Happy Math

My favorite analyst in the space uses on chain data to make price predictions. This to me is cutting edge. The whole point of blockchain is that you have unprecedented access to information. In some ways it looks like technical analysis, but this stuff isn't reading tea leaves. You're looking at data on chain and tracking how money is moving between wallets.

The guys that I think do it best are in a hedge fund and they go on the Tone Vays channel. Yes, I know Tone hates Steem(it). it's a dan scam and crap... I've heard that kinda thing from other bitcoin maximalists. That's ok, it's a big space and there's lots of room for different opinions. It's ok for him to be wrong about one of the best projects in the space. (It just means you get a better deal while trying to accumulate).

There's a video with the team that I like. The lead guy is Willy Woo who goes by woonomic on twitter. He has a few fascinating things to share.

Willy shares

Miners are dumping about 1800 coins per day.

The plus token scam is dumping roughly 500 per day. There's 40k btc left in teh wallet. So roughly 80 days at the same pace.

Based on that

So, today the market is absorbing 2300 bitcoin for sale from just these two places. In April it'll be down to 1800. In May it'll be down to 900.

Woonomic seems to think we're turned the corner based on his approach of evaluating on chain data. So, if we can be bullish with 2300 BTC of sell pressure what's going to happen when it suddenly drops to 900.

More math

Right now (BTC = ~$8000) there's about 18M USD worth of selling pressure on bitcoin every day from miners and plus token scam. It's turn down to about $140M USD worth of selling pressure in April. It goes down to ~$7M USD worth of selling pressure in May.

So, IF (big if) there's enough money coming in today to turn the price around there's got to be at least $18M USD coming in per day. In May the market only needs $7M. But if $18M is coming in, and $7M is all that's needed to sustain price what do you think will happen to price?

Will Steem and the alts get a taste if it happens to rise?

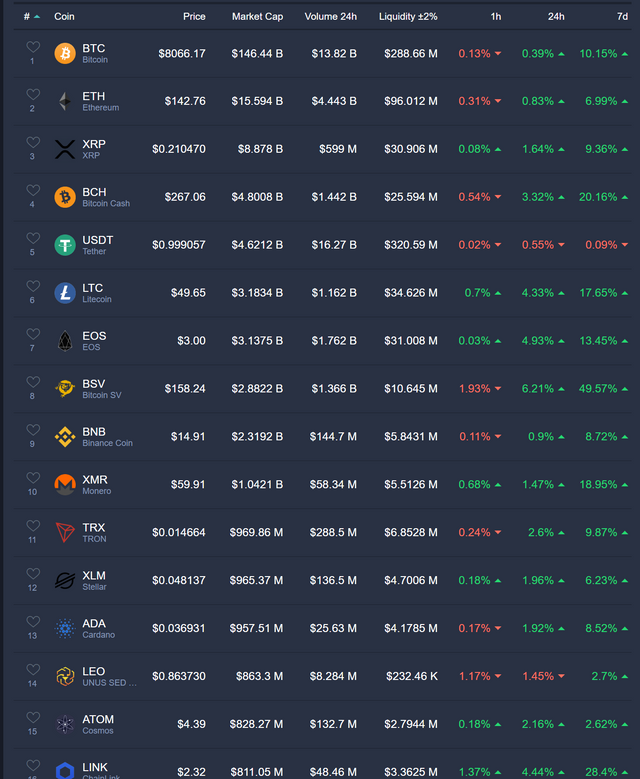

Look at this chart and you tell me.

Does it look like all the gains are just for bitcoin? Or does it look like all the tokens will catch a bid? Who knows for sure, but I think greed will be very strong for alts.

No hype yet

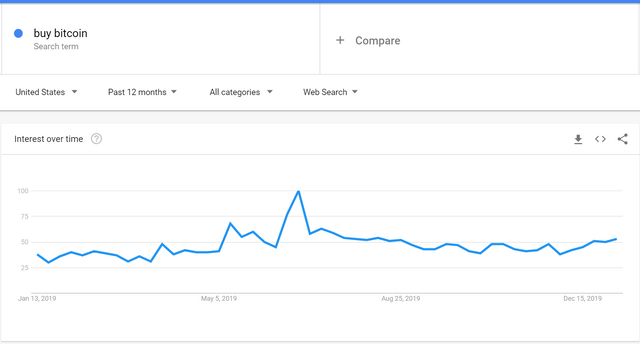

Notice this is happening without any real uptick in people looking to buy bitcoin. Actually, it looks like interest is just starting up again.

