It's time to start paying attention to Steem

Since the Steem blockchain officially launched and produced its first block on March 24, 2016, a lot has happened. Steem has transformed from a project that many cryptocurrency investors initially thought was a scam / “pump-and-dump” campaign, to an established and respected blockchain project with several of the most heavily used decentralized applications (DApps) in the blockchain industry.

Today STEEM is one of the top 50 cryptocurrencies (based on market capitalization), and is getting ready to position itself as serious contender for the top 10 cryptocurrency projects once Smart Media Tokens (SMTs) launch in Q1 of 2019.

In this article, we will explore the Steem blockchain and STEEM cryptocurrency, looking at both the positive aspects and negatives. The goal of the article is to be as comprehensive of an overview of Steem as possible, so those interested in Steem can learn more about it.

[image source @podanrj]

This work is licensed under a Creative Commons Attribution 4.0 International License.

Disclaimer

Before we get too far into the article, let’s get the fun “legal” stuff out of the way..

This article does not constitute investment advice. Everything in this article is just my own personal opinion and observations. Anything that could be considered a prediction of the future has no guarantee of coming true. It is possible that information in this article is (unintentionally) inaccurate or incomplete. Do your own research before making any investment decisions. The author of this article holds STEEM tokens as well as several other cryptocurrencies.

Steem’s History

Steem is an established blockchain project that has been around for over two years, and there is a lot of history with the project (both good and bad). Not everything has gone exactly as planned; mistakes have been made, and some of the decisions made along the way may not have been the right ones in hindsight.

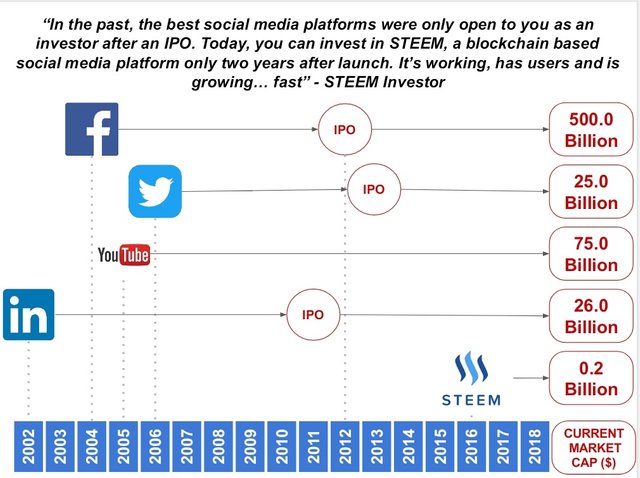

It is interesting to see investors pouring billions of dollars into ICOs each year. It is understandable why though. ICOs are easy to speculate on. There is no product yet. All that there is are hopes and dreams of a future yet to come. It is easy to imagine what an ICO could become, when nothing has been built yet.

A live project is much harder to speculate on. We know what the project will do. We know the mistakes that have been made. We know what its limitations are.

While many would point to the mistakes and shortcomings of a project as evidence for investors to stay far far away, I believe there is a lot more to be learned by reviewing what has happened to see how the project is evolving. To quote Steemit’s Content Director @andrarchy, I would much rather see a project that has “gotten punched in the face a few times and is still advancing forward” than one that is still in the conceptual stages and hasn’t had to deal with anything major going wrong yet.

Let’s start by exploring a few of the things that didn't go so well for Steem.

Questionable Launch

If you look at the launch (and re-launch) of the Steem blockchain on BitcoinTalk.org, the reaction from many was far from pretty. A lot of of commenters indicated that insufficient documentation was provided on how to setup a node, the project seemed like a scam, and many suspected it was just an elaborate pump-and-dump scheme by the founders.

Later, one of the founders (Daniel Larimer, who also founded EOS) wrote an article titled How to Launch a Crypto Currency Legally while Raising Funds, which explained why the project was launched the way it was. What it boiled down to was that in order to not be considered a security, they couldn’t pre-allocate any tokens to themselves (or others), and they had to complete the currency and protocol prior to launch. Yet, at the same time, they wanted to acquire a large portion of the initial tokens for themselves in order to fund the ongoing development of the project. They accomplished this by mining a large portion of tokens for themselves after the blockchain was officially and publicly launched.

While it may initially seem shady for the founders to have mined a large percentage of coins for themselves, the intention and use of those coins is really what matters. If you fast forward to today, it is pretty clear that Steem was not a pump-and-dump scheme. There was a long-term vision for the product, and that vision is in the process of being carried out today.

What is interesting is that if an ICO were to award the founders and core development team with a large share of initial tokens, investors would not really have a problem with that. Many blockchain ICOs allocate 30-40% of their tokens to the founders / dev team. The main difference between what these ICOs and Steem did was that with Steem there was no ICO - so any initial tokens had to be acquired through mining.

Incomplete Product

When the Steem blockchain (and front-end website steemit.com) was launched, they were launched as an MVP (minimum viable product). The majority of features that would be necessary in order for Steem to compete with Reddit, Facebook, and other social media giants had not been completed yet.

Over the past two years, the development team has been building features around us. We have seen basic stuff like follows and sharing (called “resteems”) added, as well as more advanced features such as escrow payments and the ability to collaborate and share post rewards among multiple authors. The project has come a long way already, and new features continue to be developed and added, but there is still a lot more work to be done before the platform will truly resemble what most users expect to see when they think of a social media platform.

