2016 Blockchain Year in Review for Casual Observers

2016 is over and there are still no mainstream use cases for Bitcoin or any other blockchain. Given how much media hype there has been since the fall of 2013 when the U.S. Congress and the Chairmain of the Federal Reserve first spoke publicly about Bitcoin, casual observers may think the space is dead.

Bitcoin adoption has continued to grow this year though and several other blockchains have emerged. If you look at the data, it is clear that blockchains are showing promising growth and will have major implications for the ownership rights, security and power of people around the world.

What is a blockchain?

The term “blockchain technology” gets used quite broadly, so to understand the state of blockchains in 2016, it is important to first understand what the term means.

Simply put, a blockchain is a shared database where the access to and integrity of the data is not controlled by any one central party. A database that no one controls and anyone can use has far reaching implications for everyone who has data stored in a traditional database today (think assets like money, equity and physical property and identities like personal IDs, unique IDs of physical objects, digital identities, etc.). Large companies and governments currently control all of this data, which is great for the companies and governments but bad for the users of these services from a security and privacy perspective. Blockchains fundamentally put control of security and privacy (and power as a result) in the hands of the people.

Bitcoin aka “digital gold” continued to push forward in 2016

The Bitcoin blockchain is the most important blockchain today. Nakamoto Consensus was the big technological breakthrough that started the blockchain revolution and the Bitcoin blockchain’s longevity, security and user base is currently unrivaled. The token required to use the Bitcoin blockchain is bitcoin (BTC).

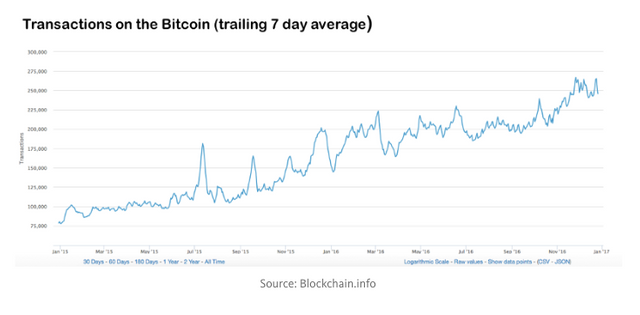

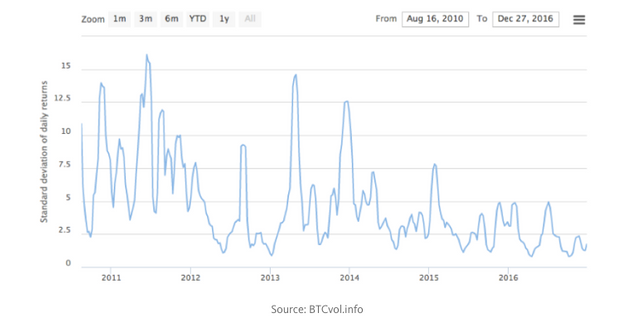

Today the total market value of bitcoin is $15B (up 114% this year as of 12/27/16) and over $180M is transacted on the network daily. The transaction volume, trading volume and number of transactions on the Bitcoin network continued to increase this year and the volatility continued to decrease.

There were no killer use cases that directly increased mainstream bitcoin adoption in 2016, and the primary use case for bitcoin remains the store of value/speculative asset use case. Bitcoin has many of the same properties that gold has as a store of value (scarcity, durability, divisibility); bitcoin can also be sent anywhere instantly and for free, making it an attractive alternative to gold for many.

There were several macroeconomic events this year that led more people to gravitate to bitcoin as a “store of value” (see the Brexit, the Chinese Yuan depreciating in value and the Venezuelan bolivar collapsing). There’s no strong reason to believe these types of macro events caused by centralized governance structures won’t continue.

