Meet Sia, A User-Owned Amazon S3 Challenger That Lets You Rent Out Your Extra Disk Space

You’ve likely heard of Bitcoin. You’ve probably also heard of Ethereum, which took inspiration from Bitcoin and made significant protocol changes such as a more flexible programming language and faster block times. But there are hundreds of other blockchain-based protocols that you haven’t heard of. I’m guessing that Sia is one of them.

It’s difficult to distinguish marketing fluff from quality engineering work

The nature of a permissionless blockchain is that anyone can use it. Being permissionless is good for innovation and inclusion, but the downside is there are a lot of low quality projects that emerge (since anyone can create one) and a lot of people get sucked in to these low quality projects (since anyone can easily invest). Complicating things further, the engineers that do the best marketing tend to have the least technical acumen. The end result is bad blockchain projects can generate a lot of attention and good projects can get lost in the noise.

Introducing Sia

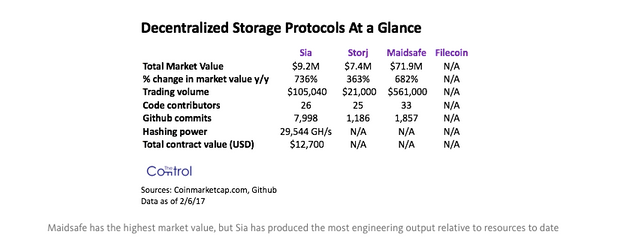

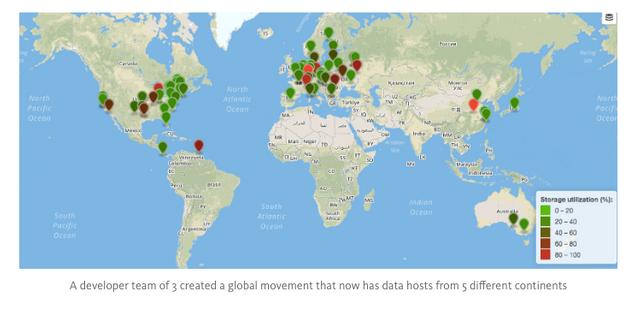

Sia is one of those good projects that has been lost in the noise to date. Founded in late 2014 by David Vorick and Luke Champine (white paper here), the Sia blockchain enables decentralized file storage that anyone can use to both rent out excess disk space and securely store files at less than 1/10th of the cost of established solutions like Amazon S3 (storage is ~$1 per terabyte per month on Sia vs $23 per terabyte per month on Amazon S3). Sia is a 10x+ improvement from a cost perspective and while there is a lot of work to be done on the UX, it’s the most impressive decentralized storage project to date by my estimation (competitors include Storj, Maidsafe and potentially Filecoin in the future, though it doesn’t exist yet). The dev team of three has done a lot with very little and I’ve been quite impressed with their pragmatic approach and focus on security and stability.

The back-end technology behind Sia

The Sia team decided to create a new blockchain. They initially considered trying to build on the Bitcoin blockchain, but the reason they ultimately did not is twofold: the scripting language of Bitcoin did not support a script that Sia needed and the scalability of the Bitcoin blockchain was not where Sia needed it to be. The team decided to build a highly specialized blockchain that includes only the necessary features for a decentralized peer-to-peer file sharing network.

The Sia blockchain relies on proof-of-work mining for consensus and uses the blake2b hashing algorithm, which was chosen because it’s ASIC friendly and is not used by any more popular projects in the space (important in minimizing risk of 51% attack). While Sia is significantly more vulnerable to a 51% attack than Bitcoin, it’s not an easy attack currently (it would take more than $5M in hardware to 51% attack Sia right now).

The main innovation of the Sia blockchain is a complex smart contract that a host and a user enter into to agree on a price to rent disk space. The host earns the native digital currency of the platform, siacoin (SC) and the payer pays SC. When the file contract is created, the renter and the host both put SC into the contract. The host gets the SC only if they’re still storing the data for the user when the contract expires.

