Bitcoin: Part 3: Low transaction fees, Push-type Payment & Multi-sig wallet.

In the ongoing #steemcryptochallenge, I have already published Bitcoin: Part 1, Part 2. Today I will detail Part 3.

This publication will cover:

- How the transaction fee in Bitcoin become negligible as the transaction size gets bigger

- How the push-type transactions eliminate the risk of Fraud-chargebacks

- How the multi-sig feature of the Bitcoin wallet adds an additional layer of security and also brings other business use-cases to the table.

Bitcoin: Microtransaction is possible, the transaction fees become almost negligible as the transaction size gets bigger

In the traditional financial system, Micro-transaction, most of the time is infeasible, as in some cases the transaction fees exceed the payment, in other cases, the transaction fees become the payment itself. That is why most of the micro traders are left out of the existing economic system.

Further, the charge(service provider fees) always comes as a combination of certain fixed(flat) fee+percentage fees. That further makes the net fees incurred on the user very high. As the trade size goes up, the total fees incurred also go up.

Take the example of card payment, it varies from 0.5% to 5% depending upon the service provider, payment gateway, and an additional 20 to 30 cent flat fees. Even if we consider the lower band of 0.5%, this figure is still going to be high if the trade size is high. Say you are transacting, 10000 USD using a card, if we take lower band (0.5% only), it will be 50 USD fees plus the flat fees.

In a Bitcoin transaction, there is no such thing as a percentage fee. It is a fixer miner fee for validating the transaction through the Bitcoin network. That fee is very reasonable.

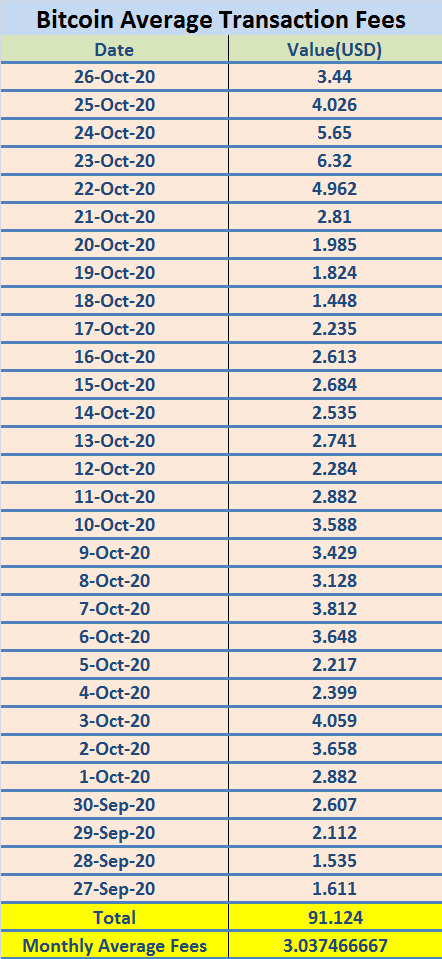

Here is the stat of the average daily fees of Bitcoin Network over the last 30 days. The average daily fee over the last 30 days is hardly 3.03 USD in the Bitcoin network. That means if I am to send 100 USD or 10000 USD or 1 million worth USD, I will incur only 3.03 USD per transaction.

Further, there is no hassle of the upper limit or lower limit in Bitcoin transaction, I am free to trade any amount with another peer without the hassle of high transaction fees, restriction by the intermediary, etc. I can make a micro-transaction in Bitcoin, I can also make any higher amount as long as I own that amount in my wallet.

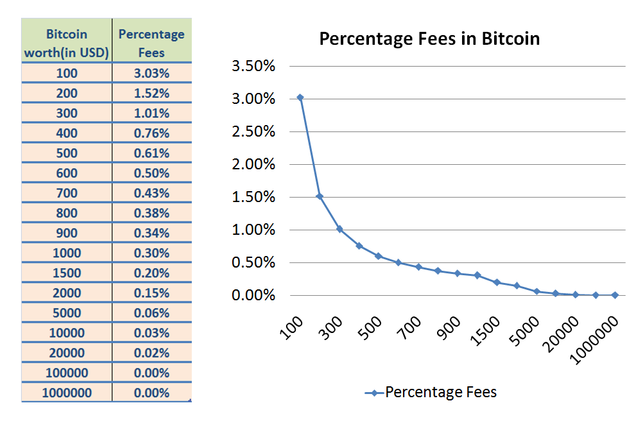

Let's project the percentage of fees in Bitcoin with respect to trade size in the case of Bitcoin taking the average monthly daily fees.

So as evident from the table and the graph, if I send 100 USD worth Bitcoin, I will incur 3.03% fees, but as the trade size goes higher, the percentage fees gets significantly lower, for an amount of 1000 USD worth BTC it is only 0.303%, for an amount of 10000 USD worth BTC it is only 0.03%, for 1 million USD worth BTC it is almost nil.

Bitcoin: The transaction is a "push-type" transaction, does not have the risk of a chargeback

In the legacy financial system, using a credit card/debit card to purchase online is a very common thing and almost everyone is familiar with this. However, the legacy financial system is also plagued with fraud chargebacks.

A fraud chargeback occurs when the consumer makes an online purchase using the card and then after receiving the product or services he initiates/requests a chargeback from the issuing bank.