But I'm a open conspiracy theorist. Here's my theory. Large investors use their economic weight to depress prices. They have a lot of friends in media who can add doom and gloom while they are accumulating. They time their moves with halvening because they are large sophisticated investors capable of doing math and then taking risks on price. When it does get to moon time they switch gears from accumulation to selling and take crypto they bought at doom and gloom lows to sell to retail investors who buy at fomo highs (with the help of media who are out inflating the price with hype).

So, in that regard, we're pre manufactured fomo, but if I make one prediction in this whole talk it's that the number of people looking to buy bitcoin as recorded on google will surpass 2018 highs.

One last thing

There's enough wallet addresses formed now that roughly 1% of the world population has a bitcoin address. Willy did some studies and looks at another study and saw that the number of accounts doubles in a bear and can quadruple in a bull market. If the halving means we have 2 bull years we'll go from 1% of the world having a bitcoin address to 16%. Ladies and gentlemen if that comes to pass it'll be an amazing two years for crypto.

Keep your powder dry.

Disclaimer

I'm not a financial analyst. I've been wrong before. I'll be wrong again. I don't know you or your financial situation so it's impossible to know what's right for you and your family. Don't invest money you rely on for things like rent or eating in a crazy ass market. Do you own due diligence. This is a post by an internet dude. Make choices based on reading this accordingly.

It just amazes me how many tokens have higher market cap than steem. Do all of those have a working product?

What's STEEM business model? In Bitcoin case it is store of value, Ethereum has the gas for running smart contracts. But in STEEM how do you justify buying pressure? Original whitepaper had this covered with the promote function, so people would buy tokens in order to promote content, that's a sustainable approach. But now that the promote function is dead there is no reason to buy STEEM tokens other than speculation or some kind of vote buying scheme.

You might make some money by investing in curation but that would require automating with bots (which further skewes proof-of-brain) and would be greatly counteracted by inflation.

TL;DR: STEEM is doomed in its current form.

Posted using Partiko Android

Very few have anything. Of course there are the stablecoins and the exchanges mixed in there but a lot of what is ranked higher than Steem has very little being done.

Well that would be great timing as I'm just shutting down a business. Now I'll have a bit more time to get my head around this stuff. I'm soooooooo slow. 😂

P.S. Happy Math is an oxymoron if ever there was one. At least in my world!

It'll be a green spring, and a greener summer. Needs to rain a little before the flowers can flourish :)

Nice picture thought they were in GTA👍😉

Hi @aggroed,

it is possible to link a real bitcoin wallet to the steem account, like you can control the wallet with the active key?

So its in code on the Steem Blockchain with access ( from Wallet) to the Bitcoin Blockchain.

I dont know about the technical terms, but it would be awesome if its possible.

Because many normal users i think would be very grateful about features like this.

Would be Awesome to send other crypto with Steem Keychain.

I do not doubt bitcoin price will rise, expressed in dollars, @aggroed. I think it is time already to make a transition to express the relation of bitcoin towards an established value — gold. For example: At the end of June 2017 (just before the Great Crypto Boom) one bitcoin was worth 1.96432 oz

Today, one bitcoin buys 5.20347 oz

The other point would be… There will be no crypto boom like it was 2017 ever more. Years 2018 and 2019 were a learning years. We saw the decoupling of bitcoin value with altcoins. I guess professor Saifedean Ammous was right talking about the growing awareness that bitcoin is real value keeper (like all PoW coins), while a mass of other altcoins (usually “improved” PoS) are at best nice transaction tool, and at worst a blatant fraud.

Hi, @aggroed!

You just got a 0.13% upvote from SteemPlus!

To get higher upvotes, earn more SteemPlus Points (SPP). On your Steemit wallet, check your SPP balance and click on "How to earn SPP?" to find out all the ways to earn.

If you're not using SteemPlus yet, please check our last posts in here to see the many ways in which SteemPlus can improve your Steem experience on Steemit and Busy.

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.