Staking Crypto for Beginners

Earn Crypto While You Sleep

Photo by David Clode on Unsplash

Staking cryptocurrencies is one of the best and simplest passive income methods out there. Staking crypto means you get free cryptocurrency as a reward for already owning cryptocurrency. You can make extra money while you sleep, while you work your other job, while you’re on holiday, while you’re on a deep sea diving mission surrounded by sharks – whatever you do, you can earn effortlessly while you do it.

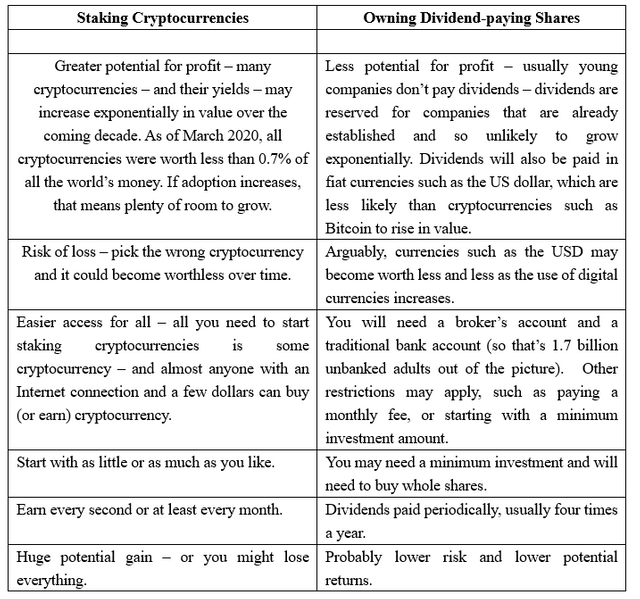

While staking cryptocurrencies is often compared to mining of bitcoin and other early cryptocurrencies, it is in many ways more similar to dividend-paying shares.

If you own a stock in a company which pays dividends, you get the dividend whatever happens, and the potential profit from the value of the stock going up (and of course the risk of it going down).

If you own cryptocurrency which pays staking dividends, you get the staking dividend no matter what, and the potential profit and risk from the value of the cryptocurrency and the dividend going up and down.

Lower barrier to entry

One of the best things about investing in, and staking, cryptocurrencies is that everyone can do it. To invest in , and earn dividends from shares, you’ll need an account with a broker ( the broker may require a number of things you may or may not have, such as passport, social security number, proof of address, bank account, etc.). Even once you have an account, you’ll need to buy a whole share. At the time of writing, one share in Google is priced at 1,539 dollars. So you need that amount just to become a Google investor. Also at the time of writing, 1 bitcoin costs 9,628 dollars. But you can become a Bitcoin investor with only one dollar (that dollar will buy you 0.0001 bitcoin).

Google doesn’t pay dividends, and you can’t stake Bitcoin, but the principle applies to all cryptocurrencies, including ones that can be staked; you can get started with any amount.

Not only can you start staking crypto with a dollar, but you don’t need a bank account, a passport, or anything other than an Internet connection.

Compound magic

“Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.”

The quote above is often attributed to Albert Einstein. Whether or not he actually said it is less important than you understanding compound interest so you can start earning it and stop paying it.

Compound interest is when the interest you earn on an investment starts earning its own interest. This means that a small investment can, over time, magnify hugely in value.

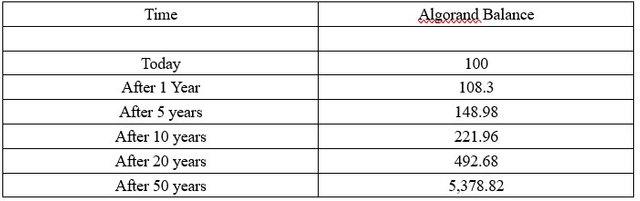

Let’s say you invested 100 US dollars in a cryptocurrency called Algorand today, and earnt an annual staking yield of 8%. The following table shows how much you would have in Algorand after different time intervals (assuming interest is calculated monthly).

The mathematical miracle of compound interest shows the importance of investing in coins with both a good chance of future success and high staking yields. There is no point in owning 5,378 coins if each of those coins are worthless, but if the coins themselves increase in value over time, and you earn compound interest on the coins so the number of coins you hold keeps increasing, your investment will pay off in two ways.

