SLC-S21W5: How to Handle Amazon Taxes

People who work for themselves in Nigeria must pay Personal Income Tax (PIT), which has a progressive structure. The PIT income brackets and tax rates are:

- 7% on the initial ₦300,000 of income yearly

-11% on the subsequent ₦300,000 - 15% on the subsequent ₦500,000

- 19% on the subsequent ₦800,000

- 21% on the subsequent ₦1,600,000

- 24% on income above ₦3,200,000 annually

Taxable income, which is determined by subtracting permitted expenses and reliefs from total income, is subject to these rates. You must file an annual self-assessment tax return by March 31 of each year if you work for yourself. to avoid penalties, you might also have to make the payment of quarterly anticipated tax.

Registering for a Tax Identification Number (TIN), keeping thorough records of your income and expenses, and submitting pertinent supporting documentation, such as invoices and receipts, with your tax returns are all necessary for compliance.

In most jurisdictions, including Nigeria, Amazon Affiliate income is considered self-employment income, which is eligible for specific tax deductions. The purpose of the deductions is to lower taxable income by deducting allowable business expenses that were incurred in the process of making that income. This is usually the case:

- Deductions for Amazon Affiliate Income in Nigeria

Website and Hosting Costs Because they directly contribute to revenue generation, website maintenance costs, such as domain registration, hosting fees, and design, are deductible.

Marketing and Advertising Expenses for marketing affiliate links via social media campaigns, SEO tools, or internet advertisements may be deducted.

Software and Tools All software subscriptions utilised for content production or performance monitoring, such as analytics platforms or graphic design tools, are qualified.

Internet and Utilities If internet expenses are utilised for affiliate activities, a portion of those expenses may be written off.

Professional Services You may deduct the costs of hiring tax consultants, accountants, or other experts to handle the financial management of your affiliate business.

Educational Resources Materials Purchases of resources or online courses to increase your understanding of affiliate marketing may also be eligible.

- Requirements for Deductions

Record Keeping: Maintain thorough records, such as bank statements, invoices, and receipts.

Tax Identification Number (TIN) is as follows: To file taxes, register with the Federal Inland Revenue Service (FIRS).

Accurate Filing: Submit an annual self-assessment tax return that accounts for eligible deductions as well as income.

- Tax Implications

After allowable deductions are subtracted, the remaining taxable income is taxed at rates that vary by income band and range from 7% to 24%.