While it is easy to look at a completed product that is already well-polished and has all the fancy bells and whistles to attract and retain users, it is much harder to look at a work-in-progress project and see the product for what it will likely become. Steem is still a “work-in-progress” project. What you see today is still only a preview of what it will likely become over the next 1-2 years.

Token Distribution and Misuse of Stake

There is a small group of people who were very-early-adopters, as well as some large investors who have bought into the platform since its launch. This small group of individuals (combined) holds a very large stake in the platform, and collectively they have significant influence over the decisions of what content gets rewarded, and which witnesses are voted into (and out-of) power.

A lot of users have become upset when these large stakeholders (i.e. “whales”) have used their stake in ways that benefited themselves (or their friends) more than the community as a whole. Users have also gotten upset when large stakeholders have downvoted content from other users in ways that have not always seemed right/fair. (This has especially been true in cases when the stakeholders in question have been the founders.)

Even though each user's stake is theirs to use however they choose, the feeling of unfairness that has arisen due to the inequality of stake among the users has harmed the user experience and perception of the platform.

Over time as new investors buy into the platform the control of this “small group” is being diluted, although it will likely take a significant amount of new investors coming in before the influence over the platform becomes more widely decentralized.

Steemit, Inc. Witness Voting

When I first joined the platform, the rumor on the street was that only the super-early-adopters and people that were friends with Dan L. / Steemit, Inc. were voted in as witnesses. It was also implied that witnesses had to go along with what Steemit, Inc. wanted - or they would be voted out.

While that may have been the case early-on, it does not seem to be the case anymore. Myself (and several others) who had no prior connections to any of the early adopters or Steemit, Inc. have made our way into the top 20 witnesses by working hard and proving our worth to the community.

Back in March 2017, there was a hardfork where the witnesses were not in support of the changes that Steemit, Inc. proposed (hardfork 17). Steemit ended up changing the code and releasing a new hardfork (18) to one that the witnesses did support.

Since that time as well, the Steemit, Inc. employees who were running witness nodes (such as @roadscape) have suspended their witness campaigns, and Steemit, Inc. employees are no longer participating in witness voting.

To me, this demonstrates a huge step forward in that the core development team (Steemit, Inc.) is respecting the wishes of the other stakeholders, even though they still technically have an overriding stake.

Steemit, Inc. Communication

One of the bigger complaints about the project when I joined was that the communication and transparency from the core development team was severely lacking. Nobody knew what they were planning to work on, promises were made and never kept, and there was little explanation for any decisions that were made.

Over the past six months, they have made a complete “180” and have started communicating regularly with the community. Their account (@steemitblog) has been making regular posts every week, and they have been doing an excellent job telling everybody in the community what they are working on, and what we should expect to see happen. There are also now open lines of communication between the core dev team and the witnesses, community developers, and several of the largest stakeholders.

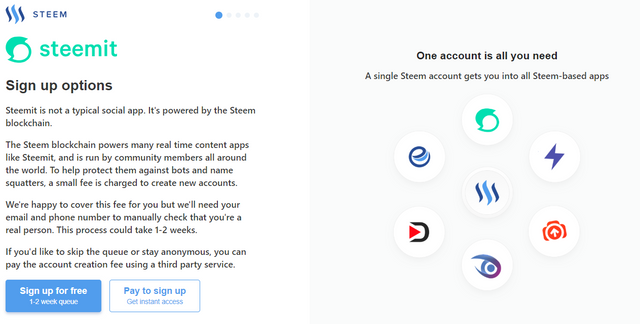

User Onboarding

When I first found out about Steem, they were not accepting any new signups. I applied to be added to their waiting list, and eventually got an email a few weeks later to create an account. For an “everything now” society that wants to have everything right away, this was a little bit of a deterrent; but at the same time I felt that I was on a list to join a cool new exclusive club.

The primary (free) signup service to create an account has been streamlined a bit, although there are still often long wait-times for users. If you go to https://signup.steemit.com/ you can apply for a free account by verifying your email and phone number. The signup is free, but expect to wait 1-2 weeks to get an account.

Alternatively, third-party services such as Blocktrades.us and AnonSteem have sprung up, which allow users to pay a small fee to instantly create a Steem blockchain account. More information on the available signup services will be covered in a section below.

Steem Features

Now that we have explored some of the shortcomings of the project, let’s look at some of the things that Steem does well at.

Three Second Confirmation Times

Unlike the Bitcoin and Ethereum blockchains, where sending tokens to other users often takes several minutes (sometimes hours), transactions on the Steem blockchain are lightning fast - confirming in approximately three seconds. This means that users can transact with each other in real-time, making digital payments via the Steem blockchain practical for everyday purposes.

Easy to Remember Wallet Names

Most blockchains have difficult to use wallet addresses like 38hDQKmMgJQeK74USYuP4SRWnots2rk5h7 (BTC) and 0x7157Da4744f3df0CC2B42a02f1229d25D2b00E5A (ETH). This makes sending payments very difficult for “regular people”. With Steem, a person’s wallet address is the same as their account name (such as timcliff), which means it is much easier for users to send tokens to friends or businesses.

Vested Stake Instead of Transaction Fees

With most blockchain protocols (such as Bitcoin and Ethereum) every time you make a transaction, the blockchain charges a small fee to process the transaction.