No one knows where blockchain will be in 50 years; compound interest applies to any kind of investing, if you invest in different areas for the long term, compound interest is a powerful tool to earn much more than you may have thought possible.

Compound coins

To make sure you earn compound interest when you stake, ensure that your staking yields are earning interest. Whether or not this requires any action on your part depends on the coin you are staking, as the following two examples show:

Staking Algorand

Algorand is a cryptocurrency that, when staked, pays out staking yields in Algorand. As your staking rewards are already added to your wallet in Algorand, you don’t need to do anything to start earning compound interest.

Staking NEO

NEO is a simple coin to stake but pays staking rewards in a separate cryptocurrency called GAS. To earn compound interest on your NEO investment, you will need to periodically exchange the GAS you have earned to NEO. Once you have exchanged the GAS you have earned to NEO, that NEO will start earning more GAS for you.

Getting started

So, which cryptocurrencies can you stake, and how should you do it? This guide will get you started on the simplest methods for staking cryptocurrencies.

Before you start

You will need to have some kind of cryptocurrency such as Bitcoin or Ethereum. You don’t need much, but you need some. Skip this section if you already have some crypto ready to use for staking.

Read the section at the bottom of the post on the risks of staking, remember that all investing carries risk, do your own research, and only invest what you can afford to lose.

Buying crypto

Standard exchanges

Common exchanges used for exchanging fiat currency (US dolllars, British pounds, Belarusian rubles) to cryptocurrency (Bitcoin, Ethereum, PutinCoin) include:

Coinbase: Sign up, link your bank account, select your cryptocurrency and buy

Gemini: Sign up, link your bank account, select your cryptocurrency and buy

Binance: Sign up with your email address, link your bank card, and buy

Peer-to-peer exchanges

Some restrictions apply for standard cryptocurrency exchanges. They are not operational in all countries, and some credit and debit cards will not send funds to such exchanges.

Peer-to-peer exchanges are a useful way to get around such problems. You send another user fiat currency, the other user sends you cryptocurrency in return.

The advantage of this is you can use online/mobile wallets such as Revolut, MPesa, or Alipay, bank transfers, or even cash deposits. This opens up cryptocurrency purchase to almost everyone in every country, even those without bank accounts. Popular P2P platforms are:

Local Bitcoins: You can buy or sell bitcoin on this site.

Local Cryptos: You can currently buy or sell Bitcoin, Ethereum, and Litecoin on Local Cryptos.

Staking with Binance

Staking cryptocurrencies on the Binance exchange is one of the easiest ways to immediately start staking a wide range of cryptocurrencies.

The advantage of using an exchange like Binance to stake cryptocurrency is that you can get started quickly and easily. Long-term, and for large investments, moving your investment off an exchange will keep it more secure. It’s safer to keep your cryptocurrency in your own wallet, which we’ll go into later.

Binance currently offers more accessible staking than its competitors. Coinbase, for example, only offers staking to US customers at present.

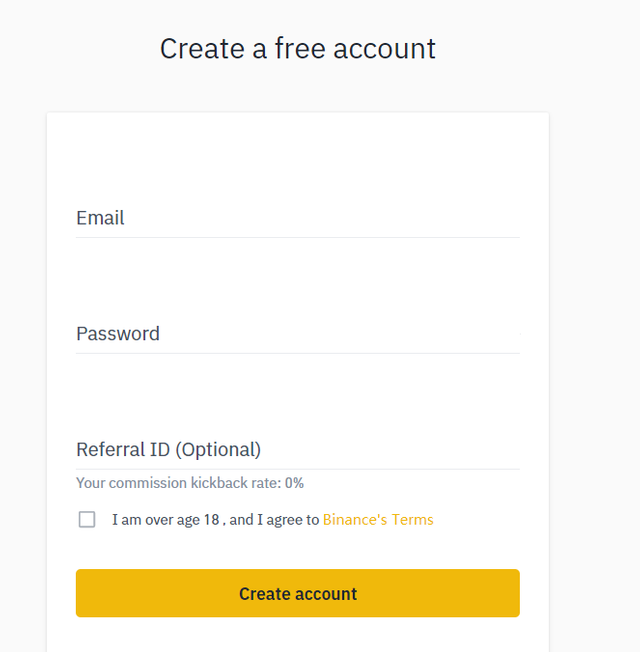

Setting up a Binance account

To sign up for Binance:

- Go to www.binance.com

- Click Register in the top-right hand corner of the screen

- Enter your email and create a password on this screen.

