Yotta Savings Reviews - The best savings account interest rates 2020

What's going on guys. My name is Val. I will share with you my honesty Yotta savings review.

.png)

So Graham Stephan bought into Yotta savings bank account. It's kind of a weird concept here in the US apparently it's been really popular over in the UK. It's a type of bank account where you put your money in. And then instead of getting just a flat percentage rate, like we're used to most bank accounts, you get a flat percentage, but then there's also a prize pool where you can win additional prizes.

This article is not sponsored. I ended up signing up for an account afterward and wanted to talk about my experience with the bank account since then.

So let's talk about what the Yotta Savings account actually is, how it works, and I give you the good things. And then what I think are the bad things about the account.

So to begin with this is a savings account and Yotta Savings is actually not the bank in this situation. The bank is actually Evolved bank, which has FTSE insurance. So when you put your money in here, you're going to get up to $250,000 with the FTSE coverage.

I double-checked. The FTSE website evolved bank is a legitimate bank that is on the FTSE insured list. So you are getting FTSE coverage in there. If a wall bank goes under your money is covered up to $250,000.

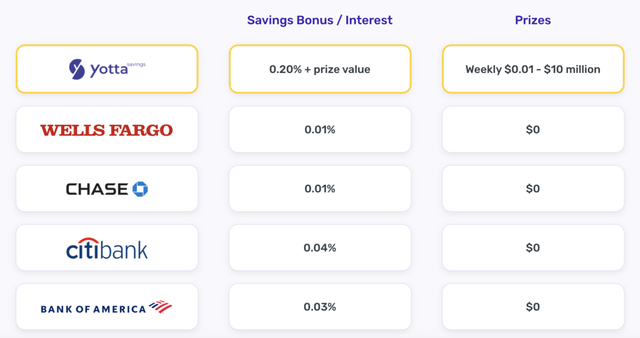

The way it works is they're paying a flat 0.2% interest rate, which is better than what you're going to get at like a traditional bank. If you go down to like a bank of America, Wells Fargo, or some local bank, they're probably going to be paying you 0.1% or even less than that, the 0.2 is already going to be higher than traditional banks.

Now it's not as high as what you would see at like a high yield online savings account. So think about like ally or VO banks, like this are going to be paying around 0.6 and were like 0.8 in terms of the high yield savings accounts.

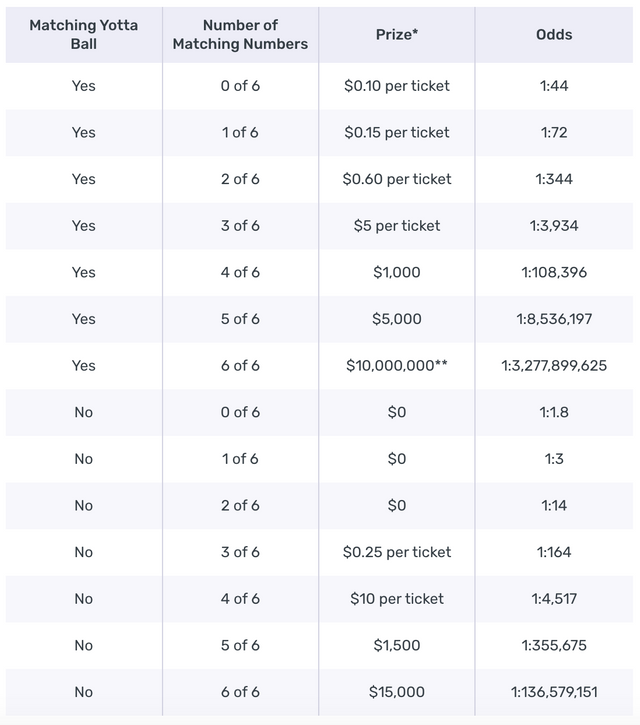

So you're getting a little bit less of yield by using Yotta Savings as opposed to an online savings account, the kicker and all this is you're effectively getting what are similar to lottery tickets and the lottery tickets mean that in addition to the 0.2%, you also have the chance to win prizes and you'll see the prizes and the odds that you can win right here. So what I did is I set up an account through the app. I transferred in a thousand dollars and then also set up a recurring contribution to $25 just to kind of test the system out.

