: "SLC-S21W5: How to Handle Amazon Taxes"

|

|---|

Research and Explain

Find out the tax rates for self-employment income in your country. Discuss whether Amazon Affiliate income qualifies for any deduction.

Just like every other country has its tax rates for self-employed citizens it is equally how my lovely country, Nigeria has its own which I will be sharing with you.

| Tax Rates for Self-Employment Income In Nigeria: |

|---|

In Nigeria, all self-employed individuals are subject to the Personal Income Tax (PIT) under the Personal Income Tax Act (PITA). In Nigeria, the tax rates for self-employed individuals are progressive, based on annual taxable income as shared below.

| Annual Taxable Income | Rates | Tax payable per annum (N) | |

|---|---|---|---|

| First | ₦300,000 | 7% | ₦21,000 |

| Next | ₦300,000 | 11% | ₦33,000 |

| Next | ₦500,000 | 15% | ₦75,000 |

| Next | ₦500,000 | 19% | ₦95,000 |

| Next | ₦1,600,000 | 21% | ₦336,000 |

| Above | ₦3,200,000 | 24% |

Multiply only the excess amount over ₦3,200,000 by 24%. For example, an annual taxable income of N6,000,000 is (N6,000,000 -3,200,000) * 24% = ₦672,000.

In Nigeria, allowable deductions include insurance premiums, pensions, the consolidated relief allowance (CRA), which is the higher of ₦200,0000 or 1% of gross income, plus 20% of gross income. Finally, all self-employed individuals in Nigeria are mandatory to fill out annual self-assessment returns accurately report income, and claim only legitimate deductions.

| Amazon Affiliate Income and Deductions |

|---|

As for Amazon based on my research I came to find out that Amazon Affiliate Income is considered Self-Employment or Business Income. This means in Nigeria, I can deduct legitimate expenses related to earning this income such as mentioned below:

Advertising or promotional costs

Professional services like consultants or accountants

Software and tools used for content creation

Internet and hosting fees

With the information above, it means deductions are only valid if they are exclusively for business purposes and are properly documented. On the other hand, non-business-related expenses are not deducted.

Amazon Tax Form Submission

Describe the process of submitting a W-9 or W-8BEN form (based on your residency). Provide screenshots (hide sensitive information) if possible.

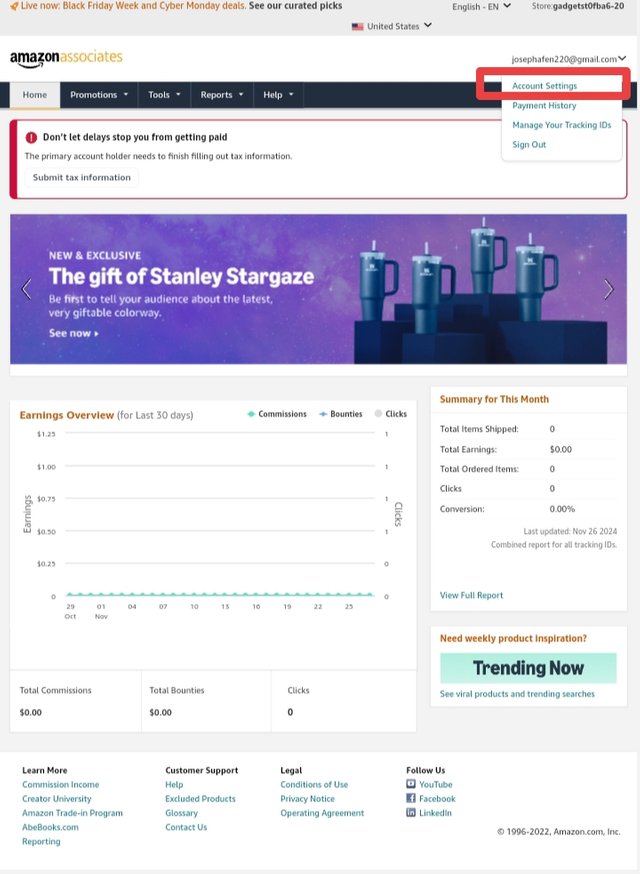

Step 1: I log into my Amazon Affiliate account

Step 2: I access the Tax Interview:

