Buyers Regaining Power as a Flood of New Properties Hit the Market – Australian Property Market Update for Week Ending 29 October 2017

It’s been a while since my last property market update. Due to the passing of my mother-in-law and an intense season in my business, my writing took a back seat. But I’m back now and plan to post these updates at least fortnightly, if not weekly.

Key Highlights:

- The number of auctions across the capital cities rose to its highest level in 2017.

- Melbourne sellers broke the record for the number of auctions held in the city.

- Auction clearance rates are slipping, giving more power back to buyers.

- In September, Sydney home prices fell for the first time in over a year. In October, the median house price in Sydney fell another half percent.

- Melbourne continues to show signs of relatively resilient demand.

The Latest Auction Activity

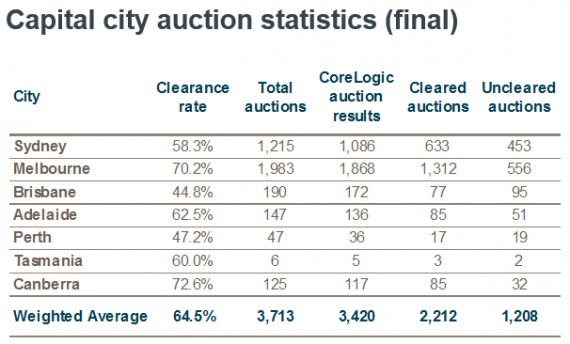

This week marked the busiest week for auctions all year, with vendors offering up a whopping 3,690 properties at auction. Melbourne led the way, breaking an all-time auction volume record, with 1,983 homes presented.

All the capital cities posted clearance rates sub-70 percent, with the exceptions of Melbourne and Canberra. The auction clearance rate in Sydney fell into the 50s for the first time in over a year.

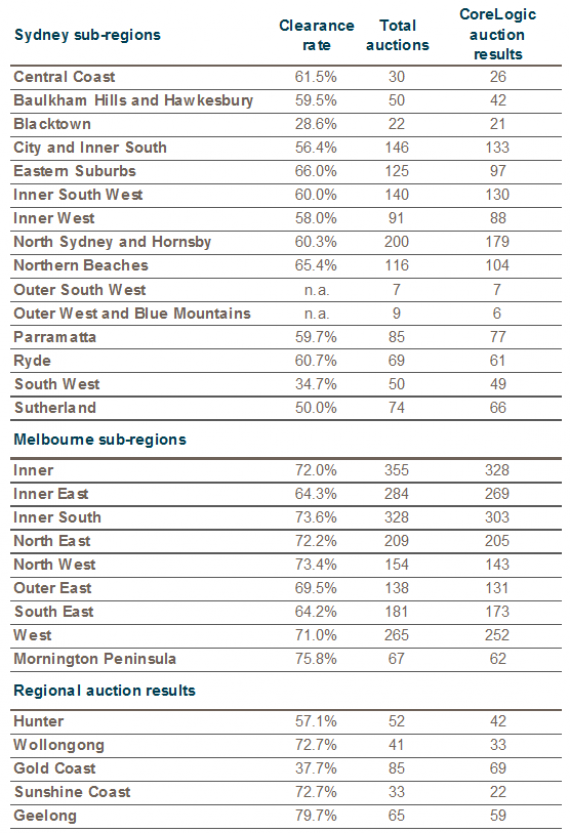

Here are the latest results for our largest capital cities, followed by a breakdown of the sub-regions and key regional areas:

Recent Changes in House Prices

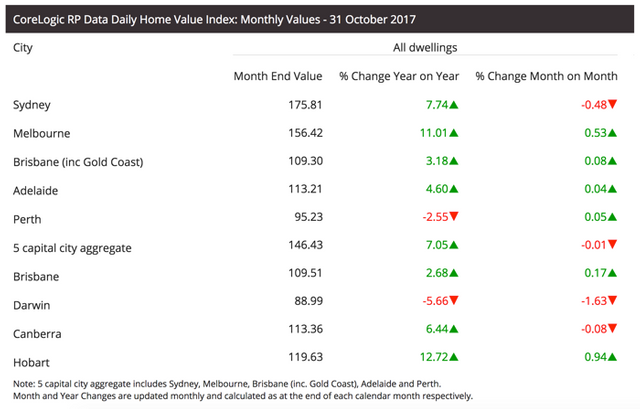

During September, Sydney prices fell for the first time in over a year. Melbourne prices, however, continued to climb. The same held true in October, with Sydney prices falling nearly a half percent.