With Steem, there are zero fees for all transactions. Instead, the blockchain requires users to purchase and “vest” some STEEM (i.e. HODL for 13 weeks) in order to freely transact. As long as users are holding a small amount of vested STEEM (called “Steem Power”), the blockchain allows them to transact for free. The more Steem Power an account has, the more they are able to transact.

This makes the Steem blockchain an excellent candidate for projects looking to use microtransactions, or games such as CryptoKitties which require users to complete multiple actions in order to play the game. This allows businesses and users to focus on what really matters - i.e. playing the game - rather than worrying about how every action taken will result in fees.

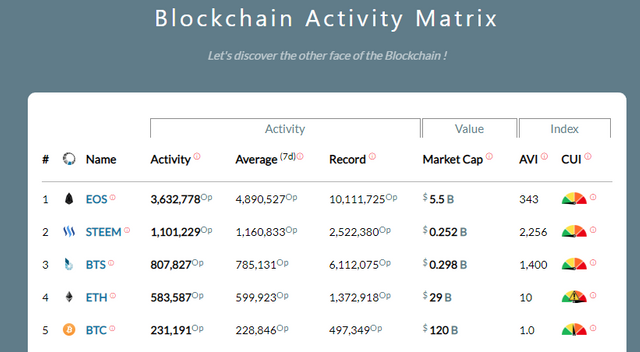

High Volume of Daily Transactions

Application developers who are interested in creating blockchain powered DApps that may need to support millions or billions of transactions per day should seriously consider the overall capacity of the blockchain network they are building on.

Steem is one of the most heavily transacted blockchains in the world. With over 1M transactions per day, the only other blockchain producing more transactions is EOS. Steem is one of the few blockchains currently in existence that is positioned to scale to supporting billions of transactions per day.

[Image source blocktivity.info]

Annual Inflation

The Steem blockchain originally launched with 100% per year inflation. Back in 2016 this was deemed unsustainable, and the inflation rate was lowered. This got changed along with several other improvements to the economic system of Steem as part of hardfork 16.

Since hardfork 16, the inflation rules have been defined as:

Starting with the network's 16th hard fork in December 2016, Steem began creating new tokens at an annual inflation rate of 9.5%. The inflation rate decreases at a rate of 0.01% every 250,000 blocks, or about 0.5% per year. The inflation will continue decreasing at this pace until the overall inflation rate reaches 0.95%. This will take about 20.5 years from the time hard fork 16 went into effect.

Digital Content on the Blockchain

Steem offers users the unique ability to publish and store different types of content directly and permanently into the immutable ledger of the blockchain as plain text. Once stored in the blockchain, data becomes available publically for developers and front-end websites (such as steemit.com) to use.

(source)

Censorship Resistance

Because the content that is stored on the Steem blockchain is distributed across the globally distributed network of decentralized Steem blockchain nodes, there is no single place that the content is stored. This means that it would be very difficult for an authoritarian government or party to force the removal of any content. It also means that if individual websites (such as steemit.com) decide to censor what content they display via their website, users will still be able to access the uncensored data through other sources.

Rewards Pool

The users who produce content and other types of contributions are adding value to the network by creating material that will drive new users to the platform, as well as keep the existing users engaged and entertained. This aids in distributing the currency to a wider set of users and increases the network effect.

The users that take time to evaluate and vote on contributions are playing an important role in distributing the currency to the users who are adding the most value. The blockchain rewards both of these activities relative to their value based on the collective wisdom of the crowd collected through the stake-weighted voting system.

(source)

DPoS Governance / Hardforks

By defining the rules for when a hardfork occurs, the witnesses elected within the DPoS framework can quickly and efficiently decide on whether or not to move forward with a proposed hardfork, allowing the Steem blockchain protocol to evolve more rapidly than most others.

The Steem blockchain has already successfully forked 18 times, and each time a hardfork has occurred, only a single chain has persisted after the fork. This is very different than what frequently happens on other blockchains when they decide to fork, where the result is often two separate chains after the fork (such as what happened with Ethereum Classic, Bitcoin Cash, and Bitcoin Gold).

Because the witnesses are elected by the stakeholders, they are naturally incentivized to vote in favor of changes that are in the best interest of Steem. This positions the Steem blockchain (and other similar DPoS protocols) to uniquely and quickly adapt to changes in order to continue innovating.

(source)

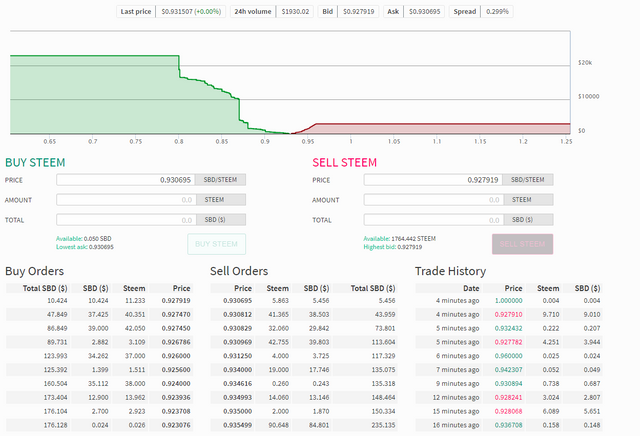

Decentralized Exchange

The Steem blockchain offers a decentralized token exchange, similar to the Bitshares exchange. The exchange allows users to trade their STEEM and SBD tokens through a public decentralized peer-to-peer market. Users are able to place buy and sell orders, and order matching is performed automatically by the blockchain. There is also a publicly accessible order book and order history which users can use to analyze the market.

