LOW EARNING METHOD WITH ZERO RISK; ARBITRAGE

Here we go again.

ARBITRAGE

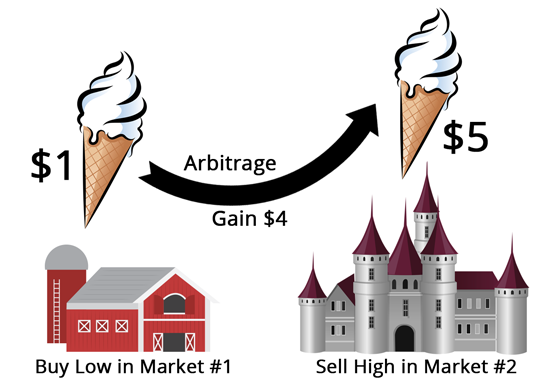

Arbitrage, to explain briefly, is to make a risk-free profit by simultaneously buying from the low-priced market and selling in the high-priced market, in case the price of the same security, currency or precious metal traded in different markets is different.

These products can be precious metals such as gold or securities such as stocks. The aim here is to make a profit completely risk-free. One of the most asked questions today is Arbitrage, that is, how to make a risk-free profit?” is the question. For this reason, many large-scale and globally known companies seek an answer to this question by creating arbitrage pricing models. However, in today's capital markets and money market conditions, this is more difficult than it seems.

Because now almost all markets are intertwined and information sharing has reached incredible speeds. For this reason, it has become increasingly difficult to manually mispricing in any market and thereby making profits by arbitrage. When this is the case, arbitrage transactions have become made with algorithmic software. These softwares perform risk-free arbitrage transactions by sending orders to both exchanges at the same time, when an arbitrage opportunity arises for the same security traded in different markets.

ARBITRAGE EXAMPLES

Although, as we mentioned above, it is difficult to arbitrage with human power in today's market conditions, it is possible to do arbitrage theoretically, especially when volatility increases. For example, Euro TL - Dollar TL gives us the Euro Dollar price. While it is almost impossible to arbitrage on the Euro-Dollar price, it is possible to make this possible by introducing TL into the business and to arbitrage theoretically.

It is also possible to catch an arbitrage transaction on the gold commodity. Gold is the right financial product for arbitrage as it is traded on almost every local exchange. The price of gold is traded in dollars in international markets. However, on local exchanges, gold is traded in local currencies. E.g; In Turkey, Gram TL contracts are traded in the Futures and Options Market under the umbrella of Borsa Istanbul. On the Indian stock exchange, gold contracts are traded in Indian Rupees (INR). By converting the same product traded in the local currency on both exchanges to dollars, an arbitrage opportunity can be found between the two exchanges.

The most important issue that should not be forgotten for arbitrage is that when we buy the same product from one place, we must sell it at the same time in the other place. Because basically, arbitrage aims to take advantage of price differences.