STEEM Price Analysis – July 19, 2017

The STEEM-BTC price appears to have found some support and is moving slightly upward at the moment.

In last week's Price Analaysis post, I wrote

To the downside, the STEEM-BTC price can drop between 39-43K satoshis, where some fairly strong support had been built during trading in May and early June.

And

As for the STEEM-U.S. Dollar price....If it moves back below ~$0.98, then we could see prices fall to $0.70 - $0.80.

Both of these happened three days ago. The STEEM-BTC price dropped down to just under 40K satoshis and the STEEM-U.S. Dollar price fell to ~$0.78, then both quickly recovered and have been trending upwards since then.

It just so happens that the Bitcoin price has done the same thing. So as much as we might want to see alt-coin prices decouple from Bitcoin, it doesn't look like it's going to happen any time soon. Whatever the sentiment is with Bitcoin and how it is viewed by investors/traders inside and outside of the regular cryptocurrency markets, the same will mostly apply to the rest of the tokens, whether we like it or not. We must always remember that when we consider investing or trading in these markets.

That being said, there are plenty of moves within the market that can be used to increase returns or to take a long-term position, so let's look at the current STEEM prices.

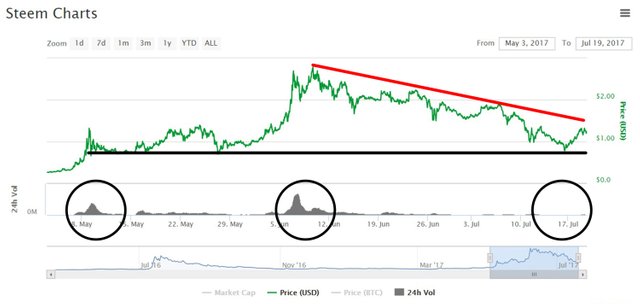

On the daily STEEM-BTC chart, we can see that the long-term uptrend remains intact (blue line). Even with the recent spike downward, the lowest prices over the past week were still a good distance away from touching it, but the gap is certainly tightening. The six-week downtrend also remains intact (red line). Prices will continue to be squeezed until one or the other gives way to a prevailing trend, which has been bullish overall since March.

Other than a couple of relatively quick spikes downward, the STEEM-BTC price has found some support around 44K satoshis (black line). This recent support adds to previous support/resistance lines, so we might not see prices fall below these levels unless there is a much stronger sell-off with Bitcoin and the overall cryptocurrency market.

The STEEM-BTC price is currently ~54K satoshis.

Looking at some of the technical data, we can see that volume still remains low (red line). Overall, volume has been much lower than any trading day in the past eleven weeks.

We can also see that the STEEM-BTC price is moving up towards the 20-day moving average, but still remains far below the 50-day moving average.

The MACD shows a possible pending crossover of the signal lines, pointing to a reversal in momentum to the upside.

The STEEM-U.S. Dollar price recently fund some support around $0.78 and quickly turned around. This occurred in the same range as previous support, including the last turnaround that kicked off the jump into the highs in June. The price is approaching the recent downtrend line, but as we can see, volume is still very low compared to previous moves. The current STEEM-U.S. Dollar price is ~$1.26.

What can we likely expect from STEEM prices?

Given all of the recent drama with Bitcoin and their potential hard forks, anything can really happen. There's no predicting what the large investors or anyone on the sidelines might do. But looking at the data and some of the points that are possibly converging, we can look at some of the potential outcomes.

The STEEM-BTC price trends are converging at the same time that the moving averages and momentum are looking to be tested and reversed. With volume as low as it has been, a large move can be made relatively quickly with few participants. If volume increases significantly on a move in either direction, we will have our answer about which trend will prevail.

My opinion is that the uptrend will continue and that a lot of the uncertainty about Bitcoin has already been priced into the market. We are less than two weeks away from the big August 1st drama, so I don't believe we'll see any large sell-offs unless something completely unexpectedly bad happens. As long as Bitcoin prices aren't dropping dramatically, the STEEM-BTC price has good potential to make some gains.

The price may be in a trading range for now (black lines, below), so we'll need to see if it can break out above the 20-day moving average and the downtrend line (red line), which currently points at ~62K satoshis. If the price can clear 57K (the current 20-day moving average on Poloniex) and push up through 62K, then it could be on its way back to the 70s.

If the price tests the 20-day moving average and fails, we could see it trade sideways until it gets closer to a convergence point with the two trend lines which would still be a couple of weeks away.

If prices do happen to take another dive from Bitcoin uncertainty, then we'll be looking at another test of support between 39K and 44K satoshis. If those don't hold, then the uptrend line would be the next test of support, currently at around 34-35K satoshis.

Continue watching the volume for confirmation of any big moves.

If you're trading, always remember:

Never invest or trade what you cannot afford to lose and put tight stop-losses in when prices creep lower towards the support lines.

As always, if you have any critiques or comments about my non-professional analysis, please let me know. If you decide to trade this market, good luck to you!

