Stablecoin Weekly Report 02: USDT suspended additional issuance and the usage scenario of USDT in Tron is single

Original link: https://bihu.com/article/1252944989

Original publish time: May 26, 2020

Original author: Lie Ma, researcher of MYKEY Lab

We released MYKEY Stablecoin Weekly Report to share our interpretation of the development status of stablecoins and analysis of their development trends to help the participants in the crypto market stay updated on the development status of stablecoin. The MYKEY Stablecoin Weekly Report will be published every Tuesday under normal circumstances, looking forward to maintaining communication with the industry and exploring the development prospects of stablecoin together.

Quick preview

The total market capitalization of stablecoins remained stable overall last week, down slightly by over $3 million.

The new address of USDT far exceeds that of other stablecoins, probably due to its adoption in wider areas.

The usage of USDT on Tron did not increase significantly with the additional issuance of USDT on TRC20.

The distribution of USDT on Tron is more concentrated than on Ethereum, with 99.20% held by the top 50 addresses.

USDT on Tron is mainly used for transactions in centralized exchanges, with at least 88% of TRC20 USDT in the address of mainstream exchanges.

- Overview of stablecoin data

We conducted a data-based review of the development of stablecoins in the last Stablecoin Report, and in this and follow-up reports, we will update its basic information every week and interpret new trends as they arise.

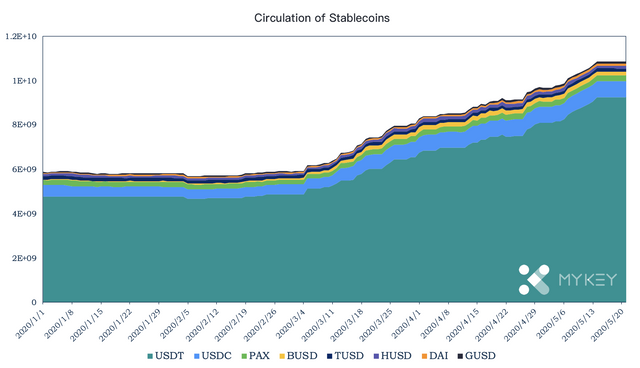

Source: MYKEY, Coinmetrics

The total market capitalization of stablecoins remained stable overall last week (from May 14 to May 21, 2020, the same below), with a slight decrease of more than $3 million, after the issuance of stablecoins increased continuously since March.

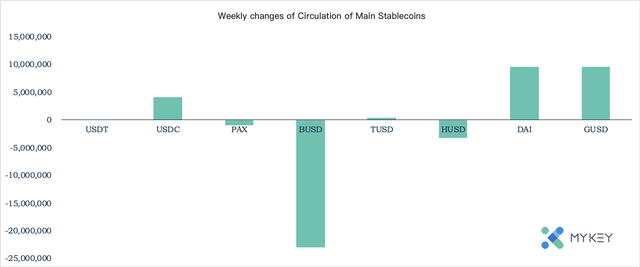

Source: MYKEY, Coinmetrics

According to the data, the decreases in the market capitalization of stablecoins came primarily from the three stablecoins reserved by the Paxos Trust. They are PAX, BUSD, and HUSD, which decreased by $1,016,358, $22,982,388 and $3,206,759. The market capitalization of USDT, the largest stablecoin, remained unchanged in the past week, with no inflation or reduction, and USDC, DAI, and GUSD all increased by $4,180,931, $9,659,813 and $9,659,813, with the increase in Dai supply mainly due to the increase in WBTC mortgages in its system.