source

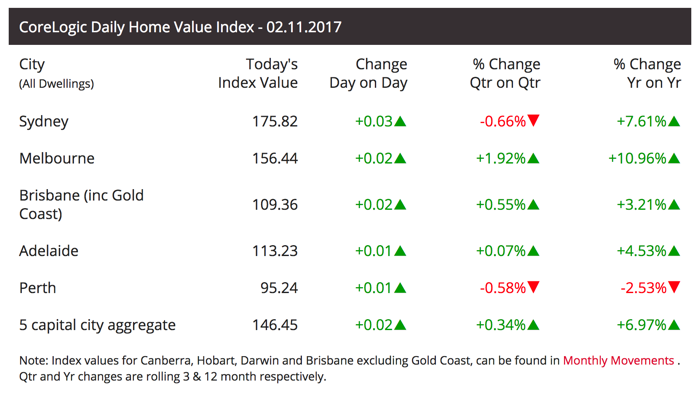

Looking back over the rolling quarter and year, although Sydney home prices are in the red for the last three months, annual growth still sits at nearly 8 percent. Melbourne home prices have risen 11 percent over the past twelve months.

source

Market Analysis

Auction volume this week was higher than even the pre-Easter figure back in April this year. Melbourne pulled most of that weight. Sellers there pulled forward auctions ahead of next week’s spring racing carnival festivities.

But Sydney also saw a significant rise in the number of homes auctions, showing that a primary reason for the increase in supply nationwide was seasonal. Every year, the number of properties for sale tends to gradually increase through the Spring, before hitting a peak in early December.

As demand appears to be declining, especially in Sydney, a further increase in supply over the next month should swing more power back toward buyers, leading to lower offer prices. Auction clearance rates will also likely fall. Don’t be surprised if even Melbourne sees a dip in price growth over November.

That said, there’s still reason to be optimistic about the Melbourne property market. If Sydney is our guide on what people can afford, based on current Melbourne home prices, there still seems to be room for prices there to move a little higher.

Another reason to be optimistic in the near term is that Victoria’s population growth is currently the highest in the country, at 2.4 percent per annum. Those people will obviously need a place to live.

Record-low interest rates are the (ultimate reason real estate is so expensive)[]. Barring chaos in the overseas bond market or a shock rate-rise from the RBA, low borrowing costs will underpin demand and should prop up home prices in the near term.

We’ll find out more on Tuesday next week about the RBA’s outlook for the economy. I expect little to change from RBA Governor Philip Lowe’s previous comments. Inflation and wage growth are low, household debt and home prices are high, and the Aussie dollar remains resilient, despite lacklustre economic data. All of that equates to a greater chance of a rate cut than a rate hike.

As I’ve mentioned before, barring chaos overseas, home price growth should remain relatively flat for the foreseeable future. After all, that’s what our regulators want, and they seem to be holding all the cards for now.

Jason Staggers

Starting to see some chinks in the housing market armor. Look forward to seeing how price and sale data progress in the coming months.

It will be interesting to see where we go from here. The Aussie psyche related to property is so bullish though, I think it will take a shock from overseas to raise rates before we see a significant fall in prices. Will keep you posted :)

I wonder how this compares with the housing market in Texas because I know the market was crazy hot there when I left.

The median house price in Dallas is about one-third that of Sydney, but the growth rate over the past few years has been about the same.

Any information about the San Antonio area. I know with the recent Oil and Gas prices in the area construction is booming (at least until the bottom fell out of the price of oil).

If that's the same as Sydney then that is insane growth! Definitely a sellers market.

What a contrived world we live in. Depressing.

It is a bit of a joke. Perhaps someday wisdom will prevail.

Hey Jason welcome back mate, there is a lot of negative news about property in the MSM lately. It's starting to look like a major reversal in sentiment for the property market, those Perth numbers are startling,thanks for the update, cheers.

Thanks mate. Yeah, I've noticed. But I think the average person, at least in Melbourne, thinks residential property is rock solid. It will take some pain before people change their mind.

That is a huge number of auctions for Tasmania. Market down there is on fire! Great update.

Haha! Yeah, that's about the average weeks for Tassie.

Sorry for your loss. Glad to have you back writing here with us. Your frank and evidence based analysis of housing market developments in Australia is both rare and invaluable. Keep up the good work :)

Thank you!

Great to see you posting again. There is such a small real estate community here on Steemit. I enjoy seeing other people's perspective on real estate - even though Australia is so far away from the US - it's amazing how similar things are - keep up the great posts.