Bitcoin: Part 2: Controlled Supply & Elliptic Cryptographic Function

In the ongoing #steemcryptochallenge, I have already published Bitcoin: Part 1. Today I will detail Part 2.

This publication will cover: Why Bitcoin is still the king of crypto in terms of the controlled supply and How does cryptography maintain the secrecy of Private key & ensures secure transaction in Bitcoin Network.

Bitcoin as an investment is a "store-of-value" & a "hedge against inflation, quantitative easing"

In the traditional financial system, a central bank is always at the helm of economic affairs to take a decision on inflation, quantitative easing, etc.

Inflation generally means an increase in the price of goods and services, but actually, it is the decrease in purchasing power. For example, when the Bank goes with quantitative easing during the recession, it results in an increase in the money supply. As a result, its purchasing power of fiat decreases relative to goods.

Deflation is just opposite to it. The value of the currency increases relative to goods and services.

The paradigm of money supply(how controlled or uncontrolled) serves as a bone of contention to the investors.

In a decentralized ecosystem like Bitcoin, there is no central authority. The currency supply, and its inflation rate, and the inflationary curve(YoY), etc all are defined by the algorithm, protocol.

In Bitcoin, it has an algorithm to determine how many Bitcoins will be minted each Block, what will be the rate, how that rate will be controlled over the course of the history of the Bitcoin, how much will be the maximum total supply ever for Bitcoin, etc.

In a decentralized network like Bitcoin, the Blocks are mined by the miners through the PoW mechanism. The genesis Block for Bitcoin started on 2009-01-03. Every time a Block is mined a certain number of BTC coins is also minted. As per the set algorithm, it started with a Block reward of 50 BTC per Block, however, this figure is not fixed and there is a reduction of Block rewards every 210,000 Blocks(which is approximately 4 years time). This is known as the Halving event in BTC.

Further, the maximum total supply of Bitcoin is 21 million only. Since it has a finite supply, in combination with the BTC halving event, the relative supply slows down with respect to time, making it scarce with each halving event. Put simply, Bitcoin follows quantitative hardening.

When BTC mining started in 2009 the Block reward was 50 BTC, then in the year 2012(Block height-210000), it halves with Block reward reduced to 25 BTC per Block, in the year 2016(Block height-420000), it goes through another halving event with the Block reward reduced to 12.5 BTC. The recent halving event was on 2020-05-11 at Block height- 630000, the Block reward further reduced to 6.25 BTC per Block.

The total supply of Bitcoin is a function of Block height and Block reward at any given time. During the initial years, it was increasingly faster(in supply), but as we go down, it gets increasingly slower. With each halving event, the Block reward halves, and the total supply gets closer to the maximum total supply(21 million).

The total supply of Bitcoin as of Oct 26 stands at 18.527 million.

This definite rule of controlled supply of the Bitcoin chain, together with a finite supply, makes Bitcoin scarce over the course of the history of Bitcoin. It makes a point for the investors to invest in Bitcoin which can shield them from the indefinite & uncontrolled supply associated with the fiat currency.

More than 89% of the total supply of Bitcoin has already been mined. Down the line, the total supply curve is further going to be flat, as the total supply is increasingly getting slower with respect to time.

The inflation rate in Bitcoin stands at 1.8% now, and it is going to be as low as 0.4% in 2025 after the next halving event. Most of the developing economies central Bank target inflation is 2%, Bitcoin's inflation today is even lower than that benchmark rate, further with a finite supply. Such a neat & clean paradigm of monetary policy of Bitcoin makes it an attractive investment in which the investors leverage on both store-of-value, favorable demand wrt time(as supply decreases).

Bitcoin is even more relevant to today's economies, with quantitative easing, uncontrolled printing of paper money. Bitcoin is literally a hedge against inflation, quantitative easing. The digital gold of today's world.

Bitcoin: The generation of the public key from the private key is a one-way function

In the traditional centralized financial system, you pay either by check or online bank transfer or through debit card/credit card, etc.

When you issue payment by check you need to enter the Beneficiary name-- "In favor of" or "Pay to", then you put your signature in the check. That signature is unique to you.

When you transfer funds through Online Banking you enter Beneficiary Bank Account Number and then you authorize the transaction through OTP, Transaction Password.

When you make a payment through credit/Debit Card, you need to enter the CVV, PIN.

In all three cases, your Name or Account Number can be made public in order to receive payment from someone(in business). But your Signature or OTP or PIN or Transaction Password is private, which should be kept secret.

In Bitcoin, you are issued with a key pair-- Private Key and Public Key.

The Public Key is just similar to a Bank Account Number or Beneficiary Name. You can share it with anyone in order to receive money, to remain in business with your counter-party.

The Private Key is similar to the Signature, OTP, PIN, Transaction Password, etc. It should be kept secret. It is used for Authentication & encryption.

The keys are created locally, stored locally either as a file or a database or simply as a wallet. The key is critical to your absolute control of the asset. In cryptos: Not your key, not your asset.

In Bitcoin, the private key controls the asset. It uses cryptography to derive the public key from the private key. This process is one way only.

The cryptography that is used in Bitcoin is Elliptic curve multiplication which is also known as trap door function, in which you can derive the public key from the private key but you can't deduce the private key from the public key.

Source- Elliptic Curve Cryptocraphy

Since it is a one-way function, when you sign a transaction or spend Bitcoin, you present your public key, and using the private key you generate a signature, the combination of the signature and public key is what verified and confirmed by the Bitcoin network to transfer the Bitcoin to the next owner.

