Block chain H5 room card bullfight source code

Block chain has now become a super hot spot in the market, open H5 room card bullfight website: h5.super-mans.com enterprise E: 2012035031 VX H5 bullfighting block chain sharing of the block chain, there are many courses, such as the 42 chapter, the quality of their course is also very good, to be honest, we begin to prepare When they decided this course, they didn't publish the course, so I felt a little unaware when they announced it, so it also posed some challenges to my course. On the one hand, I will try to cover the basic contents of other excellent courses for the students who first contact this class, but on the other hand, I have to prepare some information that they have not yet touched on, and I hope you can find that the course has a unique value.

It must be acknowledged, of course, that I am not an expert in this field, so it may be limited and must take care of more students, so some too complicated technical principles, concepts and deep content may not be involved here; besides, there is no concern about the issue of currency, such as problems in this area. Please move to other fried communities that are good at cutting leeks. It can be refunded at any time in 1 hours.

On the topic of why bitcoin is on duty, I personally think this is the case: after the financial crisis in the United States, the economic recovery of many countries is the excess of money, what is the excess of money? It means robbing everyone to make up for the hole of bad people, bad guys making mistakes and good people paying for them. This is a problem of many countries' economic policies.

We say that money comes from the credit of public power, but is the credibility of public power really reliable? There are Zimbabwe in Africa and Venezuela in the Americas. Even at the secondary level, Argentina and Nigeria have all experienced a plunge in the currency exchange rate, and South America, Africa, and even Southeast Asia, the public power and credit of many countries have been impacted. This provides a mass soil for digital money.

Behind the bitcoin is the algorithm credit, based on the consensus algorithm to guarantee the credit, which is first sought by the geeks, its monetary tightening, and also let those who are dissatisfied with the rise of attention and acceptance. It can be said that bitcoin is the opposite of the real politics, but at the same time, it is also used by the dark side, as an accomplice of the illegal trade, which is also one of the bases of the value of the bitcoin.

Burn the brain

Talk about some technical knowledge and technical ideas of block chain.

The value of block chain is common understanding, which has been emphasized by many people. Consensus comes from public algorithms, and consensus algorithm is a very outstanding achievement in the field of mathematics and computer algorithm. It is not specially designed for block chain, but block chain is a very typical application scene of consensus algorithm.

Consensus algorithm

So what is a consensus algorithm? The simple point is to seek a reliable algorithm for information transmission and validation in untrustworthy network environments in untrustworthy data transmission. Of course, this reliability is relative, not absolute. For example, suppose that bad guys can't control more than half of the information nodes. If the bad guys really mastered more than half of the information nodes, they could actually tamper with the transmitted information, so that the consensus would collapse.

There are many kinds of common algorithms, which are most commonly mentioned at present, which are used in bitcoin and the ether workshop, which are called POW's consensus algorithm, an algorithm based on workload proof. It is explained here that Ethernet is currently based on POW consensus algorithm, but its future will be switched to POS consensus algorithm. This follow - up will be explained.

Working principle of block chain

So how does the block chain work in the end? Take the POW algorithm as an example. First, each transaction, billing information, is a record, each record is published to a different node, the node will check the latest records into a new block, and then the block is published to the network by calculating the force.

But the calculation shows that there is a great chance of random randomness, that is, there are very many miners, the situation may be hundreds of thousands of units at the same time packaging and publishing data, but only a lucky mine, got the proof, generated a new block, and got the block award.

When the block is released, the other nodes get the information quickly, then give up the data that has already finished the packet, begin to accept new data, pack the next step, and try to prove that the force gets the power of release and the block award.

So in fact, the POW consensus algorithm is also shocking in the competition of computing power. But it is precisely because the probability of all nodes is consistent, which ensures that any node is invaded and tampered with, and its data information will not be accepted by other nodes, that is, the security of the main chain is guaranteed.

The current limitation of POW is that the speed of the block is limited, and bitcoin has a block in almost 10 minutes, and all transactions need to be recorded in the block, so this also limits the frequency of the transaction. Because a block is only 1M, the transaction information that can be carried is limited. So at present, the frequency of bitcoin trading is restricted to a very low order of magnitude, which can support less than 10 transactions in about a second.

Upgrade scheme

Then the upgrade program, there are the following:

The first is to increase the size of the block. For example, after the first hard forks, bit cash increased the block size to 8M block.

The second is to improve the efficiency and reduce the block award. The speed of the block is faster than that of the bitcoin.

But there are too many nodes that have the pressure of node storage and network transmission. Then we propose third solutions:

Third block partition storage scheme, although the block chain such as bitcoin is centralization distributed storage, but each full node is stored in the record set, that is, the size of the scale and local query are obviously restricted.

Is it possible for each node to store only one subset in the way of slice storage? This combination of the second solutions can greatly enhance the carrying capacity of the system, and will not put too much pressure on node storage and network transmission. But there are some other applications, I think this is worth discussing, and I'm also looking at some of the information recently, but I can't say I know where the most suitable path is, but it's still a lot of technology worth discussing.

Of course, fourth is the solution of the lightning network, the lightning network refers to the small, frequent transactions, first through a number of branch nodes to store and calculate, and in a certain time integration into the main chain, which we used to do database optimization sharing, the logic is basically the same. It can greatly reduce the write pressure of the main chain and increase the capacity of the main chain.

In burning the brain, I hope you have a better understanding of some of the technical principles. I guess a lot of people are looking forward to the temptations, looking at the way to make money. I think it's embarrassing. I think it is still difficult and difficult. The block chain actually has a lot of immature, the need to optimize and perfect, bitcoin or Tai Fang, it is also good. It may not be enough to carry the future of the block chain.