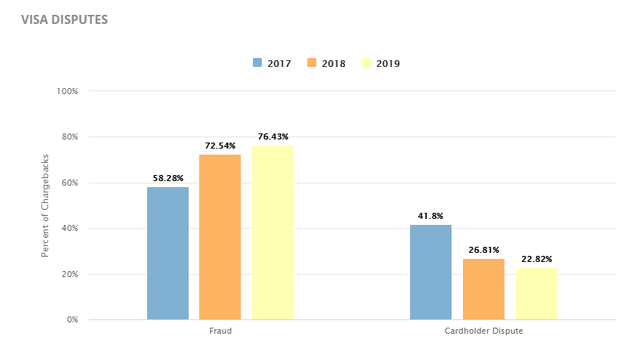

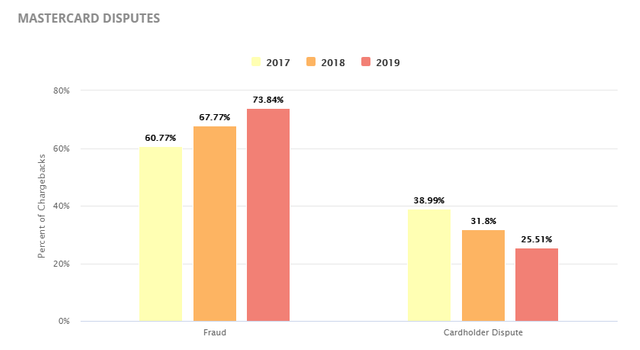

The fraud chargeback always diminishes the business environment and business potential. As per the recent data and stats, fraud chargebacks in Visa is as high as 76.43% in 2019, in the case of Mastercard, it is as high as 73.84%. These stats do not create a conducive environment for the Merchants to accept payment via Cards.

It also consumes a lot of time and also results in loss of revenue.

Although there are multiple reasons/loopholes attributed to fraud chargebacks, the root cause of it being a pull-type transaction through Card payment.

Normally when a transaction is made using a card, it happens through another intermediary other than the issuing Bank.

In the traditional system, there is a consumer who purchases using a card, the counterparty here is the merchant, there is an issuing bank(Cardholder Bank) and the Acquirer(who enables the payment to the merchant).

When a consumer purchases something via card, it does not really make a transfer, in fact when he enters the PIN or OTP, it allows the merchant to pull that payment from the issuing Bank, routed through the acquirer.

.png)

A pull-type payment technically is always subjected to chargeback and even VISA Cardholders have up to 120 days period to initiate a chargeback and that is very well exploited for fraud chargebacks. That is why the rate of fraud chargebacks is still high to this date. The pull-type payment itself is old enough as an artifact.

The solution is a push-type transaction. Removal of intermediaries to instill confidence on the Marchant domain, eliminate fraud chargebacks.

.png)

Bitcoin payments are the perfect example of a push-type transaction, further, it happens peer-to-peer. The payment architecture in Bitcoin is quite simple and straight-forward.

When a consumer makes a payment to the merchant it instructs the wallet to push the transaction to the merchant by signing the transaction with the private key. Then the transaction is broadcasted to the Bitcoin network, verified, confirmed. Most of the merchants wait for 6 confirmations to accept it as a valid payment. However, in the case of the lightning network, they won't have to wait for 6 confirmations, if a payment channel exists. So with the lightning network, it will be instant.

Note- After the first confirmation, it generally takes 10 minutes' time for each additional confirmation.

Regardless of the number of confirmations, a Merchant is always in the comfort space with Bitcoin as payment as it does not have any such risk of fraud chargebacks.

On the consumer part, it is more secure, as it does not involve an intermediary to make a payment to the merchant, as the transaction is pushed through a trust-less network. Further, it is mobile, payment can be made by mobile devices, with QR codes, that sounds like a modern technology of the 21st century.

The only way the consumer can get his payment back is by refund from the merchant.

Bitcoin: Multi-signatures prevents single-point failure, brings other business use-cases to the table

A standard Bitcoin wallet is a single signature account. It is like a personal account; when you need to authorize a transaction it requires you to sign the transaction using the private key.

By contrast, a Mustisig wallet is a joint account or a company account. A Multisig Bitcoin wallet requires the consent of more than one person, which means it requires the signatures of more than one person to authorize a transaction.

The best use-case of a Multi-sig wallet is when you handle the fund of the company through the consent of each of the executives. When you are in a group or cooperatives, you need to take the consent of each of the members to handle and authorize a transaction.

.png)

It also introduces an m-of-n combination to use a Bitcoin wallet & access the fund. For example, 2-of-3 can access the fund, move the fund. If one out of the three happens to lose the key, it is still safe.

The multi-sig feature of a Bitcoin wallet is just like two-factor authentication to make your Bitcoin safer. For instance, you can keep one key in your laptop and another on a Smartphone or somewhere else. With that the probability to lose both the key at the same time is very low, making your fund safer.

Further, the escrow transactions can be possible using the multi-sig feature.

The number one benefit of Multi-sig Bitcoin wallet is that it prevents single-point failure, which means if any of the individual owners in a group happens to lose the private key does not amount to losing Bitcoin forever.

It also adds an additional layer of security and making it less likely to compromise.

The board-of-directors, company executives, the mutually-trusted arbiter can leverage the multi-sig bitcoin wallet for their respective purposes & business use-cases.

Thank you.

Cc:-

@steemitblog

@steemcurator01

@steemcurator02

Trade on all cryptocurrency exchanges from one interface! - https://kintum.io/

Trade on all cryptocurrency exchanges from one interface! - https://kintum.io/

Trade on all cryptocurrency exchanges from one interface! - https://kintum.io/

Thanks very much @sapwood, I agree for this mentioning, Bitcoin offers very cheap and low fees charge when one is making transactions. Imagine how taxes are levied on individuals doing business at the centralized economy. Well said Buddy, the multi - signature ensures authenticity of the Bitcoin apps making it power to infringe by hackers. Thanks for this great ideas on Bitcoin.

Thank you for stopping by.

Congratulations you are one of the winners of the Steem Crypto Challenge Month...

Thank you for taking part

The Steemit Team

Thank you so much.

Steem on.