- (Optional) Enter this referral ID to save 10% of commission fees each time you make a trade on Binance: VSG463Z2 . Once you’ve entered the referral ID, your commission kickback rate should display as 10%.

- Click Create account.

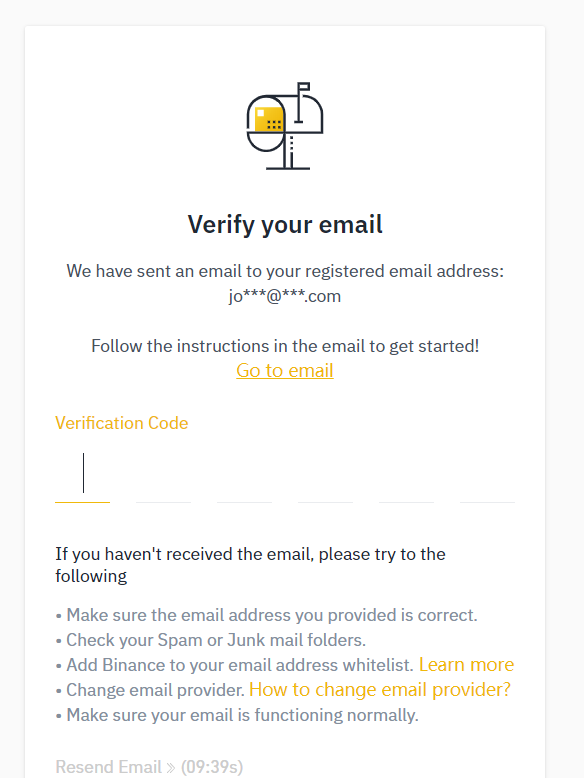

- Check your email and enter the verification code sent to your email on the screen below:

- Get cryptocurrency into your new Binance account. (This example will use bitcoin (BTC), but you can also use Ethereum (ETH), Binance Coin (BNB), Binance USD (BUSD), or Tether (USDT). To get bitcoin into Binance you can either:

Buy bitcoin directly: Go to Buy Crypto in the top left hand corner of the homepage. Under the I want to spend heading under the Buy tab, select your chosen fiat currency and how much of it you have available. Add a debit or credit card and buy your crypto. You will need to fill out some KYC information, such as ID information, before you can use your card. (Binance accepts VISA cards, but for some currencies such as Chinese Yuan, the only option may be peer-to-peer exchange.)

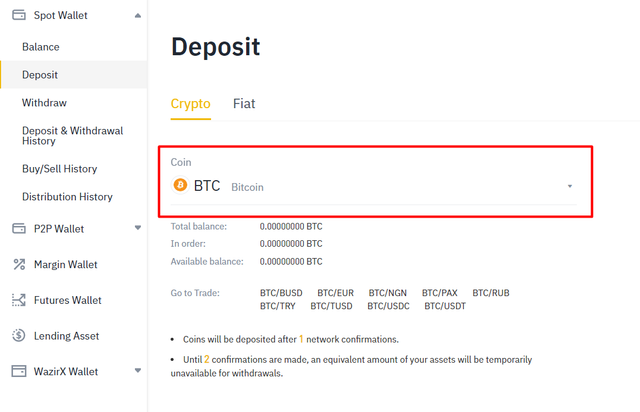

Send bitcoin to Binance: Top up your Binance bitcoin balance with bitcoin you have bought elsewhere. To do this, go to Wallet > Spot Wallet > Deposit. Check that the correct type of cryptocurrency is selected in the drop-down menu under Coin, as shown in the screenshot below.

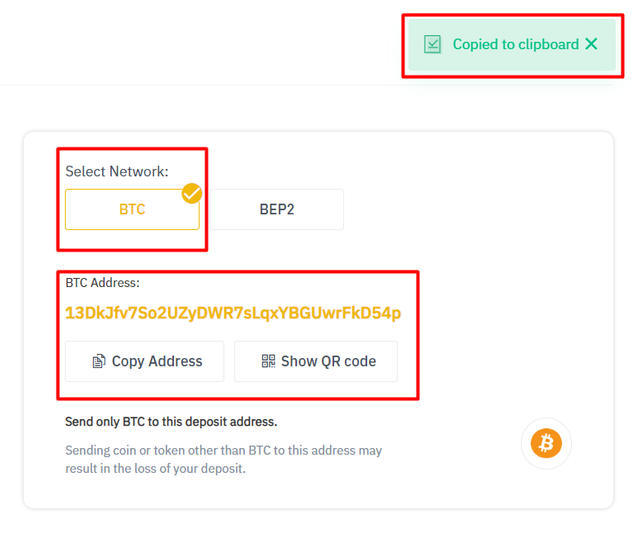

Under Select Network, ensure BTC is selected (BEP2 is a token issued on the Binance chain, If you’re not familiar with it, it won’t matter for your purposes here), then click Copy Address, and look for the green Copied to clipboard notification to display.