To continue this topic, since POW has a large number of energy consumption problems, there is also a block chain application based on other common understanding algorithms, then one that is considered feasible is the POS consensus algorithm, that is, an algorithm based on the amount and time of possession. Simple interpretation is similar to the amount of money you save in the system, the more you save in the system, the longer you save, the more you gain, so the meaning of the competition is weakened, and the meaning has been strengthened.

The planning goal of the ether workshop is to change to POS. But there are some problems in POS, such as the Matthew effect. Finally, the system decision and revenue will remain in the hands of a few oligarchs. In addition, it is also worth observing how to ensure the number of effective work nodes to complete the operation after the miner's upsurge.

On top of POS, some people put forward DPOS, the mode of voting for working nodes on the basis of the number of owners, the voting node is responsible for packing. Once a bad block or failure occurs, there will be a set of mechanisms that will automatically switch to other nodes to achieve smooth transition. At present, EOS pushes such a common task. Knowledge model, as the infrastructure of its platform, is quite good from the white book index, but the product is not online, and whether it has been tested by practice remains to be seen. To be honest, I doubt the technical indicators of the white paper. Of course, I do not exclude the limited factors of my judgement.

In fact, I think there are two extremes, consensus and efficiency. POW is actually to achieve network consensus and sacrifice efficiency. We say why Alipay is so high efficiency, based on the center system, now any one Internet Co to make a payment transaction system can have high efficiency than bitcoin, but is unable to form the effective basis of consensus. So I personally think that if we want to effectively improve the efficiency of the block chain, it is difficult to go completely to the center. The multicenter is a strategy of efficiency and consensus. In fact, DPOS can be understood as a multi center system. Now even the POW consensus algorithm avoids the monopoly of a large mine, and it emphasizes to go to the center. It may be wishful thinking.

Currency and block chain platform

Next I will explain the difference between common currency and block chain platform.

Bitcoin is the first practical application of block chain, so the core value of bitcoin, as the most common product of common consensus, is that it can be used as a book system to complete some international trade and credit vouchers in cross-border transactions. In traditional finance, the credit cost of transactions is quite high, and the block chain itself has natural advantages in this field.

But as the earliest block chain application, bitcoin problem is also quite numerous. For example, the power consumption is serious, and the trading support capability is very limited. Don't say Alipay, WeChat pay for this order, the domestic any third party payment performance demands of bitcoin interface framework may not support. In addition, it does not support intelligent contracts, and does not support zero knowledge proof. To tell the truth, the existing bitcoin architecture is a bit behind the times.

The bitcoin architecture crisis was reflected two years ago, which led to the first hard bifurcations. For the first hard branching, some loyal bitcoin supporters thought that all the hard branches were tearing consensus. But when I shared the line in Xiamen, most of the listeners were programmers, I listed it. When bitcoin was in trouble and asked questions on the spot, I said, in the face of this, you want to maintain the old system by patch, go on, support refactoring, sacrifice some old system users, and most of the choices support refactoring.

It also involves a discussion of the value of a bitcoin, as if you regard it as an asset, or as a currency, as an asset, it does not require frequent transactions to maintain a consensus. As a currency, the escalation of the architecture is taken for granted.

The ether Fang can be regarded as the second generation platform of the block chain, because of the support of the intelligent contract, the application imagination space of the Tai Fang has increased a lot, and its efficiency is obviously higher than that of bitcoin. Trading settlement cycles also showed better performance.

Because of the emergence of intelligent contracts and the support of the open platform of the Tai Fang, in fact anyone can quickly create their own token (currency), that is, the currency now said, or ICO, the ICO on the market, 99% is a token on the platform of the ether square. To be honest, there is no technical content at all.

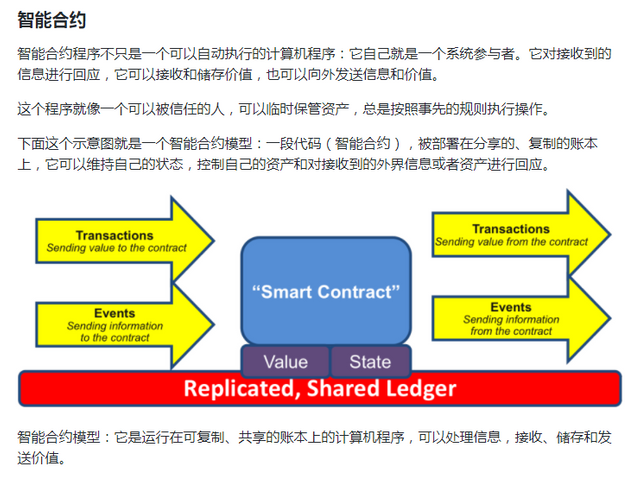

Intelligent contract

The following is to explain the intelligent contract.

Intelligent contracts, that is, the contract that is passed in the block, or the string that is passed, is not a simple string and information, but an executable script, for example, there are triggers and interactive capabilities. (equivalent to a housekeeper in a block chain)

Turing Complete

Plus a word, Turing is complete, what is Turing perfect?

That is to say, without considering the hardware constraints, the support of the script can satisfy all the Turing machine's functional demands, and the Turing machine can be simply understood as a fully functional computer. So to support Turing complete intelligent contracts, if we use the popular metaphor, you can even release a big fortune, tonight to eat chicken game on this platform.

