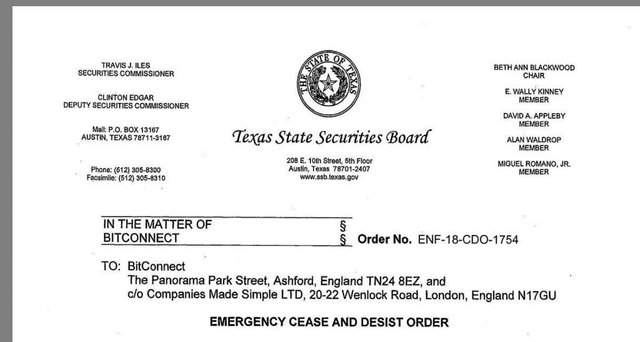

Bitconnect Slapped with Securities Emergency Cease and Desist Order

On Thursday the Texas Securities Commissioner (TSC) signed an Emergency Cease and Desist Order to stop Bitconnect from operating. The mysterious company is a popular bitcoin lending platform with a 4.1 billion USD market capitalization, and is long accused of being a scam.

On Thursday the Texas Securities Commissioner (TSC) signed an Emergency Cease and Desist Order to stop Bitconnect from operating. The mysterious company is a popular bitcoin lending platform with a 4.1 billion USD market capitalization, and is long accused of being a scam.

Bitconnect Ordered Not to Mess with Texas

The Texas Securities Commissioner has entered an Emergency Cease and Desist Order to halt the multiple investment programs operated by Bitconnect,” the press release reads, “an overseas company that claims a market share of $4.1 billion for its cryptocurrency coins.”

News.Bitcoin.com profiled growing concern within the ecosystem about Bitconnect’s doings back in November as well as through an opinion piece. Then, as now it appears officially, the worry was mostly due to promises made by the English company that seemed impossibly Ponzi.

“Bitconnect is soliciting investors for cryptocurrency-based programs that the company claims will deliver annualized returns of 100% or more,” the TSC outlines. After detailing how they issue their own coins (a fact curiously denied by advocates) with a cap of 28 million, the TSA continues, “The company requires individuals to use Bitcoin, a more established cryptocurrency, to invest in various Bitconnect programs. In one investment called the Bitconnect Lending Program, investors purchase Bitconnect Coins, which are provided to a ‘Bitconnect Trading Bot’ to generate ‘returns as high as 40% a month.’”

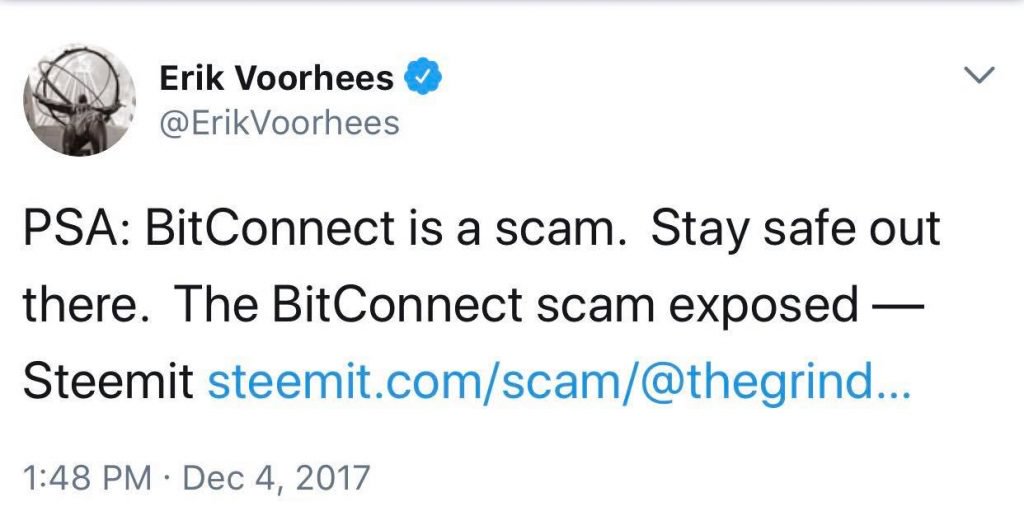

Prominent ecosystem lights from Andreas Antonopoulos to Erik Voorhees have also made it clear to move away from the scheme. Mr. Antonopoulos was plagued with advertisements on his Youtube channel, and pleaded with followers to help him untangle. Mr. Voorhees didn’t mince words in his Tweet, flat out telling followers “Bitconnect is a scam. Stay safe out there.” Jameson Lopp was slightly more diplomatic, Tweeting “I’ve been getting more questions about @bitconnect – as far as I can tell, it’s a scam. If you don’t believe me, just compare their (now removed) 2017 roadmap with the (lack of) activity on their GitHub repository.”

Known in the United States as a law enforcement state, Texas’ unusually heavy hand was hardly out of character. All the TSC had to do was find the company’s “investments are securities, but were not registered as required by the Texas Securities Act and State Securities Board Rules and Regulations. In addition, the company is not registered to sell securities in Texas,” and the rest just follows. The across-the-pond entity can appeal the TSC’s decision.

Regulators Scramble to Find Fault

Late last year Texas issued an administrative order against USI-Tech Limited, the Dubai mining investment firm, also asking it immediately cease and desist.

In the present case, regulators are most likely chafing at the thought of more initial coin offerings, unregulated, being advertised to their constituents. Indeed, the press release notes, “Sales agents for Bitconnect are targeting Texas residents, as well as residents of other states, through websites, social media, and online marketplaces like craigslist,” they allege. And while it’s murky at best to assume Texas plays a large role in the assumed scam, here again is the regulator’s logic: “The sales agents are not, however, registered as agents of Bitconnect to sell securities in Texas.”

The TSC notice also mentions an upcoming announced initial coin offering by the company, scheduled for just a few days from now, and how it “operates websites and deploys online advertising to recruit sales agents, which it calls ‘affiliates.’ The company provides marketing material to affiliates, including online presentations, and pays them commissions for referrals that result in investments in” the company’s programs.

Heat

Securities Commissioner Travis J. Iles also reasserts what some in the crypto community have found troubling too, that the company “has disclosed virtually nothing about its principals, financial condition, or strategies for earning profits for investors. It has not provided a physical address in England.”

The apology from the mysterious company’s scores of ambassadors usually involves making comparison to the unknown character of Satoshi Nakamoto and lack of centralization around the Bitcoin network. It’s a muddying of crypto waters less are inclined to consider.

Fair or not, one aspect to the firm’s doings is undeniable: they’ve brought heat in terms of regulators, who’re now groping at ways to smoke such projects out, using legal maneuvers other legitimate and worthy projects might eventually be swept up in.