U.S. Debt Bubble Now 12.25 Trillion Dollars

U.S. Debt Bubble Now $12.25 Trillion Dollars

Will you prepare to survive the next Bubble Burst?

Photo Credit: iStock

As of May 2017:

Americans have now borrowed more money than they had at the height of the credit bubble in 2008, just as the global financial system began to collapse. - The New York Times

The U.S. Economy, Still The Biggest in The World

Photo Credit: Pixabay

The United States of America continues to be the largest economy in the World with a GDP of $19.25 Trillion Dollars, producing around 25% of the worlds economic activity, even though the population is only around 326 million people vs. the global population of 7.5 billion people (including the U.S.).

India tops the world in economic growth at 7.4%, (GDP $2.3 Trillion) with China 2nd at 6.2% annual growth (GDP $11 Trillion). The United States holds third place at an estimate of 2.2%, which is still an amazing achievement for such a large economy.

The Hamster Wheel of Debt

Photo Credit: Missing in the Mission

The world is in debt. In fact the United States economy can be said to be powered by debt, to some extent. This debt will never be paid in full and is met to be continuous and to actually increase.

Keynesian Economics view debt as a sign of success and this philosophy, while completely discredited is still the thinking that drives the World's Central Banks and World Monetary Policy.

The Game

Photo Credit: 123RF.com

Just in case you haven't figured it out yet, one of the most effective methods of tyrannical control, is the control of money. These invisible chains of debt are threaded through all companies, institutions, governments and the majority of people.

Like a drug addict, the financial system easily sucks in borrowers, whom often times never escape the grasp of debt.

Contrary to belief, most money is not printed, but is actually created on paper by banks. When these loans are made, they are listed as both a credit and a debit on the bank's balance sheets. The "money" is only real because the banks and government says, it is real.

This creation of invisible money is one of the principal ways in which wealth is transferred from the majority of people to a select group of few. This group producers nothing, yet is handsomely rewarded for simply creating money, loaning it as debt.

Essentially this amounts to a hidden tax, which is paid to private institutions.

Besides creating money out of thin air, "Boom and Bust" cycles are used to also accelerate the transfer of assets and wealth to the bankers.

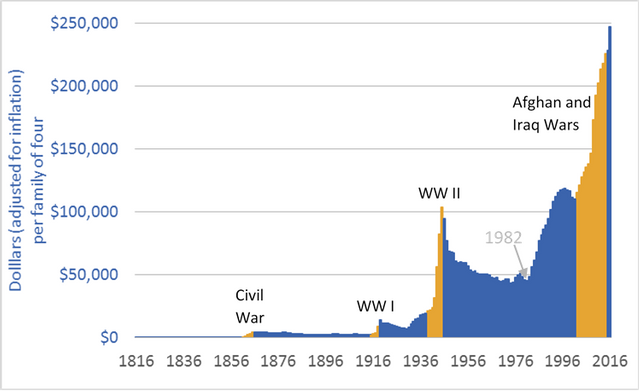

U.S. Debt

U.S. Debt per person $250,000

Photo Credit: Darrin Qualman

The value of all goods and services produced in the United States is stated to be around $18.5 Trillion Dollars and is expected to rise to $19.2 Trillion Dollars at the end of 2017, although indicators currently do not support that 2.3% level of increase.

In addition, the U.S. Federal Reserve estimates that there is around $1.5 Trillion Dollars of U.S. Bank Notes in circulation, with $5.3 Billion Dollars deposited in verified accounts. With perhaps as much as another $500 Billion to $1.5 trillion Dollars held abroad or simply "Missing".

In addition to outstanding bank notes, the United States has consumer debt in excess of $12.73 Trillion Dollars:

Mortgage Debt - $8.6 Trillion

Student Loans - $1.3 Trillion

Auto Loans $1.1 Trillion

Credit Card Debt $1 Trillion

Other Debt $0.73 Trillion

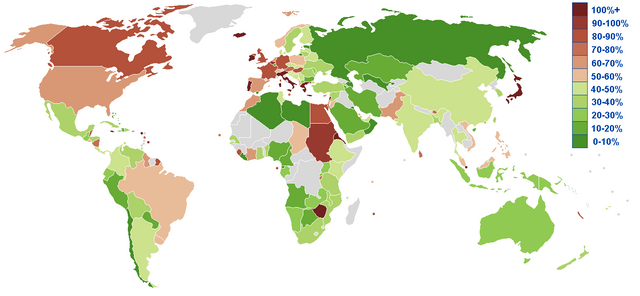

Public Debt

Photo Credit: CIA

The Combined total of Federal (104%) State and Local debt now equals 120% of the entire U.S. GDP. This has risen from 40.5% in 2008 and 73.6% in 2015.

To put this in perspective, in 1946, at the conclusion of World War 2, the United States public debt equaled 120% of Gross Domestic Product (GDP).

That's Not All Folks

Photo Credit: Warner Bros. Studios

These numbers don't count unfunded obligations like Medicare, Medicaid and Social Security, estimated at another $62 Trillion Dollars. This is close to the GDP of the entire World, estimated to be around $77 Trillion Dollars in 2017.

The bottom line is this; there is absolutely no way to "Grow Out" of this massive Debt. The only way to achieve a temporary correction is to massively deflate the value of all currency held today.

The last time this was done en-mass was by Franklin Roosevelt in 1933, when the value of all paper currency was slashed 70%.

No one knows when this will happen, only that it is likely to occur again.

Protect Yourself

Photo Credit: Sailing La Vagabonde

What can you do to protect yourself.

Get a Passport - Being able to physically leave, needs to be an option. Unless you want to stick around and get penalized for being part of the problem and stuck with the bills, get out, move away.

Prepare to Default - What would you do if you lost your job/business, couldn't pay your bills, etc. Sell the boats, the jet skis, the other junk you won't need, etc. Do it now and get liquid as soon as you can.

Once a crash occurs, no one is going to be able to afford to buy your stuff. If its been purchased with borrowed money, the bank is just going to take it back and you will have nothing. Same goes for your house, which will fall in value and likely find no buyers when you "Need" to sell.

Prepare to stop paying your student loans and other credit obligations, simply default. Student loans can't be cancelled by bankruptcy, so just walk away and move somewhere that doesn't care about your FICO credit score.

Do pay your taxes though, as the IRS can issue arrest warrants and revoke your passport, etc. So be smart and handle this before you go.

Buy Gold - If you have your wealth in physical Gold, you are protected from these currency manipulations and planned economic crashes.

Hold Bitcoin and/or Litecoin in a Hardware Wallet. Just like physical Gold, if you don't have it in your control, you don't really have it. Banks can be closed, accounts seized and assets frozen.

Find a nice place to live where you can pay cash for a home or live-a-board a boat and sail the World. Live your life and be happy, while you read stories about all the people who lost everything as the system collapsed.

If you have a business you may be able to re-open outside the U.S. and find you are more profitable or perhaps you will find new opportunities.

"By failing to prepare, you are preparing to fail". - Benjamin Franklin

Photo Credit: Sailing La Vagabonde

Sources:

New York Times

https://www.nytimes.com/2017/05/17/business/dealbook/household-debt-united-states.html

Trading Economics

If you have any questions, don't hesitate to ask. And if you liked this post please VOTE UP, RESTEEM, COMMENT and FOLLOW @clearshado for more Insightful Commentary in Support of Liberty and Freedom, Natural Rights, Alt Currency, Preparedness, Survival & Guns.

Underrated Article

Thanks for taking the time to read and comment.

Soon most people will turn to cryptocurrencies...