The economics of Sia

Siacoin (SC) is distributed continuously from the Sia blockchain. The genesis block was June 6th, 2015 and the inflation rate of SC is ~40% per year currently and will decrease until 2%, where it will stay constant. Unlike bitcoin, which has a fixed supply (21M), SC will be distributed forever. The 2% fixed rate was chosen by the creators based on what is thought to be a healthy rate of inflation by traditional economists. As is the case with Bitcoin and all blockchain projects with a token associated, this is an economic experiment that hasn’t been attempted before — some in the Bitcoin community are turned off by the lack of fixed supply. We’ll see what works best.

In addition to SC, siafunds are the other digital asset native to Sia. A siafund is a dividend paying asset that represents a stake in transaction volume in the network. About 88% of siafunds are currently owned by Nebulous Inc., the company behind the Sia project. Siafunds provide the main revenue stream for the company.

The psychology of Sia

Some people think that the reasons for decentralization are more ideological than practical. It sounds cool in theory to have a decentralized Dropbox, but in practice why would users want to use such a product?

There are a few big reasons why a decentralized file storage system may be practically preferable for users:

User control > Company control: Some people prefer to control their own data rather than trust a company like Amazon or Dropbox with that data. When you store data on S3, it remains unencrypted on an Amazon server which is vulnerable to attack or misuse. Users that value security and privacy tend to prefer the user-controlled approach over the company-controlled approach.

It’s empowering to own the products we use: When you use Sia, you actually own a stake the product you’re using (SC is required to use the product). When you use Amazon or Dropbox, the ownership stakes of Amazon and Dropbox employees increases in value, but you don’t have a stake yourself.

Cheaper costs: A p2p system can fundamentally bring the cost down 10x+ from existing solutions.

Adoption and the road ahead

While the dev team of three has made a lot of progress since they launched Sia and there is an ecosystem emerging (see the activity on the Sia network here), there is a lot of work to be done. The total contract cost of Sia, which represents the total amount of money that is allocated for storage and bandwidth on the network, is currently 36.2M SC (~$12.7K) — up 20% since November 1st but still tiny in the online storage world.

In order to increase its rate of growth, Sia needs to see an improved UX in the main client, more speed and reliability on the network, and more developers supporting the open-source community and building on top of it (though there are a few exciting projects built on top already, like Minebox). Here are the top priorities from the developer team in 2017:

- Ongoing improvements to UX, speed and scalability. The team is targeting a 100x improvement on each coming over the next 12 months.

- Adding the ability to back up all files + data using just a wallet seed. If you remember the seed, you have access to all of your data.

- Enable file sharing and content distribution. Using Sia, share files with friends when they don’t have Sia. This could pave the way for CDN services useful to Netflix, for example.

- Geographic targeting. Give users the ability to choose which countries hold data and which don’t.

Additional Resources

If you want to learn more about Sia, here are some resources:

- Read more about the project: http://forum.sia.tech/topic/107/interesting-threads

- Engage with the Sia public community: https://www.reddit.com/r/siacoin/

- Engage with the Sia devs: https://siatalk.slack.com

- Download v1.1 of the desktop client: http://sia.tech/apps/

NOTE: THIS ARTICLE WAS ORIGINALLY PUBLISHED ON MEDIUM

About me: I run The Control and am an investor at Runa Capital, an early stage venture fund. Previously, I worked on business development and marketing at Coinbase. Follow us on Twitter, signup for our newsletter and support us by upvoting on Steem.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://thecontrol.co/meet-sia-a-user-owned-amazon-s3-challenger-that-lets-you-rent-out-your-extra-disk-space-fa9da6ff9223

@smooth curious to hear your thoughts on Sia as our resident digital currency expert

Very interesting, thanks!

Has Sia had any serious real-life disaster testing - i.e., say, 20% of the storage nodes going down in a simulated disaster or some such?

thats a good question for David Vorick. I'm not sure

I Just UpVoted You! Please See Our Very Important Post Below Regarding The Blockchain Witnesses. Have An Epic Day/Afternoon/Evening!

https://steemit.com/witness/@iloveupvotes/witness-guide-suggestions-and-witness-warnings