcap

Pre-Sales + Accredited Sales = $ 1,950,000

Total Hardcap Public Sales = $ 2,000,000, - (can be scheduled in IFO if pre-sales and private sales are successful)

Total Hardcap: $ 3.950.000 PLAS

pricing is tied to USD value.

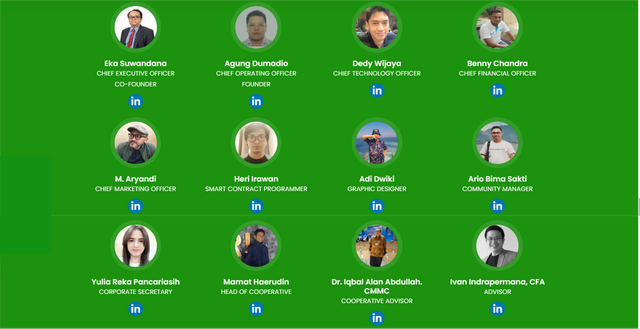

TEAM

Conclusion

Plastic Finance focuses on recycling plastic by improving the productivity of waste collectors. We do not break the waste value chain; instead, we add value to the value chain for the benefit of all parties. In addition, we support a tree transplant program to decarbonize CO2 emissions, further strengthening our commitment to a circular economy.

#Plastic #finance #ESG #Compliant #plasticfinance #plastic #bitcoin #ico #investment #pollution #waste #plasticwaste #environment #cryptounderlying #base #cube #plasticbasedunderlying #carbontrading #carboncredittrading #plasticbaseddingunderlying #carbontradingunderlying

More details here:

️Website: https://plastic.finance

Official Twitter : @Plastic _Finance

Back paper: https://plastic.finance/whitepaper.pdf

Official Telegram: https://t.me/plasticfinance

Facebook: https: //www.facebook.com/plastic.finance/

Linkedin: https://www.linkedin.com/company/plastic-finance

️Youtube: https://www.youtube.com/channel/UCxZvaGVdcOJ-_SnGaEn4kew

AUTHOR

Username: prorg

BTT profile: https://bitcointalk.org/index.php?action=profile;u=2745552

Wallet: 0xC147C42f3310e8a9b35B206b4F0f4D6FaDC5b11a