Bitcoin Prediction Report 2016

It’s already been a month since we landed in 2016, a year predicted to be ‘a bitcoin year’ among bitcoin communities and investors. From the desk of Zebpay, we bring to you our research and analysis – why bitcoin will continue to spread its wings and the right time to invest in bitcoins!

Bitcoin has already made headlines since the beginning of the year with price predictions scaling all new highs and reward halving due this year – all this we bet will definitely be fun to watch.

Let’s dive in and have a look through the lens of an investor the factors that will drive bitcoin charts this year:

1. Halving – Yeah it’s a leap year for Bitcoin

Out of 21 million coins that are ever going to exist, approximately 15 million are already in circulation and there is a supply cap which halves every four years. This year around July 2016, the bitcoin mining reward is scheduled to halve from 25 BTC to 12.5 BTC per block, second time since its launch.

Generally when market is going to witness some sort of scarcity or controlled supply in a promising concept – like bitcoin, the demand starts rising with positive sentiments. That said, markets start making speculative moves and this pushes its price upwards thus building pressure to grab the opportunity and get share in the revolutionary future.

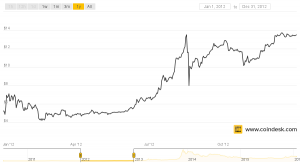

Now that during previous halving in November 2012, from 50 to 25 BTC, when bitcoin didn’t gain much popularity, the price of one bitcoin was worth around $5 in April. The price started increasing exponentially touching $13 in mid August and on the day of halving i.e. 28 November it stood at $12.35.

This means roughly before six months of halving, market reacted positively in anticipation and gained confidence in bitcoin which resulted in 150% returns!

This means roughly before six months of halving, market reacted positively in anticipation and gained confidence in bitcoin which resulted in 150% returns!

More surprising fact is that 7 weeks post halving of the block, sure there might be many more factors that may have impacted the price rise and halving being one of them, the price of one bitcoin was $130 i.e. 950% returns

We’re ready for the joy ride, do you still need time to think? Read on…

2. Global gloom

Since the beginning of the year, global economic landscape witnessed a disastrous start with all major stock exchanges around the world taking a nosedive.

Our research team identified the factors responsible for the ongoing global slowdown –

- Crashing equities in China, devaluation of Chinese Yuan

- Developed and emerging economies showing weak potential growth

- Rise in public and private debt – banks seeing more and more NPAs

- The escalating turmoil in euro zone and bailout packages resulting in fear of them going ‘default’ in future

- Falling oil and commodity prices

- Shrinking world trade

Investors have lost more than a trillion dollars after the collapse of Chinese equities. Lot’s of uncertainties around

Some respected financial services firms have even suggested their investors to sell everything (View full article). They have predicted a global recession, even worse than 2008 comparing the current scenario with that before the Lehman Brothers crises.

In such gloomy situations, investors will prefer to diversify their portfolio, especially where the future lies. Ultimate fixed supply of bitcoin and its potential growth would help bitcoin to become a store value in long term, and even superior to fiat currencies.

Thus bitcoin would act as a ‘safe haven’ for investors looking for other investment opportunities. Still confused to buy or not? Keep reading…

3. Even Governments are signing up

On the contrary to initial levels of resistance towards bitcoin, governments and regulatory authorities around the world have now realized the intrinsic potential of bitcoin and blockchain technology – sooner rather than later.

Reserve Bank of India, in its recent report on financial stability, has appreciated the strengths of the underlying ‘blockchain’ technology. Contrary to its previous note of caution, it has praised its potential to help check counterfeiting and bring a major transformation in financial infrastructure, collateral identification and the payments system (View full article).

One major welcome move is seen from the UK last week. The Chief Scientific Advisor of the UK submitted a report explaining potential of the distributed ledger technology and how it can help governance (View full article).

Our analysts studied the report and were overwhelmed to find that governments are seriously thinking in the direction of cashless society. The report has emphasised the need to support the emerging ecosystem, move further with pilot testing.