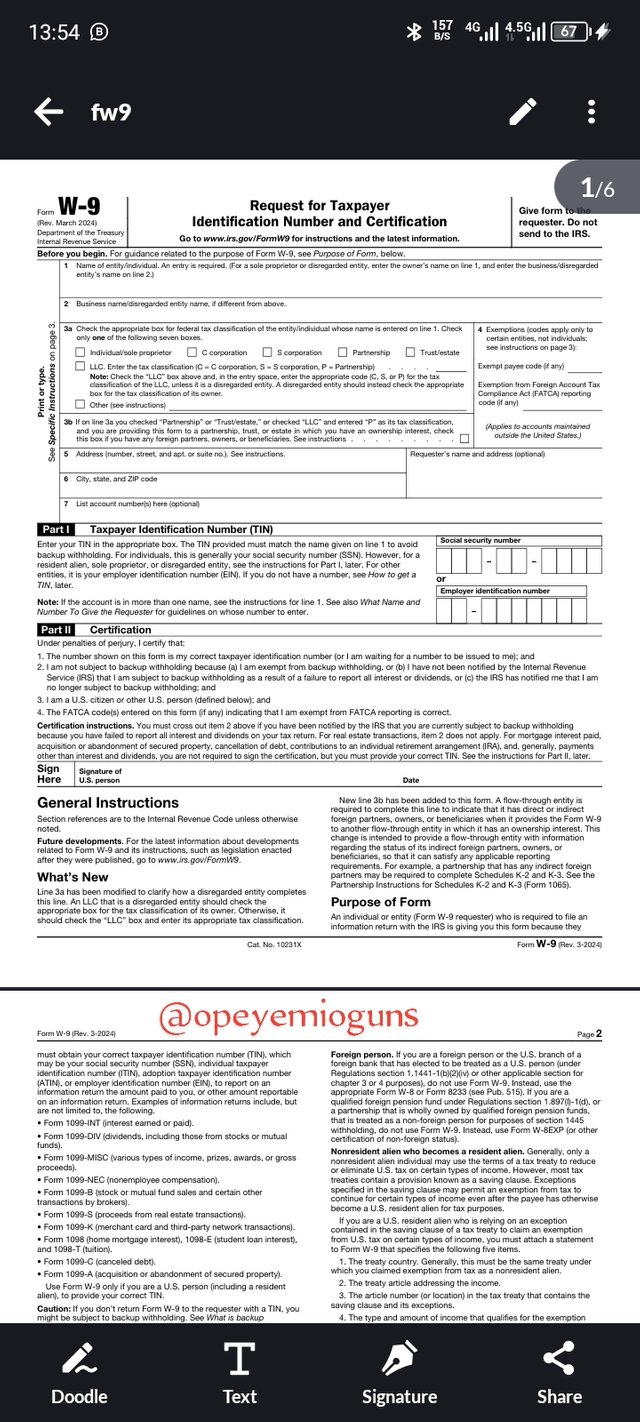

You may be required to submit a W-9 or W-8BEN form to the income-paying organisation while you are living in Nigeria and participating in affiliate marketing (like Amazon) or other U.S.-based revenue sources. The procedure is as follows:

- 1. Determine the Required Form

For U.S. citizens, residents, or entities (not applicable to the majority of Nigerians), there is a W-9 Form.For non-U.S. people or companies (Nigerians are included in this category), use the W-8BEN Form. The W-8BEN verifies that the income earner is exempt from U.S. taxes and assists in claiming treaty benefits.

2. Download the Form

- go to IRS official website to download the appropriate form.

- For W-8BEN, use this direct link.

3. Complete the Form

For W-8BEN:

Part 1: Recognition Give your name, permanent address, and country of citizenship (Nigeria). If it is important, TIN Number. Some U.S. organisations may accept an explanation if you don't have a TIN. If you have your National Identification Number or Foreign Taxpayer Identification Number (FTIN) put it.

Part II: Claim of Benefits from Treaties If relevant, state that you are a resident of Nigeria as defined by the Nigeria-U.S. tax treaty. If you are eligible for a withholding tax decrease, mention it.

To attest to the form's accuracy, sign and date it (Part III: Certification).

For W-9 (if required):

- Give your name, U.S. tax ID (if you are a resident or have two citizen), and address.

- Sign to accept the penalty of perjury..

4. Submit the Form

Forward the filled-out form straight to the payer (such as Amazon or other affiliate businesses). This is usually accomplished by uploading it to their internet portal, which is the preferred method. Sending it to their tax compliance or finance department via email. Mailing it, which is less popular among Nigerians.5. Follow-Up

Verify that the organisation has received the form. If withholding taxes were applied even after the form was submitted, ask for clarification or adjustments.

This is the website first page, I clicked on "find form instruction

Screenshot source

Then it directed me here that I can find both W-8 and W-9

Screenshot source

It's a form that I have to download, print and fill and scan back to upload when I'm done filling it

Screenshot Source

The Federal Inland Revenue Service (FIRS) e-Services Portal and other state-specific platforms have made it easier for Nigerians to file taxes online. Here's a detailed tutorial on using these internet tools to file taxes:

Register for a Tax Identification Number (TIN) Individual Registration: Go to the FIRS TIN Registration Portal. Business Registration: If you own a business, you can register your entity with FIRS by first going to the Corporate Affairs Commission and then linking to FIRS for TIN.

Access the FIRS Online Portal Go to www.firs.gov.ng, the official website of FIRS, and click on "e-Services." Choose between e-Tax Payment and e-Filing, depending on the service you require.