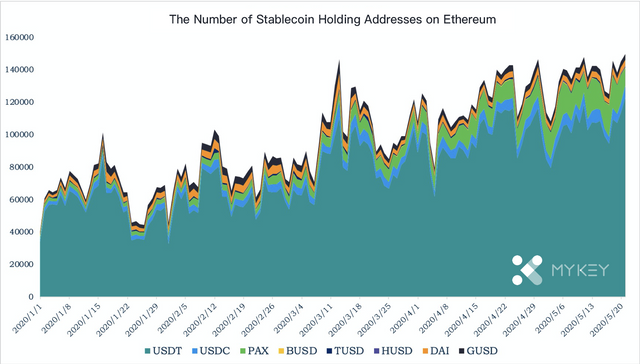

Source: MYKEY, DeBank

Although the market capitalization of stablecoins has declined, the number of stablecoin holding addresses on Ethereum has continued to rise. Last week, the number of stablecoin holding addresses on Ethereum increased by 115,598, of which 103,338 are mainly from USDT; the rest of USDC, PAX, and DAI increased by 3,515, 5059 and 3,329, respectively. We judge that the new address of USDT far exceeds that of other stablecoins, probably due to its adoption in wider areas.

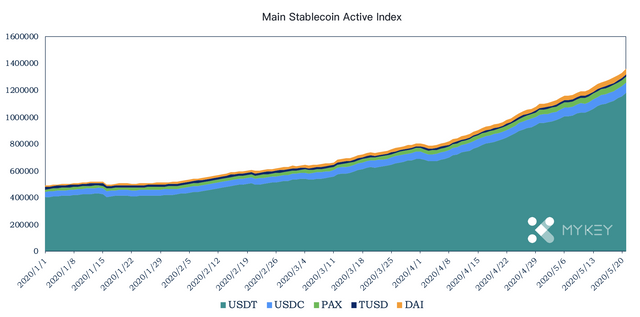

Source: MYKEY, Coinmetrics

Source: MYKEY, Coinmetrics

Source: MYKEY, Coinmetrics

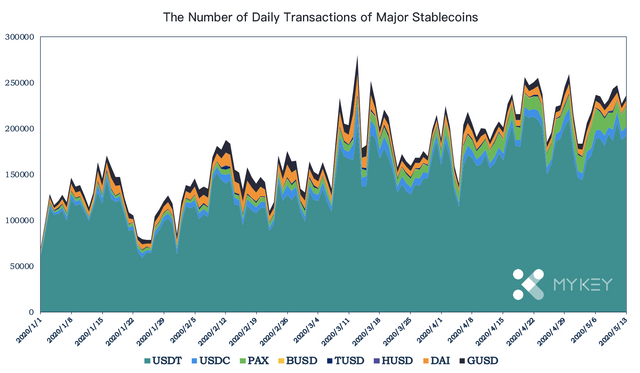

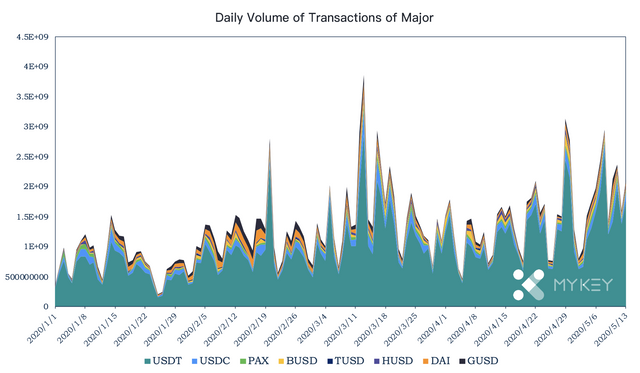

In terms of the number of active addresses, the number of 24-hour transactions and the 24-hour volume of transactions, stablecoins have overall maintained the upward trend since this year, while the proportion of different stablecoins has not changed significantly.

- USDT overflow to Tron

Source: MYKEY, Coinmetrics

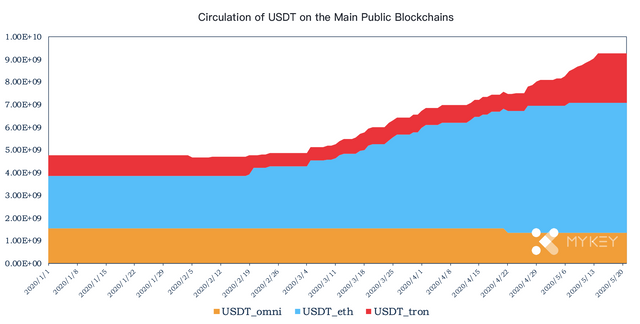

Since the end of April 2020, USDT has been additionally issued on Tron.

