Why stock and crypto traders never share their stop losses, why I did and what happened

Monday August 1, 2016 6:30 AM

Let me start by asking: Anyone else out there have experience posting stops? I would love to hear how it's effected your trading--please share in the comments!

I can't tell you how many times trading gurus make big calls without laying out their exit plans / stop losses. Of course, these guys are always still in the trade when the big gains finally come even after huge moves against their position. They never get stopped out.

Meanwhile, you follow their entry and bail with a huge loss when your investment plummets 20-30% or more.

At least that's happened to me. Ever happen to you?

So, even though no one should trade strictly based on a guru's trade, it's clear that gurus not sharing stops can hurt investors who follow them. So why don't they just share them?

If you ask the gurus (and I have) they'll tell you they don't want the public or the trading bots to see their stop because then they're sure to get it taken out.

Even if that's true (not a high probability) that's not the main reason. Let me show you the real reason from my own recent trades:

"LET ME SHARE MY HARD STOP"

From last friday's blog post:

REAL TIME Stops For ETC STEEM ETH- w charts

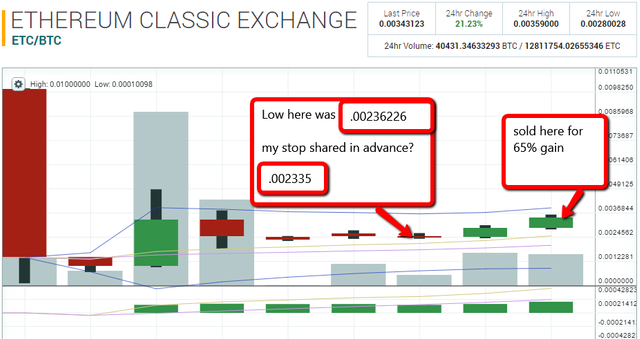

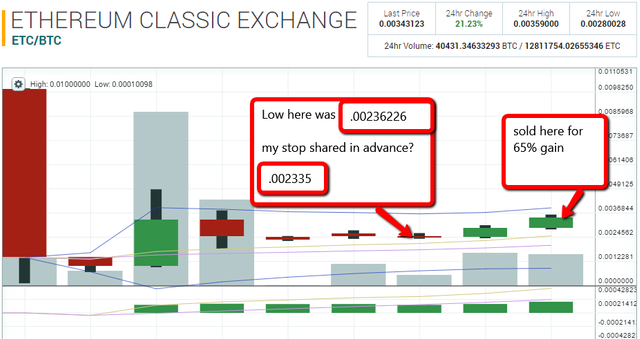

...If ETC (Ethereum Classic) drops below this 5 minute candle at .002335 again I will exit HARD STOP."

As you can see on the chart above ETC's low since this post was .00236226.

Just a few ticks lower for ETC and I would have missed the bus on what proved to be a 65% Gain (Sold this morning at about .00348.)

It would be embarrassing to call a big move like that correctly, while LOSING money if I'd gotten stopped out, right?

More importantly, who wants to follow a trading guru who gets stopped out of some of his or her best calls?

PUTTING MY ASS ON THE LINE -- REAL TIME

With my blog and social media posts, I suppose I'm applying for the position of trading guru. Why? Because I've been burned following trading gurus in the past and I believe there's a better way that can keep inexperienced traders safe in the incredibly risky cryptocurrency markets.

For the last 2 months, I've bared my soul to anyone reading by sharing my trades right when I make them. You can review my blog and twitter and see how I've earned 100% gains trading since that time, trade by trade, in real time.

But until last friday's post, I had not shared my exact stop on a trade with the public.

Let me tell you, sharing my stop loss was WAY more difficult than sharing my trade entries in real time (which ain't easy).

I'm glad I did it, and of course I'm glad the trade worked out. But, outcome aside, the experience definitely gave me a better understanding of why other gurus don't share stops.

BONUS: if you check @cryptopatterns twitter from this morning, you can see I've shared my updated stop on an active Steem trade.

The next challenge will be to write a post like this on a trade where I MISS the 65% gain -- then we'll know I've reached the next level as a trading guru.

NOTE: NOTHING IN MY POSTS IS INTENDED TO BE TRADING ADVICE. Please do not base your trades on any information presented in the materials on this blog as it is for information and entertainment purposes only. You are 100% responsible for your own trading decisions.

Thank you for sharing your insights. Following the daily /r/ethtrader subreddit, I don't often see the stop-losses, like you mentioned.

What's your strategy for defining your stop losses? I often see them getting triggered too fast due to high volatility.

Keep posting and you'll be considered Guru quickly ;)

Hey qkyrie thanks for the upvote. I was going to answer your question on my stop loss methodology and soon realized it needs a post all on it's own -- so I'll get to that soon and share the link when it's up. Thanks for the great question because it's definitely involved to get comfortable taking losses! Any other questions just ask.

Hi! This post has a Flesch-Kincaid grade level of 6.4 and reading ease of 86%. This puts the writing level on par with Stephen King and Dan Brown.