The Price of Steem should currently be trading at $2.22 and here's why:

Over the last couple of years I have heard quite a lot about an interesting equation, well "law" actually, that has been used to attribute value to certain social communities.

It's been used to attribute appropriate values to Facebook, Google, Amazon, and more recently it has even been used to calculate an appropriate value for bitcoin.

What am I talking about you might ask?

I am talking about none other than Metcalfe's Law.

Metcalfe's Law states that the value of a system is proportional to it's number of users squared.

Specifically it's defined as:

"Metcalfe's Law states that the value of a telecommunications network is proportional to the square of the number of connected users of the system (n^2)"

The "law" was originally presented in 1980 but wasn't formulated in the above way until 1993 by Professor George Gilder.

The intent was to try and explain the network effect. How adding more users to a system doesn't just increase that network's value linearly but instead exponentially.

To illustrate that, the "law" is stating that if you have 100 users and a value of 10,000 and you double your user base to 200, the current value of your users doesn't double and go to 20,000. Instead it goes to 200^2 or 40,000.

Cool, but what's the big deal?

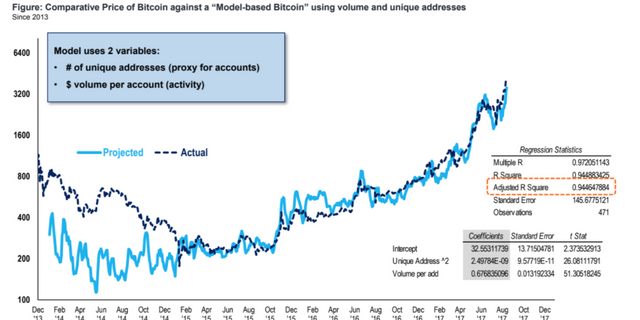

The reason I bring this up is because my favorite Analyst on the Street (Tom Lee) has been using this model for some time now to predict bitcoin prices.

Well perhaps, not so much predict, but to help get an idea of what plugging in certain numbers might do to prices of the coin.

Namely, expanding the number of users in the bitcoin network.

Surprisingly, (or not surprisingly), Lee's modeling has been extremely accurate!

Check it out:

Perhaps better than being a price predictor, this data might be useful indicating whether prices are in "bubble territory" and when prices are undervalued relative to their network usage.

For example, in the above model you can see that when the model was well below the actual line, the price eventually made it's way down to where the model was. Meaning that if you had looked at this at that time you might have guessed prices were a little overheated due to actual network usage.

Basically, this is saying that if you see a big divergence, in one direction or the other, between the number of active users squared and the price, perhaps you can gain some insight as to where prices might go next (if those usage numbers remain constant that is).

More on Tom Lee and his ideas behind using Metcalfe's Law in regards to bitcoin can be read here:

http://www.businessinsider.com/bitcoin-price-how-to-value-fundstrat-tom-lee-2017-10

Cool! How does this relate to steem?

I'm glad you asked!

For one, I would think that steem is probably even a better example of the network effect as its primary users mostly come from the social media site steemit.com.

Knowing that information, is it possible we could come up with a theoretical price of steem?

Maybe!

According to data pulled from @penguinpablo's daily steem stats report we can see that yesterday steemit.com had roughly 24,000 daily active users:

https://steemit.com/steemit/@penguinpablo/daily-steem-stats-report-friday-november-10-2017

(chart courtesy of @penguinpablo)

Applying Metcalfe's Law from above we can take that 24,000 active users number, square it, and come up with roughly 576,000,000 of value. (24,000 x 24,000)

That means with that number of active users, the total value of the system should theoretically be somewhere around $576,000,000.

More than double the current market value of $243,000,000.

To get a theoretical price of steem based on those numbers, we simply divide that 576,000,000 by the number of steem outstanding, which currently is 259,000,000.

(576,000,000/259,000,000)

Performing that calculation would give us a value of $2.22 per unit of steem.

Pretty cool eh?

My thoughts:

I know I know, this isn't really that great of a price predictor and probably not all that accurate as there are many variables that could explain why prices could be well below or well above that Metcalfe value.

Prices are often based on future expectations as well, so perhaps a number well below that might indicate that currently market participants are expecting those daily transaction numbers to not grow as fast as the inflation rate of the currency (steem)? Or it could be because of any other number of future expectations.

However, instead of being a price predictor it might be a valuable tool in deciding whether prices are over heated in terms of actual usage rate or possibly undervalued compared to its network of users.

Basically, this is all just more of something to keep in mind as opposed to something to base your buy or sell decisions on. :)

Also, keep in mind that this kind of comparison only works right now where steemit.com is the primary use case for steem. Once SMTs or any other number of apps start also using steem and the steem blockchain, the data from steemit.com mostly goes out the window as it would only be a small fraction of the coin's overall network usage.

Other than that, I hope you enjoyed my little fun steem price projection project. Feel free to leave me comments with your thoughts below.

Stay informed my friends.

Sources:

https://en.wikipedia.org/wiki/Metcalfe%27s_law

Image Sources:

Follow me: @jrcornel

Most applications of Metcalfe's Law use a coefficient to determine the value of a network. From this Wikipedia page, we can see the coefficient for Facebook is 5.7 X 10 ^ -9 based on a monthly active user count. Your calculation is correct if we assume the coefficient is 1. Which is very optimistic.

