Commodities with the Schwartz and Smith Two-Factor Model

Hello to all my dear scientific community of steemit, I want to share with you all an article that I am writing, it is about a model of commodites which is being tested with real data of oil prices and shows an excellent behavior, I hope you enjoy it as much as I.

Introduction

When stochastic processes are proposed to model commodity prices, the differences between these and another class of market assets should be considered. Commodity markets are unique in financial modeling. Your assets are not like stocks, interest rates, or currencies. The actual assets are physically produced, transported, stored and consumed. It is natural to expect that they should be treated differently in financial security markets. Many of these markets, in large industries, and in decision-making bodies in governments, are interested in the physical liquidation of contracts and the delivery of goods. For this reason, a substantial quantity of goods must be mobilized between countries, implying a cost of delivery and considerable delays. As it is practically impossible to liquidate these contracts in real time, spot contracts do not exist as such.

There is an extensive literature on this line of research, including the work of Brennan and Schwartz (1985) who developed a model to explain the relationship between spot prices, commodity futures prices and instant convenience yield.

Here I present a stochastic commodity price model to determine whether the behavior of future prices, and the spot prices of agricultural commodities such as corn, wheat, and soybeans, are related to storage costs, inventory levels And convenience performance.

What are Commodities?

These types of goods are of generic type, that is, they do not have a differentiation between them. Normally when talking about commodities, we talk about raw materials or primary goods, such as wheat, which is sown anywhere in the world and will have the same price and quality.

We define commodity as any good that has value or utility, and a very low level of differentiation or specialization. But this does not mean that all those goods that do not have differentiation are commodities, since for example, sea water is not a commodity because it has no value or utility.

The Schwartz and Smith Two-Factor Model

The two-factor model is based on the model of Gibson and Schwartz (1990), where the first factor xt denotes the spot price of the commodity, and the second factor yt denotes the yield of instant convenience. These factors are considered to follow a joint stochastic process given by:

dxt = -κxtdt + σxtdBx

dyt = μdt + ηdBy

St = e ^ (xt + yt)

Where the increases of Brownian motion are correlated: dBxdBy = ρdt

Result

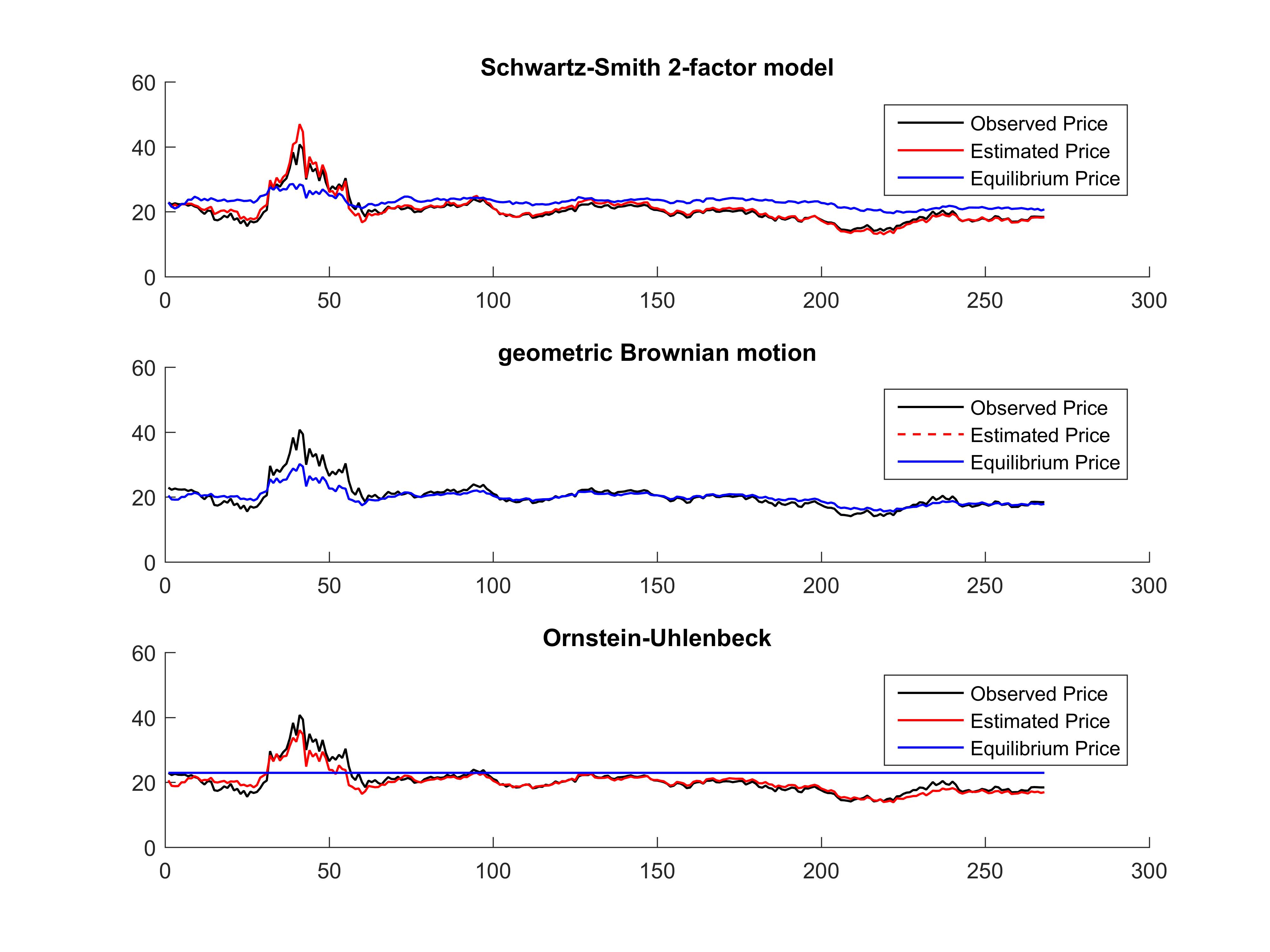

we can see the performance of the model using real oil price data together with two models to measure efficiency:

Enjoy, resteem and follow me @falcao12

Congratulations @falcao12! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP