How does the system works? Part1 Inside Job

This is really important, please take a few minutes to read it or see the film.

The documentary begins with the Iceland 2008 Banks Collapse, just to make clear that this problem affects everybody in the world.

One of the first interviewed Gylfi Zoega commented; This is an universal problem, you have that problem in NY, right?

In this film were interviewed many political and financial characters, such as Paul Volcker (Ex-Chairman of the Federal Reserve), Gillian Tett (U.S. Manager Editor of the Financial Times), George Soros (Magnate, Investor), Andrew Sheng (Chief Adviser to the China Banking Regulatory Commision), Christine Lagarde (EU Finance Minister) among many others.

This documentary is made of five parts, I'm going to highlight the best quotes of this film (You should see the whole documentary)

Part 1

How we got here.

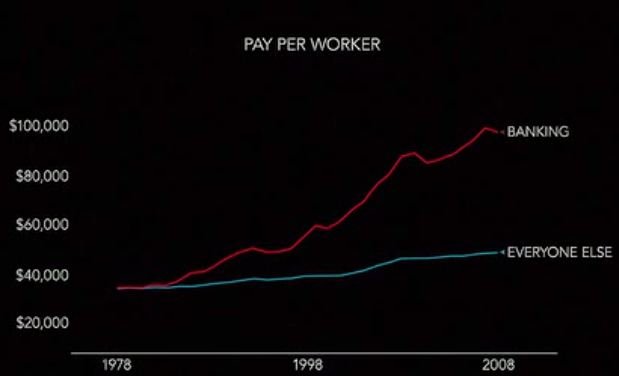

In 1980s the Investment Banks went Public: Wall Street began to get richer. (Min 13)

In 1982 under the Reagan Administrator and with Donald Reagan as the head of the Treasury the Loan and saving companies were deregulated, this cause a big bank heist that let people without saving, Charles Keating went to prison because of his Loan and Saving Company.

In 1985 came to light a document from Keating when he hired a economist called Alan Greenspan where Greenspan praised his "Sound Business Plan and Managerial Expertise" and that he "Saw no Risk on letting Keating to invest their clients' deposits" (Min 14)

After Keating went to prison, Alan Greenspan was appointed to be the Chairman of the Federal Reserve

Also reappointed in the administration of Clinton and Bush. Greenspan also worked with Robert Rubin (Ex-Goldman Sachs) and Larry Summers

The next crisis was in the 1990s with the DotCom Bubble and the Regulators (Securities and Exchange Commission )did nothing. (Min 18)

Scott Talboot (Chief Lobbyist FInancial Services Roundtable) was asked if it was acceptable that the fact of many companies that he represented were tied to criminal activities, and his first answer was; "You have to be specific" LOL

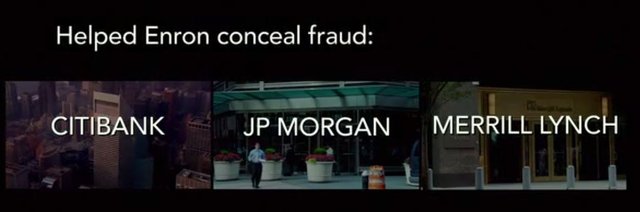

Banks that helped Enron to conceal fraud. And even when they helped Enron they didn't have to admit they did something wrong (Min 22)

At the Beginning of the 1990s with help of deregulation and technology, there was an explosion of products called Derivatives that made the market unstable, the CFTC issued a plan to regulate this market, Clinton's office had an inmediate response,Larry Summers called Brooksley Born to make her stop that plan.

After that call Greenspan, Rubin and Co recommended not to regulate this area (Min 25)

After this point started the Housing Bubble

In 2001 when G.W. Bush took office, and the US Banking power was concentrated in this five banks Goldman Sachs, Morgan Stanley, Lehman Brothers, Merrill Lynch and Bear Stearns, and this two conglomerates Citi Group and JP Morgan this three Insurance Companies AIG, MBIA, AMBAC and three rating agencies Moody's, Standard & Poor's and Fitch (Min 27)

The explanation of the Housing Bubble is much more clear in the Film (Min 28), Basically, the interest rates were too low and there were a lot of people buying houses with mortgages they didn't know they could pay, but all of the banking sector knew this was a Bubble, and the people would lose their homes and money.

Part 2

The Bubble

This is one of my favorite quotes from the film, from Martin Wolf, he described the banking system so easily: " It wasn't real profit, it wasn't really income, it was money that it was being created by the system and booked as income, two or three years down the road, if someone didn't pay they just erase the profit, I think that this was, in retrospective, a big global Ponzi Scheme " (Min 33)

The SEC was systematically destroyed at the point that just one person was in charge, they fired more than 150 people, this agency was the responsable to investigate the investment banks during the bubble but no major investigation was done.

In 2004 Henry Paulson Ex-CEO of Goldman Sachs and Chairman of the Treasury in the Bush Administration help to increase the Leverage, that is basically the amount of money a bank can create to make loans, that's right CREATE, they don't actually have the money.

The explanation of a Credit Default Swap is shown in Min 38, this is best described in the film.

Raghuram Rajan Chief Economist of the IMF warned the bankers that these situation will get worst, He made a paper called "Has Financial Development Made the World Riskier" and the conclusión was Yes (Min 40)

Another quote, this time from Frank Partnoy, he described the Bailout this way; You are going to make 2 million dollars or 10 million dollars a year if you put your financial company at risk, someone else pay the bill, you don't pay that bill, most people on wall street would say; Yes, I make that bet (Min 43)

The declaration that had to give Goldman Sachs was unbelievable, they sent emails to each others that the deals they made to their customers were shitty and after all they closed those shitty deals for their own benefit at cost of their customers' losses. (Min 53)

Also the Rating agencies had to testify and their excuse was that their ratings are just "Opinions" and should not be take for granted.

Link to the film here

Nice Post and a Interesting Film.

We need Blockchain Technology and Digital Currency Now!

Here is another interesting film, they make 3 of them.

🙄

@camellito es el pelado y @h1xa76e es perrillo pilas

josue, soy peter pilas follow

Great Post!

Thanks, please here is the second part, please try to inform to many as you can.

https://steemit.com/steem/@joiflores/how-does-the-system-works-part2-inside-job

Lived this mess, got caught up in the mess with a house and apartment complex and the wonders of real estate agent lies and banker lies. Never had it explained so well. Thanks. ~ljl~

so sorry, that happened to you, please also see this documentary. Thanks, try to inform others please

https://steemit.com/steem/@joiflores/the-crisis-we-have-to-worry-about