But the reality is impossible, because it is impossible to have such a big block to support, and it is impossible to have such a strong power to support, a little bit more complex code will be able to collapse the entire block chain network, light a simple pet cat led to the ether block. Turing integrity is only an ideal state. The current situation is greatly constrained by the network environment and the computing environment. In fact, the bitcoin itself supports simple script contracts, but a very limited number of scripting support, far less than the support of the ether workshop, will certainly not achieve the level of Turing complete.

Therefore, we say that Ethernet is a virtual currency, and this definition is wrong. The etheric square is a platform that runs thousands of virtual currencies, one of which is its own token. This platform can not only publish money, but also distribute applications, intelligent contracts. This imagination is pretty big.

Back to the smart contract.

Intelligent contract application scenario

The application scene of intelligent contract: one is electronic pet, now there are several; another is the electronic casino, and now there are many on-line. The features of intelligent contracts: first, the code is publicly verifiable; second is running on all blocks, without a central server, guaranteed by a consensus algorithm, without fear of being tampered.

The first successful application of intelligent contract is the electronic cat. Once the publisher is released, the publisher will not be able to change it later. After the success of the case becomes an electronic casino, this thing is really suitable for the casino, first, good credibility, the dealer can not cheat, even to say that there is no dealer, the code can be publicly verifiable, and there is no central server. Second, it is really difficult to be monitored and tracked. Once the entry is irreversible, the amount of money can not be traced. Some chain giants in China have already started to do this, and I will not call the names.

Of course, we hope that there are more successful cases that can be used on the right way, but the framework of the Tai Fang also has some constraints, because too many platforms, or too many cheats, with the aid of the ether Fang, and other applications, the congestion now facing the Tai Fang is also very serious. Now the ether workshop is also split, but specific I don't know much about the technical details.

Hard bifurcations

For a bit of hard bifurcations, I just mentioned the first hard fork of bitcoin. The so-called hard bifurcation is a fork square convention, starting with a block node, enabling a new system architecture to move on, no longer consistent with the main chain, but also inherits all the blocks before the node. After this node, the two sides dug their respective mines, each blasting their own blocks, each to go their own way.

In fact, hard bifurcations do not need to be allowed or passed by the main chain. Anyone can start a hard branch, all can initiate a new branch based on his own understanding and judgment, but for the believers, each branch is a tear in the consensus and is destroying the consensus. Consensus algorithm itself is to prevent failures or malicious bifurcations, and artificially forcibly bifurcated is obviously unable to deal with the algorithm.

So why so many people are hard to fork up later, and where is the meaning of hard branching for other people, this is not a technical problem, and I first sell a key and put it in the temptations.

EOS

Recently, there is something new. ICO is very popular. Many people have asked me for comment, that is, EOS.

As I mentioned above, 99% of ICO is based on Ethernet. In fact, EOS's ICO is also based on Ethernet. But what EOS wants to do is not just lie on the etheric street, but also pay for the leek. Their ambition is very big. According to the white paper, it feels like to be the platform of the third generation block chain (mentioned in front of the bit coin is a generation, the ether workshop is the second generation, this is basically accepted).

The problem is that his white paper is so beautiful that I don't seem to believe it very much.

I can say for sure that EOS was not Li Xiaolai's job, but he did give EOS a lot of platforms.

At present, the EOS platform is not running online, all of which are only the white paper's argument, so whether it can really be realized still needs time to test. But EOS promoters have other projects running online, such as STEEM, please note that it is not STEAM. A community based on the block chain, it is very interesting, it is also a prelude to the temptation, want to try low cost to earn money, you can go to steemit.com registration account post, that, so far.

Zero knowledge proof

Back to burn brain, the next concept is zero knowledge proof.

To put it simply, the transaction records are verified without revealing the details of the transaction. This is also a guarantee of the algorithm. The zero knowledge proof can effectively protect the transaction privacy, hide the source of the transaction and prevent the traceability, but also ensure that the transaction is safe, because any attempt to modify the transaction can not be verified. At present, more and more new block chain platform schemes claim to support zero knowledge proof. But in fact, many of them are still in the plan.

In addition, some of the technical concepts, such as isolation witness, are mentioned in some patches, which are not universal, and are not the core of block chains.

information safety

So the last part of the burn brain is about common sense of information security.

First, the algorithm of force hijacking is not perfect. The hypothesis is that most of the nodes are correct and trustworthy. Therefore, different consensus algorithms have some theoretical risks, if the bad guys have enough nodes. For example, bitcoin, based on POW consensus, can hijack all transactions and change transaction data in theory if a mine or mineral pool has the power of more than 51% of the whole network. DPOS based nodes that need to protect 2/3 are reliable, otherwise there will be forcible bifurcations or interference with the main chain risk. Historically, such risks have occurred, but in the end they have been resolved through consultation.

