TRADING MINDSET - DISREGARD THE IGNORANT BITTERS, TELLING YOU THAT YOU'RE WASTING YOUR TIME TRADING

Ignore the Ignorant

We always hear and read about how hard it is for ordinary people to actively trade the markets and make money themselves.

That they shouldn't even bother trying because they'll probably lose more than if they just bought and held some sort of investment.

This is the biggest load of self defeatist bullshit that could possibly be said. If someone tells you this, then they're an ignorant bitter who doesn't have the mental fortitude to do what has to be done to make it in this game.

Plain and simple.

If you're willing to put the time and effort into developing the risk management procedures that work for you, then you will make it as a trader.

Busting the Myth

No, markets don't always make sense.

One of the biggest myths going around both within and outside trading circles, is that markets are rational and make sense.

They aren't. But most importantly, we don't want them to be

Traders actually make money because markets don't make sense. Yes, their irrationality makes them profitable.

At any place or any time, marekts can make seemingly random moves for absolutely no rational reason. They make moves that just don't make sense.

Sometimes markets go up when all signs point to them going down and likewise, sometimes markets go down when all signs point to them going up.

It is what it is.

It's absolutely nosensical to assume that just because the market did one thing, that it has to make sense and do something that corresponds to that move.

Using Chart Art

While technical analysis is in my opinion, the number one weapon in a trader's arsenal, it is not because it can help you predict what a market will do next.

As we've talked about at length, markets are irrational beings and if someone tells you that they can predict the future, then you should turn around and run a mile in the opposite direction.

Technical analysis is the number one weapon in a trader's arsenal because it helps a trader manage their risk.

That's all.

Saying that technical analysis predicts what is going to happen next in a market, is probably the biggest myth going around. This then leads into the fact that people will tell you technical analysis is bullshit.

No, they are just using it the wrong way!

By highlighting key support/resistance levels through technical analysis, traders are able to quickly identify when they are right or wrong and adjust their positions accordgly.

Once you have the correct risk management strategies in place, you can then take advantage of market moves, whether rational or not, by adding into your winners and cutting your losers early.

Best of probabilities to you.

Peace 🏻.

Instagram: @forexbrokr

Website: www.forexbrokr.com

Trading Psychology plays a very important role in our trading success, that much I agree. Because no matter your analysis whether technical or fundamental, if your mind is not in the trading zone, you risk blowing up your trading account. We all know that trading is just a matter of market survival, and yes, markets are random. I would recommend all those wishing to start trading to read Fooled by Randomness by Nassim Taleb, that's a very resourceful book with immense material for every trader. Thanks for keeping us in check.

Added to my to read list. Thank you!

Nice writeup mate! I wholeheartedly agree with this - tech analysis gives us an edge by allowing us to see patterns that have a probability of working out and clearly defining our risk levels based on that.

Exactly. You know what’s up.

😎

Yeah, you so right. This TA prophets everywhere start to be Annoying!

Irrationality of markets is so strong that I start just wagging most probable scenario out in my TA analyses. Many times my predictions are turned up side down and the only life-save jacket is how to manage risk.

If I had been successful in my trades I allow to reward myself with more risk. If I blow up, my risk margin have to be shrunken. (I think that this is called anti martingale risk management to be little technical).

If I am doing very badly sometimes I forbid trading to myself to cool down and power up my scenes.

e

It's fck*g simple :-)

Simple isn’t the word I would use. 😂

Yah, been maybe to sarcastic. Maybe can use word 'simple': simple stick to your rules and strategy.

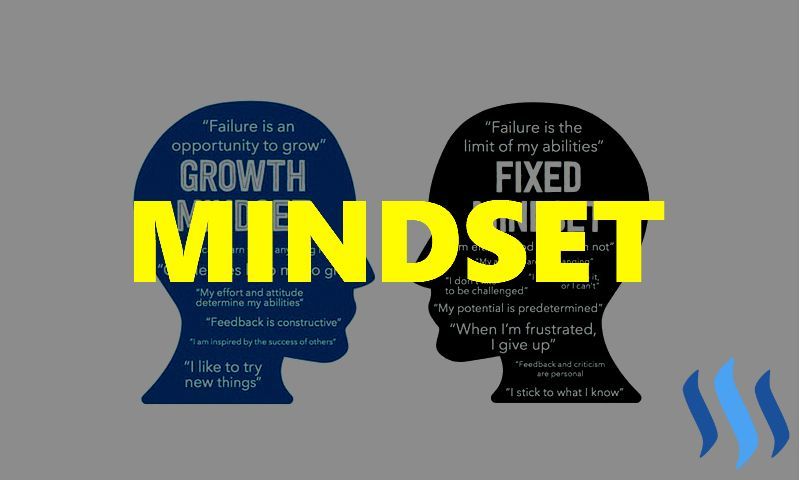

Mindset is a very important aspect of trading

Yes, it certainly is.

The market rate is unpredictable, often this happens, when the rising sign occurs when the opposite is sold. it becomes very loss

Something like that, yeah.

Yeah 🔛

@forexbrokr good post

Was it?

Thanks for the pos @forexbrokr

Not a problem.

Just simply hold.

Hold what? Wrong position?? How do you know what to hold and what not to hold??

If you’re a trader that’s exactly what you should NOT do.

Agree 1000% small losses teach, big one kills!

thanks for the encouragement

No worries. I got you.

Nailed it , I know someone who recently sold his bitcoin . I patted the dudes shoulder and said "you shouldn't trade my friend you don't got the balls !". Not that I am Gordon Geko or Jordan Belmont but my two recent alt investments are down like 60% do I sell ? Are you mental ? I say adious alts Im gonna hold you till you go to zero or finally make some money.

Just make sure you understand the clear line between trading and investing.