Is USUAL the Future of Stablecoins?

USUAL has introduced key innovations in DeFi with the launch of its USD0 stablecoin, designed to replace Tether (USDT) and offer improved stability, efficiency, and rewards. By leveraging Real-World Assets (RWAs) like investments from BlackRock, Ondo and Mountain Protocol, USUAL has created a blockchain-verifiable, permissionless stablecoin that redistributes ownership through its $USUAL governance token. This approach combines yield generation with growth potential, setting it apart from traditional stablecoins.

USUAL’s model also addresses the limitations of centralized issuers like Tether and Circle by redistributing 90% of its protocol value back to the community, ensuring users benefit from the ecosystem they help grow.

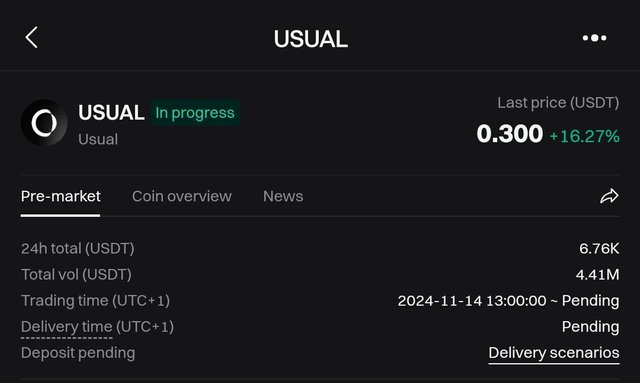

Interestingly, USUAL is already available for pre-trading on Bitget and Binance pre-market, providing an opportunity for early engagement with the stablecoin before its broader launch. This early access could give participants a closer look at how USUAL’s decentralized approach operates within the market.

As USUAL continues to evolve, it will be intriguing to see how stablecoins like USD0 and community-focused models shape the future of DeFi. How do you think these developments will impact the space?