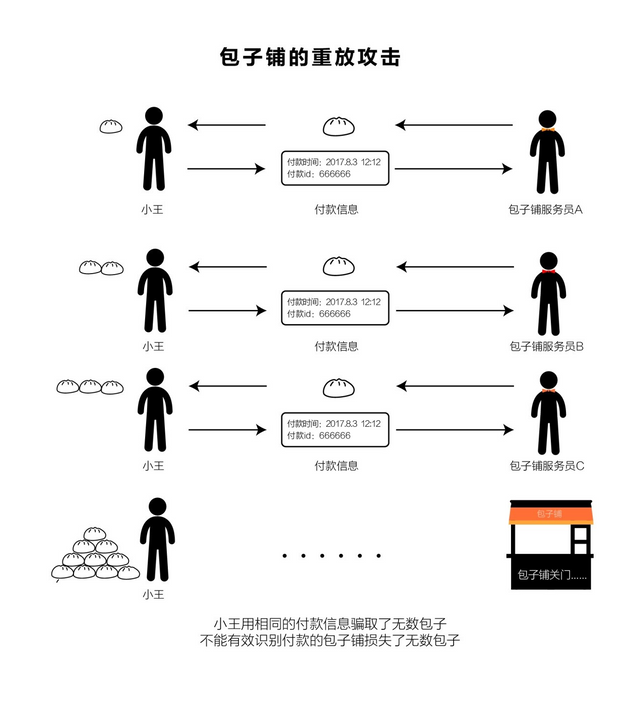

Second, replay the attack, which is the first problem that hard bifurcations need to be carefully solved. If the system is poorly designed, the transaction that is executed on the fork is copied to the main chain, resulting in the loss of the unrecognized transactions of the currency owners. So many exchanges and purse service providers are afraid to support a wide range of forked currencies, and are also worried about the risks. But from the design point of view, this problem can be dealt with. The specific logic is interested in self search.

Third, on the security of the private key, as the new admission block chain players are many, in fact, many people do not understand the meaning and value of the block chain private key, it will be the case that the exchange, or the account number and password of the wallet are the most critical. The man angled, and the private key was sent out.

Now it is very easy to steal a new player's private key by designing a fishing strategy. There are many tools on the Internet that help users to save and transfer their private keys. In fact, some are very risky. So I hope the readers here know that the private key is very, very key, if the private key is taken away by someone, Then people can take everything away from you. There is no need to call the account password.

Some people may not understand what is a private key. After you open a bitcoin purse, a string of strings will be a private key. Some purses will tell you, some purse tools don't tell you, but when you make a backup of your wallet, you will remember a lot of words and sort, these single word sort is to restore the private key, if you can restore the private key. These words are sorted out by me, and I can generate your private key and take everything away from you.

The risk of security is so great that many players don't know it, if you only have a local wallet in your cell phone or computer, without any backup processing, your mobile phone or computer is lost, or the hard disk is damaged, your money will not. If you are carrying an online wallet, Congratulations, you can log back on the Internet, then your account password is peeped, your currency is gone. Your account password is safe, but you can't see where the private key is placed, or you can see the string of backup words. Your currency is gone. You are safe, but your wallet or exchange is stolen, and your money is gone.

But your wallet address can be shown to you. There is nothing wrong with it. Otherwise, how do you deal with and accept the currency?

An open address is very safe to say, and after an open address, all transaction records can be checked. If someone says he is the richest bit of a bitcoin and an open bitcoin address, everyone can verify, even at a certain time, to have enough bitcoins. If the first rich bitcoin is the label, and the address is firmly refused, then at least I do not believe it, and in the technical currency circle all feel flickering, but in the marketing coin circle, may still be mixed up

Fourth, the security of the trading platform and the wallet tools, which has been a lot in history, has recently appeared, some exchanges have stolen, or stolen wallet tools, resulting in the loss of the user's money, and basically all irreparable. There are still several problems, one is the technical security of the platform itself, the two is the security of the platform staff, and the three is whether the platform owner will have some bad intentions and bad thoughts. Among them, two is a particularly difficult problem. You say I do well in system security, but when the benefits are large enough, who can guarantee the safety of employees?

Then someone will say, traditional banks and finance do not have such a problem, but traditional finance and banks, central storage, can be effectively traced data, and through the law to restrict such behavior, that is, you can do bad things, but you can not escape. And block chain, do you mean to centralization and centralization, but don't forget that you also lose the centralization protection. When the zero knowledge proof is popularized, the behavior of stealing money is even more impossible to trace back. The consensus algorithm protects the assets behind the string, but cannot protect the string.

In the previous period, there was a serious hacking accident on the South Korean exchange, which led to a sudden drop in the market value of the bitcoin. I had a similar accident on the Japanese exchange when I was preparing for the lesson. . So the history of the development of bitcoin, the history of the development of the block chain, and at any time, the lessons of security are painful and profound, and what new investors should pay attention to is that, in the long run, the probability of losing money is even higher than the probability that you hold a loss for a long time.

Fifth, the security of the smart contract, there is a venture capital fund based on the block chain, called the DAO, which is constrained by a segment of intelligent contract code. The code is posted online and raised more than hundreds of millions of dollars. It looks like a very good story, but unfortunately, There is a security risk in this code. As a result, hackers easily hijacked more than $55 million through a code vulnerability, and you can't get any more information except a transaction address, and you can't tell the thieves to bring it to justice. The solution is also very helpless, because the code can not be revised again after the release, so they can only be trusted by the people to turn all the funds that have not been stolen and stop in this intelligent contract to invest, there is no other way.

A brief summary of the burning of the brain

In retrospect, I hope you can understand several concepts:

Consensus algorithm is the core technology of block chain.

There are some problems in the current consensus algorithm, which is a major problem that should be faced in the popularization of the block chain application scenarios.

From bitcoin to Ethernet, in fact, the technical scheme of block chain is evolving, but who is the third generation is still controversial.

Intelligent contract is the most imaginative place to expand the application scene of block chain, but limited to the basic architecture and calculation force, intelligent contract is still difficult to make complex applications.

Zero knowledge proof has not been fully applied yet, but this logic is highly recognized.

Consensus algorithm, zero knowledge proof, is a major progress in human mathematics and information science, not simply for block chain service, but also not for the money swindlers.

The hard fork itself has some technical significance, but later it will interpret its business logic.

The importance of information security in the block chain investment is very high, and most of the newly entered users are not aware of it enough. There are many serious accidents in the whole block chain industry.

Temptations

Well, before temptation, let me talk about a concept: public chain, private chain, alliance chain.

