GOLDMAN SACHS wants to profit from the $1.3 trillion student-loan bubble

The $1.3 trillion student-loan market is a "bubble," Goldman Sachs strategists said in a recent note.

The banks believes the market for asset-backed securities refinanced by private lenders like SoFi "may offer relative value" compared to public student-loan securities.

More info in the article

http://www.businessinsider.com/student-loan-bubble-investment-is-private-abs-goldman-2017-12

My thoughts on this news

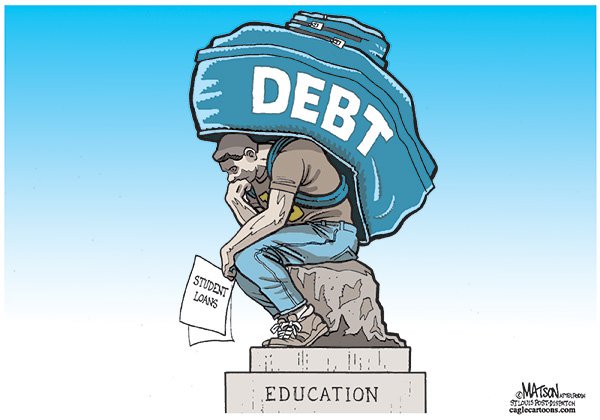

So Goldman Sachs was one of the banks that was responsible for the 2008 economic crash, and now they want to profit from American students who can barely afford to pay their debts because they cannot find living wage jobs. Of course Goldman Sachs was bailed out by the Federal Reserve Bank, the Federal Reserve had to create some money out of thin air, which increased inflation, and they gave it to Goldman Sachs so they could continue to function on a daily basis and not shut down. Unfortunately none of the Americans who lost their homes because they could not afford to pay their mortgages got any bailout money from the Federal Reserve. Now Goldman Sachs wants to privatize the current student debt so private banks can earn interest from American students who can barely pay their bills. This is what happens when we live in a broken economic system where the rich get richer...

Congratulations @suffragator! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

To support your work, I also upvoted your post!

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPThis post has received a 0.45 % upvote from @speedvoter thanks to: @suffragator.

You got a 3.13% upvote from @dailyupvotes courtesy of @suffragator!

Please upvote this comment to support the service.