The State of the Union is Centralization for Authority but Decentralization for the Many

To sum it up, this is the good old "divide and conquer". Decentralize the many so that the few can laugh all the way to the bank. But when the many are unified, authority becomes decentralized and/or nullified. You might have also heard that we've never tried socialism, capitalism, or (insert other political dogma here). This is because there are two sets of rules: those that apply to authority and those applied to everyone else (because the reality is that some people actually are above the law). This is why the few are allowed to capitalize their gains, but socialize their losses while the many socialize their gains and capitalize their losses.

We are finally reaching a turning point in the world power structure caused by centralization of financial power in the tech industry. Newton's third law is playing out by providing us with the Yellow Vests and cryptocurrencies in opposition to centralized IT.

The analog office structure of government has become a dinosaur unable to keep up with the technology. Soon we are going to see technocrats attempt to rewrite the laws to legitimize their ascension into power. It may take the form of the "software license agreement" that everyone just clicks through without reading. Finally you will make that one last click that will have sold your soul.

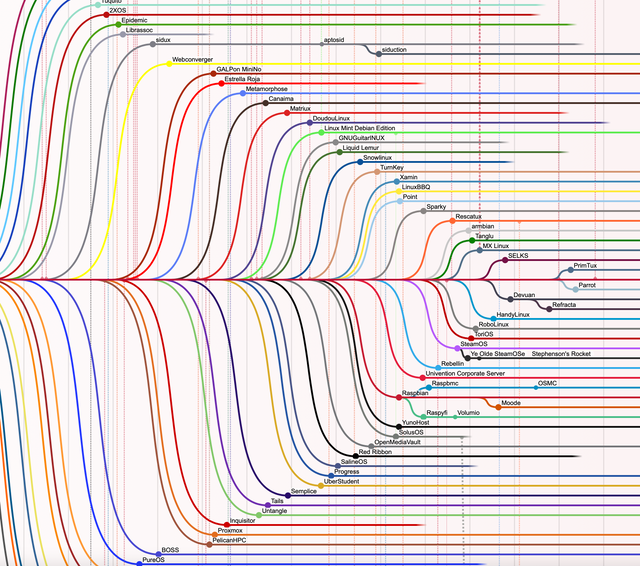

This is why I have already opted out of centralized platforms such as FB and Twitter. The software business that I have been running for well over 20 years is now captured because it has become dependent upon centralized IT. This is why I'm in IvanOnTech's Blockchain Coding Academy and am primarily more interested in Linux. Apple and Microsoft are forces for centralization of power. In contrast, the Linux distribution looks like this:

This ancestry tree is so vast that only a small portion of the image will show. This is what decentralization looks like. Does it look familiar to you? It should if you're involved in crypto. All those Linux forks are essentially the same as bitcoin forking into the thousands of altcoins. Unfortunately, decentralization runs in aversion to mass adoption. This fracturing of the platform is one of the reasons why it hasn't overcome Microsoft or Apple even though it's superior in most of the ways that matter (especially in security).

Implications for the Crypto Market

We hear people like @tonevays say that as long as altcoins are still with us that the bear market will continue. I'm not sure that I completely agree with this, but I do agree that bitcoin has suffered from the divide and conquer (forks) of the code due to lack of consensus. This causes a distribution of the market cap across an ever increasing number of currencies which means that growth of any single asset is likely to be stunted as long as lack of distinction is made. But this depends heavily upon the mathematics of wealth distribution which will become forces for an exit from national fiat in the next decade.

source

However, 2017 was the year of the ICO and this was the main reason for the cryptocurrency bull market the last time around. Lack of clarity exists at this point in what one should invest in because few understand the reasons for why bitcoin exists in the first place. Regulators will provide proof of which crypto's are the most centralized (and should therefore be avoided if you value your freedom).

