Predictive Analytics in Insurance - How it is making an impact on Insurance Data Analytics in 2019

The insurance industry is one of the largest and complex sectors for two reasons:

- Highly competitive Sector

- Highly regulated sector

Consumers are ready to pay a premium for getting good insurance plans. But the insurance marketplace is highly diverse now, as a result, consumers preference also changes. This is one area where the use of predictive analytics can be effective for Insurance companies since the companies have to foresee the change in consumer preference.

You may be wondering now:

How consumers preference change?

Well, Consumers understand the need for personalized offerings for insurance plans.

That is why Insurance companies are shifting their core focus from a “product-centric” to a “customer-focused” approach. But it is not an easy transition.

So now the question is how to make it happen?

Here is the kicker:

This is where predictive analytics plays its part in insurance and data analytics.

Before getting into how predictive analytics help insurance companies, let us look at the challenges faced by insurance companies:

Challenges

- One of the most difficult challenges faced by insurance companies is the exponential rise in types of data

- It has delivered an extremely rich data but extremely poor in delivered value.

- The conservative nature of the insurance sector is another challenge for companies.

- Analytics which are being used now are either primarily descriptive or historical.

How to overcome these challenges by using predictive analytics?

To gain high confidence in the predictive analytics companies has to rely on new predictive tools and database technologies which are integrated with big data that offers better and far superior behavioural information which guarantees security and solid behavioural information.

This is where predictive analytics has a solution for you!

So what exactly is predictive analytics and what is its use in insurance data analytics?

“Predictive Analytics used in Insurance Data Analytics is revolutionising the way in which companies mine data and fetch actionable insights on customer behaviour and other aspects.

Predictive analytics is a big data discipline that leverages existing information to make predictions about the future.

It incorporates techniques from data mining, artificial intelligence (AI) and machine learning to make educated guesses about how customers may behave under a given set of circumstances. “

4 touch points of predictive analytics

To quickly summarize about predictive analytics and its impact on insurance data analytics, the main 4 touch points are:

- Enhanced upselling and cross-selling abilities

- A heightened customer experience

- Improved retention rates

- Overall improved customer satisfaction

What companies like GeoSure has to offer for Predictive analytics in insurance underwriting, marketing, fraud claims etc?

GeoSure has created the most:

- Highly scaled information

- Real-time information

- Hyper-local safety information

Why GeoSure?

Geosure covers tens of thousands of neighborhoods across every major city

GeoSure analyzes massive amounts of data from trusted global sources as well as artificial intelligence data harvesting

Which fuels proprietary risk algorithms to create safety ratings from 1 (Very Safe/Cool) to 100 (Very Dangerous/Hot) called "GeoSafeScores."

Hyper-local risk factors for modelling and mitigating malicious perils such as kidnap and ransom, theft, arson, political violence/riot, workplace violence

Safety content and personal safety tools for policyholders.

In this way, GeoSure provides personalized, relative vulnerability awareness to anyone, anywhere, in real time.

GeoSafeScores covers critical safety categories:

- Overall Safety

- Physical Harm

- Theft

- Basic/Political Freedoms

- Disease & Medical and Women’s Safety

- LGBTQ safety

- Localized safety ratings to this level of granularity have not existed, until now.

- Safety data applications include mobile safety awareness tools available in iOS and Android

- Enterprise solutions for the Travel & Tourism, Insurance, Commercial Real Estate, and Transportation industry verticals.

“In insurance, location is everything. It helps insurers understand where the risks are, whether there has been accidental (or deliberate) accumulation of risk and where their customers are.” – Tony Boobier, Analytics Leader – Insurance, IBM

Predictive analytics help in getting real-time, hyper-local, personalised and other hyperlocal risk factors. That's why insurance companies are relying on predictive analytics for getting accurate insurance data.