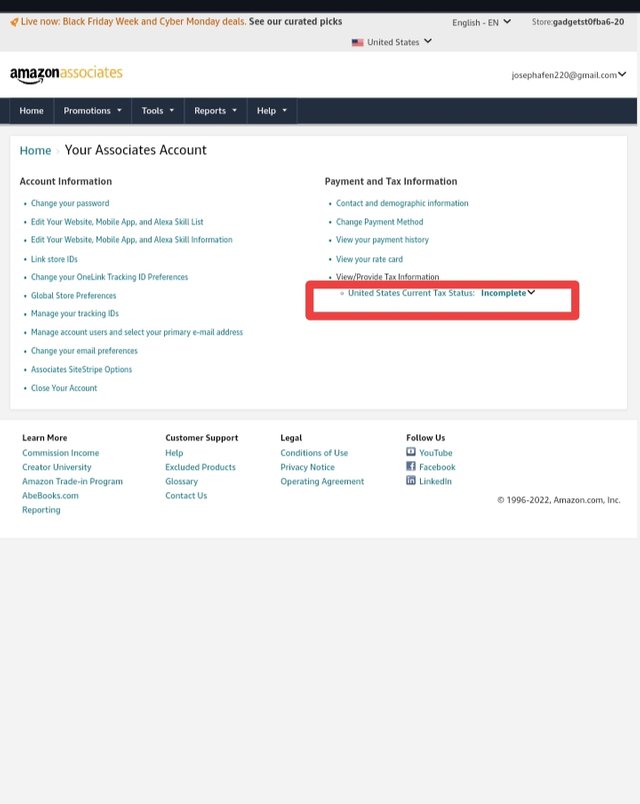

- I navigate to Settings > Account Info.

- I select Tax Information and click on View/Provide Tax Information.