And so far, my understanding is I've matched on three different tickets. I match two different balls. Now, the way it works is every single night of the week, they release a new ball at nine o'clock Easter.

And so I get a notification nine o'clock Eastern every night, the new ball has been released. I go log onto the app and I can see what the ball is and if it matches any of my numbers, do I like about this is the game of location of the process.

They gave us stats like so many millions of Americans don't have access to $400 but spend over $400 on lottery tickets every year. And so by using an app like this, where they're actually getting kind of similar to lottery tickets, but they're actually saving money.

Well, it gives them a to do something like this, as opposed to buying lottery tickets where the money's gone forever.

Now I'll tell you now I've had the app for a week plus every single evening, and now I call it Eastern. I get that notification. I click on it. I see my balance. So I know exactly how much is in there. And I checked my ball. And so I think, yeah, for people that aren't used to checking their account balances very often, there's going to be really good.

I had a really good incentive for people to log in and check their balance. I liked it. It's FTSE insured. You're going through Evolve bank as a 90 plus year history. So it's a legitimate bank you are getting up to.

Yes. I see coverage. These types of accounts have a history and are very popular in the UK. They call them premium bonds there. And so this is not a completely new product. It's just generally kind of new to the US and then when you combine the 0.2% yield, as the account is paying as a flat rate with an additional prize pool, and you calculate out the odds, you're getting anywhere from two to say three and a half percent yield on your money in terms of expected return.

That's a crazy number in today's interest rate environment, but it's not all rainbows and sunshine. Let's talk about the, so the bad things begin with it takes forever to transfer your money. Now, I haven't tried to transfer any money out, but it's just getting money into the account that has taken like 10 days.

They also kept the amount that you can put in there at $10,000 per single instance, and then flight $40,000 in a given month. If you have a lot of savings that you're wanting to put in there, it's gonna be difficult to do that really quickly.

The $10 million prizes advertise so much, it's not really $10 million. When you look in the fine print, it's actually $5.8 million. They're doing as the lottery does, and they give you an annualized amount. So if you put the 5.8 into a 40 year at nudity, they're saying that that would be worth $10 million.

So the actual price is $5.8 million. You also shouldn't expect to win that prize. The odds are like eight point something billion to one, which is like 25 times worse than winning the Powerball.

Now, if you hit on it, it's a thousand dollars or more. You are going to have to split that with anybody else that hit that well in that given week, what that means is that as more and more people sign up for the app, the chances of you splitting the prize become a lot harder.

So the effective rate of savings of two to 3% is going to be coming down as when people sign up for the app. And now that we've had some big YouTube accounts talk about it, you're going to expect to see a lot more people sign up for the accounts. It's important to make sure that you understand that that's an expected return of the prize pool.

Nobody's actually going to get that return. Some people are going to get a lot more, a lot of people are going to get even less. And the last issue I have is that the app can be confusing. I'm not sure exactly how much I've won so far.

I know I've matched on a couple of balls on a few tickets, but I'm not sure exactly how much I've won. All I know is that a transferred in $1,025 my first week, and I've got $1,025 and 21 cents. Now it's not exactly clear to me if that's off the 0.2%, or if it's because I won on some other tickets.

Now, if you are going to sign up for an account, make sure that you use a referral code. I'll leave mine down to this. And below gets you an extra a hundred tickets that also gives me an extra hundred bucks.

My referral link for your 100 bonus tickets: https://www.withyotta.com/?code=VALENTIN7

It doesn't mean it's a win. Anything just gives you extra chances. But in conclusion, I like that idea, especially for people that don't have a lot of savings.

And haven't really been incentivized to say, before I leave, the yield is going to come down to around a market average pretty quickly. I'm not going to use it as my primary savings account, but it's fun to get the balls every evening and go check and see if I've won anything.

Even though I'm not somebody that's ever really played the lottery that much. Hope you enjoyed it.

I'll be seeing you soon.