We judge that the increased issuance of USDT on Tron is closely related to the performance limitation of Ethereum. The continuous issuance of USDT on Ethereum has brought certain pressure to Ethereum. The number of daily transactions on Ethereum has accounted for more than 20% of the total daily transactions on Ethereum in the past month. Just as USDT overflows from Bitcoin Omini, USDT will overflow from Ethereum to other encrypted public blockchains when performance is limited.

The USDT on Tron currently exceeds 1.8 billion, surpassing the Bitcoin to become the second-largest public blockchain issuing USDT. What we care about is whether the additional issuance of USDT on Tron increases its use, how the use of USDT on Tron is different from its use on Ethereum.

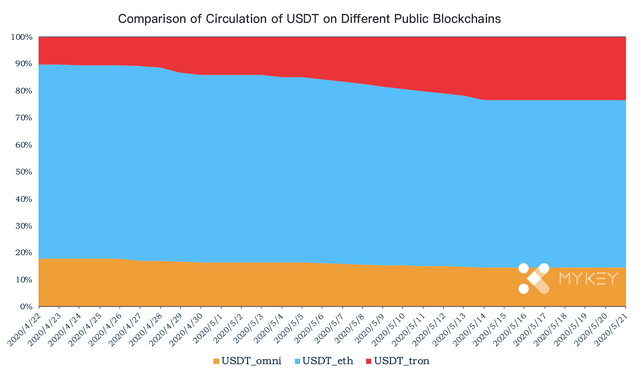

More specifically, the additional issuance of USDT on Tron is from April 28 to May 14 and we use the relevant data of nearly a month (April 22 to May 21, during which the circulation of USDT on Ethereum has not changed) to explore the above-mentioned issues of interest.

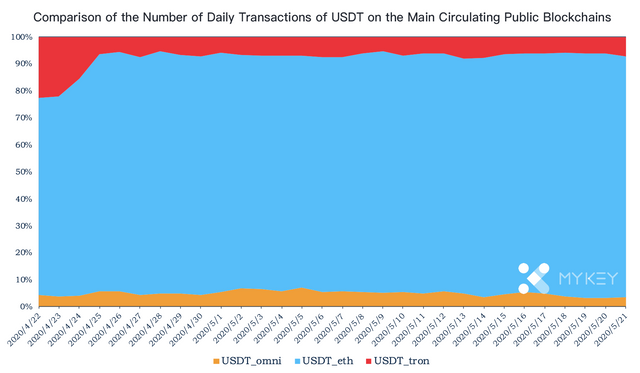

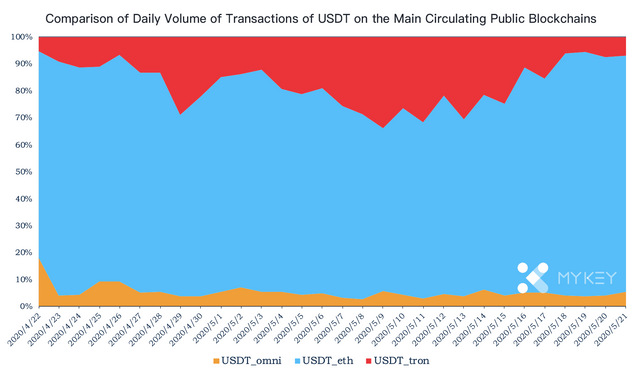

Source: MYKEY, Coinmetrics

Source: MYKEY, Coinmetrics

Source: MYKEY, Coinmetrics

It can be seen that compared with the usage on Ethereum, with the additional issuance of TRC20 USDT, the number of daily transactions of USDT on Tron has not increased significantly, and the increase of volume of transactions also returns to the previous level with the disappearance of additional issuance.

