STEEM DOLLAR Becomes Redundant as Haircut Hits 38%

Why would anyone still be HODLing SBDs at this point? It’s no longer a Stable Coin, there is a Haircut on Conversions at 38% (at time of writing) and it’s no longer getting paid out as a liquid reward for Steemians who are still posting. To top it all off, its Conversion Value is going to be capped at $1 USD even if the market does bounce by more than 50%. So now that the SBD is pegged to STEEM instead of the USD why would anyone still be holding SBDs? At least with STEEM there is no limit on the upside and it can still be powered up and used, but what utility does the SBD now hold…?

Source

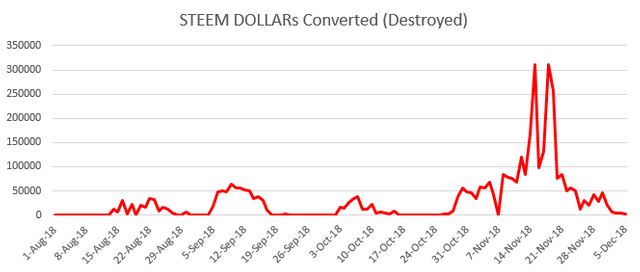

Obviously there are still plenty of people HODLing their SBDs as there are millions of them still sitting on the exchanges. In my last post on this subject HERE I predicted that the SBD conversions would dry up and then some of the remaining HODLers would dump when the market collectively realised that the SBD was now pegged to STEEM. I think we are seeing the 2nd part of this prediction play out today, but first let’s have a look at the Purge stats.

You can see that up until December 5th the SBD Conversions did indeed dry up. I may have underestimated the market a little bit as the SBD price has been tracking the Par Value on conversions pretty closely up until today. There are some growing signs of panic from SBD HODLers today though. With SBD now trading at around 58 US cents it looks like market participants are now waking up to the peg situation and they are barfing SBDs. So we look to now be re-entering Purge Territory with Market Value now dropping back below Par Value. If you want to calculate Par Value for the SBD yourself, check out the Steem Info tab on SteemWorld and do the simple math below.

Source

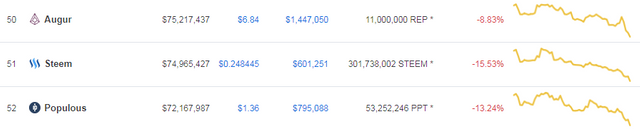

SourceI wish I could say that I think we’ve hit the bottom, but I still have a lot of concerns. A bit has happened on the Steemit Inc front since my last update. Firstly they announced a 70% lay-off of staff to focus on reducing costs. When I first saw that news I immediately thought this would kill either the timing or the scope of SMT delivery. SMTs are what many have been holding up as the “Great White Hope” for the platform so I expected it to have a big impact. I was surprised that the market didn’t dump hard on this news but quite likely this news was priced in already and those “In the know” were possibly selling hard prior to the news breaking. That might explain why we saw STEEM dumped from 80 cents to 30 cents in November (before the news broke). In hindsight we could blame the Bitcoin and broader Crypto-market drop but if we’re being honest the STEEM price has been savaged and has under-performed almost the whole market. STEEM has now dropped to Rank #51 on Coinmarketcap.com

I’m also hearing some grumblings from the Witness ranks as the earnings from producing blocks (which are paid in STEEM) have dropped below the cost of running the underlying infrastructure. The STEEM blockchain has been running for a few years now, so there is a lot of data in the blockchain and there is a growing concern that the Witness ranks could be decimated as many would be running on infrastructure that is now making a loss. This subject is probably worthy of its own post series, but it’s worth noting that we have seen another announcement yesterday that Steemit is going to try and help Witnesses costs by implementing RocksDB to reduce infrastructure requirements. Steemit is also trimming down the scope for the SMT implementation which they have now labelled SMT-lite. It looks to me like an attempt to re-assure the market and stem the bleeding, but I do think it’s positive that we’re finally seeing some greater transparency and communication from the #1 stakeholder. Let’s hope it succeeds in calming the market and Steemit Inc can deliver on these new promises.

Yep, I'm not sure what we should think of SBD at this point. If it's not a stable currency then what is it and why do we need it? :)

It's going to be interesting to see where this ends up. I guess I'm silly for not powering down but I kind of want to ride it out anyway! All my SP/SBD is from earnings anyway, easy come easy go I guess. I'm prepared to hodl my crypto down to 0, so we'll see where this goes!