Every data point has some relationship to a location in the Insurance Industry. Location data helps insurance companies in insurance data analytics in the following ways:

- Advertise their core services

- Find their customers who fit the user persona

- Analyzing potential risks

- Distribution strategy to be deployed

- Supply chain management systems

Advantages of Predictive Analytics in Insurance Sector

Advantages in Underwriting

Predictive analytics assist in the underwriting process by:

- Enabling better risk assessment

- Enabling better classification

- It leads to better pricing

- Real-time support

- Dynamic pricing

Want to know the best part?

Pricing analytics is the tipping point here for consumers in looking for best insurers and products.

Further, it leads to better profitability for insurers since they can now target customer segments which are specific and desirable to the requirements.

Advantages in Marketing

Predictive analytics has applications for marketing in:

- Customer acquisition

- Retention

- Cross-sell

It is observed that customers with more than one policy show a better and higher retention rate.

The worst part is, Inorder for each policy to become profitable it will take 2-3 years because of sales acquisition costs.

This is where predictive analytics help to solve the problem since it helps to target the right customers by predicting who may leave or churn.

Other Advantages

- Predictive Analytics can be used as an important defence against insurance claims fraud

- Insurance fraud is one of the largest crimes in the USA which is resulting in a fraudulent loss of $80 billion (Reference - - - Coalition Against Insurance Fraud)

- Predictive Analytics helps in to detect duplicate and fraudulent claims and flag it

- By combining predictive analytics on future losses with past losses data, it helps in managing loss reserves

- Better allocation of funds

- Predictive analytics can improve cash management which can improve margins

Still not convinced? Here are some key insights on why Insurance companies should go for Predictive Analytics

Data and Analytics served as an essential tool for insurers in recent years. Mainly to develop and design more sophisticated approached across all aspects of operations.

An incredible amount of data is flowing in from a lot of digital channels. We can see the paradigm shift in the functioning of insurance companies in areas like:

- Claim processing

- Product planning

- Pricing

- Customer self-service

- Marketing

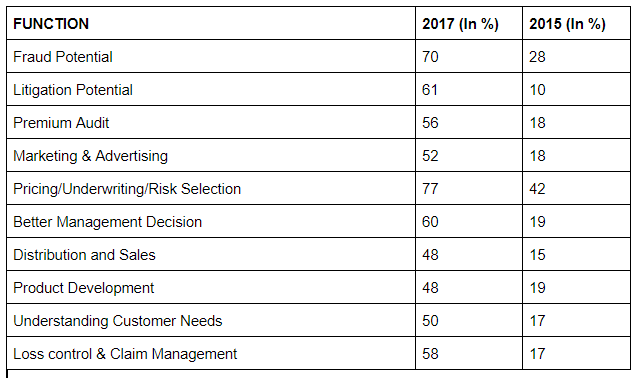

Below table gives the insight about the number of insurance companies which are relying on predictive analytics, you can see the change in number when it comes to 2017 from 2015.

Think about this for a moment: In the last two years, There is almost a surge of 60-70% in the number of companies who are relying on predictive analytics in Insurance data analytics.

Just imagine: Still, around 30-40% of your competitors are yet to explore the application of predictive and big data analytics. This is the right time for you for a head start. You’re in a never-ending battle when it comes to insurance data analytics, so this is the right time to kick off.

What’s the bottom line?

Predictive analytics in insurance helps insurance in reaching new heights. To summarize:

- Improved and better underwriting profitability

- Advanced intelligence on customer and underwriting trends

- Very personalized products and offerings

- Advanced risk management enabled by analytics

- Maximized returns from investments

- Faster claims processing leading to improved customer satisfaction

- Real-time or near real-time analysis for responding to new business

- Insight-driven decision making enabled by drill-down information on product, producer and customer profitability

Hey @saheen! Glad to meet you here! Have you tried Partiko? It’s a really cool Steem app! You download it, login using your Steem account, and boom, you can use Steem on your phone!

What’s even cooler is that they reward you Partiko Points for using it, and you can cash it out for STEEM!

Join using this link: https://partiko.app/referral/vintage-m , and you will get 3000 Points as a bonus! Let’s see who can reach 30000 Points first!

Congratulations @saheen! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!