This shows that the issuance of USDT on Tron is more of a top-down behavior, not driven by the demand on Tron, which coincides with our previous judgment that the issuance of USDT on Tron is an "overflow".

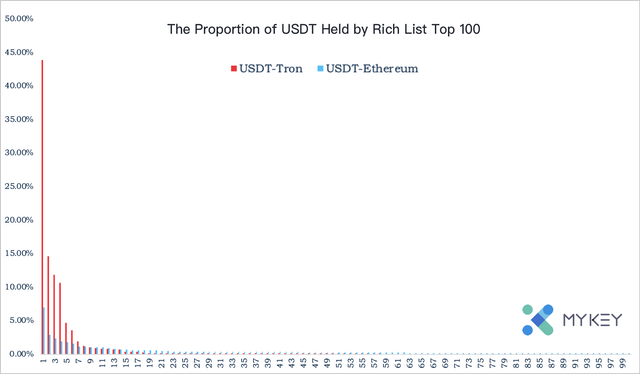

Source: MYKEY, Etherscan, Tronscan

At the same time, we can see that the distribution of USDT on Tron is more concentrated than that on Ethereum. On Tron, the TRC20 USDT held by the top 10 addresses accounted for 93.85% of the total, and that of the top 50 addresses accounted for 99.20%, which means that almost all USDT on Tron is held by the first 50 addresses on Tron. On Ethereum, the TRC20 USDT held by the top 10 addresses accounted for 21.78% of the total, that of the top 50 addresses accounted for 38.62%, that of the top 100 addresses accounted for 46.46%, and that of the top 500 addresses accounted for 65.25%, which are relatively dispersed.

According to the labeling of the addresses of mainstream exchanges on Ethereum and Tron, we found that at least 88% of TRC20 USDT is in the addresses of the labeled mainstream exchanges, which indicates that USDT on Tron is mainly used for transactions. In contrast, only about 15% of ERC20 USDT is in the addresses of the labeled mainstream exchanges, and USDT on Ethereum is used for other purposes.

We believe that for users in the cryptocurrency market who are more exposed to the scene on the blockchain, USDT on different public blockchains will have a certain nonhomogeneity, some people will be more willing to accept USDT on A, rather than USDT on B; with USDT is familiar by people outside the cryptocurrency market, for non-chain scenes, unless there is a significant performance difference, users outside the cryptocurrency market will not care where USDT is issued on. USDT on different public blockchains is a homogeneous asset for users outside the cryptocurrency market.

We judge that in terms of on-chain scenarios, the Ethereum ecosystem has a great advantage over other public blockchains. The use of USDT in on-chain scenarios on Tron is relatively limited, and it is difficult to expand it greatly. Therefore, in a natural state, the use of USDT on Tron will first expand to the existing off-chain scenarios of ERC20 / Omni USDT, such as the use of centralized exchanges (current state), centralized lending, and certain payment scenarios.

This may be the opportunity that USDT brings to Tron. After USDT overflows to other public blockchains as it grows, we hope to see the relevant operators use this “Asset Card” and promote the use of crypto stablecoins in more scenarios.

This is what we're sharing in this MYKEY Stablecoin Weekly Report, welcome to stay tuned for follow-up weekly reports. We will provide more interpretations of the development status of stablecoins and analysis of their development trends to help you stay updated on the development status of stablecoin in the follow-up report.

PS: MYKEY Lab has the final right to interpret the content of the article, please indicate the source for the quotation. Welcome to follow our official account - MYKEY Lab: MYKEY Digital life.

About Us

KEY GROUP :https://keygroup.me/

MYKEY Web: https://mykey.org/

BIHU: https://bihu.com/people/1133973

Telegram: https://t.me/mykey_lab

Twitter: https://twitter.com/mykey_lab

Medium: https://medium.com/mykey-lab

Github: https://github.com/mykeylab

Youtube: https://bit.ly/2K7O252