Log in or Register on the e-Filing Platform If you're a first-time user, create an account using your TIN and enter the necessary personal or business information, such as your email address and phone number. Once you've finished registering, log in with your username and password.

Provide pertinent tax information Regarding individuals: Upload income details, including employment income, freelancing income, or other sources. For businesses: Submit records of revenue, expenses, and other financial operations.

Calculate the Due Taxes Based on the income and provided deductions, the portal computes taxes automatically. One illustration of this for individuals is the Personal Income Tax (PIT). deductions for relief (such as charitable contributions, dependents, and pensions). Businesses are responsible for calculating value-added tax (VAT), corporate income tax (CIT), and other relevant taxes.

Send Money Pay taxes immediately via the portal using online payment alternatives like: Remita is integrated for paying taxes directly. Bank Transfer: A Reference Number will be provided to you for usage at participating banks. After payment, save the payment receipt that was created.

Submit Your Tax Return After payment, fill out and upload your tax return form (such as a CIT/VAT form for businesses or a self-assessment form for individuals). Carefully check the information before submitting.

Get an Acknowledgement Slip The system will generate an acknowledgement slip as proof of compliance after your filing is successful.

State-Specific Portals For state-level taxation (e.g., Lagos State Income Tax), utilise platforms such as the Lagos State Internal Revenue Service (LIRS) e-Tax Portal (https://etax.lirs.net).

The procedures are analogous to the FIRS system but may concentrate exclusively on personal income tax. Resources for Assistance FIRS Contact Centre: 0909 744 4444 or [email protected]. For additional support, visit a local FIRS office if online issues arise. By following these guidelines, taxpayers in Nigeria can effectively meet their tax obligations online and avert penalties for late submissions.

- Why Proper Tax Management Is Important for Online Earnings?

For both legal and financial reasons, it is essential to appropriately manage taxes on internet earnings:

Law Compliance: In the majority of nations, online income is subject to taxes, regardless of whether it is earned from e-commerce, freelancing, or the production of digital content. Depending on your jurisdiction, failing to record income may result in penalties, fines, or even legal repercussions.

Avoiding Financial Penalties: You can be subject to interest on overdue taxes or additional costs for late payments if your taxes are not computed and paid accurately. Avoiding unforeseen liabilities is ensured by effective tax management.

Professional reputation: Managing your taxes correctly enhances your professional reputation. It conveys to partners, customers, and tax officials that you do business ethically, which may foster confidence and open up commercial prospects.

Financial Planning: You can better manage your cash flow, savings, and investments if you are aware of your tax responsibilities. You can avoid financial pain during tax season by allocating a portion of your salary for taxes.

Access to Benefits and Deductions: You can also benefit from credits and deductions that lower your taxable income when you properly declare your income. Professional software subscriptions, internet fees, and home office expenses, for instance, can all be deducted if they are associated with your online business.

- What Did I Learn from This Process?

This task taught me that handling taxes on internet income is not only required by law, but also essential to operating a long-term company or side gig. I also came to understand how crucial it is to maintain thorough financial documents, including invoices and receipts, in order to support earnings and outlays. Additionally, knowing local tax regulations and seeking advice from a tax expert helps minimise mistakes and save time, guaranteeing compliance and optimising tax advantages. This procedure demonstrated the importance of proactive tax planning for long-term success and financial stability in the digital economy.

Conclusion

To sum up, preserving compliance with tax rules, avoiding penalties, and guaranteeing the long-term profitability of your online business all depend on effectively managing Amazon taxes. Sales tax and federal income tax are two examples of taxes that necessitate proper record-keeping, consistent reporting, and knowledge of state-specific laws like nexus requirements. You can reduce financial risks and maximise your tax responsibilities by taking advantage of deductions and seeking professional advice. Amazon sellers can concentrate on expanding their companies while remaining in line with the rules by remaining proactive and knowledgeable.

Below are the evaluation results, highlighting the strengths of your post and any areas of focus for improvement:

Your entry is invalid. I used three AI detection tools to verify your post, and all confirmed it was generated by AI.

The tools used were:

Please see the attached screenshot for evidence.