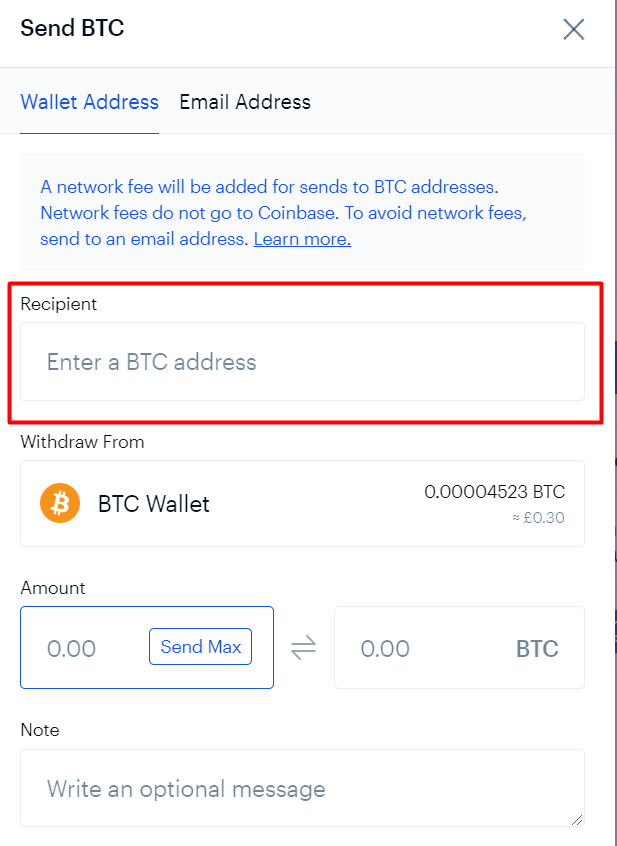

You can then send bitcoin from any other exchange or wallet to this address. From Coinbase, for example, (screenshot below) sign in then go to Portfolio > Bitcoin > Send. You can then paste the long string of letters and numbers you just copied from Binance into the Recipient box, input the amount of bitcoin you want to send, and press Continue.

*Note: Always double check to ensure you are sending to the right address, and make sure you only send bitcoin (BTC) to a bitcoin (BTC) address. If you tried to send bitcoin cash (BCH) to a bitcoin (BTC) address, the transaction would fail and you would probably lose the money you tried to send. *

Your bitcoin will then show under Total balance and Available balance once all the network confirmations have been approved. For bitcoin, this will sometimes take an hour or even longer, so don’t panic, go and do something else and then come back to check later. Once your bitcoin shows up in your available balance, congratulations, you can now exchange your bitcoin for other cryptocurrencies and earn staking rewards.

Buying coins

Now you’re almost there. You have a Binance account, and you have some cryptocurrency you’re ready to exchange for stakable cryptos. All you need to do is exchange your coins and start earning.

Exchange your coins

The main decision when exchanging your coins will be which staking coins are best. This section will take Algorand as an example, and show you how to exchange bitcoin for Algorand. The next section, Which coins should I stake? , will take a look at how to select which coins to invest in. This section will focus on how to make the exchange and start earning.

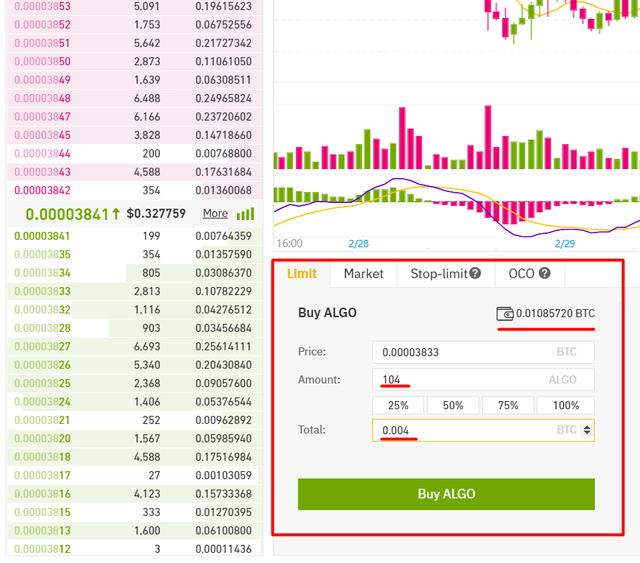

Buying and staking Algorand

- Go to Finance > Staking on the Binance website.