And if any government as serious as the UK really takes a huge leap forward in the technology adoption, the chances are it will position itself as a global leader

Takeaway – The time is now!

4. Investment soared in 2015

Year 2015 has seen a fundamental shift in the types of investors interested in bitcoin who believe it would be the biggest disruption in the financial ecosystem of the world.

With the advancement in bitcoin concept and most importantly its underlying technology blockchain, many technology investors, high net worth individuals (HNIs) and some institutions have showed growing interest in the digital currency.

Bitcoin venture capital funding rose by 494% in 2015 from the end of 2013 with total investment equating to $ 927 million since 2012.

Doesn’t that mean faith in bitcoin is mushrooming? Who says bitcoin is dead? They are kidding right

5. Networking – beyond social

Bitcoin’s presence has been remarkable since its inception due to ‘network effect’ creating ripples in the financial ecosystem.

It is a general tendency in humans to follow others, to do what others are doing – benefit of the doubt.

Just like people started using Facebook and Whatsapp by seeing others doing it, they are now buying bitcoins seeing others doing it or using it.

With all the leaps and bounds taken in last two years, there has been a tremendous rise in number of bitcoin buyers, transaction volumes and trading turnover across major bitcoin exchanges, where people are following the trend.

6. Rise in the number of wallets

In August 2012 i.e. 3 months before halving, there were around 13,000 wallets registered and rose by 200% in the month of November to 40,000 wallets on blockchain.

Number of wallets registered on blockchain by December 2015 stood at 11 million! And still counting (View full aticle)These astonishing figures shows the rise of enthusiasm and faith in bitcoin investment, in line with the network effect.

7. Hardfork and the great debate on Blocksize

Recently, there has been news that bitcoin companies are unable to come to an agreement on an important technical aspect.

The debate is about how to scale the network so it can handle more transactions.

There is news that this can lead to two versions of the blockchain, bitcoin’s underlying technology.

Experts refer this as a hard fork. A hard fork would reduce confidence and can cause unforeseeable problems for bitcoins. This disagreement has caused a few people to go as far as pronouncing that bitcoin is dead.

The problem that there are a huge number of transactions on the bitcoin network is a good problem.

The bitcoin miners are coming towards a consensus on how to avoid this. If they do not come to an agreement, they stand to lose the most.

Hard core bitcoiners believe this is just a growing pain which will be resolved soon.

8. Sow well today and you will reap tomorrow

Among all the venturecapital investments done till date in bitcoin-based innovations, more than half came in 2015, a bet for favourable 2016.

Despite of slower growth seen in the digital asset in 2015 due to troubled 2014, the investment trend did not see any downturn.

Investors continued to pour in their money in previously held companies as well as new bitcoin-based companies for product and technology innovations which will be released in 2016.

Now this is what we call smart investing!

9. Bitcoin and Paparazzi

At the time of its launch, bitcoin was a topic attracting programmers, technology geeks and few other people belonging to weakening economies facing currency depreciation.

The meetups and conferences held around bitcoin concept failed to catch media’s attention.Eventually, with more and more heads getting involved in bitcoin, ranging from technology enthusiasts to serial entrepreneurs, it started creating a buzz in media, both online and offline.

With bitcoin exchanges, wallet service providers and mining hardware companies coming into existence, the community started growing.This attracted mainstream media and bitcoin finally started making headlines.

During its first halving in 2012, from 50 BTC to 25 BTC, it had gained no attention. With interviews from top entrepreneurs like Richard Branson and comments from Bill Gates favoring bitcoin, it started building digital footprints.

Final verdictInvestment tip– The price will start showing speculative moves in positive pushing it much higher and scaling all time highs. The clock is ticking!Best profit time – Start accumulating in January and reap fruits in JuneOur take:

Bitcoin is still alive, and it will scale and thrive! Sit tight & just hold on for the ride

BITCOIN IS NOT JUST AN INVESTMENT – IT’S A MOVEMENT

Upvoted you