STEEM Price Analysis – June 7, 2017

The STEEM-BTC price is heading for mostly uncharted waters, so be ready for potentially large price swings.

Since last week's post, the STEEM-Bitcoin price traded out of the short-term downtrend, then quickly and extraordinarily resumed its long-term upward move.

The previous downtrend line was broken (red line) as volume picked back up, giving us a great indication that market sentiment was positive for STEEM. Momentum continued to turn over to the upside and we saw a huge spike in both volume and price yesterday. The candle for yesterday's move stretches from just under 50K satoshis up to over 97K satoshis, which is about a 95% gain from the low to the high. The price is now trading well above the recent uptrend line (blue) coming off of the 33K low on May 26-27.

Since yesterday's peak, volume has lightened and momentum has slowed a bit. There is a support line right around 80K satoshis (black) and a lower high that was made around 92K satoshis. If this pattern continues - lower highs and repeated tests of the support line (a descending triangle) - we could see the price drop back to lower price support.

The STEEM-Bitcoin price is essentially in uncharted waters right now. There is some minimal historical price data going back to last summer, but we can't really give it too much weight. That being said, the 100K satoshi line does have a small amount of data and it could prove to be a big psychological hurdle - round numbers tend to be that way in markets and trading. There is currently ~550 BTC (~$1.5 million) of sell orders on Poloniex that would need to be overcome in order to push through that price.

If the price were to break through 100K satoshis, it could easily run to ~120K, maybe meeting some selling pressure at 5K or 10K increments along the way.

If the price falls back on a correction, the stronger line of support would be around 75K satoshis, then 65-68K below. A 50% retracement from this most recent move would be around 73-74K.

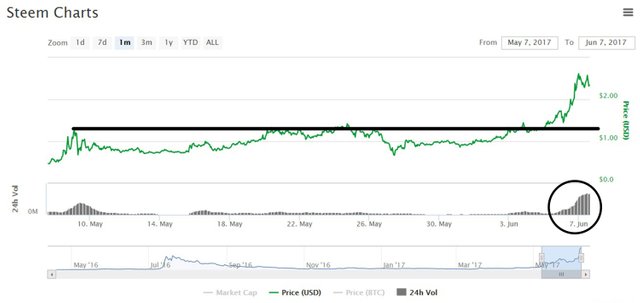

The STEEM-U.S. Dollar price came off of the $1.00 support line over the last couple of days. It traded through the resistance line once again, traded sideways for a brief moment, then shot like a cannon from ~$1.44 all the way up to ~$2.75, which was about a 91% move. We can also see the large spike in volume over the past 24 hours. The price is around $2.40 at the time of posting.

What can we expect in the near-term?

As mentioned above, we are approaching mostly uncharted waters for STEEM. Last summer's moves were quick and in one direction. There wasn't much time to build up support/resistance lines and the volumes were extremely light compared to now. We also need to remember that there is a lot of new money flooding into cryptocurrencies, so we're in a bull market (or bubble) overall. Whatever you want to call it, the money is coming in, the crtypo "king" is still the most dominant coin and will essentially drive most of the market sentiment, and the ride can get pretty volatile, even if STEEM wasn't reaching fairly new prices.

The upside targets for the STEEM-BTC and STEEM-U.S. Dollar prices are almost literally the sky. The sky is the limit. What we'll likely see if prices continue to rise is some resistance at round numbers, as I stated above. So, look for resistance at prices like 100K or 120K satoshis with the STEEM-BTC price and $3.00, $3.50, or $5.00 with the STEEM-U.S. Dollar price.

On a retracement, I think 75K satoshis could catch the price on any smaller moves, and anywhere between 48K and 68K should catch a stronger dip.

I would be cautious about buying into these markets at some of the current prices. Anything can happen, including another 90%+ run today or tomorrow. If you're looking to buy in now, pick your targets and average in. I wouldn't start above 80K. Depending on conditions at the time, if the price falls to 75K, that might be a good place to start accumulating.

On the other hand, if the price can break through 100K satoshis convincingly, then that might also be a good time to buy and catch the run up to the next high. I would only recommend this for more experienced traders or for those who can afford to lose money.

If you're trading, always remember:

Never invest or trade what you cannot afford to lose and put tight stop-losses in when prices creep lower towards the support lines.

As always, if you have any critiques or comments about my non-professional analysis, please let me know. If you decide to trade this market, good luck to you!

Disclaimer: I am not a professional adviser and this info should not be used for trading. These are only my interpretations and opinions, and while I would be flattered that you think so highly of my fairly basic analysis, it would not be prudent to use this for transacting/trading with real money.

