SLC-S21W5: How to Handle Amazon Taxes

Research and Explain Tax Rates

I reside in India, so i have done research for the tax slabs applicable in my country, although i am already a tax payer but my friend is a CA so he handles most of the part all i have to is make him payment.

There are two tax regime old and new as new tax slab was just announced this year and while filling tax you can choose through which regime you want to fill the tax, so i wil mention the tax slabs for both regime.

Tax Rates for FY 2023-24 (Applicable For Old Regime)

Income UPTO 2,50,000INR - NIL

2,50,001 - 5,00,000 - 5% (Although Rebate is available under section 87A)

For Income 5,00,001 - 10,00,000 - 20%

Above 10,00,001 - 30%

Tax Rates for FY 2023-24 (Applicable For New Tax Regime)

Income upto 3, 00,000 - NIL

3,00,001 - 6, 00,000 - 5%

6,00,001 - 9,00,000 - 10%

9,00,001 - 12,00,000 - 15%

12,00,001 - 15,00,000 - 20%

Above 15,00,000 - 30%

Note - All the figures are given in INR(INDIAN RUPEE)

AMAZON AFFILIATE INCOME

Individuals like me who are regularly promoting affiliate links and having business expenses like hosting advertising etc can claim deductions for those expenses.

In case your affiliate marketing income is a very minor source of income and you do not really treat it as business income then it can be classified under 'Other Sources'

Considering the case 1 where i am earning a good amount then my income qualifies for tax and deductions for business expenses also.

1. Business Related Expenses

- Hosting fees

- Advertising Expenses

- Internet usage Cost

- Software & Subscriptions

2. Depreciation

If you own assets such as laptops, camera for affiliate marketing, you can claim depreciation on your assets.

3. Office Expenses

Just in case if you are working from a dedicated business space then you can claim your expenses such as electricity rent maintenance etc.

Sample Calculation for amazon affiliate income tax-

Gross income from affiliate - 8,00,000 INR

EXPENSES - 2,00,000

TAXABLE INCOME -8,00,000 - 2,00,000 = 6,00,000

Tax Liability -

Upto 2,50,000 - NIL

2,50,000 Will be taxed at 5% = 12,500INR

1,00,000 Will be taxed as 20% = 20,000 INR

Total Tax to be paid = 12,500 + 20,000 = 32500INR

Amazon Tax Form Submission

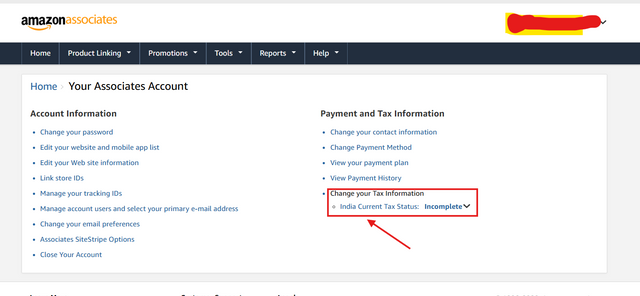

Step 1 -

Simply log in to your amazon affiliate account dashboard, and click on change your tax information as you can see in the given screenshot. Click on it to go to next page to fill the tax form.

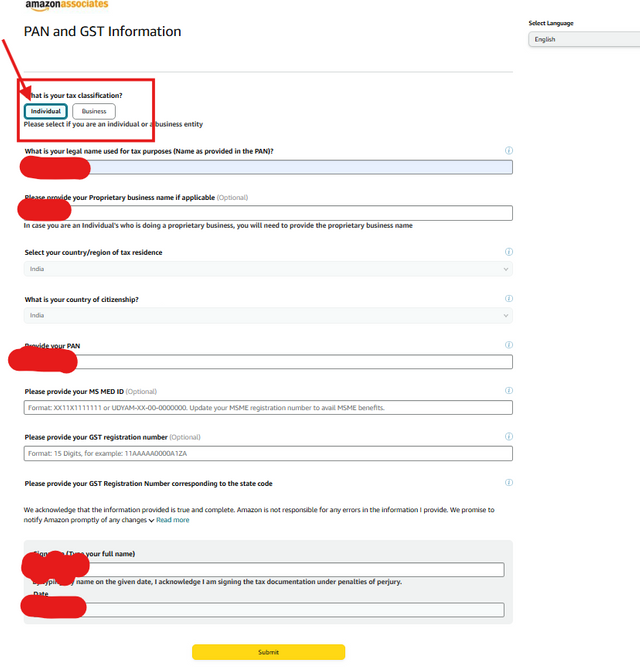

Step 2 -

Once you have click from the step 1 fill out the W-8BEN Form and all the basic and personal details asked.

Since i belong to india, i am required to submit my PAN(Permanent Account Number) along with my personal details once you have filled all details, click on submit at the end of the form and it will be submitted and then wait sometime the status will be updated to completed.

