Ripio Credit Network is really exciting

After Enigma Catalyst, Wanchain and Red-Pulse investments, we need to think what's next : )

Ripio Credit Network could be the one. It looks like it has it all.

Great team with a history of a growing startup, great advisory board, backed by top blockchain VCs, the right use case of their token and the blockchain technology and big market potential.

The Product and the Vision

Ripio, formerly known as Bitpagos, is a financial payments company that provides electronic payment solutions for businesses in Latin America. It offers a range of financial services for the emerging markets using the blockchain technology to make a more accessible financial system. The company helps merchants process international transactions with credit cards or bitcoins for a fraction of the cost as well as consumers buy bitcoins instantly with cash. It deals with clients in Argentina, Brazil, Chile, and Ecuador.

Today more than 65% of the people in the world don't have bank accounts. They mainly use cash and they don't have credit (They can purchase only as much money as they have now, unlike with a credit card which you can purchase now and pay a month later).

Ripio Credit Network will be another service that is built on top of the existing wallet app with a vision to not only allow credit to the unbanked population but also to allow them to get loans.

Ripio Credit Network is a global credit network based on cosigned smart contracts and blockchain technology that connects lenders and borrowers located anywhere in the world and on any currency.

Three core components fo the platform:

- Peer-to-peer network

RCN enables connections between lenders and borrowers located anywhere in the world, regardless of currency, allowing better conditions for both sides, creating a better credit alternative than anything available today.

2.Smart contract driven

The RCN smart contract connects agents with information on the borrower’s identity to agents that analyze the borrower’s credit risk impartially, thus standardizing credit lending through blockchain technology.

3.Co-signature

The cosigner acts as a reinsurer that distributes and reduces the lender’s risk and, at the same time, helps to improve the contract conditions by retaining access to the borrower’s local legal system.

The Team

Ripio, formerly BitPagos, reached the finals at the TechCrunch Disrupt New York competition last year.

BitPagos started it's way back in 2014 and now have become one of the most popular block-chain products in Latin America.

The team proved us that they can bring an idea (Bitpagos) to a working product with more than 100,000 users. Now they are using their product, knowledge, and userbase to implement the loaning network on top of it.

Advisory Board

Juan Llanos, Fintech & Regtech Lead at Consensys.

Consensys, founded in early 2015, in order to develop decentralized apps on the ethereum blockchain. It is one of the leaders in the crypto world.

LinkedIn- https://www.linkedin.com/in/juanllanos/

About Consensys- https://en.wikipedia.org/wiki/ConsenSys

Sergio Demian Lerner, Co-founder & Chief Scientific at RootStock.io (RSK)

Rootstock is a smart contract platform, secured by the Bitcoin network. more than 50% of the miners are implementing the RSK plugins. This project is backed by many top players in the Bitcoin industry.

Jeff Stewart, Co-founder & Chairman at Lenddo.

Lenddo uses unofficial data (Like social network activity) to analyze the credit and risk score of a credit seeker (Borrower). Their algorithm is used by third parties around the world.

https://www.lenddo.com/index.html

VCs:

