Power Packed: Flow Batteries vs. Lithium-Ion

If alternative energy sources hope to compete against the fuels that powered developed societies into the 21st century, they will need help from energy storage systems.

The best chance to keep pace with fluctuating energy demands from unreliable sources, such as wind and solar, is to have a stable source of energy storage and release.

Thusfar, Lithium-ion (Li-ion) Battery technology leads the sector for residential and commercial energy storage. However, Flow Batteries are gaining marketshare, (Using the term "Flow Batteries" will encompass all battery compositions varieties that can handle commerical-grade loads (Hydrogen, Bromide, Vanadium and some Organic).

Redt Vanadium Flow Batteries

Three key measurements drive market dominance for battery packs: duration, costs and interoperability.

-- Duration is the amount of time a power pack system can provide sufficient energy to the it's endpoints without charging

influx. Duration also entails the lifespan of the battery packs before degradation requires replacement.

-- Cost is the over/under of traditional energy sources such as coal or natural gas. Cost drivers are also maintenance and

replacement of cells or fluids within the battery pack, and entire system replacements.

-- Interoperability concerns the level of support during the lifecycle of the power system and especially towards the end-o-life.

Consumers and clients want to know the company that supplies the equipment or a similar manufacturer will be available to

support and replace the system. Similar to a stock that's not listed on any major exchanges, the liquidity or ability to sell that

stock is more important for investors even if the company looks strong and has great productivity currently. This issue of

equipment liquidity or replacement when necessary, may cause better technology to lose if customers don't believe the

company can survive until mass adoption.

Research firm I.H.S. Markit issued it's biannual Grid-Connected Energy Storage Tracker in late July 2017. Among its predictions are the fasted energy storage regions which include California, South Korea, and Australian markets.

In California, private and public money is available for stopping Brown-outs on the west coast. There's much government regulatory subsidy pushes towards Self-Generation and increasing energy storage capacity from providers.

South Korea has many reasons for procuring multiple sources of reliable energy reserves. I.H.S. expects South Korea to grow more than 300MW annually from 2018 onward.

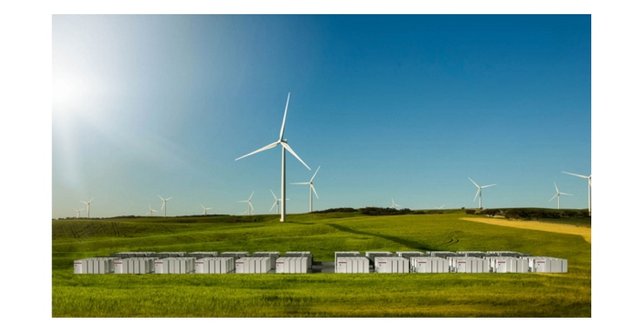

Australia is a natural fit for energy storage solutions due to its shaky grid reliability and high energy costs. Tesla is directly involved with providing a Li-ion solution with a combination of wind-farms across the great plains of SA.

Tesla's vision of Battery Modules supporting Windmills

The Australian project is the biggest project yet for Tesla. Elon Musk states the system will be, "three times more powerful" than any other on earth.

With 100 MW output, it is three times larger than the AES battery system recently built by San Diego Gas & Electric, and five times larger than Tesla's current biggest project in Mira Loma California.

Duration is definitely dominated by Flow Batteries. Flow Battery manufactures are consistantly boasting a 6 hour backup time with 20 year warranty at 95% power capacity. This is compared to the average of 4 hour backup time, 10 year operating life with 3 to 5 percent degradation of Li-ion battery.

Li-ion cells may need replacement before end-of-life, with some models predicting 50--85% replenishment between seven and 10 years.

Costs are cheaper up-front for Flow Batteries also, however Li-ion prices continue to fall as stated in UtilityDIVE by Perter Maloney, "The cost of li-ion battery packs has dropped from $1,000/kWh in 2010 to $350/kWh in 2015 and as low as $190/kWh in 2016, according to Selmon and Wynne." Tesla's magic number is $100/kWh and they are very close.

Most Flow Batteries are behind as stated in ValueWalk, “Ben Kallo at equity analyst firm, Baird, believes that Tesla’s current battery costs are ~$150 to ~$200 per kilowatt-hour – well below the industry average pack costs of ~$350 per kilowatt-hour (as estimated by Bloomberg New Energy Finance). Kallo suggests that Tesla “could reach its <$100 per kilowatt-hour target in the intermediate term as Gigafactory production ramps up”.

However, some output per unit can be increased with more flexibility in Flow Batteries simply by increasing the amount of fluid in each cell. For example, a startup called ViZn Energy Systems with a zinc-iron Flow Battery, claims to produce at a 20% cost reduction of a current Li-ion storage provider with Tucson Electric Power.

The problem with Flow Batteries corrosive and sometimes toxic fluid, it is expensive. Also, there are parasitic costs with Flow Batteries due to energy required to run the pumps. With the cost of Li-ion coming down so rapidly, Flow Battery technology must achieve better than 20% difference to entice providers to chance thier technology.

Taking a risk on Flow Batteries brings us to the final big word, INTEROPERABILITY.

Will the rugged startup be around in the 20 years guaranteed by its warranty? Who will be around to service the battery packs for companies with only 7% of market share? Can the Flow Battery technologies scale the same as Li-ion battery farms already in operation?

The lead in markets of scale may be too heavily weighed in favor of Li-ion technology at this point.

Large scale projects breeds large scale companies that can install quickly, maintain systems, and most importantly replace broken parts or systems well into the future.

Sometimes better technology doesn't always win as in Betamax vs VHS, 1920's electric car vs gasoline, or TiVo vs Cable Companies "good enough" dvr.

If it's good enough (and getting better), why take a chance on the other?