- You know the Private Key-- You can create digital signature(s)

- You know the Public key & signature-- You can verify a transaction

Private Key, Public Key, Address

The Public key is derived from the Private Key using Elliptic-Curve Multiplication. The Address is derived from the Public Key using the Hashing Function. This is a one-way generation, you can not calculate the values in the reverse direction.

The private key in Bitcoin is created cryptographically using the SHA256 algorithm, which is 256 bits number.

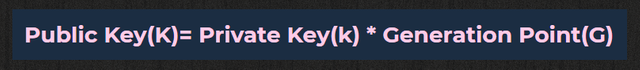

Deriving Public key from Private Key

The Public Key(K) is generated by multiplying the Private Key(k) with a Generation point(G) on the Elliptic Curve. That is why it is also known as Elliptic curve multiplication.

Thye Generation point(G) is a predetermined point on the Elliptic curve(the same for all Bitcoin users). When it is multiplied with Private Key(k), it will produce another point on the Elliptic Curve, the resulting Public Key(K). So the only variable is the Private Key which is different for different Bitcoin users. Again, you can calculate K from k, but not k from K as Elliptic Curve Multiplication works in one direction only.

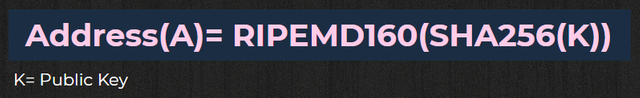

Generating Bitcoin Address from Public Key

Similar to Private Key-Public Key, the Bitcoin Address(A) is also generated from Public Key(K) as a one-way cryptographic hash algorithm. In simple words, the Address(A) is the hash of input. Here the input is Public Key(K).

In Bitcoin, the hashing algorithms used are-- SHA256 & RIPEMD160.

.png)

When the public key(K) is computed with SHA256 & RIPEMED160, it produces a 160-bit number. Further, for human readability, easy to use, easy to transcribe, it is encoded as "Base58Check"(which is basically a Base 58 Binary-to-text encoding). In this way, the Bitcoin Address is generated from the Public Key(K), again, it is a one-way function only.

Conclusion

Even with the brute-force search method, it will take an enormous amount of time(even more than the age of the Universe) and computing power to figure out the Private Key. So practically it is infeasible. That further strengthens the case of secret Private Key & secure transactions in Bitcoin, instills confidence in the Bitcoin users.

With regard to the magic number of 21 Million supply, it is theoretical only, the actual circulating figure is even lower than this figure. Reportedly around 3.7 Million Bitcoins(as they are not moved from the wallet for more than 5 years) are lost forever1, as many early users of Bitcoin did not know how to handle Bitcoin, they somehow lost control out of ignorance or carelessness, etc.

Note- I have also contributed to those 3.7 Million in 2015/16.

That means the current tangible supply of Bitcoin is somewhere around 14.827 Million(as against the current circulating supply of 18.527 Million).

Put simply, Bitcoin is scarce by its algorithm(controlled supply, quantitative hardening), but in reality, it is, even more, scarce(as approx 20% of the supply is lost forever). That gives a reason for the investors to love Bitcoin.

Thank you.

Cc:-

@steemitblog

@steemcurator01

@steemcurator02

I am totally agree with that because Bitcoin is technologically structured for this. In this way, the community acts as a place where investors and the different participants in the technology project can take action against the inflationary consensus.

And like this acting we can see bitcoin and digital currencies as a real and meaningful hedge against inflation and the economic and political thought that powers it.

Thank you for coming around.

Have a great day.

This is a great post @sapwood. You are definitely a genius at this. The tight security around bitcoin surely makes investors confident about purchasing it.

And with the decreasing supply of bitcoin, prices are sure to skyrocket. Great job!!

Thank you so much for your kind words. The actual supply of Bitcoin is around 20% lower than the theoretical supply, and that further makes each coin worth a little more.

Thank you.

Trade on all cryptocurrency exchanges from one interface! - https://kintum.io/

Trade on all cryptocurrency exchanges from one interface! - https://kintum.io/

Trade on all cryptocurrency exchanges from one interface! - https://kintum.io/

Trade on all cryptocurrency exchanges from one interface! - https://kintum.io/

Trade on all cryptocurrency exchanges from one interface! - https://kintum.io/

Trade on all cryptocurrency exchanges from one interface! - https://kintum.io/

Trade on all cryptocurrency exchanges from one interface! - https://kintum.io/

Great post friend! Lets continue!

Also i can like and comment my post

https://steemit.com/blockchain/@vitek147/invizion-blockchain-project-that-will-save-us-from-garbage-and-save-our-planet

Congratulations you are one of the winners of the Steem Crypto Challenge Month...

Thank you for taking part

The Steemit Team

Thank you so much.

Steem on.

This is a great post @sapwood

I love bitcoin .

I love steem it .

I believe that Bitcoin, more than a "store of value" or protection against inflation, is an asset of current importance in any investment fund.

I realize Bitcoin is only backed by its Limited Supply, but it seems very unstable to me...

Because it is not Stable, I tend to believe it will go to Zero, once our U.S. Electronic Coinage is Activated...

I have no insider information, other than my Vision for the Return of U.S. Sound Money, back to it's full 100% Spending Power...

October 29, 2020... 7.0 Hollywood Time...