Can We Predict Crypto Currency Prices? (ENGLISH/TURKISH)

I've always liked things that require calculations. I studied engineering, and I spent almost all of my professional career analyzing data. I started wondering if I could predict asset prices when I could apply analytical methods at a certain maturity level. If you can predict the price development of a stock or currency, you can become rich in a very short period of time. So the prize is huge.

There are thousands of people in the economy media who express views on the development of asset prices. There is also millions of people that follows these people. When I look at the situation, I conclude that asset prices are predictable. On the other hand, I witnessed extraordinary intelligent, well-educated, experienced and hardworking managers in the bank I used to work who could make these predictions well in accordance with their profession and they didn't care. Who was right? Those trying to predict stocks or currencies or the bankers who focus on their daily business without worrying about such a prediction?

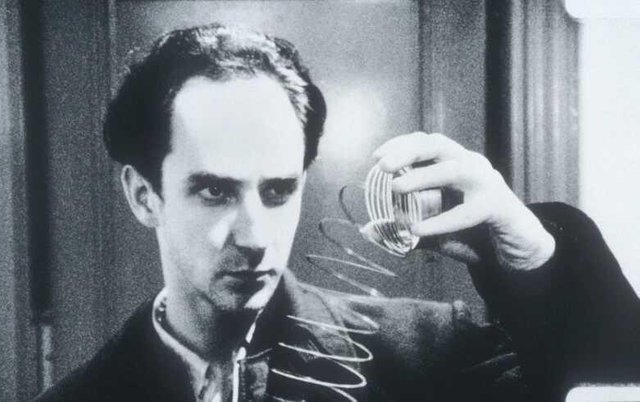

I have always followed the prices of currencies, stocks, real estate, bonds, although it is never my primary hobby to predict asset prices. I followed the economic media by my profession and tried to understand the price correlations between general economic trends and asset classes. I experienced the Asian crisis, the 2001 crisis, where the 9/11 disaster was exacerbated, and the 2008 crisis, which could led to the end of capitalism, as a banker and as a modest investor. My mind was always engaged in the money markets with an instinct to understand the relationships between events. However, I never fully focused my mind on the subject, like Director Darren Aronofsky's film PI's main character.

Image source: indiewire.com

As stated in the movie PI, if nature speaks with the language of mathematics, the secret of asset prices is to be hidden in the equations. Money markets are unfortunately not expressed in simple mathematical equations. In fact, the mechanism is very simple, this simple mechanism creates complex patterns. We know that price is the result of the relationship between supply and demand. However, supply and demand are not at all a harmonious pair, they give us many surprises. A small spark or sensational event can cause markets to get out of control. After major price changes, everyone is trying to explain why the major price change actually occurred. Of course, the dramatic price movement, which is made up of these explanations, does not explain us why it did not happen in the past months or even years, when there were almost the same conditions. Markets have a chaotic structure, which makes it very difficult to predict the future. I came to this idea after reading a book that describes the order and chaos in the money markets through Mandelbrot sets. Mandelbrot sets show us how complex numbers form complex patterns with equations that appear to be simple.

Source: https://giphy.com

The irrational price formations in the markets are of course not only due to the chaotic nature of the markets. When prices over-fall or over-rise, people start to believe that the trend will last longer. It is a good example that even after oil prices fell from $50 to $20 in recent years, no one came back to buy oil, and oil prices dropped to about 14 dollars. The price of Brent oil is at 75 dollars today. The times of untimely pessimism are followed by exaggerated euphoria. Human psychology is so dominant on the market that behavioral economics has become very popular in recent years.

When director Darren Aranovsky's Black Swan film was shown in year 2010, it attracted a great deal of interest and was widely acclaimed by large audiences. Contrary to movie PI, the film had nothing to do with money markets. The author, Nassim Nicholas Taleb's book, Black Swan, which has the same name as the film, described how the "Black Swan" events in the money markets overrule the traditional methods of analysis. The author gave examples

Nice read. I leave an upvote for this article thumbsup