Public chain, private chain, alliance chain

The public chain is the bitcoin we know at present, the ether Fang, and the Swiss currency, everyone can participate, each person can trade on it, and if the intelligent contract is supported, everyone can also release its own application.

The private chain is now being considered by many financial institutions, building a block chain system within its own system, not opening to the outside world, but providing an internal consensus network to solve such problems as credit certificates, contract management, and so on. However, there is a lack of consensus in the private sector, and the endorsement of the public authority, which is of limited value compared with traditional centralization. It can only be said that preventing hackers from tampering may be of little significance.

So the alliance chain refers to some organizations and organizations that are willing to share the common faith with each other, and provide a platform for consensus credit and value transmission for their respective organizations. So long as the alliance does not have a single big situation, it can also realize the basis of consensus and may be more valuable, and I think the alliance is in fact. The chain has some market opportunities.

ICO

First, read the logic of ICO.

ICO is a way of raising funds based on block chain. At present, there are two main types of ICO in the market. One is the public equity and the other is the issuance of the token.

Last year, the Chinese government banned ICO, but all of them went abroad to do ICO. They also benefited a lot. But I want to say that this matter is 100% problematic.

Many friends will say, is there a hundred percent problem is not too absolute, will injustice good people, well, there is this possibility, may injustice good people, but I know the fact is, now all the investment circle big guy said, ICO 99% is a problem, but also hinted that his platform is that 1%, how do you see the question Question. If there are 99% problems, I'm sorry, all the swindlers say they are an extra 1%. Therefore, it is wrong to injustice a good person. And in fact, it's hard for you to believe who is a good person.

From the stock market, ICO, though the code is used to guarantee the scale of the issue and the proportion you have, that is, the part you have is not tampered with, will not be maliciously misappropriated, sounds reasonable, isn't it? But the problem is that there is no country's laws and policies that stipulate or constrain the relationship between the equity and the virtual tokens. You say you do not believe in the government and you are going to centralization. So many people do not realize that the centralization also means losing the protection and restriction of the authority. The code issued is algorithm bound, but the relationship with the development of enterprises is constrained by human nature, and the algorithm is not bound to human nature.

Another type of token is the issuance of tokens in an application scene or platform instead of equity, which can be used in this platform and can be controlled and trustworthy by the block chain technology. A more successful case, such as the BNB of the coin.

You see, the Tencent has its own QQ, all kinds of network games also have their own virtual currency. Now, it is not better to protect the users by the block chain.

To be frank, the token itself is meaningful, because now many countries have financial regulatory reasons, and many exchanges have bank constraints when they allow users to buy block chain products. In this case, trading through tokens is a lower transaction cost for the exchange, and the transaction risk is more available. The way to control.

But there is a key logic here. The Tencent makes money not because of the issuance of the QQ, but because there are a large number of products in the payment scene; the net game is not because there are gold coins in it, but the scene of the user's use of gold coins. So the use of virtual currency itself is only a tool in the whole system, a means, not the value of the core of the application, and not the reason why the application is profitable.

But now a lot of platforms, say white, what application scene is not, what business scene is not, first send a few billion dollars, this is fundamentally divorced from the essence of the coin, and the platform's currency itself is for business healthy development; and hype, or the value of currency appreciation as a selling point, in fact itself is Injury to business also exposes the essence of speculators.

ICO ownership itself does not create value itself, it is just a new means of value protection; ICO does not create value itself, it is only a means to complete the appeal of the platform business scene, and now something is on ICO, even air money, all kinds of ICO, to follow the concept, come out of the money. This market reflects the disarray of people, which is very shocking.

In fact, I do not dislike the means such as ICO, and even look forward to a certain time point in the future, there are some regulations and policy guarantees, can be supervised, and can audit the ICO project, so that the guarantee of the block chain is meaningful, at least avoid a lot of annoyance, such as equity correction. But I am very tired of the current situation, in fact, every new technology, new concept, the first use of a group of swindlers, while the public does not understand a sum of money, what nanotechnology materials, what quantum technology, even gravitational waves can be used by cheats to do product publicity.

At present, the cost of ICO is very low, I know there is an article, teach you to use the Yitai Fang 10 minutes to do ICO, the most complex thing is to write white paper, in fact, there is no problem, on Taobao spend hundreds of people to help you write. Then it is to find the so-called big man platform endorsement, big guy is very greedy, endorsement first agreed, take 20% to 30%, some are particularly low discount, and some even do not pay. Then the leeks were picked up. In theory, the income issued by the ICO should be the right money for the team to do the project, but all parties after the issue will take this income as a profit and start to divide the stolen goods.

There are also some investment circles who have a slight face. They do not dare to give the ICO platform, but in private, they are also busy ICO. I don't know. Once an accident happens, I'll leave it at once. When the spoils are uneven, will they run out?

Hard branching can also be used for wool

ICO said another funny thing, hard forked. But from the perspective of temptation, let's talk about the logic of money.

As mentioned before, the first hard fork is actually a reason for a dispute over technical upgrading, and of course this is not acceptable to all, but from my point of view, I can understand. But then someone found out, ouch, this thing can make money.

mining

Let's talk about mining industry. Maybe some people are familiar with it. Some people are not very familiar with it.

First, logically speaking, if you can legally put a banknote printer at home, the money you print can be used for flowers. Can you open it?

I guess all people are willing, so the problem comes. Bitcoin mining can be analogous to a banknote printing machine. You can use your own computing power, whether it's a computer, a video card, a mobile phone, or a professional miner, to run a bit currency terminal program. If you are lucky, you can prove the power, get the reward, and now a reward. The second award is not much, 12.5 bits, the market price of 50-60 million, if you believe that you can win a prize, you can run a terminal on the mobile phone can also be dug out.