*Charts are from Poloniex and Coinmarketcap.com. Analysis is current as of approximately 1:00pm EST, June 7, 2017.

I'm so glad you do these @ats-david, for the artists lacking the analytic/number based brains, lol. My friend @lovejoy used the exact same phrase last night, "...uncharted waters". I felt mentally and psychologically exhausted by the time I get in bed last night. If it drops, I'll got money set aside to buy it up!

No problem - and thanks for reading and supporting me. I try to write these so that they aren't too technical. I want noobs to be able to understand what I'm seeing and talking about, and to also pick up on some of the analytical tools intuitively.

I hope it's working!

It's working! Thanks!

Yeah it has been a pretty crazy couple of days. Lets hope we continue into uncharted waters, well not waters as there is no water on the moon, but you know what I mean.

Why do you think there was a dip? Normally, I wouldn't ask, but considering so many people are locked into steemit, you would think it could only retrace so much compared to BTC and other cryptos.

I

It seems there is a direct correlation between the STEEM charts and the the trending searches of Steemit. I don't see this with other coins, like ETH for example.

I attribute this to the fact that it's backed by a social network and it's basically free for individuals to get involved. They search for Steemit, and then the natural tendency is to register because they think, "oh free money". Then once in, they have incentive to invest further.

Your thoughts?

Thats realy interesting! I hope it will grow as fast as google grows :D

First - there was a dip because that's just how markets work. After large rises, a retreat in price is practically guaranteed. Traders want to take profits and buyers want to get a better entry price.

As far as the correlation with search traffic - I imagine that a lot of that is from people who are interested due to the price/payouts. Most of that traffic could just be from people in the crypto world who see the increases and decide to visit the site to see what's happening. As prices rise and fall, so does the user base (at least that has been the trend here so far).

Yes..."free money" is always a great lure. It's unfortunate that there isn't much else to offer right now. I hope that the dev teams at Steemit, Inc. have some bigger plans that they're about to execute. You don't want to miss the influx of interest/hype for a second time.

I partially agree with you, but you are forgetting that even if those people leave Steemit once the lure wares off, they have to do it by powering down. Even if they never invest, registering the account entails STEEM they can't touch immediately in whole, and if I understand it correctly even in part, for two years. I am talking specifically the "free money" in each account. Once would assume that this would keep STEEM more stable than even Bitcoin because of this. Even when STEEM rises due to traders trading it, most would do their due diligence and many would end up singing up for Steemit themselves. Even when WHales power down, they would always have more in than they are able to take out.

This is no longer the case. The hard fork back in December (16, I believe) changed the power down schedule to 13 weeks for completion.

Can I ask, you this then, if you start the power down and then stop it, does it still restart from the beginning or just continue? And I also noticed that Poloniex and a few other exchanges are on the Whale list. Does this mean all of the STEEM they hold is also documented here on steemit?

Poloniex operates a wallet on Steem to facilitate transfers into the exchange. Case in point, if you pull the deposit window on Polo, the sending address for STEEM is poloniex (@poloniex).

There is a sreem wallet that freewallet.org provide on the App Store I must warn people not to use it it does not work properly I can't send my steem any wear it don't let you do smart pay out and you can't access your funds all transactions fail but of course it lets people pay in and send funds to them but it's a scam in my opponion

/me registers @polaniex and @poloneix and such

EDIT: oh lulz guess i wasn't the first with that idea

Thank you, very useful! Keep posting, I love it! Greetings from Latvia to all! :)

Good luck to yourself and all the steem traders. All my steem will be locked into SP for a good few years yet, it's still great to see these huge recent gains though!

Good analysis buddy, I literally just posted one myself few minutes ago. On a whole we are on the same page, you get a bit more in depth as I really just focus on price, volume and support/resistance ranges.

But yeah, ideally we need to stay above 75k satoshis for this to establish as a new higher range.

Good thing is we had a volume spike on yesterday's big move so that is def. a positive!

Yes, that volume + price move was important. I mentioned that in my last post. Breakout confirmed! Now we just need it to hold at this higher range and not dip back down into the 40s or 50s again.

Agreed!

Great analysis @ats-david, it is appreciated!

As always a pleasure to read your analyzises and a chrytsal clear resteem. Thanks for sharing your knowledgement.

As always, your observations and analysis are useful. I don't do much trading myself, but it is eminently valuable to have an idea of where things are, where they've come from, and where they're likely headed. Investing time into Steemit is still an investment, and I'd like to know what I'm getting back.

Great Post, very well written and user friendly :)