Here’s the most important Bitcoin data from 2016:

Transactions on the Bitcoin network are at an all-time high, up 50% Y/Y

30 day BTC-USD volatility is at an all-time low, down 75% since 2010

Bitcoin price was up 114% in 2016

Bitcoin headwinds in 2016

While Bitcoin made progress this year, there were also some challenges. Given the lofty expectations private investors had in 2013, ’14 and ’15, when over $1.4B of venture capital was invested in the space, some are disappointed that things haven’t moved quicker at the protocol level and use cases haven’t emerged at the application level. Many would cite the two primary headwinds as the unresolved blocksize debate and the slowing down of innovation on top of the Bitcoin protocol.

Bitcoin applications that launched this year, such as the peer-to-peer marketplace OpenBazaar and the web browser with micropayments built-in Brave, have shown promise but have not crossed the chasm to reach mainstream users yet. Additionally, scalability solutions that increase the transactions per second limit (over 7 transactions/second currently slows down the network), such as the lightning network, have shown promise but are not live yet.

These headwinds will be important to pay attention to in 2017.

New blockchains emerged in 2016

The number of open-source protocols that have been widely used in the past 30 years can be counted on one hand (HTTP for the web, SMTP for email, BTC for money). Most of the innovation in software has occurred at the application layer, led by companies that extract significant profits and don’t always put the security and privacy of users first (e.g. Google, Facebook and Amazon).

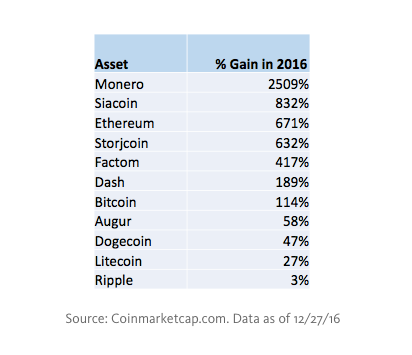

Bitcoin has inspired developers around the world to launch blockchain-based protocols that empower users in new ways. A number of new blockchain-based protocols have gained significant traction this year. In our estimation, the following blockchain-based protocols currently have the most potential to become the future backbone infrastructure for the Internet:

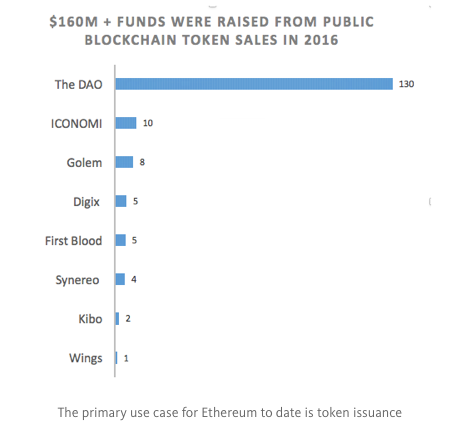

Ethereum is a developer-friendly blockchain that makes it easy for developers to build decentralized applications. Ethereum is the second most well-known blockchain, with a total market value of $630M (up 671% in 2016) and a very robust developer ecosystem that is attracting new developers to the blockchain space. Although no mainstream use cases have emerged yet (the Ethereum blockchain is just 1.5 years old), there has already been over $160M worth of token sales transacted using Ethereum smart contracts. Crowd sales have been the major use case for Ethereum thus far.

Zcash is a privacy-focused peer-to-peer payment protocol that allows users to secure and send funds anonymously. Bitcoin has a transparent ledger that reveals the address, amount and time of every transaction. Zcash uses some breakthroughs in cryptography to make transactions private. Launched on October 29th, Zcash is just a few months old and currently has a total market value of $14M.

**Steem is a blockchain-based media platform that makes it easy for content creators to earn tokens directly from the Steem blockchain. Steemit, the largest social network built on the Steem blockchain, is the first and largest service built on top of Steem but not the only. Steem has a robust developer ecosystem and the total market value of Steem is $36M.

It is unclear whether the acceleration of these new blockchain-based protocols will have staying power — the reality is that the vast majority of the value created so far has been speculative value. But it is clear that blockchains beyond Bitcoin have momentum heading into 2017.