So all the people go to the printing press, but the printing machine is very strange, the total amount is limited, that is to say, the prize is limited, the more people involved, the lower the probability of winning the prize.

So in the end, what is the balance, what balance is the balance, the cost of digging a coin is almost equal to the price of a coin, and the player is out of balance, and the new player will enter.

This is a typical logical problem, many people entangled, always said that the traditional currency also has energy consumption, I do not know how the energy consumption is coming, the cost here, in addition to the cost of the machine, is mainly electricity.

Then, we continue to follow this logic. If you want to gain competitive advantage in balance, you must have some cost advantages. For instance:

Your electricity does not need money, such as Trojan horse digging, embedded code mining, or mining with electricity bills paid by the public.

I know a case, a giant before a lot of procurement server, the server before the shelf to do the first test, after the test confirmation is arranged formally, because the giant process is relatively long, the test time is still a few. And the server configuration is very high. As a result, the engineers of operation and maintenance were running a mining script every time the server was tested. When it was officially launched, the company did not know. Then one day, the operation and maintenance with thousands of bitcoins resigned. Of course, the case may have exaggerated elements, after all, it is not a single hand, but the Trojan horse mining, embedded script mining are also clearly confirmed cases.

After all, free electricity is not of scale and sustainability, so if you want to be big, your electricity is cheaper than others. For example, it is now popular in Quebec mining, where the electricity bill is 2.48 cents, and the weather is cold, and natural ventilation can greatly save the cooling cost of the machine room. In addition, Iceland is also a place where the concentration of coal mines is located. The main domestic ones are some remote hydropower plants, which are all wrapped up by the whole mining field. So the price is all the best.

What does your average power cost lower than others? What does it mean by doing the same calculation? You're less electricity than others, and that's why there's a professional mine.

PS: what if a supercalculation is used? Will all the mines be dug up? In fact, it will not. The efficiency of the supercalculation is not so high.

Then it was found that GPU was more efficient than CPU, but later, it was suggested that using a dedicated ASIC chip to prove the power to maximize efficiency, the Chinese companies first came out, from the roast cat to the Avalon to the ant mine, now the bitcoin is the largest manufacturer in the world.

The only mining chips are more efficient than the common chips, so these specialized miners, in order to spell out the power output of the unit, do not do anything except mine.

What is the world's largest concept, at the end of last year, the order quantity of TSI is second, the first one is the apple we know well, and the third is who, the HUAWEI, that is, the bit continent has more than the HUAWEI in TSI.

More than one order of magnitude, should be two orders of magnitude, but from the chip order, it is already quite horrifying, and the 9 generation of ants is 16 nanotechnology, then the next generation plan is 10 nanometers, which can be said to be very forward.

This chip of the bitcoin machine, because it is specially designed to prove the power of the mining, so the efficiency of energy consumption is very terrible, so all other similar mining methods are useless. But we say second generation block chain products, the ether Fang, in fact in order to centralization, in calculating the calculation of the algorithm to contain the advantages of ASIC chip, so now the ether mill is still based on the GPU, because the price of the ether Fang soared, the current GPU price has also increased with the Jingdong, and from the Jingdong can see, not Often out of stock, some manufacturers do GPU, such as nivida did not think before, the last to make them rich is not the needs of image processing, but the demand for virtual money mining.

So the design and production of the mining machine has become a hot business, in disclosing a data, in fact, the industry is not a secret, in November last year, ant mining machine, futures prices, 1.1 in case of a single, no deposit, not a deposit, about January this year, the result of January, the mining market is too hot, How much is the spot price on the market when the ant miner is out of stock? 30 thousand out of the first one, some people ordered a batch of mining machines in November, thousands of units, also two months time, get spot, mine do not dig, directly sell spot, a earn twenty thousand, we calculate, thousands of this profit is how much money. Even more outgoing, last year bought a mining machine mining, dug a year early back, also do not want to do, the second-hand mine machine out to sell, even more expensive than last year.

But bitcoin prices have fallen sharply and the market has reversed recently. Now the official 17 thousand quotation of S9 is already on sale. The market is crazy to say.

Some people say that when I sell a batch of mine machines and other markets, they can't sell when they are mad. But you know that technology is progressive, iterative, although the market may be crazy, but it is not sure that the new miner's power is ten times more than one or two years. It doesn't make sense to stay. So this time difference may also only look at luck, not suitable for long-term.

Outside the mine is the mine, which is to buy a lot of machines, put them in a cheaper place, and run to calculate the power. Because bitcoin prices have skyrocketed, there has been a lot of people investing in the mines recently, and the market will eventually improve until the new equilibrium.

Then there is a business called ore pool, which is a platform for the unified access of mines, the allocation of calculation power and the collective distribution of harvesting.

Let me explain the logic here. If every mine is digging itself, then some luck is good and some luck is different. As mentioned in front of it, it is now a block out, that is, 12.5 bits of money. If you have a bad luck, you invest a hundred miners in the world. You can't explode in half a year, you can't burst in half a year. Is it not sweet to eat, not to sleep. The meaning of the mineral pool is that you all share the same harvest, you are all connected to my platform, all the exploded awards, I assigned you according to the power of your contribution, even if you have only one machine, I give you a little reward every day. The larger the pool is, the more rewarding rewards are based on probability. Of course, ore pool is not a matter of doing nothing. It will receive a reward of about a thousand points as its own income.

