QFL Position Trading Methodology - Step-by-Step (high-level)

Disclaimer: This is not advice, this is just information that can be consumed and used however you may wish - but it is not advice or guidance.

QFL Trading Methodology + My Rules (applied):

Phase One - Determining Coin Pairing

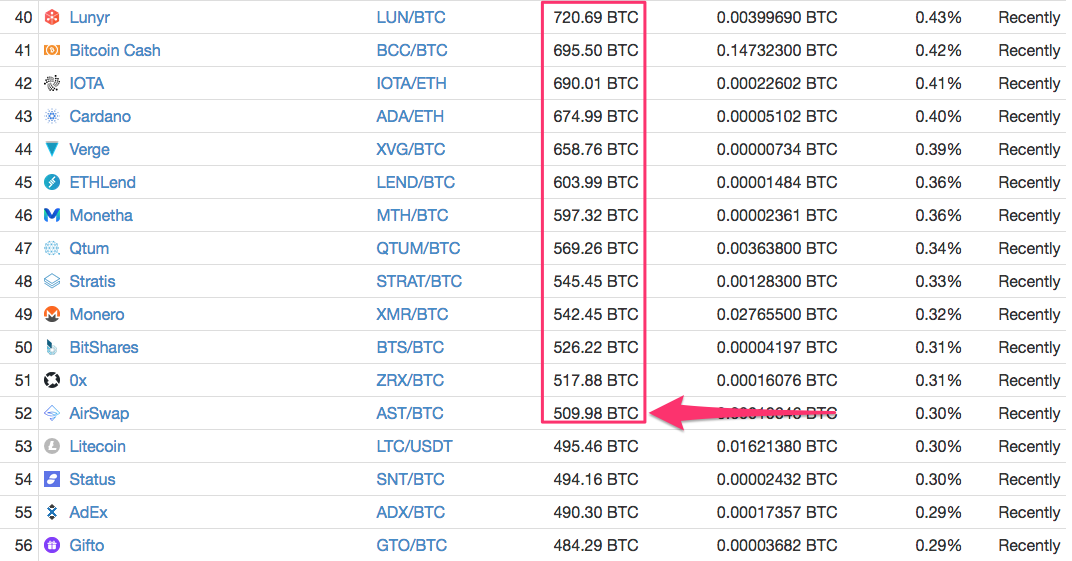

- I only choose coins that have at least 500 BTC/24 HR volume on Binance - anything lower or another exchange is an added risk. Its still possible to QFL, but it is an added risk.

See this link for volume data: https://coinmarketcap.com/exchanges/binance/

- Open tradingview.com or multicoinchart.com and select the correct pairing and the correct exchange.

- I only choose coins that have at least 500 BTC/24 HR volume on Binance - anything lower or another exchange is an added risk. Its still possible to QFL, but it is an added risk.

Phase Two - Defining the Base/Price Support Point

- Change the chart between 1D -> 4H -> 2H -> 1H to look for a solid base.

- Use the "price range" tool (you can favorite it so its always available on the screen)...and look for a 10% drop and 20% bounce in a short period of time to find the most recent base...the shorter the time, bigger the drop and bigger the bounce, the better the base

- If possible, do this on any recent bases within the past 1-2 months. The more bases you find, the better you can analyze what prices were supported by the chart in the past 1-2 months. Also, if you are able to collect data on these bases, great. I will go over data collection in a separate post.

- When charting, if you use a shortcut on your keyboard, on a mac its "option+H" on your keyboard, it will draw a blue line across the screen wherever your cursor is. I use this to signify where the current base or price support is.

- Once you define where the base is, the next step is to decide where you are going to buy and where you are going to sell.

- For this, I analyze the previous base-cracks-and-bounces in the past 1-2 months. Again, only defining a base as 10% drop and 20% bounce.

- In addition, I only collect data on base-crack-bounces with the following additional rules (feel free to ask any questions if this is confusing):

- The base must be cracked within 7 (seven days)

- Once the base is cracked, the low of the crack must be reached within 48 hours

- Once the low of the crack is reached, the high of the bounce must be reached within 48 hours

- Change the chart between 1D -> 4H -> 2H -> 1H to look for a solid base.

Phase Three - Data Collection

- I collect the following data on each base-crack-bounce:

- Base in satoshi value (BTC)

- Whether it respected the base or not (whether or not the crack bounced up to the base after cracking the base)...keep in mind I only look at cracks that go 12% or more below the base

The initial drop and initial bounce that formed the base - The date and time of the base and crack

- The time elapsed between the time of base and time of crack

- The crack %

- The low of the crack to high of the bounce (48 hour timeframe) as a % - and this must occur without another 10% drop in price - thus it must be a "true bounce"

- Date and time of the low of the crack and high of the bounce

- The time elapsed between the low of the crack and high of the bounce

Phase Four - Setting your Buy and Sell Orders

- Now I calculate the average and median of all of the said data

- I use this data to help better predict my buy order layers and sell order layers

- If I see that a crack is behaving in a similar way to a previous base-crack-bounce, then I try to model that data as much as possible

- From there, I use a calculator I created which helps me set my buy and sell layers and also determines how many coins I need to buy at each buy layer and sell at each sell layer based on how much BTC/ETH I am trading with.