Disclaimer: I am not a professional adviser and this info should not be used for trading. These are only my interpretations and opinions, and while I would be flattered that you think so highly of my fairly basic analysis, it would not be prudent to use this for transacting/trading with real money.

*Charts are from Poloniex and Coinmarketcap.com. Analysis is current as of approximately 2:00pm EST, July 19, 2017.

Follow me: @ats-david

You are doing it all wrong. It is much easier to say you think "Steem is going to hit $10 within a few months". Such postings make very many Steemses.

I wanted to keep that a secret, but since the proverbial cat is out of the proverbial bag...

STEEM WILL GO TO $10 IN THE NEXT COUPLE OF MONTHS!

I will now await my $500 for this comment.

You're now $499.99 away.

I don't think I'm going to make it. Still need $499.80.

Still a long way.

Hahaha thats better!

As always, an excellent and highly appreciated analysis, thank you! Namaste :)

You're welcome. Thanks for reading.

Cool, seems as i have been no. 100 to view that awesome tech analysis lol

Does that make you feel all tingly inside? Do you feel like dancing?

Absolutely, feel like dancing every day - especially for such a reason - party video maybe tomorrow.

Informative, learning something new everyday also enjoy your candor

Thanks! I also enjoy candy!

C'mon SBD... This is how I earn my living so every penny helps! I think a lot of the panic surrounding Aug 1 is beginning to wane. The people that were going to freak out already have and I think we'll see some positive growth even before Aug.

I'm pretty sure that the "big scare" has subsided. But it's crypto, so you never know.

It's not a market for the faint of heart... I have to admit, I panicked too! I had about $40 in my bitcoin wallet when I loaded up my card. Somebody said to clear your BCwallets by 8/1 so I bought Ripple (if that isn't desperation lol)

I agree @richq11 :)

At least that's what I'm hoping for!

I got to say, your analysis are always spot on with my thoughts of the market and you don't sugarcoat it. Nice analysis as always.

Thank you very much. I try to call it as I see it and I'm glad it's appreciated.

Agree, BTC is still very much the tracking coin and it likely will be for sometime.

It will be interesting to see how the price action on STEEM plays out as we near the intersection of the descending triangle that formed.

The test and bounce off 40k-ish support was good to see, even if the volume was thin. We shall see what the coming weeks bring :-)

I could be super optimistic and say that we'll be back up to $2.50+ by next month, but I think the recent sell-off may have done some damage among the new crowd of investors that were piling into cryptos recently. It may take at least a few months to get back to a steady increase in prices.

But what do I know? Other than this is not very predictable?

Yes, exactly. In the end it's probabilities that we aim to put in our favor. I do agree about the recent pullback shaking the interest of the larger crowd.

It kind of ruined that bandwagon effect cryptos had going in their favor.

Yeah, I blame all of those Bitcoin clowns. They're always causing unnecessary drama for the entire crypto space. It's unfortunate, I guess.

@ats-david I did read your opinion, but I am curious as to what you would suggest. I have absolutely nothing invested in BTC or STEEM at the moment. I intended on liquidating some of my unused property and buying in but then everyone is telling me to wait until after Aug 1st. I'm not asking for advice, just a hypothetical suggestion. lol

::I'm pulling what little bit of hair I have::

I would say that it depends on your strategy. If you're buying for long-term and plan on holding, I think either one or both could be a good buy right now. Averaging in would be best.

I'm honestly not convinced that crypto tokens are even worth anything at all, being digital placeholders for self-contained transaction networks. But people are pouring money into them. For how long, who knows? There still seems to be a lot of excitement and interest and actual use cases for businesses have been emerging for blockchains, so the tech and development has some legs to it.

If I was putting a lot of money into something for the long-term, I'd look at viability of the blockchain tech regarding network transaction ease/speed and actual use cases for the chain. Steem fits the bill, but I question the leadership and development. Bitcoin is the big dog, whether we like it or not, so as long as money is flowing in, it should be one of the largest beneficiaries.

As far as timing goes - I don't know if there will be much of a difference between buying now or in a week or two, or both. In a few years, the difference between the price swings could be absolutely negligible. Then again, everything could be worth pennies. Such is digital tech and currency markets. They're high-risk, so you have to have the stomach for it.

Whenever you decide to get in, as I said above, averaging in would be the safest bet. It may not be the most profitable though.

Fair enough. I think you have a reasonable explanation about the viability of digital currency. I'll spread it out and play the waiting game. Thanks for the in depth response.

This is very good advice... If you buy a bit at different price points and plan to hold for the long term then it will probably work out very well over the course of 6 months or longer but patience and determination is going to be a strength!

a very clear presentation that makes sense even to someone as crypto-impaired as me. Whether or not Bitcoin becomes widely accepted as a digital market currency or continues hampered by its anonymity and past Silk Road associations, it is still the standard for all other coins. It really comes down to expectations of traders/investors as you pointed out, and I think taking a long view is the best course rather than hoping it tanks and buying in to make a quick buck. As usual, a very balanced and sane analysis.

Woah good read about a fine evaluation of pricing. I will hold on to my few dear Steems and SBDs.