Users can interact with the exchange directly using the blockchain’s Application Programming Interface (API), or use a Graphical User Interface (GUI) such as the one on steemit.com.

(source)

Payments Through Escrow

The irreversible nature of blockchain transactions is an important security feature, although there are many cases where users may not be comfortable sending their tokens to another individual without a way to get them back if the other user does not hold up their end of the agreement. The Steem blockchain provides a way for users to send coins to each other along with a third party designated as an escrow service. The user acting as the escrow service is able to determine if the terms of the agreement have been met, and either allow the funds to be released to the receiver or returned to the sender.

(source)

Hierarchical Private Key Structure

Steem employs a first of its kind hierarchical private key system to facilitate low-security and high-security transactions. Low-security transactions tend to be social, such as posting or commenting. High-security transactions tend to be transfers and key changes. This allows users to implement different levels of security for their keys, depending on the access that the keys allow.

(source)

Stolen Account Recovery

If a user’s account is compromised, they may change their keys using their private owner key. In the event that the attacker is able to compromise the private owner key and change the password on the account, the user has 30 days to submit a previously functional private key through Steem’s industry-first stolen account recovery process, and regain control over their account. This may be offered by a person or company who provides account registration services to Steem.

It is not mandatory for the registrar to provide this service to its users, but it is a feature that is available for registration services to offer their users if they choose to support it.

(source)

Multi-Sig Authorities

The Steem blockchain allows an authority to be split across multiple entities, so that multiple users may share the same authority, or multiple entities are required to authorize a transaction in order for it to be valid. This is done in the same way as Bitshares where each public/private key pair is assigned a weight, and a threshold is defined for the authority. In order for a transaction to be valid, enough entities must sign so that the sum of their weights meets or exceeds the threshold.

(source)

Multiple Reward Beneficiaries

For any given post there may be a number of different people who have a financial interest in the reward. This includes the author, possible co-authors, referrers, hosting providers, blogs that embedded blockchain comments, and tool developers. Whatever website or tool that is used to construct a post (or comment) will have the ability to set how rewards from that comment are divided among various parties. This allows for various forms of collaboration, as well as a way for platforms that are built on top of the Steem blockchain to collect a portion of the rewards from their users.

(source)

Other Positive Aspects of Steem

Beyond the technical capabilities of the Steem blockchain, there are many other positive things happening with Steem.

Gateway to Cryptocurrency

Steem is often called the “gateway to cryptocurrency”, because it is specifically designed to attract, onboard, and retain “regular” everyday users. As more people join and begin using Steem-powered apps, that is more people being introduced to cryptocurrency. It's a real gateway to the decentralized world.

Lots of DApps with Real World Adoption

The Steem blockchain has several of the most heavily used DApps in the blockchain industry. The most frequently used DApp is steemit.com, which receives over 250k unique visitors per day, and continues to grow in popularity. There are also hundreds of additional functioning DApps built on top of the blockchain which are being used by “regular everyday people.”

Just to highlight a few of the popular DApps built on Steem:

- Steem Monsters is a collectible card game where card ownership and game results are all published and verifiable on the Steem blockchain.

- Utopian.io is the only platform rewarding contributions to Open Source projects by utilizing a decentralised, vote-based reward system built on top of the Steem Blockchain.

- Fundition is a decentralized crowdfunding platform which uses the Steem blockchain to raise money for projects.

- SteemPeak is a crisp and clean user interface that users can use to interact with the Steem blockchain (similar to steemit.com).

- DTube is a platform similar to YouTube that allows users to upload videos and receive cryptocurrency rewards based on their content.

- What - Q&A is a decentralised Q&A platform on the Steem blockchain that rewards users for asking & answering questions.

- Steem Snake is a variation of the classic Snake game where users can play and earn STEEM.

- D.Sound is similar to DTube, although it is specifically designed for musicians and creators of audio content.

- SteemGigs is a freelance services marketplace (similar to Fiverr) that accepts STEEM cryptocurrency as a form of payment.

Community Developers are a Priority

The core dev team has been focusing on building out the infrastructure and documentation to support third-party developers who are interested in building DApps on Steem. Their Developer Portal is receiving regular updates, and there is a SteemDevs Discord channel where developers can talk with each other about the projects they are working on and receive/offer support.

Steemit, Inc. is Hiring

The core development team has been (and continues to be) focused on hiring new talent. Interested parties can check out their available job listings at https://jobs.lever.co/steemit.

Community Contributions to Hardforks

As a testament to decentralization, community developers have started contributing changes to the blockchain code to introduce changes that have support from members of the Steem community. In the upcoming hardfork 20, there are multiple changes included that were developed by members of the community and submitted to the official GitHub repository as pull requests.

Tapping into the Steem Community

Entrepreneurs in the cryptocurrency sphere have discovered how much potential there is in tapping into the Steem community. There are around 100,000 active users on Steem who have an interest in cryptocurrency, with multiple platforms available to reach the entire audience.