See below for the top 12 digital assets from a price appreciation perspective (criteria for inclusion: trading for >12 months, total market value >$3M and average daily trading volume >$10K).

Blockchain crowd funding emerged in 2016

Ethereum makes it very simple for a developer to set up an address, receive funds at that address and issue tokens directly to the address of the sender. Crowd funding via a token issuance enabled by Ethereum has become a new way for any developer with an idea to get funding for a project, align incentives and acquire passionate early users. Despite the regulatory uncertainty associated with this model, there has been a lot of early activity.

There were several other crowd funding projects with varying degrees of quality and success in 2016 — from the DAO, an $130M decentralized venture fund that failed due to a security flaw, to Golem, a promising project that raised over $8M. It will be interesting to see if this trend continues in 2017 and beyond.

Private blockchain projects continued in 2016

There are now over 25 consortiums of private blockchain projects. R3 is the most well-known, with participation from over 70 financial institutions. Unlike public blockchains, these private blockchain projects lack public data, so it’s impossible to evaluate the traction of these projects objectively. There weren’t any financial institutions using private blockchains in production in 2016 though — we’ll see if this changes in 2017.

Summary and additional resources

If you’re reading this as a casual observer, you still may not have a clear sense for why blockchains are important to you. The reality is that to most people, they’re not yet important and they won’t be until you’re actually using them in your every day life.

In 2016, speculation and investment in digital assets (primarily Bitcoin) and crowd sales (primarily via Ethereum) were the main use cases for blockchains. Beyond these, there are a variety of ways that blockchains are beginning to empower people by giving them control of their own digital identity, physical property and money. The continuing developer momentum is likely to bring more of this innovation to light in the coming years, though there’s a lot of work to be done!

Resources

- The most important information on blockchains: The Control

- Easy and safe way to buy digital assets: Coinbase

- Secure your own digital assets: Ledger

- Easy and safe way to trade digital assets: Shapeshift

- Great developer tools: 21.co

- Get started with smart contracts: Ethereum

NOTE: THIS WAS ORIGINALLY PUBLISHED ON MEDIUM

__

About me: I run The Control and am an investor at Runa Capital, an early stage venture fund. Previously, I worked on business development and marketing at Coinbase and as an Associate at North Atlantic Capital. My work has been featured in publications like the Wall Street Journal and Entrepreneur and I’ve guest lectured at the Yale School of Management. Follow me on Twitter and signup for our newsletter!

Looking forward to more The Control! Thanks, Nick

@ned I hope you do not mind this....

Can I ask you to support this post?? It is to help Nolan our 15 year old witness everyone knows as - @theprophet0

TYIA and keep up the good work!!

https://steemit.com/steemit/@barrydutton/help-we-need-to-support-our-steemit-member-here-theprophet0-and-here-is-how-you-can-do-that-this-week-quickly

Thanks for the ShapeShift plug! Much appreciated :)

Of course. I'm waiting for the native Steemit integration!

Really great rundown, I think a lot of people around here who are new to crypto could learn quite a bit from posts like this :)

I also recently wrote a series of posts on Blockchain and it's applications which may also be of interest to new people trying to get their heads around it.

https://steemit.com/blockchain/@eroche/blockchain-i-got-to-the-end-but-it-keeps-growing

good stuff! followed

Going to go back and give these a look through as well. Thanks for the link. Followed you for more posts like this as well, I could use good sources to give to people who want more information :)

Great I hope it's helpful to others. I had fun researching and writing it.

Thanks, much appreciated!

That is the goal - one of the best things about Steemit is that it is attracting new people to the space and I hope posts like this can help educate these people on the broader ecosystem.

I am happy that there are people like you dedicated to doing just that! Crypto is ... well intimidating for people who are just learning about it. Clear and informative explanations of what everything is are key for the future IMO. Those explanations being on steemit are really icing on the cake for me. :)