I guess it helped that I never invested more than I could afford to lose in crypto!

and I've been through all this before. I'm not feeling FUD. I've got FOMO (not for Steem though mind you)

I would be expecting the calls to abolish SBD to be getting louder at this point as people start asking that question.

My personal opinion is still that we need to fix the peg with reverse conversions so that if we ever pull out of this death spiral and recover it will become useful again. Unfortunately the reputational damage to the SBD and STEEM overall is significant at this point.

I wonder how other digital asset-pegged stablecoins are doing right now. Dai looks fine, so far. Aren't there some SBD-sort-of's in the EOS ecosystem?

Not sure on all the other stable coins. I do know that bitUSD on Bitshares had a Black Swan / Global Settlement that made a bit of a mess. I have resorted to a fiat backed stable coin for my reserves - specifically TrueUSD.

I do hate the idea of having counter-party risk on my stable coin and trusting a bank for my Crypto reserves....but desperate times call for desperate measures.

Regarding the bitshares black swan thing. Do you have a link where i can read more about that?

https://steemit.com/bitshares/@lukestokes/bitshares-global-settlement-and-chain-freeze

Thanks

NuBits was the first to be rekt by the crypto bear market followed by SBD and BitUSD. DAI is still doing okay but my view is that is mostly because it is relatively new and tiny compared to its backing asset, ETH. Given a bit more time to grow before the crash (or with a faster and/or deeper crash) it would likely end up looking a lot like BitUSD.

It appears they all suffer from the same limitation which is simply that too-rapid and too-severe depreciation (aka crash) of the backing asset isn't something they can absorb while retaining stable value. We will need to evaluate these solutions not in terms of retaining stable value unconditionally (which appears impossible) but in terms of the magnitude of the shocks they can absorb and their ability to recover. (NuBits, for example, still hasn't recovered after several months and now trades around 0.05.)

I expect this is something (at least for now) that users of algorithmic stablecoins are simply going to have to accept as a necessary tradeoff for not having a counterparty and everything that goes with it (for example all of the new custodial stablecoins have features which allow the issuer to freeze your coins).

Perhaps they should have been developing SMT-lite to begin with. The last fork suggested they should stop working towards such huge updates. A basic SMT that can later be updated with time might be a better choice. They've been promising SMTs for too long. Clearly it was far too big of an update, taking far too much time.

Incremental change via a more agile development process would be a great way to go. But considering the deploy / test / release process is so immature on this platform it might be asking too much.

Gotta crawl before you can walk I suppose.

Well...a sane development process might be asking too much...

Actually (setting aside buying below fair value to immediately convert) there are situations when SBD can do better than STEEM. For example, if STEEM stabilizes (stops dropping) and SBD continues to be converted at a steady rate. In that case the peg target (STEEM price necessary for SBD to repeg to $1) will continue to drop along with the SBD supply, and fair value (and possibly market value, but there are no guarantees) of the remaining SBD will appreciate closer and closer to $1. For reference, the peg target has dropped from I believe 0.415 (when first reaching the 10% cap) to 0.402 (now).

I'm not telling anyone what if any tokens to hold (do your own research) but just pointing out that the above analysis is missing a factor.

This has been going on for a year. Of course it is possible there have been some "in the know" about some things happening behind the scenes for quite some time. Excellent transparency and communication has never been a Steemit strong suit, and that creates a perfect breeding ground for insider trading.

Probably true for backup witnesses but not for top 20.

What he said. Hopefully not too little, too late.

@smooth, you're one of the people who know the most about how the Steem blockchain works, so maybe you could ask a (slightly) related question: why are the rewards being paid out assuming a median price of $0.40 when the 3.5 day average has been well below that for a week now? Is that also because SBD is now pegged to Steem?

Steemnow

It is a glitch in the UI that is being investigated. In fact the rewards are being paid out in the correct amount but the UI is displaying them with the wrong exchange rate (yes, indirectly caused by the SBD peg switch).

I appreciate your insight on this. I wrote a post talking about this stuff, but no one seemed to know.

I'm limited in the programming knowledge that I have and the tools that I know how to use, so I just look at sites like SteemWorld and then compare to Steemit.com. From what I see on Steemworld, for my last post that paid out, I received 0.55 STU as my portion. You can see from my rewards at the top of this screenshot that I received 1.38SP for that post. So I divided .55 by .4 (the listed median price) and got 1.38. So to me it seems like it's actually paying out at the .4 level.

