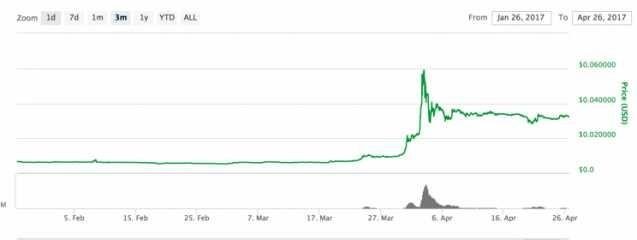

Ripple hitting the moon and back....invest!!!!!

The concept of a blockchain originated in 2009 with the digital currency bitcoin, but now Wall Street institutions are interested in blockchain technology without bitcoin.

Ripple, which offers a blockchain-like rail for faster settlement of international payments, and has nothing to do with bitcoin, has added 75 banking clients already.

Ripple announced on Wednesday it has signed 10 new banks from all over the world, including BBVA in Spain; MUFG in Japan; Akbank in Turkey; SEB in Sweden; and Axis Bank and Yes Bank, both in India. Add those 10 to the 47-bank consortium in Japan that implemented Ripple in March. And add those 57 to existing big-name clients like Bank of America, RBC, Standard Chartered and UBS, and Ripple starts to look like it’s gaining traction very quickly.

“Our pace [of signing new clients] has dramatically increased,” says Ripple CEO Brad Garlinghouse. “I also think people are getting more comfortable with blockchain technologies. It’s no longer a science experiment. It’s not theory, it’s very real.”

The bitcoin blockchain is a decentralized, public, permissionless ledger that records every transaction and trade done in bitcoin. But now all manner of companies, from “blockchain as a service” startups like Ripple and Chain to established tech giants like IBM, are developing all manner of blockchains for areas like food shipment tracking, smart contracts, and agriculture. In many cases these applications of blockchain are closed and permissioned, which is a very different proposition than the spirit of the anonymized, open-to-all bitcoin blockchain. In banking, for now, the main appeal is to improve the efficiency of their blockchain

Why banks are gravitating to Ripple

Ripple’s value proposition to banking clients is cheaper rates and faster transfer times for international payments. The bank’s customers don’t have to know or care that they’re using Ripple (it isn’t like you’d tell your bank, “I want to send this money using Ripple”), but would certainly notice the faster transaction time than they’re used to.

Garlinghouse gives the pitch to banks this way: “If your customer wants to send yen to Japan, you are captive to the correspondent banking network and your customer has a bad experience and you, as a bank, have to endure cost to transmit that money.”

Ripple’s Consensus Ledger can process 1,000 transactions per second, and settles an international payment in three seconds on average. (He compares that to the bitcoin blockchain, which has slowed recently to two hours per transaction, creating a debate over block size; to be fair, both speeds are much faster than sending money with a traditional clearinghouse like Western Union.)

Ripple can also be used for in-country payments; many of the banks in Japan are using Ripple for domestic payments due to the sluggishness of the local payments network there. But for the most part, Ripple is focusing on cross-border payments because that’s the biggest pain point for banks and banking customers.

Santander added a function to its mobile app that lets customers send money abroad over the Ripple network. While Ripple is hardly the only blockchain-for-banking startup out there, Garlinghouse boasts, “We are the only company in the space with real customers.” Competitors, Garlinghouse says, “are still playing in the sandbox. And proof of concepts are not a business model.”

That’s tough talk, and true only to an extent. Chain has partnered with heavy-hitters like Visa, Citi, and Nasdaq, but for now the results have been experiments, trial runs, or “previews” like Visa B2B Connect.

All the experimentation has led critics to say that the Wall Street interest in blockchain is all just talk, or as IBM blockchain exec Jerry Cuomo puts it, “blockchain tourism.” Ripple CTO Stefan Thomas acknowledges that the term itself has become a “classic technology buzzword.”

But Garlinghouse is confident that blockchain tech and its many applications will bring about the “Internet of value.” Many have applied that phrase to bitcoin (causing some contention over who owns the phrase), but Garlinghouse says it hasn’t lived up to that promise.

“We feel like to enable an Internet of value, you have to connect through repositories of value, and those are the banks,” he says. “Where many in the bitcoin community have espoused a view of, ‘Down with the banks, down with fiat currency,’ Ripple has taken the opposite: we think the banks are critical to the future of an Internet of value.”

What about bitcoin?

Bitcoin has risen 178% in value in the past year (it’s now around $1,300), but critics now doubt that the coin can become more than a speculative investment.

“We might end up finding that bitcoin is the Napster of digital assets,” Garlinghouse says. “Napster lived in a world devoid of trademark law, and royalties, and tried to live outside of the rules, and you could say the same about bitcoin. I’m not predicting that bitcoin will go the way of Napster, but I would point out that bitcoin has demonstrated some very cool capabilities that, in the end, bitcoin may not be the best tool for.”

Ripple’s digital currency

Ripple has its own digital token, XRP, and it is often billed by tech press as a bitcoin competitor, but that’s not quite right. Ripple uses it as a settlement token, and banking clients don’t have to use it or touch it at all. It is more of an institutional digital asset than a public investment vehicle like bitcoin, though anyone could buy some XRP if they wish. (Its value has risen 345% in the past year, but in dollars it is worth just 3 cents; again, its trading price is not the point.)

Ripple’s XRP coin is “about reducing the cost for banks to fund liquidity around the world,” says Garlinghouse. That can double as a statement of Ripple’s purpose, too. And if its banking clients, over time, decide that Ripple’s rail has reduced friction and made customers happier, expect Ripple to continue adding banks and financial clients, who are itching to show their innovativeness by saying they’re in the blockchain tech space.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://finance.yahoo.com/news/75-banks-now-ripples-blockchain-network-162939601.html

Ripple is underrated and under-priced, but I can't see it staying that way. They have momentum and credibility with banks and so I think they're going to fly.

Interesting post. I was about to post a similair post. Not sure if I believe in the current crypto investment climate but I do believe in the blockchain. We really need more insights in the market and previous investment results (even though they don't deliver any guarantee for the future). An interesting website I found: https://www.coincheckup.com Supposingly they researched every crypto coin in the scene based on: the team, the product, advisors, community, the business and the business model. They even score the coins stengths. Check: https://www.coincheckup.com/coins/Ripple#analysis To check Ripple Detailed report