- The Byteball cryptocurrency project had over 70,000 Steem accounts register to use their platform after offering an airdrop to Steem account holders.

- When developers launched the alpha version of Steem Monsters, a collectible card game similar to MTG or Hearthstone run on the Steem blockchain, they received over $200,000 worth of card sales within the first two months.

As the platform continues to evolve and more users sign up, there will be even greater opportunity for developers and projects to get involved with Steem.

Looking Forward

Advertisements

Online advertisements are a billion dollar industry. As the Steem community continues to grow, there will be more and more opportunity for entrepreneurs and businesses to market to the Steem community in the form of ads. Once the size of the community reaches critical mass, the potential for a large increase of capital into the ecosystem focused on advertisements is likely.

Coinbase Custody

Coinbase Custody is a digital asset storage solution for institutional investors. They recently announced plans to consider adding 40 new digital assets, including STEEM. If they move forward with the listing, more institutional investors will have the opportunity to add STEEM to their portfolio.

Smart Media Tokens (SMTs)

Smart Media Tokens will introduce new ways for publishers to monetize their online content and user-bases, based on the existing Steem blockchain technology. The protocol changes to support SMTs (scheduled to be completed Q1 2019) will add the capability for projects to launch their own tokens on the Steem blockchain, similar to how the Ethereum blockchain supports the launch of ERC20 tokens.

Unlike ERC20 tokens however, SMTs will also support the same types of features and properties that are available with STEEM - such as feeless transactions, three second confirmation times, and distribution of token emissions via a proof-of-brain rewards pool.

With SMTs, projects will be able to conduct ICOs in order to acquire funding to launch their project. This will fuel the growth of new powerful DApps built on Steem, as well as tap Steem into the billion dollar ICO industry.

SMTs will also allow niches to develop within the larger Steem ecosystem, by allowing a community to form their own token distribution among their members, while having full influence/control over how the rewards pool for their SMT is distributed.

Other Information about Steem

Account Creation

Unlike BTC and ETC wallets where anyone can create a free wallet address out of thin air, new accounts on the Steem blockchain must be registered and paid for. There are several ways to create a new Steem blockchain account in order to securely store tokens and interact with the social side of the blockchain.

- https://signup.steemit.com/ offers one free account (paid for by Steemit, Inc.) to each individual who applies. It requires a unique email address and phone number to verify a user’s unique identity, and the verification process may take up to two weeks. This still remains the primary signup method, since the account creation is free.

- BlockTrades.us offers a paid account creation service, where users can instantly create a Steem blockchain account by paying a small fee. They accept BTC, ETH, LTC, STEEM, and several other cryptocurrencies.

- AnonSteem is another paid account creation service, with extra support available for those who which to remain anonymous. Payments are accepted in BTC, LTC, and STEEM.

- SteemCreate is a paid account creation service that accepts payments via several major credit cards.

Steem Wallet Apps

There are several wallets that can be used to securely hold and transfer STEEM tokens:

- steemit.com has a built in wallet that is available to users after they login.

- steemwallet.app is a fast and secure open-source wallet for the Steem blockchain, available on iOS and Android platforms.

- Vessel is an open-source desktop wallet for the Steem blockchain that you can run on your computer without needing to run a local instance of the blockchain. Technically the wallet is still in “alpha”, although it has been in existence and heavily used for over a year. It is one of the most popular wallets among the community, and is trusted by many of the large stakeholders. Users can download and compile the source code, or simply download the pre-compiled executables. The wallet is supported on Windows, Mac, and Linux platforms.

- eSteem is an all-in-one wallet and platform application with advanced escrow and vesting route features. The app is available for iPhone, iPad, Android, as well as PC, Mac, and Linux devices.

Steem Blockchain Interaction

- cli_wallet is the officially supported command line interface wallet for the Steem blockchain. Using the cli_wallet does require you to download and compile the Steem blockchain source code, or use the officially supported docker images. It is possible to host and run a local instance of the Steem blockchain and connect the wallet to that, or connect the wallet to one of the public RPC nodes.

- There are also officially supported JavaScript, Python, and Ruby libraries that can be used to transact with the Steem blockchain.

Longer Term Investment Options

The Steem blockchain offers STEEM token holders additional benefits if they decide to “power up” their STEEM tokens. Powered up STEEM tokens become locked into a 13-week “vesting” smart contract called “Steem Power” (SP), whereby the tokens cannot be transferred or traded for as long as they remain powered up.

SP can be “powered down”, which turns the tokens back into liquid STEEM over a period of 13 weeks, so they can be transferred and traded again.

Some of the benefits available to SP holders include:

- Ability to make more feeless transactions on the Steem blockchain.

- More influence over the distribution of the rewards pool.

- Earn curation rewards by voting on content.

- Vote on the witnesses who power the DPoS blockchain.

- Passive income options.

Many SP holders use their influence over the rewards pool to incentivize and reward the users who are making the greatest contributions the platform. Voting to reward contributions that are likely to add value to the Steem platform is an indirect way to make the value of their STEEM tokens go up.

SP holders may also decide to delegate their influence to projects and communities that benefit the Steem platform in various ways such as Curie and SteemStem.

There are delegation markets where SP holders lease the use of their SP to other users in the community who would like to have additional voting influence.

Businesses who hold SP can use their influence to incentivize bloggers who write positive things about their products or services.

