Federal Reserve Turns on Another Money Faucet

Federal Reserve to start buying $60 billion of USA Treasury Bills per month at least through the second quarter of 2020.

Some people would call this QE 4:

Quantitative easing: is a fairly recent “unconventional” (not natural) monetary policy in which a central bank purchases government securities or other securities with funds they print directly from the market in order to increase the money supply and encourage lending and investment.

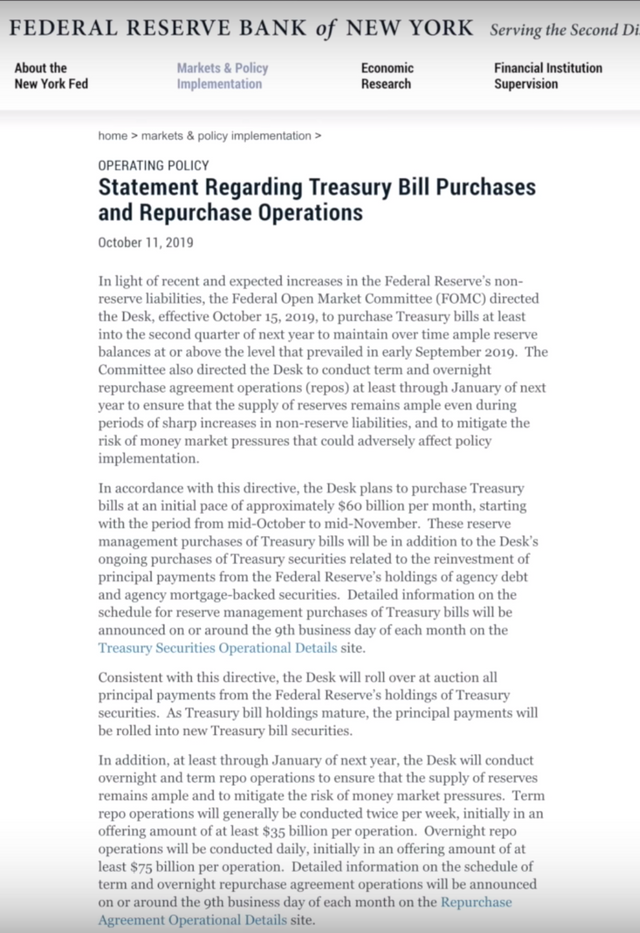

The original announcement by the NY Fed is currently not available as their website went down

for maintenance—however a Canadian Youtuber (the Money GPS) took a snapshot before the announcement became unavailable.

https://www.newyorkfed.org/markets/opolicy/operating_policy_191011

These funds are in addition to the Fed having to pump 35-75 billion per day in the USA bank overnight Repo market. The Fed has also just said that they will extend the emergency (my word) overnight repo cash infusions through at least January.

QE History:

Since the last recession the Fed has had to print and purchase 4 Trillion USD. You can find this yourself by searching for:

“FRED — Assets Total Assets: Total Assets (less Eliminations from Consolidation)”

One should notice since the last big recession in 2008 the Fed has printed dollars and then used that money to purchase 4 Trillion dollars worth of assets (mostly US Treasury bonds). This printing of dollars also mirrors the rise in US stock markets and property values over the same time period. This strongly hints that the rise in property values and stocks during that time is not a natural rise due to market forces or business activity, but instead at least partly due to currency debasement/inflation and corporate loans/stock buybacks.

FYI: The other 120+ central banks in the world have likely done the same as the USA’s FED since the GFC, the majority of the world’s central banks move in relative similar manners. However, in many cases the interest on their local government bonds might even have NEGATIVE yields (interest rates) and thus why they also purchased US stocks. (See my previous article https://kenburridge.com/stock-portfolios-and-retirement-accounts-overvalued/).

References:

The Money GPS

NY Fed Statement

Federal Reserve Bank of New York

Operating Policy

Statement Regarding Treasury Bill Purchases and Repurchase Operations

October 11,2019

https://www.newyorkfed.org/markets/opolicy/operating_policy_191011

Board of Governors of the Federal Reserve System

Press Release

Statement Regarding Monetary Policy Implementation

October 11,2019

https://www.federalreserve.gov/newsevents/pressreleases/monetary20191011a.htm

https://kenburridge.com/federal-reserve-turns-on-another-money-faucet/