But if the mine is a little black heart, maybe it will steal some power, just as many stationmaster alliances will steal the amount, but the investors of the mine are not stupid, they will compare the income of different mineral pools, so this phenomenon will not be particularly obvious.

Well, here is a new industry to share the mine. That is to say I open a mine, my own mine, and then I sell the calculation force to investors, you do not have to buy a mine machine, not to talk about the price of electricity, I give you all the price, of course, the price is more expensive than buying a mine machine alone, to buy electricity, but who let you have no such resources or bargaining power, this is also very popular now. But the truth is that the rate of return is certainly not as high as that of building mines.

At present, because the domestic government has begun to clean up the mine, the mining field is also a trend, the main destinations of Chinese overseas mines, Iceland, Malaysia, and Quebec, Canada.

This is another derivative business. I will do a good job in the computer room and talk about the electricity price. The local government will do well in the relationship. I will ask the mine to check in and share the management fee.

In short, the mining industry actually has a whole industrial chain, from chip design, to government relations, to power plant negotiations, to the maintenance of ore pools, and so on. Moreover, bitcoin mining and Ethernet mining, or Wright coin mining, or different equipment service providers, of course, the cost of electricity is the same.

So let's look at the development of an industry. We should not just look at the core items that have risen or fallen. At present, the largest mining company in the world, the largest ore pool and the largest mine, are basically in the hands of the Chinese. The largest exchange seems to be Korean, but at least three of the top five are Chinese. (but many are registered outside the country for policy reasons). And every business here is an annual profit of several hundred million.

So how big is this plate digging? How do we evaluate it? This is another logic.

What is the annual output of bitcoin, a block per 10 minutes, 12.5 bits per block for each block, 650 thousand bits of output in one year, the new edition of the Ethernet version reduced the reward, and at present almost every 12 seconds a block is excavated, each of almost 3.3 ether coins, so almost about 8000000 of the ether each year. The output of the currency was about 11 million in the past. Then we calculate the market price of these outputs, which is the method of calculating the revenue of the mining industry. There are, of course, other bits, such as bit cash, and all kinds of fork money. Let's calculate the mainstream ones first.

The value of 650 thousand bitcoins is 6 billion 500 million dollars in 10 thousand dollars; in the case of 8000 dollars, 5 billion 200 million dollars. 8 million the ether workshop, according to 1000 dollars, 8 billion dollars, $800, 6 billion 400 million dollars, so we can figure out, mining the annual output, according to the latest price, more than 10 billion dollars more than a lot, and here has not included a lot of other coins

So what do you want to say? This is also a market of tens of billions of dollars in annual output. As we have just said, exchanges are also a market of tens of billions of dollars in annual output.

So how did the money be allocated? Miners, electricity, mines or miners, ore pools. There is only one point in the ore pool. If you don't steal the calculation, there will be 500 million dollars a year. How are the three parts of the mine, electricity and mines allocated?

Or the logic of regression, if the value of the currency is stable, then the competition will enter a relatively stable state, at this time, the cost of electricity is higher, more than half is not unusual. In the history of bitcoin crossing the same way, I hope you understand this logic, then what happened last year? The value of money has risen rapidly, that is, the upgrading of the whole network has not kept pace with the raising of the currency value, which has brought about a very high rate of return in this time period. At this time, the miners who have the power of calculation are the most profitable, because the miners sell the futures, but they don't eat the most, but after all, the orders have surged, the miners earn a lot, and the middlemen who resell the miners make a lot of money. But when the whole network calculates the balance between power and currency, the profit will drop and the electricity tariff will rise. In order to make money when calculating the power balance, a mining machine must rely on technical iteration to increase the power consumption ratio and force the old machine to be eliminated.

These logic are how you know some business logic and business investment behavior, and you may think that I don't approve of it, don't go to a mine that is a bad thing, but I hope you can understand such a thing.

So who is making money, how to make money, make a lot of money, this is based on some public data, many can be estimated, I recently chatted with people around, many people have no concept of the size of the market, they are very shocked to take out the data, but these data are not my only secret book, online can be If it lacks a basic logic, it will not establish such an information connection.

Further, it is the business opportunities that may exist in smart contracts. A typical case is the previous etheric cat. Another typical case is the casino which runs on Intelligent contracts in the ether shop.

Then the imagination of intelligent contracts is very huge, but limited to the current block chain architecture and the constraints of computing power, it can only be used in some simple programming scenarios. At present, it is unable to satisfy more complex computation and large scale business data processing. But even so, there is still plenty of room for imagination.

Imagine, 1, an open and transparent strategy that anyone can check the logic reliability of its code; 2, in real time combined with the block payment, typically like the ether workshop. 3, de centralization and sustained vitality. After the code is released, even if the publisher fails and dissolves, its product will still run on the chain.

You don't have to worry about the issuer's running. You don't have to worry about the issuer's fraud. It involves clearing all the direct block chain currency transactions, without worrying about the existence of a transaction fraud or non payment.

But if you have to let me find out some of the best applications other than electronic pets and casinos, I can't tell the truth. If I want to come out, do some investment, and tell me what the Internet is doing.

But today, if we understand the meaning and value of intelligent contracts, we can think about it more. At present, there are some entrepreneurial projects based on Intelligent contracts in the market to do ICO, I feel a lot of too much reluctance, in order to catch hot and hard to move, but may still have some value.

Another business mode is wallet or other tools, such as key backup and recovery tools. The normal business logic is to make an exchange advertising and earn a commission, but this is an extra caution. First, it is possible to be a fishing tool, even if it is not a fishing tool, it may also cause loss by internal staff greed or external invasion. Second, even if the product itself is good, there are risks of being eavesdropper, or the risk of being hijacked and redirected. So you have to have a sense of security everywhere.