Oracle-D is a service that SP holders can use to have new media continuously produced for them by professional content creators. Because the content creators are paid with rewards from the Steem rewards pool, the SP holders do not actually have to pay to have content produced. In fact, the SP holders can even earn a dividend (called “curation rewards”) from the money that the content creators earn from their articles.

Exchanges

STEEM has been listed on several of the major cryptocurrency exchanges, allowing investors to purchase STEEM tokens using other cryptocurrencies such as BTC and ETH.

Some of the exchanges where STEEM can be purchased include:

Conclusion

[image source @kabir88]

I hope this article has helped to inform you about everything that is happening with the Steem blockchain and STEEM cryptocurrency. If you have any questions about Steem, feel free to reach out in the comments below or email me at timcliff.steem.witness ‘at’ gmail.com.

Whoa! What a read. I love it 1000% first thank you for posting the history and the future of the platform in a comprehensible post.

I came across this platform by accident over a year ago and I liked the concept, almost seemed too good to be true at first and realistically I am pretty close to computer illiterate, especially this whole blockchain and crypto thing was a foreign concept to me. With all it's flaws I never regretted it and it's given me the opportunity to learn a lot, still have a lot to learn but I think i'm one step ahead of the rest of my peers that still ask "WTF is bitcoin" . I keep informing them of steemit being the future of social media which I always believed from my early days here, sure it's not perfect but it's just growing pains, for a while with the lack of communication I was almost wondering about it's future and if anyone even cared. Clearly with your article that is a big yes and makes me optimistic for the direction the platform will go in the future.

I really hope coinbase adds steem as one of the currencies and that would probably cause investors to take the platform more seriously and possibly attract more users. The trending page and bidbot abuse still needs to be addressed and I don't think it's the first impression we want new users to get but it is evident that some of the bot owners are starting to take more responsibility as to what their business promotes.

One thing I would like to see is being able to buy steem directly from the platform via credit/debit card or whatever without having to buy thru a third party or having to buy another currency to convert, or perhaps someway to make gift cards exchangeable for steem, could be used as a promotion tool in stores as well, kind of like a apple card. That is the one crypto project I really believe in because of it's fast and painless peer to peer transactions so far.

Overall , even without much computer knowledge, I found steemit easy to learn, seems overwhelming and much more intimidating than it actually is at first with all the information to take in. I still struggle to explain to my friends what is steemit and how it works and get them to join but I will share this to my other social media because you did such a great job at explaining the platform, better job than I will ever do!

I am hopeful that communities and SMTs will help to address this issue.

I think everyone wants this :)

The problem is it is difficult to do in terms of the regulations in the US.

Hopefully someone will eventually implement it though.

Thank you for your response!

Check my some Indian recipe

NexusBot.io - Best Crypto Trading Bot

Welcome to NexusBot.io

I think many of the problems we face today will be solved as more tools come online...I have faith in Steem and have for a while. Kind of hard when shit's getting rewarded rather than good content though. It's going to be interesting when Steem comes back from this dip, as we might have whole new whales...or at least dolphins and orcas.

In regards to the ICO's dolling out tokens to themselves...everyone does it...but it doesn't mean that people think it's right, or that investors don't consider how much they kept for themselves. It has an effect. When you put it in full context, how Steemit mined Steem is kinda cool actually in a way, especially if at that time anyone was technically capable of mining Steem. I wish I had known about it then. Not like I have a mining rig though.

As for the CryptoKitties...not possible on the Steem blockchain. We aren't Etherium. We can't do the whole distributed app thing. That means that we have to make any apps centralized in some way, or work cross-chain. We can do ownership of assets though! I hope SMT's allow you to launch coins with different capabilities, then we would be able to have things like CryptoKitties. If we were to do them on Steem today, we'd have to have a central server, or set of servers, that were crunching the numbers to make the kitties.

Regarding CryptoKitties, it is not possible to do in the same way as it is done on Ethereum, but it can be done using a process called 'soft consensus'. It is what SteemMonsters uses, and is explained here: https://steemit.com/steem/@steemitblog/steemit-interviews-steemmonsters.

I had read that interview when it was first published, but I had mostly just sort of skimmed it. I read it carefully just now and I'm still not quite sure how they use soft consensus...but while reading it I did kind of have some ideas on how you might be able to do a fully distributed app on the Steem blockchain.

The only way I can really think of possibly doing it is by having people run software on servers and their home computers to validate "transactions" and then pay them with proceeds from the game for their services. That would sort of lose some of the benefits of Steem, but you have to pay for servers. So, rather than running servers yourself, you would have a sort of smart contract that pays people for running servers for the app.

Perhaps you know of some other resources to read on this? I'm going to be doing a deep dive into it for the next few months, as I would like to eventually figure out how to do some kind of blockchain based games and apps. Even if I never end up making anything successful, learning's fun.

There are also extreme benefits of figuring out how to do this on Steem. Plus, I like Steem.

The basic idea behind soft-consensus is that a set of rules are written for how to interpret the data on the blockchain, and the application follows those rules. The blockchain itself will not reject blocks with "bad data" (that doesn't follow the rules), but the application layer will. It is 100% publicly auditable, since the data is all in the blockchain.

Great points brought up here.

One point that was missed which ties to a post I wrote this morning is the fact that the distribution of STEEM is spreading out. With the reward system the way it is, with 75% going to content creators, this means that there are many more people earning SP today than when I joined 13 months ago.

