STEEM Price Analysis – July 13, 2017

Cryptocurrency prices have taken a beating over the last couple of weeks but uptrends remain intact for now.

Let's put some context into what has been happening lately with the STEEM price.

We need to remember that the crypto markets are largely driven by the price and sentiment of Bitcoin and Bitcoin investors and traders. When money is moving in and out of cryptocurrencies, it usually flows through Bitcoin. When BTC has a sustained drop in price, most of the other tokens will follow. Likewise, when it is in a strong uptrend, it will carry most of the rest of the tokens with it.

A lot of money has flowed into the crypto market over the last few months, so it's not unusual to see profit-taking in a lot of the individual tokens and some outflows from the larger market. Volume is generally down across the entire space, so it's possible that this is just a seasonal trend as a lot of people cash out, take vacations, and enjoy the summer. As the old adage goes in the stock market, "Sell in May and go away." Since the prices began falling a little later in the crypto markets, maybe we can say:

Sell in June and come back "soon."

With that in mind, let's take a look at STEEM prices.

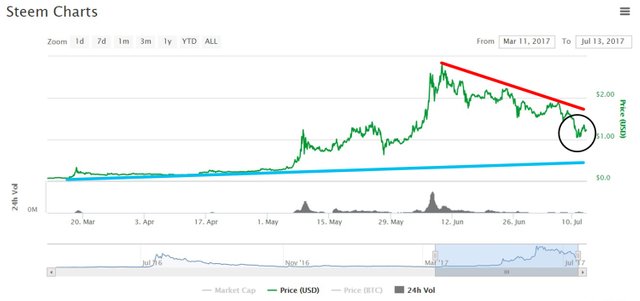

The STEEM-BTC price has taken a good beating since June 25th. There have been some wallet issues on Poloniex (see chart below) and even on Bittrex that may be contributing to some of its price woes. However, most of the price decline appears to be related to the larger market conditions and price action.

Nevertheless, the STEEM-BTC price remains in its long-term uptrend that began in March (blue line). Currently, that uptrend line rests between 32-33K satoshis, or 0.00032 - 0.00033 BTC (black line). We also see the downtrend line (red) that began on June 9th. As long as the price does not trade below that 33K satoshi line, it remains in an uptrend and our price outlook and trading decisions need to take that into consideration.

However, there are some negative indicators for prices.

First on this chart is the crossing over of the 20-day moving average below the 50-day moving average. This occurred three days ago - July 10th.

The MACD shows a fairly strong negative divergence in momentum with a zero-line crossover occurring on both signal lines over the past week and a half.

But volume may tell the story here. It is relatively low compared to recent price action that moved prices upward. The downward price action may be steep, but a lot of money may be sitting on the sidelines waiting things out. The downward trend could continue for some time before bigger players start to rejoin the table.

The STEEM-U.S. Dollar price remains firmly in an uptrend with the uptrend line resting at ~$0.50. We can see the strong downtrend line from the highs near $2.80 on June 9th and the light volume that has accompanied it.

Keep an eye on the Dollar prices from here, as it appears that a double-bottom may have occurred two days ago at around $0.98. We will need further confirmation of this in order to see if it was in fact a trend reversal. The current price is ~$1.15.

Where can prices go from here?

Keeping in mind the unpredictability of the cryptocurrency markets and the strong ties/correlations to Bitcoin, we can identify some technical levels to watch.

To the downside, the STEEM-BTC price can drop between 39-43K satoshis, where some fairly strong support had been built during trading in May and early June (black line). If the STEEM-BTC price falls through that target, the next stop would likely be the uptrend line (blue), which currently sits at 32-33K satoshis and also happens to be the next line of support. So, unless the market takes another dive right now, the uptrend line would be the last hope to remain in the trend that began in March.

To the upside, the STEEM-BTC price could trade all the way back to ~64K satoshis before hitting strong resistance. Over the last two days, it has traded between 47K and 57K satoshis. There may be opportunities to successfully trade here, if the market continues to move sideways for some time. If the price can break through 64K and the recent downtrend line (red), then a run back up to the 70s is possible. But with the current indicators pointing downward, I wouldn't expect a large move up - unless it is accompanied by a large increase in volume over a 24-hour+ period.

And, of course, the price could simply trade sideways on low volume from here.

As for the STEEM-U.S. Dollar price, I would look for a move above $1.40 to confirm that the uptrend has resumed, but I'd feel much better if it can cross $1.50 and trade above that level. If it moves back below ~$0.98, then we could see prices fall to $0.70 - $0.80.

If you're trading, always remember:

Never invest or trade what you cannot afford to lose and put tight stop-losses in when prices creep lower towards the support lines.

As always, if you have any critiques or comments about my non-professional analysis, please let me know. If you decide to trade this market, good luck to you!

Disclaimer: I am not a professional adviser and this info should not be used for trading. These are only my interpretations and opinions, and while I would be flattered that you think so highly of my fairly basic analysis, it would not be prudent to use this for transacting/trading with real money.

*Charts are from Poloniex and Coinmarketcap.com. Analysis is current as of approximately 2:30pm EST, July 13, 2017.

Follow me: @ats-david

Great inside and great post. I would not be worried so much where the price is going right now since it was a decent correction from ATH which is only creating some good entries and buying opportunities on those dips. We can definitely go lower from here but if you spread your disposable income for those dips then you can get great average price. That is a good strategy for those who want to invest in steem for long term. Personally I beleive we have a lot of upward potential not only with steem but other cryptos as well so the ones with great future potential will make some massive returns in the years to come. Buy the dips and HODL!

The last few months have been geat for the altcoin market. The prices of these cryptocurrencies went so high that almost everyone started to talk about it and this lets a lot of newbies into the crypto market.

Now that they do not see any profits, most of them are selling and running for shelter. And I feel that this price correction is necessary and I am glad this is happening.

The next few months, the price will settle and will increase eventually, slow but steady, slow but stronger than what it is right now.

Thanks for the post.

I think the markets are generally going to be quite sideways until we get definitive resolution of the Bitcoin situation post August 1st.

Now this is not a good sign for us if this downtrend continues. I hope segwit2x success and bitcoin makes new ATH. All cryptos will gain volume after it and steem will be at $2 soon.

Some people say that Steem may soon be worth about 10$. I'm not sure if they say that because they do analysis or they just wish to get rich :D

I think it's the latter, but I guess we'll see.

Steem started falling when Polo's wallet was disabled - I think people were literally selling to convert to bitcoin because they could withdraw that.

Of course that then created a downward trend that the TA people have latched onto, and it's been downhill ever since.

Good luck!!

I think you just buy and hold for the long term....Every day we are in the red means we should be buying.

We are going to look back in 5 years and laugh at the thought of thinking the price of steem was only$1.15:)

Most important key to Crypto investment is 'risk management'. The best tool for risk management are stop losses that auto sell when your token or coin falls below you risk tolerance level.

Live to trade another day.

Nothing good for social. In fact, the value of our votes goes down, the winnings drop, a tear also drops. Many despair. So let's wait.

And good vacation at all

Nice one - and this time not a technical analysis but a price analysis - useful. Keep them coming, i read them and try to understand 10%

You should try to understand 100%. You might get better results that way. If you only shoot for 10%, then that's the most you'll ever be able to understand.

#math