Tax Filling Process - India

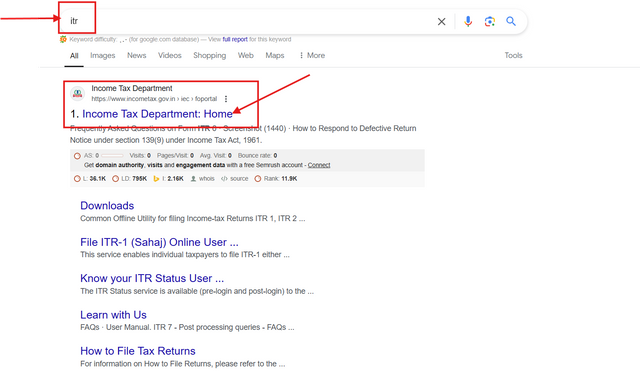

STEP 1-

Go to google and search itr or itr file, you will get to the official portal for file your income tax return online as you can see in the given screenshot or simply click https://www.incometax.gov.in/iec/foportal/

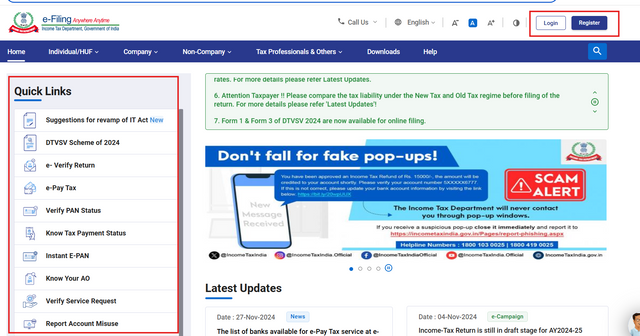

STEP 2-

Once you click the official website in the step 1, then you will get to the homepage and there you can see options such as log in or register and other quick links, since i am already registered, i will simply sign in using my credentials.

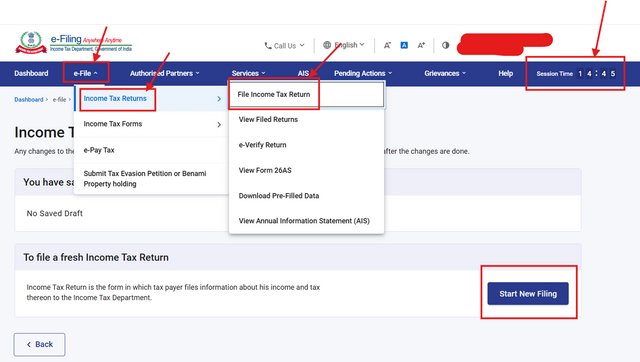

STEP 3-

In this third step, once you are logged in, find the option E-file then income tax returns and then file income tax returns, remember the session will only last for 15 minutes then it will be automatically logged out, but your draft will be saved

Importance of managing taxes

Managing your taxes properly has its own advantages, but most importantly you it's important because of following reasons-

- Legal Compliances

As we all know the compliance with regulations of taxes is important for all of us residents, because of tax evasion you may face severe tax penalties and legal compliance under the income tax act, so it's one of the important aspects to be responsible citizen and you can safeguard yourself from audits and investigations.

- Avoid penalties

If you manage you taxes properly, you can avoid tax penalties, as avoiding taxes or under payment of taxes can lead to multiple fines under section 234F and other interest with penalties under sections 234A, 234B and 234C even late filling of taxes can lead for a penalty of upto 10,000 INR, so be responsible and mange your taxes properly.

- Financial credibility

This is one of my favorite advantages, as your income tax returns serves as a proof of income which literally enhances your credibility, which is required while applying for loans, credit cards and many government schemes such as MSME Loans

Learning from the process

From the process mentioned in the task i learned the following important lessons regarding tax process and amazon affiliate income taxation.

- Categorization of income

From the task i learned that the income from the amazon affiliate is eligible for tax and can even fall under different income heads while filling itr such as under business, profession or other sources income and each with different tax implications.

- Importance of Record - Keeping

It's very important to keep an organized records of income from various payouts such as Amazon affiliate accounts and even expenses which ensure smooth process of tax filling and complete the compliance during audits.

- Awareness of Tax Laws & Benefits

I have learned that there are various of benefits of filing your income tax, such as getting a financial credibility which makes getting a loan easier, understanding financial deductions such as Section 80C of investments and section 80D insurance premiums while filing income tax.

Thank you very much for sharing your assignment task with us! We truly appreciate the time, effort, and creativity you have put into completing this assignment. Your dedication to following the guidelines and your commitment to learning are evident, and it’s a pleasure to see your progress.

Below are the evaluation results, highlighting the strengths of your post and any areas of focus for improvement:

Teacher Recommendation and Feedback!

To enhance the overall impact of your assignment in the future focus on adding more detailed reflections and ensuring all required components like attachments are included.

Total | 9.3/10

Thanks for the information, I'll be more focused next time..