Also, we are seeing a lot of SP delegated from larger accounts to the applications, thus making them mega accounts in terms of their voting power. This is important because they go around upvoting the content that is placed on their platform, a great deal which is done by smaller accounts.

This is furthering the push of SP into the smaller accounts, giving them even a greater percentage of the reward pool.

Yeah, you're right that the distribution of Steem is spreading out. In some ways that sucks, as it feels REALLY hard to get substantial upvotes, but it should also mean that it's harder for some accounts to abuse the system to get upvotes on their crap.

Great article written in a balanced, open and honest way. Resteemed!

Agree 100%! also resteemed!

In the interest of fairness, and not just a Steem cheerleading session, here's some info on the problems with Proof-of-Stake, Delegated or not.

Also, when the ENTIRE CHAIN froze and locked out people, I'd consider that a rather big "oopsie" that should be mentioned, in addition to the abysmal retention rate -- 13%.

Reference:

https://medium.com/@hugonguyen/proof-of-stake-the-wrong-engineering-mindset-15e641ab65a2

I encourage people to look into the technology deeper than a "everything is great" post. And I'm not even getting into the bot-infested problems Steemit has, either. That has been covered elsewhere.

The incident was fully explained here: https://steemit.com/steem/@steemitblog/steem-blockchain-patch-issued

In my view, what happened was dealt with appropriately, and I saw the incident as more favorable than unfavorable in terms of the way it was dealt with.

In terms of technical details, it was much less about DPoS vs. PoW, and much more about a corner case in the consensus logic built on top of the DPoS technology.

As blockchain consensus logic starts to become more and more complex (as many of the functions on Steem are) the possibility for unexpected scenarios and glitches also increases. Incidents such as this are likely to become more prevalent as the blockchain industry advances.

Having the blockchain freeze up is actually what you want to have happen in a situation like this, because it prevents the unexpected scenario from turning into something more serious like a loss of coins.

I have severe reservations about a system whose acceptable failure mode is "stop everything", especially when it keeps getting touted as the "best" solution and the "most transacted" chain.

I'm sure you can see how both of those goals diverge?

Also, why don't more exchanges carry Steem to begin with? You've obviously been around for a while, what is the reason for severe lack of fungibility?

To be honest, I'm not holding my breath. The reason you need complex "solutions" to these problems is because the underlying PoS forces you to -- and by doing so, they're just bandages over the problems Proof-of-Stake introduces -- either directly or tertiary.

Its just like Ethereum and their gradual realization that they can't scale, so they come up with increasingly complex answers instead of refactoring their base assumptions.

Yep. Obviously never ever having a single software glitch would the the goal.

We are a top 40 coin (not a top 20). The integration with STEEM is more complex than other chains. Many exchanges also want $1M+ listing fees. We have been getting added to more and more exchanges though. Higher marketcap would help.

I'll have to disagree with you here on a technical level. The glitch we are talking about would have happened on a PoW chain too, if the consensus rules had been written on top of a PoW chain. It had nothing to do with PoW vs. DPoS.

Can you elaborate on how the issue we are talking about is an instance of STEEM running into a limitation that needs complex answers, and what the base assumptions are?

While I can empathize with your exasperation with the sort of empty optimism that often replaces deeper analysis, I'm a bit confused with your outrage that all or most posts about STEEM on the STEEM blockchain are generally optimistic about its future. Most people with a more scathing outlook tend to leave the platform or become relatively inactive eventually.

Also, though an unprecedented and rather scary event (many blocks being missed while the chain froze), what would be a better way of dealing with a similar anomaly than halting things so that everything remains safe until a solution is found and adopted by a supermajority of witnesses, in your view?

"Most people who hate us, leave us, so what's the big deal?"

It matters because given the abysmal 13% retention rate, when you only have a bunch of hooray-henries populating your platform - then there's something amiss.

The best question would be - "Why does Proof-of-(mis)Stake have this kind of edge case where we shut the whole thing down?" Here's the answer -- because its an inferior solution that requires trust of other nodes by its very design.

Everything bolted on top is because of this base flawed assumption. It adds complexity and gives "edge" cases a huge leg up in happening more than just "once in a while."

I'm here to watch the PoS fail-train come to its logical conclusion. Someone needs to witness it without being blinded by unicorn-vision - if only to write the sober post-mortem the day after.

Yeah, the terrible user retention rate is one of Steemit's biggest problems, at present. To be clear, I would prefer to have both "hoorah-henries" and "hellno-hanks" around, because it makes for more enriching discussion.

I think you have me wrong though. Just because I invested heavily in STEEM doesn't mean I believe PoS will be a sustainable system in the scale of decades. I'm too uneducated on the underlying technology to conclude that with confidence. I also don't think it will keel over tomorrow, next week, or next year, though.

You still didn't answer my question:

but I'm guessing you would say there is no real solution because DPoS is an inherently dysfunctional system in your view.

Hey @d-pend. I suspect that through the same premonitory steps and walkarounds of @talltim, there are yet a few coherent and eloquent "hellno-hanks" here with some interesting and illustrative stuff worth a read to enrich healthy discussions. Maybe everything is not lost and the "hoorah-henries" won't run away with the trophy so easily yet. };)

I'm kinda curious what would you think about that?

