The truth behind Ripple, and why I sold it all

Ripple (XRP) has been famous for the last few weeks for jumping out of relative obscurity to the #2 spot on the cryptocurrency charts, and even outpacing Ethereum.

As an investor doing research primarily based on charts and trend analysis, I didn't do a heavy amount of research in the coin, and I invested a small amount a few weeks back. I ended up making over 250% in profit, before doing a bit more research, and selling it all.

What is Ripple, and why did my research findings prompt me to drop the coin? Let's find out.

Contents

- What is Ripple?

- The Centralization Crisis (Frozen Coins)

- 100% Pre-mine

- Conclusions

What is Ripple?

To put it simply, Ripple is a protocol that helps banks better manage their profits and business. Unlike Bitcoin, whose whole purpose was to defeat the necessity of banks, Ripple helps banks grow and gain more control over finance.

Here's Ripple's own website's description:

Ripple connects banks, payment providers, digital asset exchanges and corporates via RippleNet to provide one frictionless experience to send money globally.

Now, any investor at this point would think, "Wow, so all these banks are going to use XRP for transactions? Let's buy it up, we're going to be rich!". Not at all.

Ripple Labs, the for-profit company behind Ripple, created RippleNet, a collection of financial tools to help banks operate better. When a bank is said to be using "Ripple", they're using Ripple Labs' for-profit RippleNet tools, and not the XRP coin.

This is the first extremely important thing to realize:

Ripple is not XRP.

When banks are "using Ripple", they're using Ripple Labs' RippleNet products, which barely use XRP in the first place. I encourage you to watch this video on a more in-depth explanation of why the XRP token is not the Ripple ecosystem.

There is only one component of the RippleNet ecosystem that involves XRP: the xRapid product, which uses XRP as a backend ledger system to bridge between currencies.

However, XRP doesn't do anything special here. Any cryptocurrency or token could be used for this; in fact, the only thing XRP has going for it in this case is the brand name.

Now, we've realized a few things:

- Ripple is not the same as the

XRPtoken - The

XRPtoken is barely used by banks who rely on RippleNet products - Ripple was created to help banks operate more efficiently

We'll expand on these points in the next section, where we talk about the centralization crisis.

The Centralization Crisis

In 2008, Satoshi Nakamoto invented the world's first cryptocurrency— Bitcoin, on the principle that we can free ourselves from the regulation and control of banks and middlemen, and move money in a much more decentralized fashion.

Hold up— what does decentralized even mean? It's the opposite of the word "centralized", but what does that mean in the first place?

Using regular money via the normal banking system requires going through different layers of regulation, from the bank itself, to perhaps a clearing house, maybe other middlemen, and even after passing through those layers your money may get frozen in place by the central government.

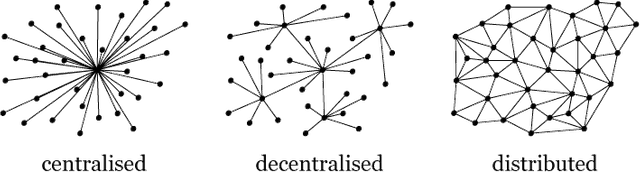

This is a "centralized" system. One, or a few entities have overwhelming control of the entire system, and you do not have control over your money.

Decentralized is just the opposite. Rather than a few entities having control over the system, many users help support the weight of the network. No single user can make a change without approval of other users, and the entire system works coherently and harmoniously.

With Bitcoin (a decentralized system) and many other cryptocurrencies, you do have control over your money. Do you have to get approval from a bank to send Bitcoin? Can the government freeze your money? No.

But what does this have to do with Ripple?

Ripple is Centralized.

I'll say it again: Ripple is centralized. Where's the proof?

In late 2014, Ripple Labs pushed out the Ripple Freeze feature to its network of gateways. Any gateway could then issue a 'global freeze', freezing all of the assets of their consumers, or issue an individual freeze, stopping the movement of coins from one user.

This has huge implications. With Bitcoin and decentralized cryptocurrencies, nobody can stop you from sending your money across the seas. However, with Ripple, a gateway can (for any reason at all) freeze your tokens.

Ripple Labs used the freeze feature at first to stop the movement of their co-founder Jed McCaleb's coins. McCaleb had agreed not to sell more than $10k worth of XRP per week, yet he was caught attempting to pull $1 mil. out of Bitstamp.

Ripple ended up intercepting the coins and using its freeze feature to stop the movement of XRP.

While McCaleb's actions may not have been warranted, the fact remains that Ripple and XRP Gateways can freeze your coins at will. This goes completely against Satoshi Nakamoto's vision for a decentralized future. XRP is not a decentralized cryptocurrency.

XRP is a centralized digital asset designed solely to benefit Ripple Labs.

Tomorrow, I'll be releasing the next/last segment of this two-part series, focusing on Ripple's gigantic pre-mine and how XRP is not a mineable cryptocurrency in any form factor.

Stay tuned!

Thanks for reading,

— @mooncryption

image sources: a, b, c

legal stuff: All opinions and information in this post is for educational and informative purposes only. Do your own research before making any investments!

Excellent post, @mooncryption. Upvoted.

This summarizes it all. They are fooling people with this. In addition, when banks need XRP, they can buy it from the Ripple company with a discount.

Thank you!

Everyone is buying ripple they think that's it's another Bitcoin. But thanks for sharing awesome information i got it and clear now

I do the same thing! I sold half of my holdings and keep the other half!

I am so astonished at the lack of understanding of how Ripple works...thank you for a great article that I can show instead of typing (badly) myself ;) You got a repost & follow from me :)

Congratulations @mooncryption! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board of Honor

If you no longer want to receive notifications, reply to this comment with the word

STOP2.06% @pushup from @mooncryption

Hello, you received a boost courtesy of @steemdunk! Steem Dunk is an automated curation platform that is easy and free for use by everyone. Need a boost? Click me

Upvote this comment to support the bot and increase your future rewards!

This post has received a 5.31 % upvote from @booster thanks to: @mooncryption.

Thanks for clearing that up! No to centralisation I'm selling my XRP as soon as some nice profits can be made which I will be putting them into decentralised; BTS, Steem, EOS.

I didn't invest, either.