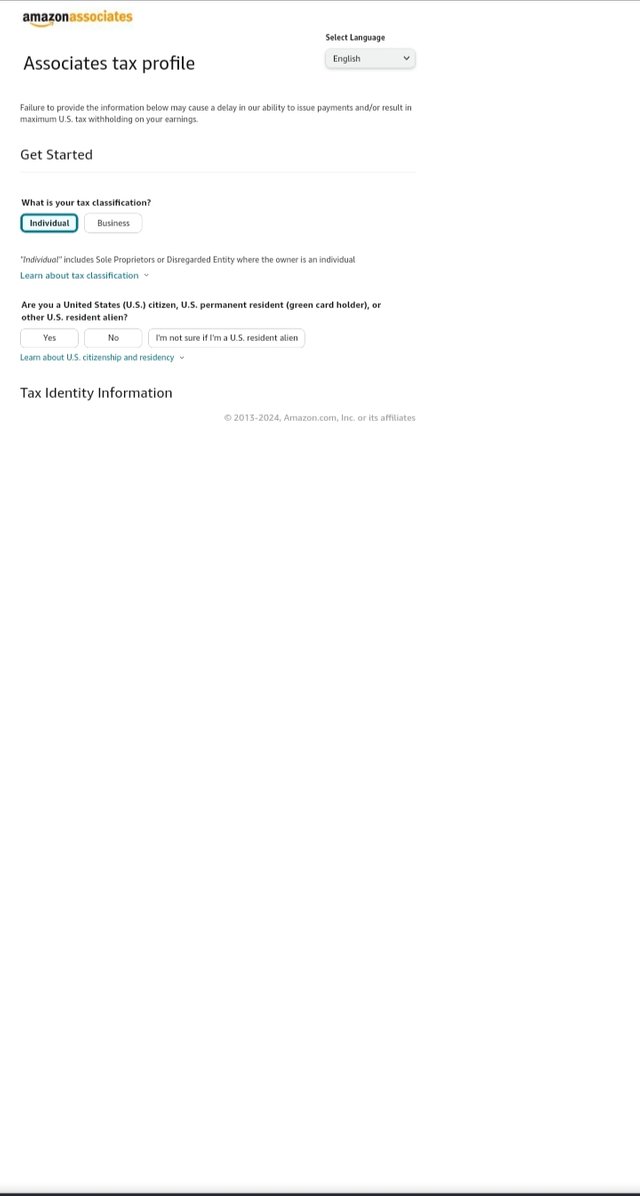

Step 3: Choose W-8BEN From:

- I select the W-8BEN form which is required for individuals or entities outside the U.S. which I am one of the individuals.

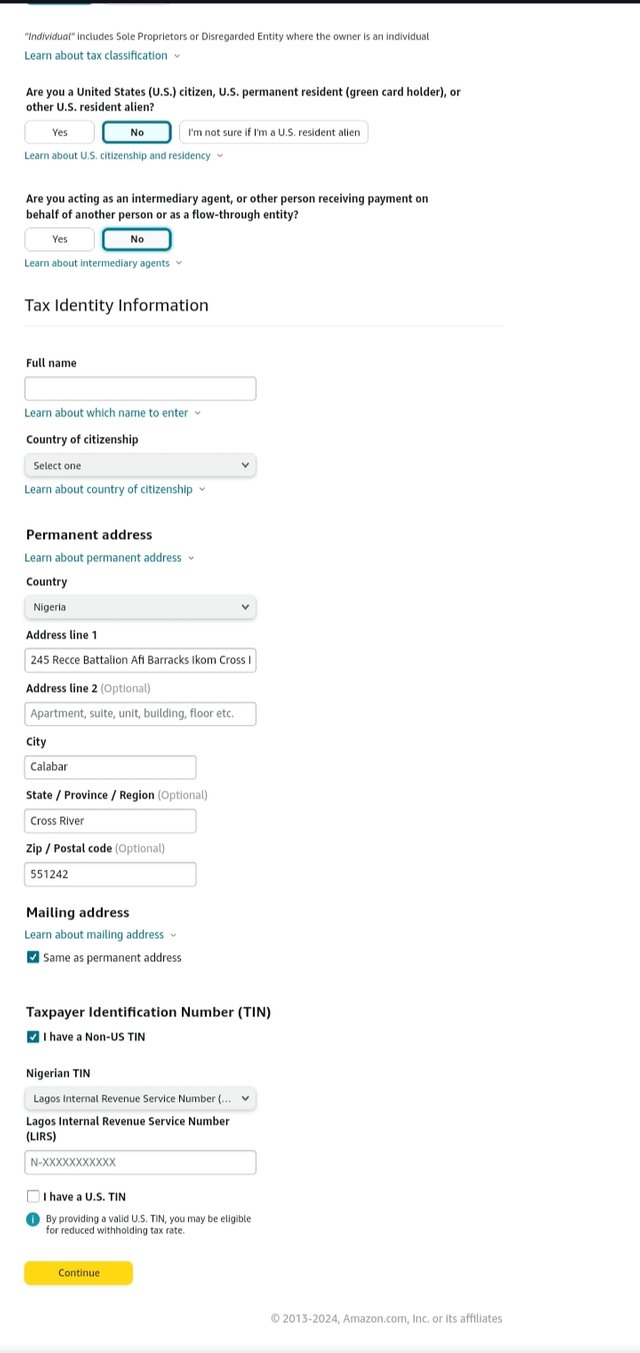

Step 4: Complete the Form:

- I fill in my legal name and country of residence.

- I provide my local tax identification number

- I skip the tax treaty benefits

|  |

|---|

Step 5: Certify Your Information

- I Review my response carefully

- I sign the form electronically to confirm my information.