So to sum up, the business ecology of the block chain, ICO is a very big piece, and is also the most popular piece of momentum, but I personally think that the current problem is very big, too challenging human nature, I am very refusing the present ICO behavior. In addition to hard branching, although we first said the hard branch had its technical argument, it was later flavour, with the name of the hard branch, where the asymmetric information was too large, and many people did not know how low the distribution of the forked currency was, and did not know once the big exchange or purse system sent sugar. The price will fall in an avalanche.

The exchange is a fast growing market plate, and there should be a lot of room for development in the long run. The latest news is that Robinhood, a well-known US securities trading platform, has begun to provide block chain trading and no commission. The traditional securities trading platform is also rapidly turning to the market, so the future pattern may still be very messy, everything is possible, in addition, the security risk has always existed, and there must be a large number of safe eventsMine, mine, mineral pool and derived format are also super large, and even have great impact on the chip related fields. I see news, domestic chip sealing industry benefit from the mining machine business is also a lot of profit. But it must be said that, as the consensus algorithm is further advancing, the future mining is the basis of the mainstream consensus algorithm, and in my sense, it should be possible to be replaced. But the miner has also begun to lay out the AI chip. Interestingly, many giants called all in AI last year, and this year's all in block chain. As you can see, bit mainland has already been very advanced in these two fields.

Woolen or what can earn a little money, but not too obsessed, time cost is also very high.

Finally, some technical resources are introduced to everyone.

Block chain technology guide this block chain technology guide e-book is very good, not only the technical description and explanation is very detailed, but also have the code demonstration and case description, for the intentional engaged in the block chain development of child shoes, a strong suggestion.

The mastery of bitcoin.Pdf provides a downloading address and can actually search for "mastery of bitcoin.Pdf". This document is a document that I saw for a night, or a lot of problems, and a certain understanding of the block generation mechanism and efficiency constraints.

Tsinghua University iCenter "block chain technology development open course" public welfare course, should be free of charge, now has been open for third periods, the courses have been opened should be online learning, but if the conditions of the proposed registration line courses, this is also a strongly recommended technical development course.

In addition, if there is a concept of basic common sense, it is worth looking at the white paper on the nature of the platform, such as the ether Fang, EOS, and the Swiss currency, and some new concepts and evolutionary routes. However, there are too many white papers on the market. Most of them use technical terms to fudge leeks. According to the scale of transaction, choose several mainstream ones.

In the end, I would like to emphasize a view that if you think this lesson is very rewarding and learned a lot, then I'm sorry, but I might have hurt you all. I emphasize a point, more than not to understand the worse is, think to understand, two hours, listen to some introductions, understand the block chain, I am sorry, this is impossible.

I hope you have a clear understanding. If you do have an interest in this area, you do have an idea about some of the views, some detail data, a niche market, and suggest that you search for more information, search for more data, search for more market or technical information to improve recognition. Knowledge, promotion of understanding. We should avoid using simple descriptions and concepts as knowledge and take some superficial cognition as a conclusion.

In my opinion, my judgment may be wrong, but I hope you have the ability and action to prove yourself, identify yourself and explore yourself. Most people in the world like to recognize the world with tagged, simple conclusions, and you can surpass them as long as you work a little harder than those.

Another thing to remember is that in the case of interest relations, any bigwigs can not believe everything, including me, though I am not a big guy.

Finally, if you feel that the course is enlightening and helpful to you, you are also welcome to share your lessons with your friends, your relatives and friends, and wish you a happy Spring Festival.

A digression

I hope to see the technology and products of the block chain in front of us in 2018, but at the moment, I honestly don't know.

In 1996, I first came into contact with the Internet and got addicted to my first contact. I am convinced that this play will change the world. But now, there is no such feeling at all.

There is no curriculum behind, ha ha, I do not cut leek, I did not say, I recommend what money you want to buy.

Block chain and cloud computing, in fact, do not have much to do with.

Many people think that the block chain is the same opportunity as the Internet, including Xu Xiaoping, including some scholars, and I can only say that I can't see it at the moment, of course, and maybe I'm out of the woods.

The core technology of block chain is the consensus algorithm.

Someone has asked how to evaluate the technology of block chain projects. Let me briefly explain.

There is hardly any technology in making money in the ether shop. Taobao can find someone to write a white paper.

Based on the code of the mature public chain, copy the Shanzhai public chain, now some big men are doing, a little change the parameters, adjust it, it is good or bad to see the source code, a bit of technology, but the threshold is not high.

A new consensus algorithm, or a significant improvement in the efficiency of the existing consensus algorithm, and a solution, is quite forced to know that some of the consensus algorithms have been awarded the Turing Award. In addition, efficient support for intelligent contracts is not simple. V is quite a cow, but Shanzhai is not so complicated. Because there is a problem with the existing consensus algorithm.

Calculation force proved to be the most reliable consensus algorithm, but the force is serious, others have not been widely recognized. Do you say dpos is good, POS is good, but is it really widely accepted? Whether there is a risk of forcible forking and whether there is a risk of a common tear, which needs further proof.

If I say absolutely, or too much. I used to be a technical source, and I was a cock silk technology source. I used to use very broken servers to complete a very high load scenario. So for a person like me, it is natural to see bitcoin architecture. This efficiency is just a joke with this expense, so maybe that's my limitation. So now the development of block chaining technology is initially a group of people who dare to think and dare not to be bound by traditional technological thinking.

I think multi center, the alliance chain may be a direction