The Rising Popularity of Debt Financing for Startups

Debt financing has been a popular way of financing for late-stage startups in recently years. Just give Crunchbase a browse and you will notice an increasing # of debt financing for Series C and onward financing rounds. The traditional financing model for any startup since the beginning is built on raising equity instead of debt, debt raised in the later rounds of financing. It should be clear that I am not referring to convertible debt in this situation as these are usually raised in the pre-seed round from friends and families and are usually substantially < $250k. For generations, almost every religion has inveighed against debt, with some seeking outright bans and others strongly urging followers to "neither a borrower nor a lender be", and perhaps with good reason. On a personal level, having spent 10+ years in Asia before, the general population's mentality is to buy and sell everything and even operate companies with cash instead of taking on credit/debt. There are definitely good reasons for this mentality but I think it's worth examining the light and dark side of debt financing.

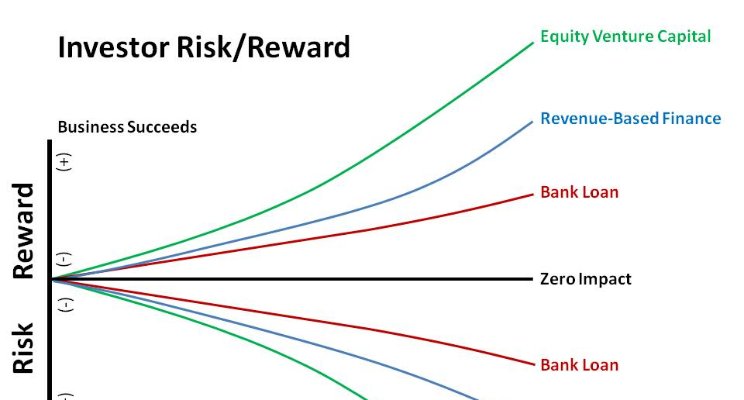

Access to capital is the paramount concern of emerging growth companies. First and foremost, a startup must secure the proper amount of capital; too little and it may fail to thrive, too much and it may become bloated and unable to grow efficiently. Cost is critical as well—many an entrepreneur and investor have built successful companies only to find that the fruits of their labor have been diluted significantly along the way. That said, there is no denying that the decision of whether to borrow money, and if so how much to borrow, has become a critical part of running a medium-late stage startup.

Operational and Ownership Opportunities and Challenges

-- Tax Benefits: One of the most commonly known benefits of raising debt is is the tax benefit associated with it as interest expenses are tax deductible while cash flow from businesses are not. Even though the cost of borrowing for a loan package might be 7%, the true cost of borrowing this might be at 5% given the interest expense deduction.

-- Team Discipline Management: Having debt on the company's balance sheet will make the management team more disciplined in choosing smart solid projects given the liabilities. However, it should be well-noted this is only applicable to medium-late stage startups given the stability of their cash flow and revenue base. Taking on debt as an early-stage startup (any financing rounds before Series B) should never be considered within the context of this point because it will drastically slow down the process of launching products and product features that needs to reach some level of market validation and adoption.

-- Bankruptcy Cost: The likelihood of bankruptcy cost increases when a company or startup starts to add debt on their balance sheet provided that debt holders have the first right of access to capital in the case of liquidation. Taking on too much debt early on in the financing process might also impede a startup's ability to raise future rounds because at the end of the day, it's increasing the riskiness level of a venture capital's investment.

-- Interest Rate: I think another reason for the recent popularity of debt financing is the lower cost of debt capital provided by the current macro environment. Even though the cost of debt for startups is lower in general, it is still hovering ~7-15% range, which makes logical sense, given the banks and debt investors have to be properly compensated for the risks they are taking for evaluating a business without any substantial assets and stable cash flow.

-- Equity: Startups will be able to achieve more progress and/or increase the likelihood of hitting certain milestones set by the VC's and management team before the next valuation round, without adding much, if any, dilution to the current ownership structure.

Overall, I am big proponent of debt financing for medium-late stage startups as it adds more structure and discipline for any future product, product feature and team investment decisions along with the ability to retain ownership and tax benefits. But it is ill-advised to take on debt (not convertible debt) as an early-stage startup because often times than not, it impedes the ability of a team to invest, grow and ultimately reach market validation and adoption.

Interesting thoughts