Step 6: Submit the Form

- I then click on Submit to complete the process.

If the process of all my information isn't accurate I will be delayed or rejected if there should be anything I can contact the Amazon help center for assistance.

Tax Filing Process in Your Country

Explain the process of filing taxes in your country using online portals if available. Include steps and resources specific to your country.

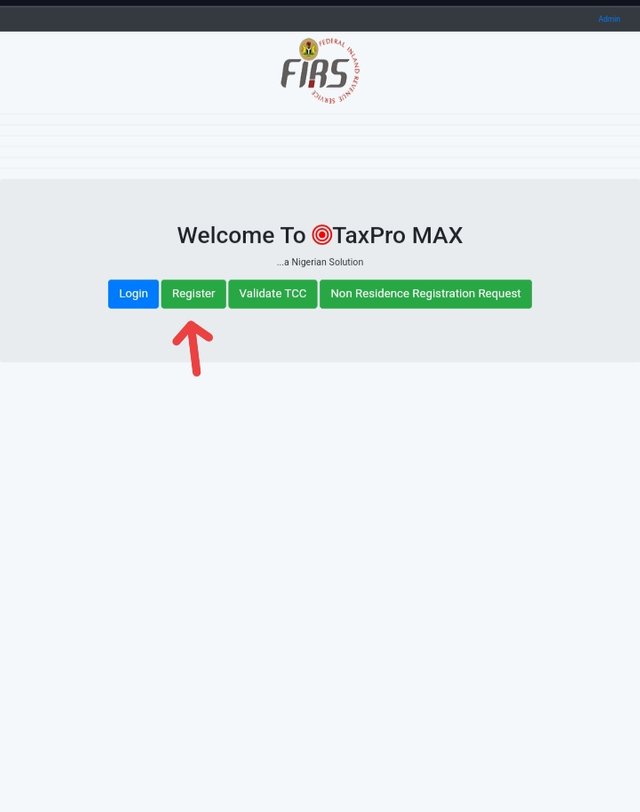

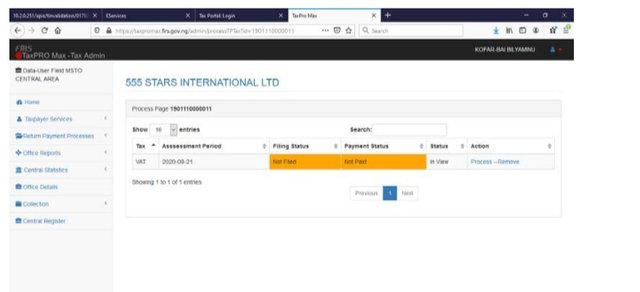

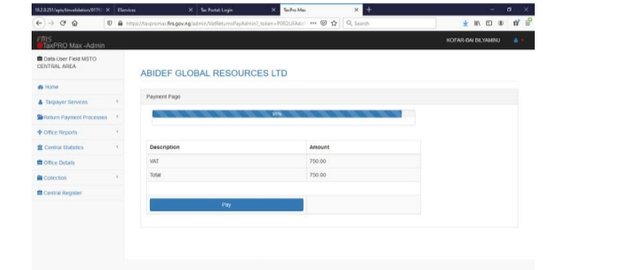

In Nigeria, the process of filing taxes can be done online through the Federal Inland Revenue Service (FIRS) e-services portal below I have shared the step-by-step guide for businesses and individuals to fill taxes online in Nigeria.

- Visit the official FIRS e-Services Portal https://taxpromax.firs.gov.ng.