- Scroll down and select View More.

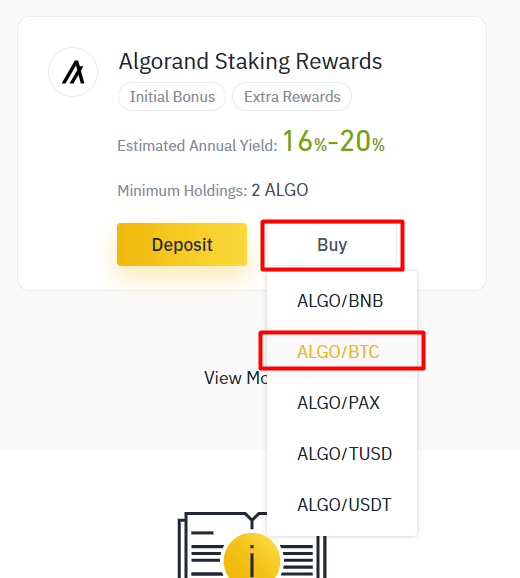

- Look for the heading Algorand Staking Rewards. Under the heading, select Buy > ALGO/BTC.

- The next screen is the trading screen which looks overwhelming at first, but just scroll down to the Buy Algo section. Under Total, input how much bitcoin you want to spend on Algorand. The amount of Algorand you’ll get for that amount of bitcoin will then show under Amount. (The number by the wallet icon shows how much bitcoin you have available to spend.)

- Confirm and click Buy ALGO.

- Go to Wallet > Spot Wallet to see your ALGO. It may take a while for the transaction to go through.

- Congratulations! As soon as you have ALGO in your wallet you can start earning staking rewards; Binance will keep track of your balance daily and send you your staking rewards each month. Kick back and relax, you are now earning passive crypto income.

- Want to earn more? Add more to your ALGO balance, or select another coin on the staking process and repeat steps 1 to 4 above (for that coin) to add the coin to your wallet and start earning. You can apply the same steps to all the coins that Binance offers staking for.

Which coins should I stake?

There are currently 20 coins available on the Binance staking page. How to choose which ones to stake is up to you. Some factors you might want to look at, and some tips and thoughts, are listed below.

Annual yield

The estimated annual yield for each coin is shown on the Binance staking page. The Algorand currency has one of the highest estimated annual yields at 8-10%.

While yield is important, it’s not the only factor, as there’s little point in high earning staking rewards in a coin if the value of the coin itself is falling drastically.

Minimum amount

The minimum amount you need to deposit to earn staking rewards is also listed on the Binance Staking page. This amount is usually tiny (for Algorand, it is just 2 coins), but it’s worth being aware of it before staking.

The coin itself

What may matter more than annual yield (especially in the long-term) is the coin itself and the blockchain project attached to it. If the value of your coin increases over time, the value of the staking rewards you earn will also increase over time. If your coin becomes worthless, so will your investment.

You can research a coin by reading its whitepaper, visiting its official website, researching the team behind the project, and looking at fundamentals such as market cap (the larger the market cap the less risk there is of failure, but the less room there is for explosive growth).

Beyond Binance

“Not your keys, not your crypto” is a commonly repeated saying reminding cryptocurrency owners that cryptocurrency held on exchanges is held by the exchange and by the users.

The good news is you can still stake your cryptocurrency from your own wallet and control your own crypto keys. The next section shows how you can do this for a couple of cryptocurrencies.

Staking with Trust Wallet

Trust Wallet gives users the access to their private keys and currently claims to support staking of the following currencies:

VeChain (VET)

TRON (TRX)

Tezos (XTZ)

Cosmos (ATOM)

VeChain (VET)

Callisto (CLO)

Kava (KAVA)

TomoChain (TOMO)

IoTeX (IOTX)

Algorand (ALGO)

My experience staking these cryptocurrencies on Trust Wallet has been mixed. Sometimes they start earning immediately, sometimes it is less easy. I have written my experiences below, as the technology continues to update, it may be different for different users.

Staking VeChain (VET)

Staking VeChain on Trust Wallet is as simple as transferring VeChain to your Trust Wallet account (you can buy VeChain on Binance and send it to your Trust Wallet VeChain address). Once you have VeChain (VET) in your wallet, you will automatically start earning staking rewards in the form of VeThor (VTHO).

Unlike when you stake VET on Binance, and receive your rewards monthly, you will see your staking rewards increase every few seconds when you stake VeChain on Trust Wallet.

VET is the easiest coin to stake on Trust Wallet, as you can see your staking rewards start to accumulate almost immediately.

Algorand (ALGO)

Just as easy to stake as VeChain (VET). Add your funds to your wallet, and after a few days you should see your balance slowly increase.

Staking Callisto (CLO)

To stake Callisto (CLO), select DApps at the bottom of the Trust Wallet app. Scroll down and select Staking > See All > Cold Staking. Select Browser Wallet and it should connect to your Trust Wallet. You can now click Start Staking and select the amount you want to stake. You will receive a warning message that your funds will be locked for 27 days.

Staking Tron (TRX)

To stake TRX from Trust Wallet, you can go to your balance, and then select More > Stake. You then need to select how much you want to stake and select a validator and then click Next and confirm the transaction. Each time I have tried to confirm the transaction, though, I have received a “Not supported” transaction error.

Kava (KAVA) and Cosmos (ATOM)

Kava (KAVA) and Cosmos (ATOM) can both be staked on Trust Wallet by going to the page that displays your balance, clicking More > Stake, selecting your Validator, clicking Next, and confirming the transaction. You should hen be able to see a Rewards heading on your balance page that shows you much you have earned.

Staking Tezos (XTZ)

My XTZ are staked on Trust Wallet, but after several months I have still received no rewards, though I have earned monthly rewards for the XTZ I have deposited on Binance.

Staking TomoChain (TOMO)

Staking on the Tomo network requires a balance of at least 50 TOMO, and is more complex than simply depositing your TOMO and earning. If you want to find out more, you can do so at:

https://medium.com/tomochain/staking-with-tomo-the-first-basic-notes-for-newbies-ce7ff19f9fb4

Staking IoTex (IOTX)

Staking IoTex now appears to only be available through the official IOTX wallet and not through Trust Wallet.

Adding a NEO wallet

NEO is one of the easiest coins to stake, but is not yet supported by Trust Wallet. Holders of NEO are automatically rewarded in GAS. GAS is described as the fuel for the NEO economy; when making transactions on the NEO blockchain, you can pay for transactions in GAS. You can earn GAS when you hold NEO on Binance, but that way you don’t have control of your private keys. To keep control of your private keys and earn GAS, download one of the wallets at this link:

With the NEON wallet, you can start earning GAS almost immediately; you can claim GAS rewards every five minutes. Just like when you hold your NEO on the Binance exchange, you don’t need to do anything but hold NEO in order to earn GAS. Just click claim every time you visit the wallet.

Remember your private keys are the only way to access your wallet and ensure they are backed up securely.

Risks of staking

Staking some coins is complex and comes with risks and drawbacks including tokens being locked, and even funds being taken through validator commission and slashing of rewards.

There is also the risk of your coin losing value. If your crypto is locked because it is staked, you may be powerless to sell the coin during volatile periods.

Staking your coins on an exchange like Binance is easy, but if something happens to the exchange, you can lose your crypto.

To mitigate the risks, you can start by staking small amounts of easy-to-stake cryptocurrency. While familiarizing yourself with staking on your own wallet, start out with simple options like VeChain on Trust Wallet, and wait until you gain experience before exploring riskier and more complex options.

When sending funds to any wallet, do your own research to make sure the wallet is secure, and make sure you copy and paste the wallet address correctly. Try sending a small “test amount” to a new wallet before sending larger amounts.

All investing carries risk, and investing in, and staking cryptocurrencies is no different. Cryptocurrencies are considered a high risk investment, but not investing at all also carries the risk of missing out on what could be nothing less than a financial revolution. If you choose to invest, do your own research, start out with small amounts, and only invest what you can afford to lose.

Reference: