4 Easy Steps to Tokenize Your Assets

Efficient tokenization of assets should be based on an optimal balance of rights and obligations of each side – a company and investors. Moreover, it must diminish information asymmetry between the sides at the lowest cost possible. Creation of an optimal approach for each company individually is very tedious and expensive for both companies and investors. Smartlands develops standardized yet flexible framework to solve this complex issue.

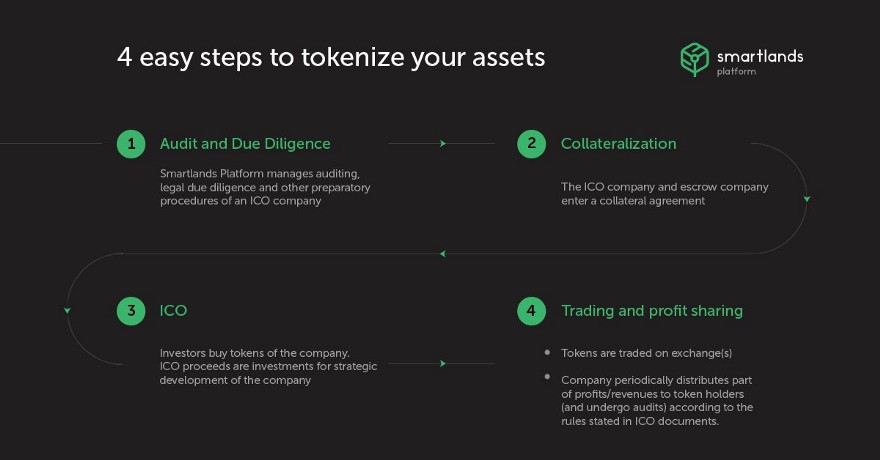

To tokenize assets under the Smartlands framework, a company should take the following 4 easy steps together with the Platform.

- ICO preparation: Audit and Due Diligence.

Smartlands Platform manages auditing, legal due diligence and other preparatory procedures of the company under the standardized framework.

The company pays a fee for the provided services to the Platform and other counterparties that take part in an ICO preparation (legal and auditing firms). - Collateralization.

The agricultural company and an escrow company enter a collateral agreement for the assets that will secure the ABT issue. - ICO.

The Platform provides a standardized offer to potential investors. Investors buy tokens of the agricultural company, while proceeds of an ICO will be used as investments for development of the company. - Trading and Profit Sharing.

a. The Platform ensures that tokens are tradable on SDEX and lists them on partner cryptocurrency exchanges (as a possible option in some cases) to enhance token liquidity.

According to the rules, ABT investors buy the required amount of SLT tokens from their holders at an available price.

b. The company periodically distributes part of its profits/revenues to ABT holders according to the rules stated in the ICO documents.

The company undergoes periodic audits to provide transparency of its operations and value of the tokenized assets.