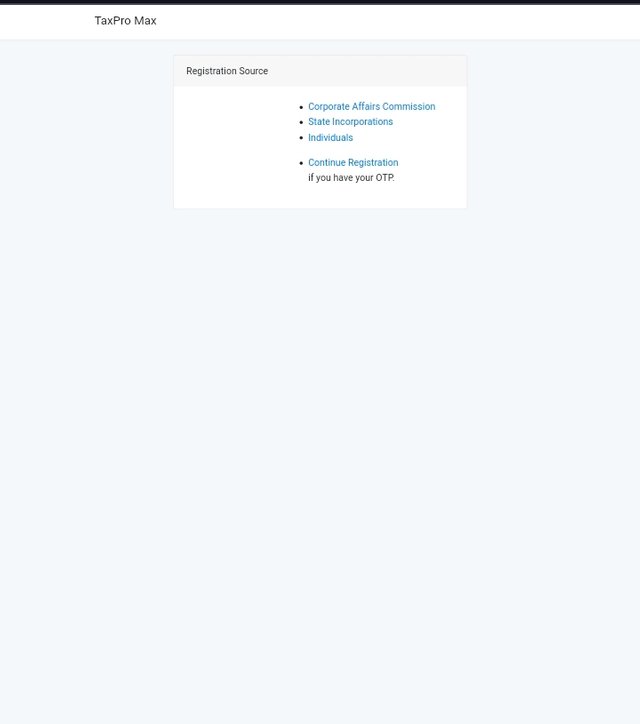

- If you don't have an account, you will need to click on Register and fill in the required details, including Taxpayer Identification Number (TIN), email address, and other information.

- To activate your account, you will need to check your email for a verification link or activation code from FIRS and follow the given instructions to activate your account.

|  |

|---|

Before filling, you need to ensure you have gathered the following:

- Records of revenue or income earned during the tax year.

- Taxpayer Identification Number (TIN)

- Proof of allowable tax reliefs for individuals and allowable deductions for businesses.

- Relevant financial statements for business registration.

|  |

|---|

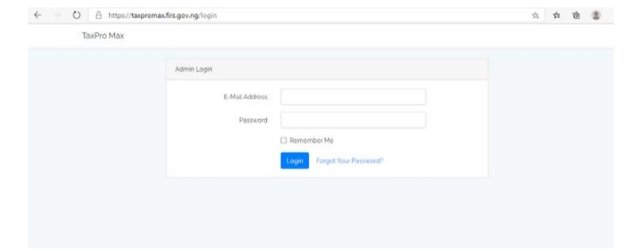

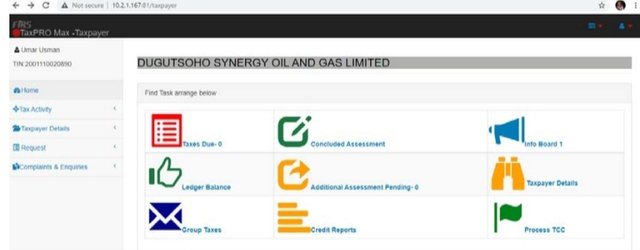

- Once your documents are ready, Log in to the Tax Pro max portal and enter your details to access your dashboard.

|  |  |

|---|

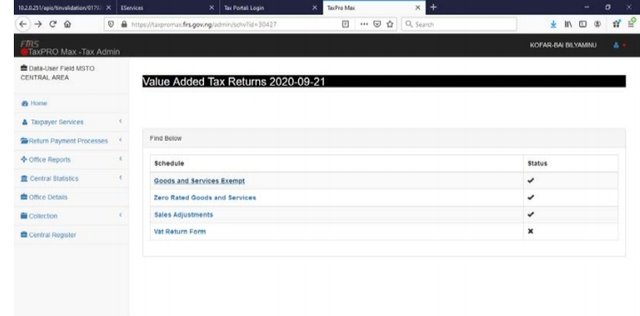

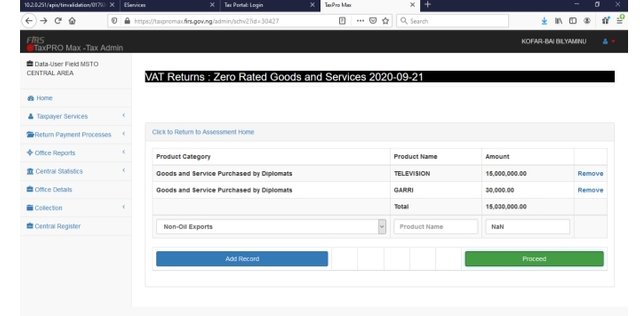

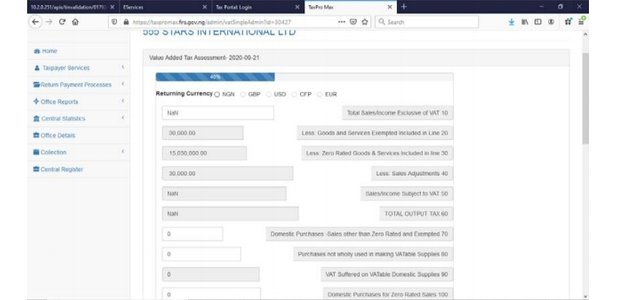

Select the type of Tax to File (Personal tax PIT) for a self-employed Taxpayer or Pay-As-You-Earn. For business, VAT or (WHT) Withholding Tax.

You will then need to complete the tax form and calculate and verify tax liability.

Submit the Return Once you are satisfied with your information click on Submit.

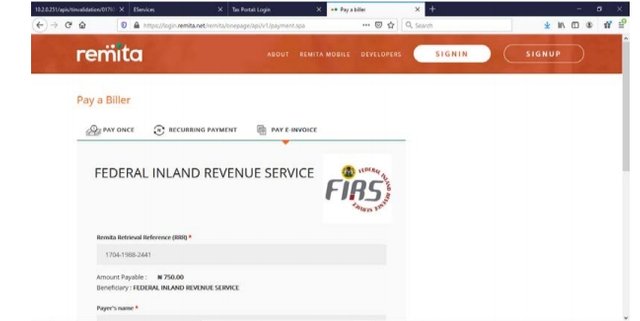

After you have submitted your information, You can then generate a Remita Retrieve Reference (RRR) for your payment which you can pay online or through a bank.

After payment you can then obtain your tax clearance certificate on the same portal.

Reflection

To my understanding, I think it is crucial to manage taxes properly for online earnings for the following reasons:

Legal Compliance:

If one fails to report online income accurately it can result in fines, penalties, or legal action which with proper tax management will ensure compliance with government regulations.Financial Stability:

*It helps to understand tax obligations which would help me to plan and budget effectively, preventing me from unexpected tax bills that could affect my finances.Business Credibility:

Maintaining accurate tax records would help me to build credibility and professionalism, most especially if I am running an online business.Tax Benefits:

With proper management of online tax, I would be able to identify credits or deductions, which would help me to reduce my tax burden.

What I Have Learned From The Process

I have learned that organization is key. That is keeping details records of expenses and income helps to simplify the tax filing process.

I have also learned and gained knowledge about tax laws relevant to online earnings which can help me to make informed decisions.

I have learned how to set money aside for taxes throughout the year to avoid stress.

Finally I have learned the importance of consulting with a tax professional to optimize tax outcomes.

I am inviting; @dove11, @simonmwigwe, and @ruthjoe

Cc:-

@hamzayousafzai

Thank you very much for sharing your assignment task with us! We truly appreciate the time, effort, and creativity you have put into completing this assignment. Your dedication to following the guidelines and your commitment to learning are evident, and it’s a pleasure to see your progress.

Below are the evaluation results, highlighting the strengths of your post and any areas of focus for improvement:

Teacher Recommendation and Feedback!

Total | 9.5/10

@tipu curate

;) Holisss...

--

This is a manual curation from the @tipU Curation Project.

Upvoted 👌 (Mana: 2/8) Get profit votes with @tipU :)