I doubt-checked this with my pending rewards in my Steemit.com wallet which shows that I have 1.475 SP waiting to be claimed which is the SP from the post, plus the unclaimed curation from my votes. (There's another .01 not in the screenshot, but taking rounding into consideration, it's the same.)

I claimed the rewards and the SP in my account increased by 1.475 which is the amount that SteemWorld said (and that's not as much as it should be if it were based on the actual median price.)

So if it's just a UI issue, when does the other SP go? And when does it get credited to our accounts?

There is no extra SP. The reward fund is in STEEM from start to finish, and the share allocated to the payout is equal to the amount that ends up paid out. The STU/$ value is just something that the UI estimates and the steemit.com UI (along with most if not all of the others) is estimating it incorrectly.

There will always be an arbitrage play when the Market Value differs from Par Value on conversions. My logic is that for conversions to be happening (to reduce supply of SBDs) then Market Value needs to be lower than Par Value. In this scenario a regular Steemian is still better off converting to STEEM than HODLing SBD - even though the underlying value of SBD might creep up due to the debt reduction.

However, a lot of this is too complicated for regular Steemians to get a good handle on fringe cases.

Yes, I was talking about the Witnesses collectively. I think if we lost the Witnesses outside the Top 20 we'd be in serious trouble. It's not just about centralisation (since we really are already fairly centralised), it's about having fail-over / redundancy and a robust network that can self-heal.

If you are performing conversions yourself, then the comparison between holding SBD and holding STEEM is irrelevant. Go ahead and convert.

But if you aren't converting (say because there is no discount at the moment, or because you just don't want to), then holding SBD is very likely to outperform holding STEEM because the conversion/peg value will creep up to $1 (as conversions occur when the SBD price dips below par) even if STEEM remains unchanged, and if STEEM rises, until the peg value reaches $1, SBD still either rises with it or outperforms it (for the same reason). At some peg value near $1, one might prefer STEEM, because of the possibility that STEEM suddenly jumps to well above the repeg point, but at this price it is a negligible factor.

The 'creep' is not insignificant. The peg-to-par price for STEEM has dropped from 0.415 to 0.401 over the past several days. That's a few percent outperformance for SBD.

The high ranked backups who serve as (somewhat) immediate fail over still do okay. They get 5x per block compared with top 20 (which was put into place exactly for this reason), and 1-2 blocks per hour. That's still well above server costs. It is the lower ones who get only a block or two per day who are are struggling. They need to operate very lean (maybe a laptop at home) or quit, or accept the (small) losses for community participation.

Anyway, low STEEM prices are painful for everyone (except shorters if there are any).

SMT-lite.... awesome B! We must thank @smooth for this idea. Good times ahead. SK.

Posted using Partiko Android

I wasn't aware of his involvement in this decision. His blog is sparse so I assume it was discussed in a comment thread somewhere. Any links?

Go to Ned's last video. It was a question that S put to N. And it is smart idea. It is SMTs without the bells and whistles.

Posted using Partiko Android

Thanks for the post, I never was in the loop on SBD being pegged to Steem instead of USD. Used to be they approximated the price of Steem / USD and this was the conversion mechanism for SBD into Steem.

And what happened to the conversion thing? I don't see it available on the wallet anymore.

Steemit disabled it in the UI when the SBD pump started in Nov-17. It seems they aren't interested in re-enabling it and the attitude appears to be that the feature is for "advanced users" only.

You can still do it via SteemConnect or SteemWorld.

I hope those trying to run away would just dash me their SP or liquid STEEM. AM loving STEEM more in the now!

My understanding is that SBD isn't really a stable coin. The peg is loose, so we saw it shoot well above $1 in a bull market and now its well below $1 in a bear market. I suppose the reason to hold it because if Steem goes back to all time highs, SBD.s are likely to do so too? Might not be a sensible plan in the short term but I think many people are just hodlers and are only interested in the long term.

Why the problem is SBD ??? ... I see problem is not this all steemit...

problem is this big coin market there out... this waht makes as feel bad and see this bad price here .

I dont know its problem

Come on, Steemit Inc!

Good power, focus, and energy to them.

Thanks for the post.