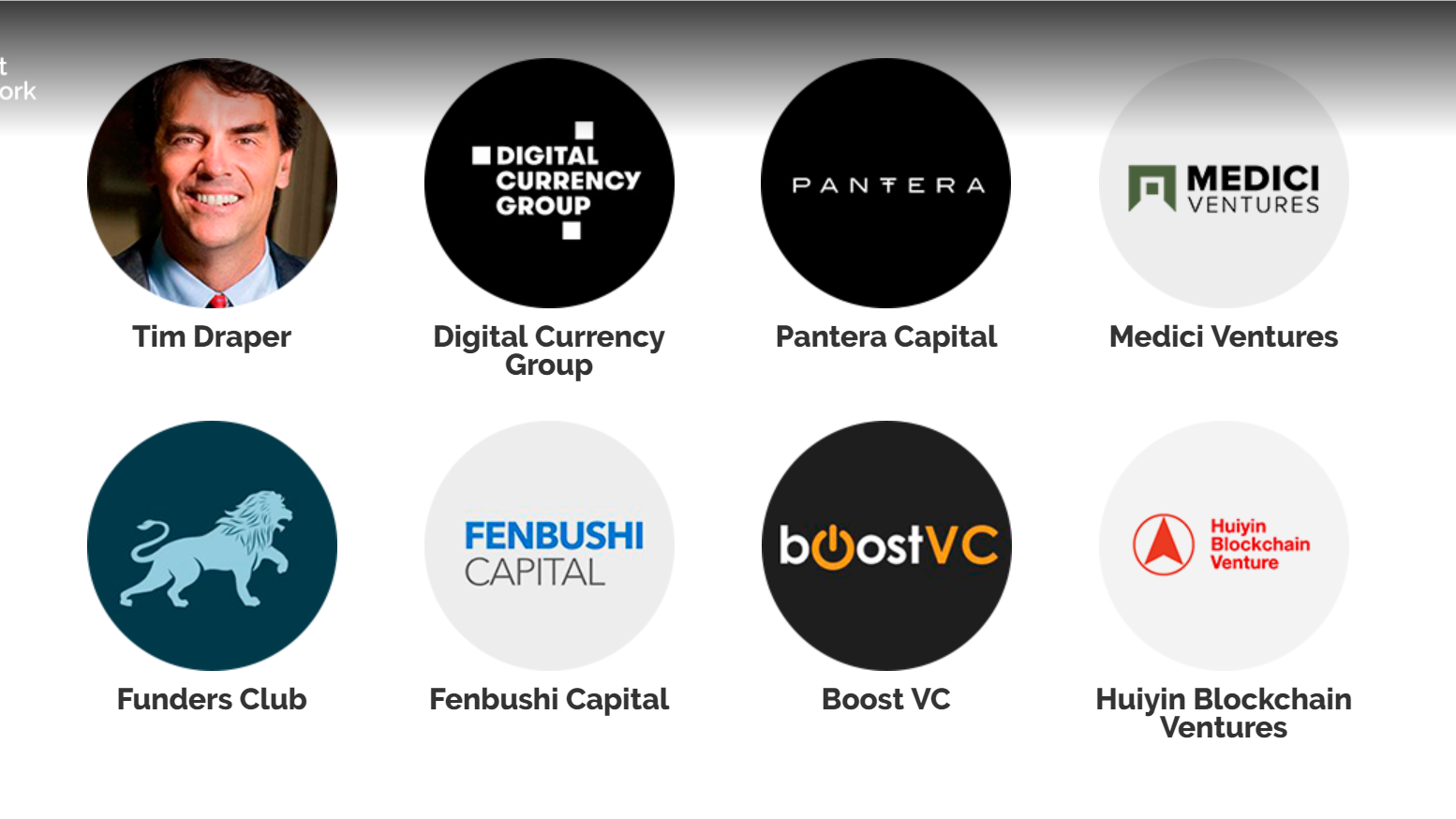

Ripio is funded by top VCs (more than 7 million USD total investments):

Fenbushi Capital (Vitalik's VC), Digital Currency Group, Pantera Capital are the top blockchain VCs that backed many successful blockchain companies.

Key Dates:

The Ripio Credit Network is to be live on April/2018

Community:

This project is attracting much interest by the community, and it's growing fast:

more than 4,000 members on Telegram, and around 2,800 followers on twitter

Many YouTubers started to cover the project...

The RCN token:

An ERC-20 token. Although Borrowers and Lenders will likely prefer to denominate credit transactions in a local currency. The RCN tokens are required for the lending process to work. The amount of tokens that will be used in each transaction is vague but seems like it will correlate to the fees that will be paid to the agents. Meaning some percentage of the overall transaction volume.

ICO details (public sale - 24/10)

Hard Cap: 127,500 ETH

Presale: closed (106,250 ETH)- no bonus. The personal cap was 12750 ETH.

Public token(21,250 ETH), the personal cap will be 20 ETH.

Token allocation: 51% to the public.

Tokens will be transferable immediately (No lockup)

Whitelist- there will be a whitelist, they will announce the details in the next 48 hrs (from publishing this article). For now, you can subscribe for updates:

https://ripiocredit.network/index.html#flow

Cons:

The presale allocation is crazy high (42.5% preslae/8.5% public) and their cap is also high (12,750 ETH), meaning that the value of the token can be manipulated easily.

Pros:

The team is great with a successful working product behind them, the market potential is huge, the use of the token and the blockchain is right, it is backed by TOP VCs and a great advisory board, the hard cap is reasonable.

The team is trying to solve a real-world problem with the blockchain technology, if it will succeed, people in the developed countries will have more financial resources and people from the western world will have the ability to get more revenue on their saving.

Feel free to follow me, I share my thought of great ICOs to come.

By the way, I was honored to interview Zooko (Zcash founder), enjoy:

https://cryptopotato.com/zcashs-encrypted-blockchain-satoshis-vision-interview-zooko/

Links:

2016 TechCrunch Disrupt New York finals :

https://techcrunch.com/2016/05/10/bitpagos-uses-the-blockchain-to-enable-credit-for-online-payments-in-emerging-markets/

Business Insider- The 10 Most Promising Startups Building Stuff With Blockchain Technology:

http://www.businessinsider.com/10-most-promising-blockchain-companies-2014-5

Ripio official website (Ex Bitpagos):

https://www.bitpagos.com/en/

Ripio Credit Network WebSite:

https://ripiocredit.network/

RCN whitepaper:

https://ripiocredit.network/wp/RCN%20Whitepaper%20ENG.pdf

a great talk by Ripio cofounder