It looks like 2020 will be the year that the SEC goes after cryptocurrency companies that are unlicensed securities. They have been going after small companies in order to set a legal precedent knowing that they will accept a plea deal in order to not contest the charges. Of course, the larger companies will be much harder to bring down, so they are saved for later. I suspect that the next bull run will start when a few of these larger marketcap altcoins are demolished by regulators around the summer of 2020, but not because of the regulators. I think the next bull run will be sparked by those who consider crypto to be a safe haven when the traditional markets begin to suffer volatility.

Dinosaur Government Fade Away or Collapse?

The US government will increasingly become a puppet similar to the English monarchy in relation to parliament that secedes control over to technocrats. They have already moved in the direction of merging FB and other social media with the deep state (NSA, CIA, etc). In time, they may eliminate the pretense that you have any control whatsoever through the vote. The reality is that the vote is a red herring designed to distract you from your real power which lies in your wallet. In case you realize that, they want one extra assurance, that you are saddled with debt.

In addition to this, the current power structure has become opaque and you've become transparent. They know exactly how far they can push you because they are fully aware of the extent of your resources. This lack of privacy is one of the key reasons parasites have been able to grow so powerful. Information is the most valuable wealth asset one can have.

When in a negotiation for a sale, if the question diverts away from the object's worth, to "how much do you have", you've crossed the line of voluntary exchange into slavery. Knowledge of your assets can be used to bargain right up into your limits which decreases your power and makes you subservient.

This is why decentralized cryptocurrencies such as bitcoin are important for monetary sovereignty and promoting true freedom. It has a long way to go yet because the bitcoin blockchain is public which means that fungibility of the currency is not as strong as USD (cash). Freedom depends upon whether technologies to make transactions private, such as mimble wimble, zksnarks, etc, will succeed and be adopted. Anonymity gains strength in large numbers.

3FwxQsa7gmQ7c1GXJyvDTqmT6CM3mMEgcv

Another great post.

If I am not mistaken, I believe Linux is the most used system for servers...is that correct?

Also, what do you charts say about the rest of 2019? Do they view another below average performance?

I agree the next bull could coincide with the collapse of the traditional markets. Fiat is pumping it up so much. I thought it would hit in 2019 but with the earnings reports and the Fed pulling back, I think it is pushed back to 2020.

I do feel that if the SEC did ever lighten up and allow the sharks to start setting up funds to sell crypto to the institutions, that would also spark it. Ironically, it looks like, if this comes, it will be pushed back to 2020 also.

@tonevays says not to look for an ETF any time soon. Technically the bear market is supposed to end this month, but if you look at the historical bottom, they appear to be lengthening out so the downward force is gone but upward movement will likely be lacking for the rest of the year. I think we will see a bottom this year. I'm expecting sideways trading for the rest of this year. Crypto gains should be really spectacular by early 2021. I think that summer 2020 will be similar to the mood of crypto in spring of 2017.

Not sure, but it would make sense because Linux's security model is far better.

Astrologically, the Jupiter, Saturn conjunction often represents a change of leadership and generational changes (death of the old, birth of the new). This happens in 2020. On top of this, the USA Pluto return is coming up in 2022 - 2023 which means that the world revisits the spirit of 1776. The war with the British began a couple of years before, but continued well into the 1780's. This time though, we are aligned with the British, so who are the colonists? The 3rd world. Crypto will offer them an opportunity for freedom. The rest of us could be in danger of living in a digital panopticon in the west for a while if we submit to authority. The period between 2020 and 2040 will be similar to the period between WWI and WWII in many ways.

I too have made the comparison of crypto to Linux.

However, In some circumstances,

I think we have to look at the differences.

Crypto is a trust network of value. It can pay to develop itself.

If organized properly, it can pay for all open source dev.

Our need to revolutionize money far exceeds the need to revolutionize operating systems. Linux never has and never will garner this much attention, and I think that points to a pronounced acceleration in the years to come.

The tipping point comes when developers can quit their jobs and come work for blockchain. Indeed, this will happen in the developing world first because the cost of living barrier to entry is lower.