That was far from a cheerleading session. He actually started off the article listing the problems. Perhaps yours could have been mentioned as well but what platform or technology doesn't have those.

As to Proof of Work vs proof of stake opinions may differ but I know where I stand and we'll see where things end up.

The only thing mentioned were early start-up issues, not the entire blockchain seizing up like a suburban dad having a heart attack from shoveling too much snow off of his driveway.

And no, the PoS vs PoW isn't an opinion - its technical merits and drawbacks that aren't touched upon, because every post about Steemit is rah-rah go team - instead of taking a hard look at why it functions the way it does.

Steemit is going to have to do something radically different to change that 13% retention rate, that's for sure. But I doubt they have the will to refactor a system they're obviously emotionally invested in.

I think that Steemit will fade into the background as other projects emerge on its blockchain. The seizing up that I've seen has been on other blockchains.

Interesting - care to list any? Also, were they PoS based?

Inquiring minds want to know...

then why is it that many users are hodling?

it makes the platform look like monopolized specially when one gets to join and see how it works voting on one's own posts or comments

it also makes it look like you need to keep Steem or earn less even if your posts provides value

one experienced investor's few questions about it are ... why would you need to have so much SP just to have that much weight of voting influence? What good of an investment it would be if you can't sell and profit from it when the price is ripe ? How is this community different from the blue pill holders which empowers those who have more as well?

Would the reward pool be refilled during the HF20 like it did during the HF19 ??

I hope you get to reply, thank you very much.

PS upvoting my comment for visibility

The reason that influence is based on the amount of SP held is explained in the Steem whitepaper.

You can calculate how much an upvote is worth based on current conditions using this calculator: https://www.steemnow.com/upvotecalc.html

There are multiple ways to handle this. One would be to have some liquid STEEM ready to sell, while keeping the rest powered up. Otherwise, long-term holding is an option too.

I'm not familiar with that protocol, but the Steem blockchain is designed to empower those who hold more SP tokens more than those with less.

There are no changes to the rewards pool planned for HF20. You can read all of the changes here.

Fantastic article with a great history.

I was interested that EOS had more transactions than Steem and looked into it.

I'm not sure what is causing the high EOS transactions but it is not real activity like on Steem. All the EOS dApps combined only have about 10% of the 60,000 daily users of Steemit. See https://dappradar.com/eos-dapps

Block.one knows marketing. Whether it's real activity or fake, some people will fall in the trap - it proves that the production network of EOS is capable of running those 10 Mil tx/day. I believe we should prepare well and do something similar on steem too, because it wil prove without possible doubt that it can handle that amount.

Yes it will have a cost in terms of the size of the block log as @gtg was saying but you can't advertise for free. Being up there in blocktivity.info with a 8 640 000 tx/day (that's 100 tps) for a production blockchain with about 200 000 active users has a huge value for investors, and this is what we are talking about here.

Is the marketing potential of being up there in blocktivity with 9 Mil or 10 Mil tx/day worth the increase in the block_log size ?

I am both an investor - I know what investors look at.

And I am also a witness, @lux-witness, so I can gauge the two sides of the equation

My opinion is that the marketing value of reaching 100 tps on the steem mainnet is amply worth the cost of having to deal with a larger block_log

@timcliff, what do you think? What do other top witnesses think?

I agree. If a fairly simple technical change can put Steem in the 10 Mil transactions per day league it’s worth doing. You’re right that it will get investors attention.

Posted using Partiko iOS

I am against it. My view is that in time, the blockchain with the most 'real' activity is going to be the one to win out over the others. We don't need to generate fake transactions just to get better numbers.

Thanks for replying. Unfortunately in real life the best product does not always win. Betamax vs VHS is the typical example that is given in this cases, but it's not the only one.

True,the Bitcoin is not the best coin from the technology but still remains market cap leader because it was the first coin...

It steem, it is mostly bots.

Yeah, you're right...

Yeah, there seems to be quite a bit of unusual activity surrounding EOS.

A few accounts are spamming the network.

NexusBot.io - Best Crypto Trading Bot

Welcome to NexusBot.io

Great article!

I just shared it on Twitter (31.3K followers): https://twitter.com/iLoveSteem/status/1036617270917832712

You should've waited for the 11am Steem Blast ...

Great article @timcliff, thanks for taking time to write this up. Also, thanks for listing steemwallet.app

Shameless plug:

Interested in Steem and it's community? Come to the annual gathering, SteemFest 2018, this year in Kraków, only a couple of days after Etherdevcon which is organised pretty close by. Make it a Eurotrip!

Why is Steem not listed on DappRadar?

They have ETH & EOS apps but Steem Apps are much larger. Another reason Steem is not getting the attention it deserves.

This popular tweet re dApp usage just ignored Steem completely!

We had some discussion about that in our discord channel. It is something to pursue further, but we believe it is related to the way they measure the success of the DApps. Steem is an entirely different model, and our DApps probably wouldn't work for their ranking system.

Very interesting information Tim. Steem platform is one of the most innovative blockchain projects. What I like about it that is provides free transactions and also rewards the content creators and curators. However, there is one bad thing about it, it is highly addictive. Today, I competed six months on this platform and in this short period, I have learnt a lot from this platform.

I agree its a bit addictive, but in a good way, encouraging you to create good content, rather than trawl though cat memes and trolling.