But, let's say that we that bound the valuation of Steem to 10 cents per Steem with the current user base. This is a very pessimistic valuation btw. That makes the coefficient for Steem around .045. If we expand to 100,000 active users in the next year using Metcalfe's Law and add 9.5% inflation to your current Steem number, we get a lower bound for 2018 of $1.56. If we reach 200,000 users by this time next year, that number goes up to $6.34. And that is using Metcalfe's Law with a pessimistic lower bound. Things are bright if the network can stay healthy.

I was just writing about the coefficient. It was all good write-up until the assumption that 1 user = $1.

@greer184, why do you think 10cents per Steem is pessimistic?

Also, the trend for number of users doesn't seem great. Do we have an indication that the number of active users might reach really 100k?

I think 10 cents per Steem is pessimistic because I feel that the market demand would never let the value of Steem decline to that point (unless the site was dying). The trend for active users is not great, but that is most likely due to Steemit still being in beta and thus having no marketing presence and a lot of attention to Bitcoin's 2X drama.

If you look at sites like Twitter or Facebook, with an effective marketing campaign plus crypto becoming more mainstream gives me believe that the platform can get to 100,000 active users sometime in the next 18 months. I feel that Bitcoin is on the verge of becoming mainstream. Once Bitcoin pops, people will look for other opportunities naturally leading them to other cryptocurrencies with "network effect" potential.

sounds like a win-win situation

0.50 USD - 2.00 USD per Steem is realistic range, so 0.10 USD is indeed pretty pessimistic valuation. I set my sell limit to about 1.70 USD per Steem on HitBTC, because I think the value will reach that in decent time.

Great points and thanks for breaking that down like that. Yes, I used a very simplistic version. The point is the same though, we grow this place, we likely grow the value of our holdings! ;)

this is so informative ... thanks for sharing

What would you get if you tried to derive the value of a single user? I'd love to know the value of a Steem user versus a Facebook user. I'm guessing you wouldn't just divide the coefficients

Yeah, you wouldn't divide the coefficients. You could calculate the value added by the next active user added to the network at the network's current sizes. So, perform both calculations for n active users and n + 1 active users and subtract. Then divide the results for both Steemit and Facebook. You would also need to make sure you are measuring against the same time span. The coefficient they used for Facebook was for monthly active users, while I just borrowed the daily active users number above.

But the issue here is that Steemit is so new that we don't know if we have a reliable trend against Metcalfe's Law like Bitcoin or Facebook currently have. So the biggest question would be finding a good way to derive that coefficient. The estimate I did as a lower bound might still be too optimistic given the small user base that we currently have. Metcalfe's Law might not kick in until we reach a certain point.

You break down complicated data into understandable bits...you are a math Master! Thank you @greer184, I admire minds like yours.

Lets not forget that STEEM can and does apply to much more than just steemit.com.

anybody can do it now , must wait .....

Wow man, this is really useful math. I never thought about it this way. I mean, I knew Metcalfe's Law but I never thought of deriving a valuation based on it in this manner. Kudos!

Community Liaison, Steemit

Nice support.

it can be possible as steemit coomunity is growing @rapid speed

https://steemit.com/song/@bhagyashri/highly-viewed-popular-song-155m-views

This is first time I hear about Metcalfe method and this is the kind of thing I was looking for! Thank you!

if only it was. Would be nice to see the platform growing because of it. The greedy people will wash out anyway and the actual community will grow.

This means at 1Million daily user the price of STEEM should be 3,861$ if you take todays number of STEEM outstanding as a basis. lol

Good to know...

60,000 daily users would be 13.90$

100,000 -> 38.61$

150,000 -> 86.90$

Thanks for your information :)

Awesome post!

I was hoping Steemit would have much more than 25k daily active users by now. Aren't we a bit on the low side with that figure?

I would tend to agree. Once the anchor is pulled and they start promoting this place I think that number quadruples pretty quickly. :)

Promoting bit is nice. I had actually written a few lines on my post but it did not go well with an editor. I guess it was not my day. There are a lot of experienced writers in our fb group but many are not familiar with the process of withdrawing earnings in the form of crypto currencies. If only, someone set up an agency or bot to do so and transfer it to paypal, I am sure there will be an influx of writers to steemit. Thanks for writing about this.

That's an excellent idea :)

Thanks

Promotion? Who believes that is probable?

Number of users should increase when attracting more platforms to use it. Most ICOs use Reddit, Telegram, Twitter, FB and so on.

advertising for #steemit would be nice.

The value of steem is bound to rise mainly because more and more people use them.

Anyone know how to find the number of unique accounts on Bitshares? I'm curious now.

I'm getting 459396 accounts at the moment by using the API

uint64_t graphene::app::database_api::get_account_count()

http://docs.bitshares.org/api/database.html#_CPPv2NK8graphene3app12database_api17get_account_countEv

scroll up just a bit to see

uint64_t graphene::app::database_api::get_account_count()

It's an interesting piece but I think it stops short of a few steps. Steem isn't the community. It's still a currency mainly driven by speculation and market forces. It's price is based on the value people think it has, not just the people who use it.

Personally I think it's valued right or even too high. There needs to be more uses for the currency and incentive for people to buy it.

I share your wisdom and perspective good sir - thank you

There are some big plans for the Spring, so I think taking into account the future value of these new features, Steem should correct upwards.

@marketreport @good-karma @jerrybanfield

Update on 27-Nov-17: The price of STEEM has moved up as I expected (see above) and is now at $1.17. If it can break above $1.47 in the next few weeks, IMHO it has a very bright future.

@marketreport @good-karma @jerrybanfield